ASX 200 slumps to fifth loss as resources, property stocks fall, discretionary stocks rise

Today in Review

Markets

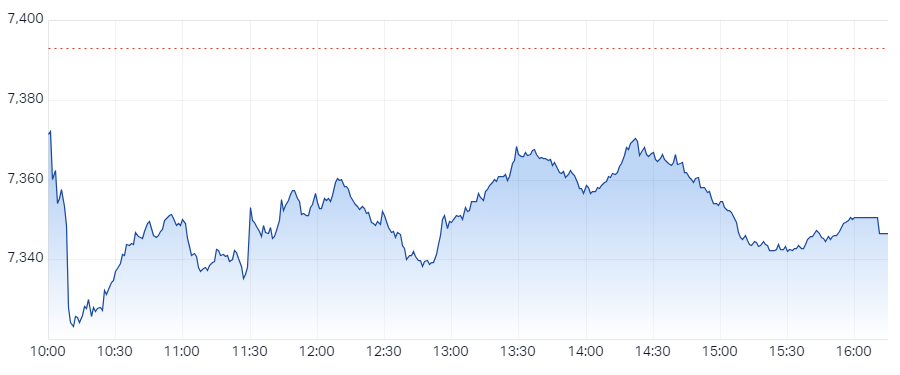

ASX 200 Session Chart

%20Intraday%20Chart%2018%20Jan%202024.png)

The S&P/ASX200 (XJO) finished 46.6 points lower at 7,346.5, 0.33% from its session low and just 0.63% from its high. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by a dismal 94 to 180.

It’s a bit of all or nothing for the Aussie stock market lately. Between 28 November and 2 January, the S&P/ASX200 logged gains in 16 out of 23 trading sessions for a gain of 640 points or 9.2%. Since then, it’s delivered us 11 out of 13 losing sessions for a loss of 281 points or 3.7%.

The good news is we’re still head of where we started. The bad news is investors appear to have lost the unbridled optimism which drove them to pile into stocks at the end of last year. Instead, they appear to be focusing on the reality they probably overcooked expectations of when and how much rates are going to be cut in 2024.

Doing it tough today was the S&P/ASX 200 Materials Sector (XMJ) -1.1%, not surprisingly when you consider the prices of iron ore, aluminium, copper, nickel, lead, zinc are all down. Even worse, as I alerted you to in yesterday's article on Chinese stock and property indices, there were further heavy losses there.

Apart from resources, the S&P/ASX 200 Real Estate Investment Trusts (XPJ) -2.3% was the worst sector. It doesn't like the creep higher market interest rates as investors are paring back their expectations for the size and timing of rate cuts this year.

Bright spots? To be fair I've been drawing your attention lately to the solid technical picture of the S&P/ASX 200 Consumer Discretionary Sector (XDJ) sector which added a commendable 0.3% today given the circumstances. It's today's sector chart of the day.

The XDJ is still showing all of the signs of excess demand: short and long term uptrends, solid price action, and predominantly demand-side candles. This combination of technical factors is even more impressive when one considers how many of its sector counterparts have unraveled lately. I suggest this remains the key sector to watch, particularly if broader market conditions improve.

Economy

-

Australian employment change and unemployment rate

Aussie economy lost 65,000 jobs in December, a far worse result than the 15,000 increase in jobs forecast by economists

November result of 61,500 jobs created was revised higher to 72,800 jobs created

According to the ABS: "strength in employment in October and November and the fall in December, reflected changes in the timing of employment growth in the last few months of 2023, compared with earlier years", seasonally adjusted, employment grew 32,000 through the last 3 months of the year

Unemployment rate was steady at 3.9%

What to watch out for...

Later this week:

Saturday 02:00am: US Prelim UoM Consumer Sentiment, forecast 69.8; US Existing Home Sales, forecast 3.83 million

Latest News

12 stocks with game-changing catalysts in 2024

Goldman’s 2024 Australian banking stocks playbook: Best to worst

Where Forager is hunting in 2024 (including 8 stocks and one unloved sector)

Is Evolution Mining a bargin at $3?

BHP's Q2 report: Iron ore production exceeds expectations, copper misses, nickel woes persist

Directors went Christmas shopping: Insider trades for the December quarter

Interesting Movers

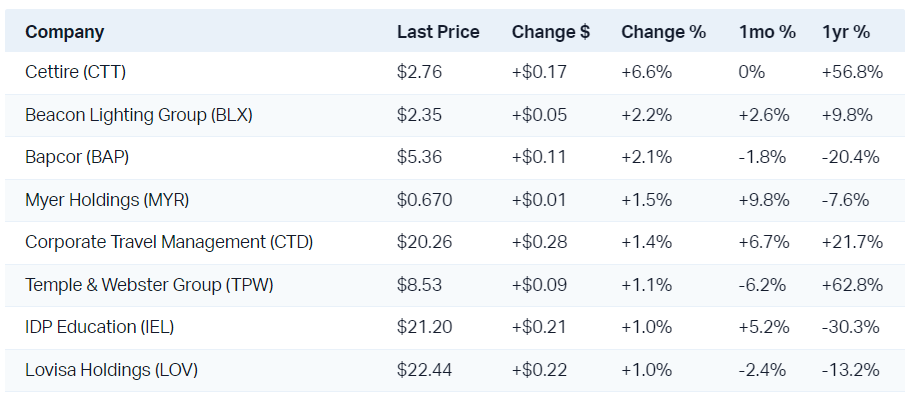

Trading higher

+22.1% EML Payments (EML) - EML Payments to exit 'PCSIL' business

+6.6% Cettire (CTT) - No news, bouncing off long term uptrend ribbon

+5.2% Select Harvests (SHV) - No news 🤔

+4.6% Zip Co (ZIP) - No news 🤔

+4.5% Lycopodium (LYL) - No news, bouncing off short term uptrend ribbon, rise is consistent with prevailing short and long term uptrends

+3.9% Perenti (PRN) - Perenti secures A$420 million of contract extensions

+3.9% Mount Gibson Iron (MGX) - Quarterly Activities Report

+3.5% BSP Financial Group (BFL) - No news, rise is consistent with prevailing short and long term uptrends

+3.4% Nuix (NXL) - No news since 12-Jan Bouncing after sharp sell off following 1H24 Results Update

+3.2% Emerald Resources (EMR) - No news, rise is consistent with prevailing short and long term uptrends

+3.1% Life360 Inc. (360) - No news 🤔

+3.0% Tyro Payments (TYR) - No news 🤔

+2.7% Mader Group (MAD) - No news, rise is consistent with prevailing short and long term uptrends

Trading lower

-40.8% APM Human Services International (APM) - No news since 17-Jan First Half Trading Update, broker downgrades from Jefferies and UBS, see Brokers section below, fall is consistent with prevailing short and long term downtrends

-10.7% Liontown Resources (LTR) - Albemarle sells stake in block trade, weaker lithium sector on continued falls in lithium minerals prices, fall is consistent with prevailing short and long term downtrends

-6.5% Piedmont Lithium Inc (PLL) - No news, weaker lithium sector on continued falls in lithium minerals prices, fall is consistent with prevailing short and long term downtrends

-6.4% Latin Resources (LRS) - No news, weaker lithium sector on continued falls in lithium minerals prices, fall is consistent with prevailing short and long term downtrends

-5.6% Coronado Global Resources Inc. (CRN) - No news

-5.1% Cromwell Property Group (CMW) - No news since 15-Jan Valuations Update, weaker property sector on rising market rates, fall is consistent with prevailing short and long term downtrends

-4.6% 29METALS (29M) - No news, fall in copper price, fall is consistent with prevailing short and long term downtrends

-4.4% IGO (IGO) - No news, fall in nickel and lithium minerals prices, fall is consistent with prevailing short and long term downtrends

-4.3% Champion Iron (CIA) - No news, fall in iron ore price

-4.3% Waypoint Reit (WPR) - Ceasing to be a substantial holder from CBA, weaker property sector on rising market rates, fall is consistent with prevailing short and long term downtrends

-4.1% Develop Global (DVP) - No news, weaker lithium sector on continued falls in lithium minerals prices, fall is consistent with prevailing short and long term downtrends

-4.1% Calix (CXL) - No news since 17-Jan Calix announces change of auditor, fall is consistent with prevailing short and long term downtrends

-4.1% Nickel Industries (NIC) - No news, weaker nickel price, fall is consistent with prevailing short and long term downtrends

Broker Notes

Alkane Resources (ALK) downgraded to accumulate from buy at Ord Minnett; Price Target: $0.70 from $0.75

Altium (ALU) retained at neutral Citi; Price Target: $46.65

ANZ Group Holdings (ANZ) retained at buy Goldman Sachs; Price Target: $27.85 from $26.66

-

APM Human Services International (APM)

Downgraded to hold from buy at Jefferies; Price Target: $1.32

Downgraded to neutral from buy at UBS; Price Target: $1.27

Abacus Storage King (ASK) retained at buy Citi; Price Target: $1.20

Bapcor (BAP) retained at underperforrm Morgan Stanley; Price Target: $5.30

Bendigo and Adelaide Bank (BEN) retained at neutral Goldman Sachs; Price Target: $9.57 from $9.35

BHP Group (BHP) retained at neutral Citi; Price Target: $49.00

Boab Metals (BML) retained at buy Shaw and Partners; Price Target: $0.52

Bank of Queensland (BOQ) retained at sell Goldman Sachs; Price Target: $5.00 from $5.15

Commonwealth Bank of Australia (CBA) retained at sell Goldman Sachs; Price Target: $82.55 from $81.64

Deep Yellow (DYL) downgraded to hold from buy at Jefferies; Price Target: $1.45

Elders (ELD) initiated at hold Jefferies; Price Target: $7.70

-

Evolution Mining (EVN)

Upgraded to buy from neutral at BofA; Price Target: $4.00

Downgraded to outperform from buy at CLSA; Price Target: $3.50

Retained at equalweight Morgan Stanley; Price Target: $3.45

Retained at buy Goldman Sachs; Price Target: $3.70

Upgraded to buy from neutral at Citi; Price Target: $3.95

Insurance Australia Group (IAG) retained at overweight Morgan Stanley; Price Target: $5.50 from $5.45

Judo Capital Holdings (JDO) retained at buy Goldman Sachs; Price Target: $1.58 from $1.57

Mineral Resources (MIN) downgraded to neutral from outperform at CICC; Price Target: $59.20 from $67.40

Macquarie Group (MQG) retained at neutral Goldman Sachs; Price Target: $180.80

Matador Mining (MZZ) retained at buy Shaw and Partners; Price Target: $0.19

National Australia Bank (NAB) retained at buy Goldman Sachs; Price Target: $31.17 from $30.52

National Storage Reit (NSR) retained at buy Citi; Price Target: $2.60

Orora (ORA) retained at buy Goldman Sachs; Price Target: $3.50 from $3.55

Peter Warren Automotive Holdings (PWR) retained at overweight Morgan Stanley; Price Target: $3.40

Super Retail Group (SUL) retained at sell UBS; Price Target: $12.60 from $11.50

Suncorp Group (SUN) retained at overweight Morgan Stanley; Price Target: $16.20 from $15.70

Westpac Banking Corporation Ordinary (WBC) retained at buy Goldman Sachs; Price Target: $22.85 from $20.70

Scans

This article firs appeared on Market Index on 18 January 2024.

4 topics

9 stocks mentioned