ASX 200 scrapes into green on tech, health, while energy hit by uranium meltdown

Today in Review

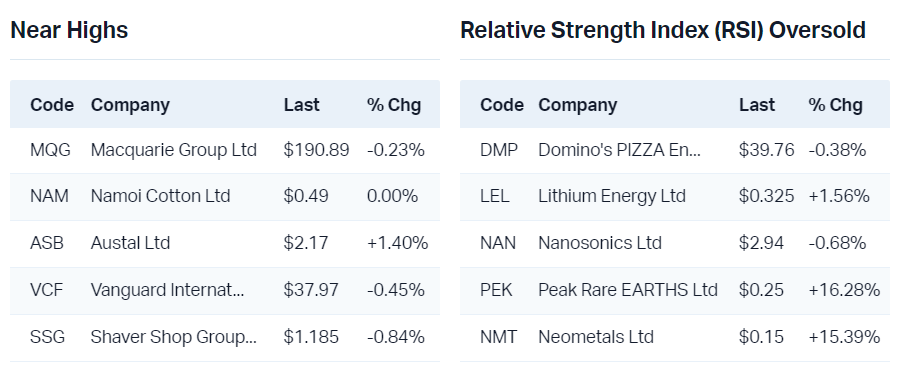

Markets

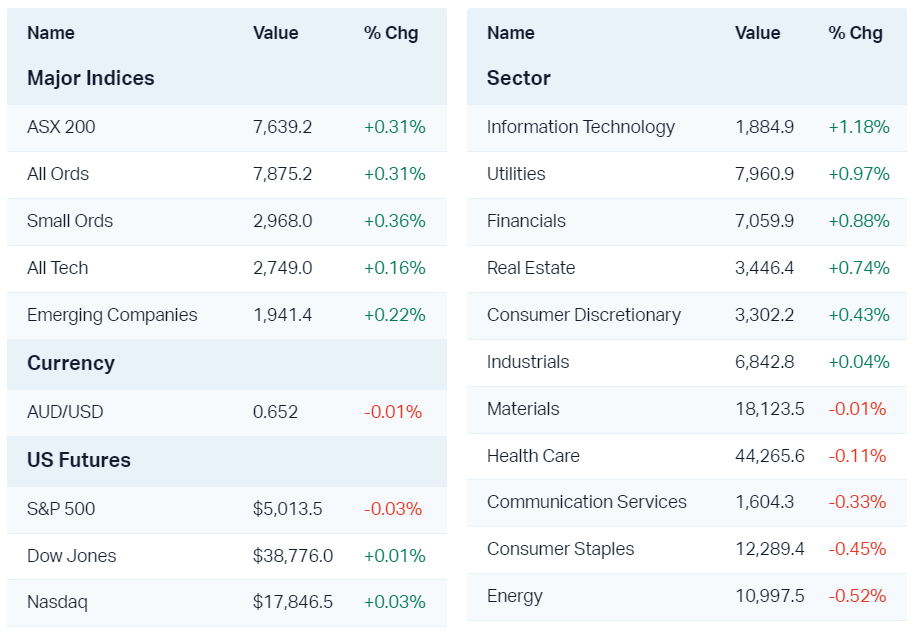

%20Intraday%20Chart%209%20Feb%202024.png)

The S&P/ASX200 (XJO) finished 5.6 points higher at 7,644.8, roughly at the mid-point of the session's range. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by a narrow 150 to 124. For the week, the XJO finished down 54.5 points or 0.71% lower.

Information Technology (XIJ) (+1.1%), Communication Services (XTJ) (+1.1%) and Health Care (XHJ) (+0.9%) were the best performing sectors today. There's plenty of overlap between the tech and comm's sectors, and much of today's gain could probably be attributed to positive results yesterday from REA Group (REA) yesterday lifting the tide and the rest of the ships with it. Audinate's (AD8) move was particularly interesting given it reports its first half FY24 results on Monday.

Doing it tough today were the Energy (XEJ) (-0.9%) and Utilities (XUJ) (-0.5%) sectors. Again, two sectors with a massive overlap. Today's move was less about the usual excuse, i.e., lower crude oil prices, and more to do with the meltdown in ASX uranium stocks. Read this article to find out why, but it's not like rest of the stocks in either sector were that good either.

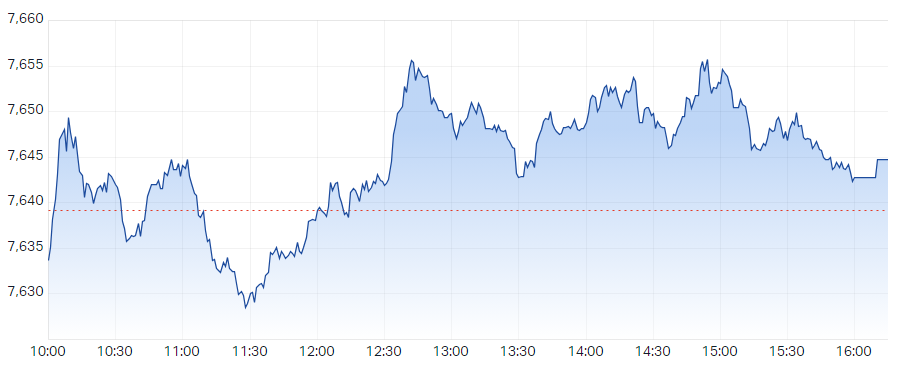

ChartWatch

S&P/ASX200 (XJO)

The benchmark ASX 200 is going to close out the week with a loss, but the important aspect from a technical perspective, is that it rallied more than half way up the weekly range by the close. If we use the mid-point of any candle as its demand-supply balance point, we can assume a close above the mid-point indicates the demand-side is in control, and vice versa for a close below the mid-point. Obviously, the higher the close / lower the close, the greater the control being exerted by either party.

Short and long term uptrends remain very much intact here, and the price action remains higher peaks and higher troughs. The last trough at 7542 sits in-line with the second from last peak, a classic sign of buy-the-dip behaviour. Candles could be better (i.e., refer the "ice cream sandwich" we discussed in Monday's Evening Wrap), but there's still plenty to like about this set of technicals.

Boral (ASX: BLD)

You might have noticed how often I write "rise is consistent with prevailing short and long term uptrends" in the Interesting Moves section. At least, I hope you've noticed! Trend following is about following probabilities as much as it is about following trends. And in my experience, the balance of probability lies with a strong trend continuing.

What happened in the uranium sector today is an equally important lesson about trend following as is this Boral chart. The future is unknown, and just because a trend was strong yesterday (and trends in uranium stocks were exemplary), there's no guarantee they'll be strong tomorrow.

For Boral, today's gap and run is an impressive showing of excess demand. There was a little selling during the session (refer upward pointing shadow), but on balance it was still a strong indication market participants still see the stock as cheap – even after its big pop. My question is, when you look at a chart like Boral's do you see cheap?

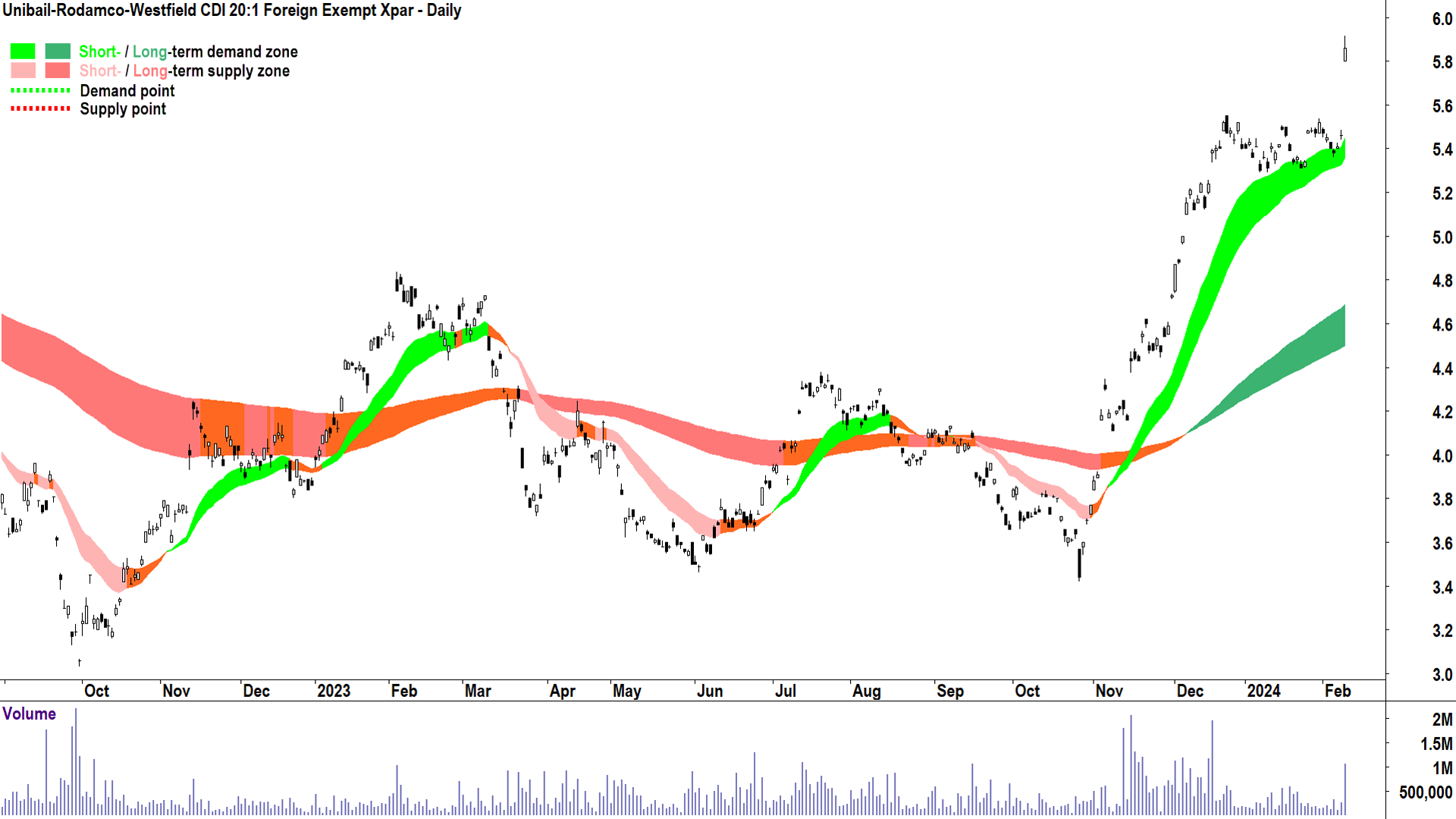

Unibail-Rodamco-Westfield (ASX: URW)

I don't have to cherry pick these. Another positive news announcement in line with the prevailing short and long term uptrends (there I go again!). I remind you, this type of price action can only occur if all market participants believe the stock is cheap. Cash clearly wants in. Why? Because they think the stock is cheap. Existing owners don't want to sell. Why? Yep, because they too think the stock is cheap.

Again, what do you see when you look at the URW chart...cheap or expensive?

Economy

-

AU RBA Governor Bullock speech

“Do we have to be absolutely in the inflation band before we start thinking about if we think monetary policy is restrictive now, which we think it is?"

“No, I don’t believe we do. But we do need to be very confident that we’re going to get there as we start to remove the restrictive nature of policy"

We don't want inflation to move into the target band "and then pop out again.”

Latest News

The biggest gold and lithium hits of the week – Auric Mining, Azure Minerals

Why Boral's bumper earnings and guidance upgrade might not be enough

Buy Hold Sell: Your 5 top small and mid-cap stocks for 2024 (and 2 big fundie buys)

Morning Wrap: ASX 200 futures flat, S&P 500 hovers around 5000 + Charts of the Week

Evening Wrap: ASX 200 edges higher as AGL, Cochlear & News Corp pop on results

Don't miss an ASX announcement this reporting season, check out our comprehensive H1 FY24 Earnings Season Calendar and set up and receive announcements direct to your inbox on Market Index: Create Alert Now

Interesting Movers

Trading higher

+12.8% Calix (CXL) - Continued positive response to yesterday's: Heidelberg Materials assessing alternative sites for L2, also looks like a bit of short covering going on!?

+12.5% Brainchip Holdings (BRN) - No news, possibly caught by the short covering bug!?

+11.4% Novonix (NVX) - Panasonic Energy and NOVONIX Sign Binding Off-Take Agreement, possibly caught by the short covering bug!?

+10.4% Liontown Resources (LTR) - No news, just rumours about a potential takeover from Gina Rinehart doing the rounds again, possibly caught by the short covering bug!?

+8.3% Boral (BLD) - 1HFY24 Results Presentation Slides, rise is consistent with prevailing short and long term uptrends

+7.3% Unibail-Rodamco-Westfield (URW) - URW Reports Fy-2023 Earnings, rise is consistent with prevailing short and long term uptrends

+5.9% REA Group (REA) - Continued positive response to yesterday's: Appendix 4D and Interim Financial Report H1 FY24, rise is consistent with prevailing short and long term uptrends

+5.9% Cochlear (COH) - Continued positive response to yesterday's: Cochlear Upgrades FY24 Earnings Guidance, rise is consistent with prevailing short and long term uptrends

+5.5% Audinate Group (AD8) - No news, H1 FY24 results on Monday, some positioning ahead of that 🤔

+4.6% Zip Co (ZIP) - No news, rise is consistent with prevailing short and long term uptrends

+4.5% Supply Network (SNL) - No news, rise is consistent with prevailing short and long term uptrends

+4.0% Arcadium Lithium (LTM) - No news, possibly caught by the short covering bug!?

Trading lower

-12.7% Boss Energy (BOE) - Uranium sector meltdown on Cameco fourth quarter results

-11.1% Bannerman Energy (BMN) - Uranium sector meltdown on Cameco fourth quarter results

-10.3% Silex Systems (SLX) - Uranium sector meltdown on Cameco fourth quarter results

-9.9% Deep Yellow (DYL) - Uranium sector meltdown on Cameco fourth quarter results

-8.5% Piedmont Lithium Inc (PLL) - No news, fall is consistent with prevailing short and long term downtrends

-7.0% Paladin Energy (PDN) - Uranium sector meltdown on Cameco fourth quarter results

-6.5% Adriatic Metals (ADT) - No news, struggling to hold above the long term uptrend ribbon

-5.7% Omni Bridgeway (OBL) - No news, fall is consistent with prevailing short and long term downtrends

-5.6% Lotus Resources (LOT) - Uranium sector meltdown on Cameco fourth quarter results

-5.0% Alliance Aviation Services (AQZ) - Continued negative response to Wednesday's: Half Year Accounts & 4D

-4.6% Michael Hill International (MHJ) - No news, fall is consistent with prevailing short and long term downtrends

-4.5% Silver Lake Resources (SLR) - Continued negative response to Monday's: Red 5 and Silver Lake Resources to Merge

-4.4% Nickel Industries (NIC) - No news, fall is consistent with prevailing short and long term downtrends

-3.7% Syrah Resources (SYR) - Buy rumour, sell fact: Syrah commences AAM production at Vidalia, USA, fall is consistent with prevailing short and long term downtrends

Broker Notes

-

AGL Energy (AGL)

Retained at accumulate at Ord Minnett; Price Target: $12.00

Retained at neutral at Macquarie; Price Target: $9.60 from $9.30

Ampol (ALD) retained at buy at Goldman Sachs; Price Target: $37.10

-

Amcor (AMC)

Retained at neutral at Jarden; Price Target: $14.40 from $14.30

Retained at neutral at Macquarie; Price Target: $14.90 from $14.80

Alliance Aviation Services (AQZ) retained at buy at Ord Minnett; Price Target: $4.35 from $4.50

Antipa Minerals (AZY) retained at buy at Shaw and Partners; Price Target: $0.04

BHP Group (BHP) retained at neutral at UBS; Price Target: $46.00

Boral (BLD) retained at neutral at UBS; Price Target: $5.50

Beach Energy (BPT) retained at sell at Goldman Sachs; Price Target: $1.66

Bluescope Steel (BSL) retained at overweight at Jarden; Price Target: $26.40 from $24.90

BWP Trust (BWP) retained at underweight at Jarden; Price Target: $3.30

Commonwealth Bank of Australia (CBA) retained at sell at Goldman Sachs; Price Target: $82.37

Centuria Industrial REIT (CIP) retained at overweight at Jarden; Price Target: $3.60 from $3.50

-

Charter Hall Long Wale REIT (CLW)

Retained at hold at Ord Minnett; Price Target: $3.68 from $3.62

Retained at underweight at Jarden; Price Target: $3.75

Retained at neutral at Macquarie; Price Target: $3.62 from $3.54

Cooper Energy (COE) retained at neutral at Goldman Sachs; Price Target: $0.15

-

Cochlear (COH)

Retained at sell at Ord Minnett; Price Target: $220.00 from $210.00

Retained at neutral at Jarden; Price Target: $229.00

Coles Group (COL) retained at neutral at UBS; Price Target: $16.25

Cettire (CTT) retained at buy at Bell Potter; Price Target: $4.80 from $4.00

Fortescue (FMG) retained at sell at UBS; Price Target: $24.60

Karoon Energy (KAR) retained at buy at Goldman Sachs; Price Target: $2.40

Light & Wonder Inc. (LNW) retained at buy at Jarden; Price Target: $147.00 from $147.00

Lynas Rare Earths (LYC) retained at outperform at Macquarie; Price Target: $7.00 from $7.30

-

Mirvac Group (MGR)

Retained at buy at Ord Minnett; Price Target: $3.10

Retained at neutral at Jarden; Price Target: $2.15

Retained at outperform at Macquarie; Price Target: $2.38 from $2.20

Mineral Resources (MIN) retained at sell at UBS; Price Target: $53.00

Medibank Private (MPL) retained at neutral at Goldman Sachs; Price Target: $3.70 from $3.56

Metcash (MTS) retained at buy at UBS; Price Target: $4.00

NIB Holdings (NHF) retained at buy at Goldman Sachs; Price Target: $8.50 from $8.40

-

News Corporation (NWS)

Retained at lighten at Ord Minnett; Price Target: $34.00 from $32.40

Retained at buy at Goldman Sachs; Price Target: $45.00 from $42.85

Upgraded to neutral from outperform at Macquarie; Price Target: $43.00 from $37.00

-

REA Group (REA)

Retained at sell at Ord Minnett; Price Target: $112.50 from $110.00

Retained at hold at Bell Potter; Price Target: $174.00 from $179.00

Retained at underweight at Jarden; Price Target: $155.00

Retained at neutral at UBS; Price Target: $182.90 from $167.00

Retained at buy at Goldman Sachs; Price Target: $201.00 from $203.00

Retained at neutral at Macquarie; Price Target: $179.00 from $185.00

Rio Tinto (RIO) retained at neutral at UBS; Price Target: $130.00

South32 (S32) retained at buy at UBS; Price Target: $3.80

-

Santos (STO)

Retained at accumulate at Ord Minnett; Price Target: $12.30

Retained at overweight at Jarden; Price Target: $8.05

Strike Energy (STX) retained at buy at Goldman Sachs; Price Target: $0.50

-

Transurban Group (TCL)

Retained at hold at Ord Minnett; Price Target: $12.50

Retained at neutral at Goldman Sachs; Price Target: $13.10

Retained at outperform at Macquarie; Price Target: $13.69 from $13.40

Downgraded to hold from buy at Jefferies; Price Target: $13.42 from $13.57

Treasury Wine Estates (TWE) retained at buy at Goldman Sachs; Price Target: $12.40

Viva Energy Group (VEA) retained at neutral at Goldman Sachs; Price Target: $3.40

Vista Group International (VGL) initiated at buy at Shaw and Partners; Price Target: $2.00

-

Woodside Energy Group (WDS)

Retained at buy at Ord Minnett; Price Target: $45.00

Retained at underweight at Jarden; Price Target: $29.00

Woolworths Group (WOW) retained at buy at UBS; Price Target: $40.50

Scans

This article first appeared on Market Index on 9 February 2024.

5 topics

10 stocks mentioned