ASX 200 to cross 8,000 for the first time, Dow tops 40,000, Investors pile into small caps

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 51 points higher, up 0.64% as of 8:30 am AEST.

S&P 500 SESSION CHART

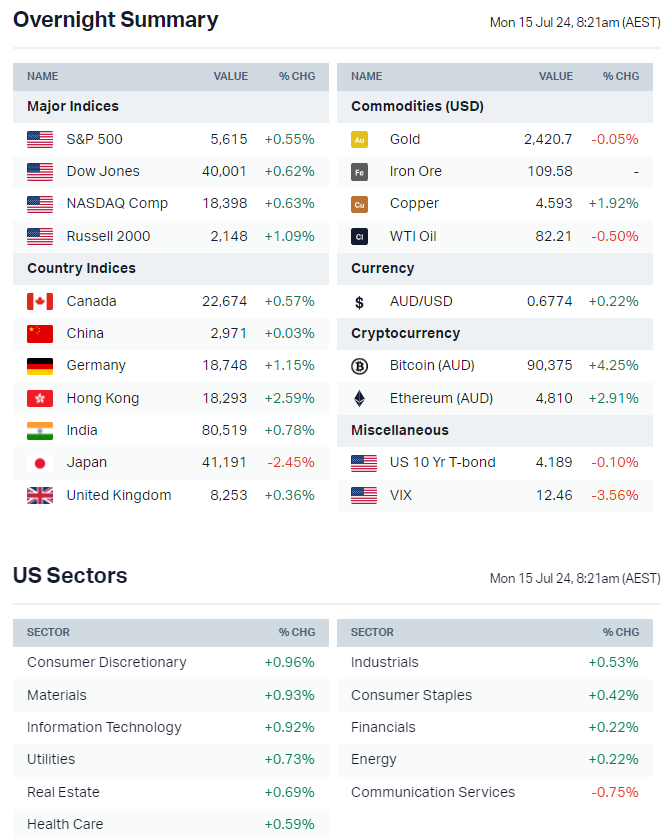

OVERNIGHT MARKETS

- Major US benchmarks finished higher but off best levels amid a last-hour selldown

- Dow narrowly missed the all-time high it set on 17 May

- Big tech names were mixed with Tesla up 3.0% but Meta down 2.7%

- Market continued to rotate into cyclicals like small-caps, heavily shorted stocks, retailers, yield-sensitive sectors and commodities

- When the market experiences a significant one-day rotation from large to small caps, this trend tends to persist for the following four weeks, according to UBS

- Weekly benchmark recap: Russell 2000 (+6.0%), Dow (+1.59%), S&P 500 (+0.87%) and Nasdaq (+0.25%)

- Earnings expected to grow at fastest rate since Q4-21, sets up high bar this earnings season (Bloomberg)

- Analysts see safe havens, groups leveraged to Trump victory as likely gainers following assassination attempt (Bloomberg)

- Broadening market could be painful for passive investors as performance could come at expense of big tech (Bloomberg)

- Bitcoin ETF inflows jump after recent Mt. Gox driven selloff (Bloomberg)

STOCKS

- Wells Fargo shares tumble 6% after Q2 net interest income falls short of estimates, guidance for 2024 to come in at the low end of prior outlook (CNBC)

- Citi shares ease 2% but net interest income, margins and EPS all topped analyst expectations amid surge in investment banking activities (Reuters)

- JPMorgan shares ease 1% despite largely in-line results and unchanged net interest income and expense guidance, investment banking highlighted as a standout (CNBC)

- Pepsi warns consumers becoming more price conscious after years of price hikes (link)

- Delta earnings reflect industry profit headwinds after years of capacity growth (link)

- Tesla launches new Model 3 long-range variant at US$42,490 or US$5,000 lower than the all-wheel drive version (Reuters)

CENTRAL BANKS

- ECB may signal another rate cut in September at this week's meeting (Bloomberg)

- Fed officials increasingly suggesting they are preparing for a rate cut (FT)

- Chicago Fed's Goolsbee says CPI gives him confidence inflation tracking to 2% (Bloomberg)

- Fed's Daly, Musalem see recent inflation data as encouraging (Bloomberg)

POLITICS & GEOPOLITICS

- Former President Trump injured but safe after assassination attempt at Pennsylvania rally, suspect killed (NY Times)

- Trump confirms he will be at RNC next week after assassination attempt (Bloomberg)

- Biden warns European allies ready to cut investment in China over its support for Russia (Bloomberg)

- Gaza truce talks making progress though lingering differences remain (Reuters)

ECONOMY

- US producer prices rise slightly more than forecast, up 2.6% in June vs. 2.3% consensus – this marks the largest advance in March 2023 (Bloomberg)

- China export growth tops forecasts as imports unexpectedly shrink amid weak economy (Bloomberg)

US-listed sector ETFs by iShares, Global X and VanEck (Source: Market Index)

ASX TODAY

- ASX 200 to open at another record high and above 8,000 for the first time on record

- ASX 200 changes effective prior to open on 22-Jul: Zip in, Altium out

- Altium holders vote in favour of proposal acquisition by Renesas (ALU)

- BHP approached by Lundin about JV bid for copper miner Filo Corp (Bloomberg)

- Champion Iron temporarily closes Bloom Lake mine due to forest fires (CIA)

- Genesis Capital to vote its 19.9% stake against Crescent Capital $1.90 per share proposal for Pacific Smiles (AFR)

- Rio Tinto considering offering more than US$30bn for Teck Resources (Sky News)

WHAT TO WATCH TODAY

- Rotation debate: Small caps and rate-sensitive pockets of the market continued to rally overnight while growth and momentum stocks eased. The UBS comment about how the occurrence of a significant one-day rotation from large to small caps tends to persist for four weeks could set the local market for a very strong month. Last week, the top performing ASX 200 sectors include Discretionary (+3.8%), Real Estate (+3.2%), Telcos (+2.9%) and Financials (+2.7%)

BROKER MOVES

- AGL Energy initiated Neutral with $10.35 target (Goldman Sachs)

- Ebos Group initiated Buy with $33.50 target (Ord Minnett)

- Origin Energy initiated Buy with $11.35 target (Goldman Sachs)

- Paragon Care initiated Accumulate with $0.46 target (Ord Minnett)

- Sigma Healthcare initiated Accumulate with $1.35 target (Ord Minnett)

KEY EVENTS

Companies trading ex-dividend:

- Mon 15 July: None

- Tue 16 July: Metcash (MTS) – $0.085

- Wed 17 July: Turners Automotive (TRA) – $0.069

- Thu 18 July: None

- Fri 19 July: None

Other ASX corporate actions today:

- Dividends paid: None

- Listing: Piche Resources (PR2) at 12:00 pm

- Earnings: None

- AGMs: None

Economic calendar (AEST):

- 12:00 pm: China GDP Growth Rate (Q2)

- 12:00 pm: China Industrial Production (Jun)

- 12:00 pm: China Retail Sales (Jun)

- 12:00 pm: China Fixed Asset Investment (Jun)

- 2:30 am: Fed Chair Powell Speech

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Funds

The 5 best-performing super funds of the year

Livewire Markets

Equities

Buy Hold Sell: 5 ASX stayers built to go the distance

Livewire Markets