ASX 200 set for worst session since April, S&P 500 tumbles on growth fears

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 144 points lower, down 1.81% as of 8:30 am AEST.

S&P 500 SESSION CHART

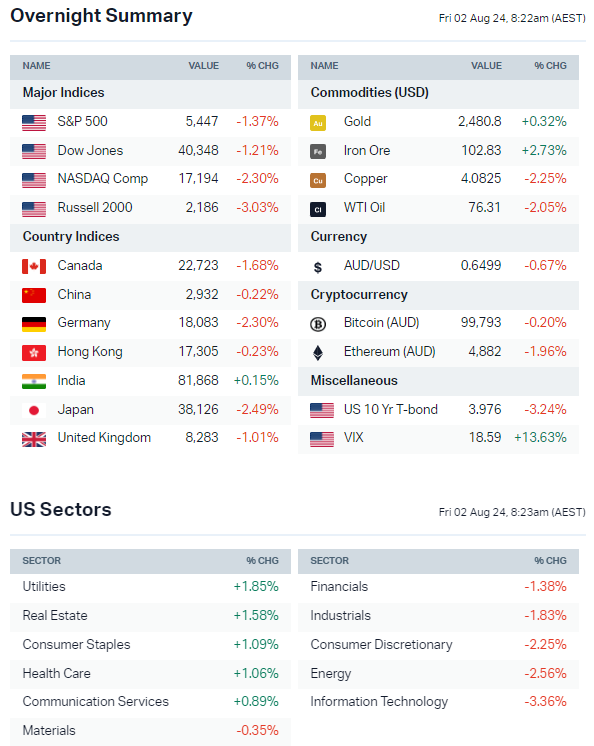

OVERNIGHT MARKETS

- Major US benchmarks flipped back to risk-off and finished not far from session lows

- Russell 2000 posted its worst session since February

- Semiconductor stocks had their worst session since 20 March, with Nvidia down 6.6%

- Overnight earnings themes – Big tech capex ramp up remains the biggest theme/concern as well as weak China demand, growing consumer headwinds, improving advertising trends and a focus on cost-cutting

- Growth fears spike on weaker-than-expected US labour and manufacturing data, alongside buildup of consumer-softness commentary in earnings calls

- Swaps traders fully pricing in three 25bp Fed cuts this year (Bloomberg)

- Chip-making stocks becoming increasingly sensitive to investment plans of handful of Big Tech companies (FT)

STOCKS

- Intel shares down 19% after hours after plans to cut 15% of its workforce and suspend its dividend, Q2 EPS was just 2 cents vs. 10 cents consensus (Reuters)

- Meta Q2 revenue beat by 2% while EPS was 9% ahead, Q3 revenue guidance was 2% above consensus, management noted healthy advertising demand but bumped up 2024 capex outlook by US$2bn and expects 2025 capex to increase significantly (FT)

- Qualcomm beats expectations, cautious on phone shipment outlook, shares tumble 9% after management cited flat year-on-year revenue growth (Bloomberg)

- Toyota shares down 8%, profits jump after weak yen and robust demand in North America boosted sales (Reuters)

- Eli Lilly obesity drug Zepbound cuts heart failure risk, late-stage study shows (CNBC)

- Maersk lifts guidance on continued shipping disruptions in the Red Sea (FT)

CENTRAL BANKS

- Bank of England cuts rates from 16-year high, 'careful on future moves' (Reuters)

- Fed leaves rates unchanged, though with some dovish tweaks to policy statement (FT)

- BOJ chief Ueda's hawkish streak signals more rate hikes to come even against backdrop of weaker economy (Reuters)

POLITICS & GEOPOLITICS

- US mulling restrictions on China's access to AI memory chips (Bloomberg)

- Iran orders direct attack against Israel, raises fears of a wider Mideast war (Reuters)

- Israel confirms it killed Hamas military commander Deif (Bloomberg)

- US and EU diplomats holding urgent discussions in bid avoid wider Middle East conflict (FT)

ECONOMY

- US July ISM Manufacturing drops to 46.8 vs. consensus 48.9 or an 8-month low, the employment sub-index hit the lowest since June 2020 (Reuters)

- US initial jobless claims posted 249,000 vs. consensus 235,000, the highest in nearly a year amid summer volatility (Reuters)

- China Caixin manufacturing PMI unexpectedly contracts (Bloomberg)

- Eurozone manufacturing PMI deep in contractionary territory with output declining at fastest pace this year (Reuters)

- UK manufacturing PMI at highest since February 2022, with stronger output, hiring and optimism around new government (Reuters)

- South Korean export growth hits six-month high amid in chip shipments (Reuters)

US-listed sector ETFs by iShares, Global X and VanEck (Source: Market Index)

ASX TODAY

- Block reports Q2 adjusted EBITDA of US$759m vs. $689m consensus, Q3 and full-year guidance also ahead of consensus (SQ2)

- Pinnacle Investment Management reports FY24 NPAT of $90.4m vs. $81.7m consensus, issues final dividend of 26.4 cents (PNI)

- ResMed reports Q4 EPS of $2.08, in-line with consensus, raises quarterly dividend by 10.4% to 53 cents (RMD)

WHAT TO WATCH TODAY

Get ready for a rough one. Lots of bearish moving parts overnight – Heavy overnight session for commodities, markets front-running Fed rate cut expectations, megacap tech stocks heavy on capex concerns (plus Intel miss/layoffs) and weak US macro data.

- Uranium: The Global X Uranium ETF nosedived 7.7% overnight to close at a 9-month low. This should see local names open broadly lower.

- Copper: Copper prices took a sizeable hit overnight on growth concerns, down 2.3% to US$4.06/lb or the lowest since early April.

- Lithium: Lithium-related ETFs fell around 3% overnight but the big story was from Albemarle. The lithium giant said “The market is not improving. It’s actually probably getting a little worse. We’re using the term ‘lower for longer’ from a pricing perspective."

- Defensives: S&P 500 sectors including Healthcare, Staples, Real Estate and Utilities all finished more than 1% higher overnight. Let's see if ours can offset some of the weakness that'll occur across everything else.

BROKER MOVES

- Bluescope Steel downgraded to Neutral from Overweight; target $23 (JPMorgan)

- Capricorn Metals upgraded to Buy from Overweight; target increased to $6.28 from $5.80 (Jarden)

- Jupiter Mines initiated Buy with $0.40 target (Argonaut)

- News Corp downgraded to Neutral from Buy; target cut to $46.30 from $36.78 (UBS)

- Orora downgraded to Neutral from Buy; target cut to $2.30 from $2.86 (Citi)

KEY EVENTS

Companies trading ex-dividend:

- Fri 2 Aug: Several ETFs trade ex-dividend today. See a full list here

- Mon 5 Aug: PRL Global (PRG) – $0.05, Perpetual Credit Income Trust (PCI) – $0.007

- Tue 6 Aug: BKI Investment Company (BKI) – $0.04

- Wed 7 Aug: Amcil (AMH) – $0.03, Mayfield Group (MYG) – $0.02, Pacific Smiles (PSQ) – $0.07

- Thu 8 Aug: None

Other ASX corporate actions today:

- Dividends paid: None

- Listing: None

- Earnings: ResMed (RMD), Block (SQ2), Pinnacle (PNI)

- AGMs: None

Economic calendar (AEST):

- 11:30 am: Australia Home Loans (Jun)

- 11:30 am: Australia Producer Price Index (Q2)

- 10:30 pm: US Non Farm Payrolls (Jul)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment