ASX 200 to fall, oil prices hit 10-month high + China's iPhone crackdown

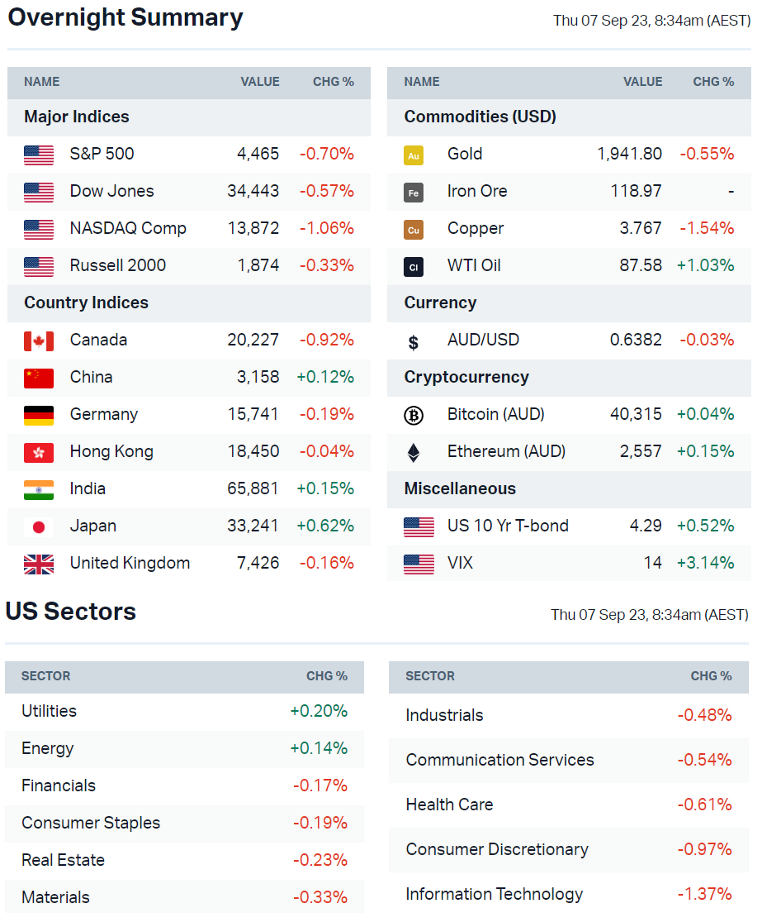

ASX 200 futures are trading 35 points lower, down -0.49% as of 8:20 am AEST.

S&P 500 SESSION CHART

MARKETS

- Major US benchmarks lower but off worst levels

- Overnight weakness was relatively broad-based, led by big tech

- US Dollar Index extends gains to a 6-month high, up 5.3% since mid-July

- Bond yields higher, the 10-year is on a five-day winning streak, up 19 bps

- The market is on the backfoot again, with a defensive and risk-off shift amid renewed strength in bonds and the dollar, a spike in energy prices and poor breadth

- Oil rises above $90 for first time in 2023 after Saudi and Russia extend cuts (FT)

- M&A activity shows signs of picking up after a slow start to the year (Axios)

- Hedge funds face pressure to perform from investors or face redemptions (FT)

- No signs of strain as Fed offloads $1tn of bonds from its portfolio (Bloomberg)

- US government shutdown could begin on 30 Sept if Congress fails to pass spending legislation, White House has asked to pass a single short-term measure called a ‘Continuing Resolution’ to fund the federal government at current levels (CNBC)

STOCKS

- Apple inks new long-term deal with Arm for chip technology (Reuters)

- Apple shares sink 3.6% after a report that China banned the use of iPhones and other foreign-brand services by government officials at work (CNBC)

- WeWork to renegotiate nearly all leases, exit 'unfit' sites (Bloomberg)

- Streaming company Roku to lay off 10% of staff, consolidate office space (CNBC)

- AMC tumbles 37% as it plans to sell up to 40m new shares to raise cash (CNBC)

CENTRAL BANKS

- Boston Fed's Collins says Fed can 'proceed cautiously' on future hikes (CNBC)

- SF Fed study finds rate hikes curb economic output for at least a decade (Bloomberg)

- Bank of Canada held rates at 5.0%, noting that the economic had a period of weaker growth but could raise again if inflation does not subside (Reuters)

- ECB's Villeroy says options remain open at coming meetings (Bloomberg)

- ECB's Knot says market risks underlying hiking chances (Bloomberg)

- Poland's central bank unexpectedly cuts benchmark rate by 75bp (Bloomberg)

CHINA

- China says economic 'fundamentals' are unchanged despite slowdown (Bloomberg)

- China property developers soar in wave of speculative buying (Bloomberg)

- Poll suggests China's exports and imports likely contracted but at slower pace in August (Reuters)

ECONOMY

- US services sector picked up in August along with prices (Reuters)

- Eurozone retail sales dip as auto fuel purchases fall in July (Reuters)

- German factory orders slump most since lockdowns in 2020 (Bloomberg)

Sectors to Watch

Another heavy overnight session. Energy continues to climb while the rest of the market suffers. Oil has hit its highest levels since November 2022, which won't bode well for global inflation trends. As for sectors to watch on Thursday:

- Energy: Utilities and Energy were the only positive sectors on the S&P 500. The energy rally is beginning to get a little choppy at these extended levels. Despite higher oil prices overnight, there was a slight pullback for other energy-related commodities such as Newcastle Coal futures (-2.0%) and uranium (Global X Uranium ETF down 1.5%)

- Tech: Classic risk-off overnight session with Tech and Discretionary leading to the downside. Heavyweight Apple (-3.6%) took a hit after China banned all government employees from using their products. Let's see if this tone weighs on local tech and growth-y sectors.

Broker Watch

Uranium awakens: Spot uranium prices are up 5% over the last two months due to production guidance downgrades and supply risks in Niger. A coup from late July has driven fears of disruption, against a stronger demand backdrop. Recent developments could also cause the benchmark Sprott physical uranium fund to buy more of the commodity.

"The Sprott physical uranium fund has not reported any purchases since late April, but with the discount of market price to NAV narrowing, this could trigger more purchases, as seen in Feb 2023 and Sep/Oct 2022," said Morgan Stanley analysts.

Is insurance (still) an underrated opportunity: Ask a lot of value fund managers (Lazard, Yarra Group for instance) and they'll tell you that insurers are the far better financial play over the banks. But which insurers are presenting the better opportunity? Citi's thoughts are that the general insurers are a better way to play the space.

"We should see strong top line momentum, growing earn through of recent premium rate rises and, potentially too, moderating claims inflation. This should lead to expanding margins, even though headwinds such as higher reinsurance costs look set to continue for some time yet," analyst Nigel Pittaway wrote to clients.

The general insurers are QBE (ASX: QBE), Suncorp (ASX: SUN), and IAG (ASX: IAG).

Morgan Stanley tends to agree, but they also add that it may be worth looking at the insurance brokers for a different-but-same way to play the space. But - and I emphasise but - there seems to be only one clear winner.

"Among the brokers, only AUB (ASX: AUB) (+10%) was a clear positive, then Steadfast (ASX: SDF) (+1%) & PSC Insurance Brokers (ASX: PSI) (-0.5%). We think the insurers could deliver more upside on a one-year view given potential to over-earn during an El Nino dry weather period and room to re-rate," analyst Andrei Stadnik wrote.

KEY EVENTS

ASX corporate actions occurring today:

Trading ex-div: Insignia Financial (IFL) – $0.09, ASX (ASX) – $1.12, Perpetual (PPT) – $0.65, Reliance Worldwide (RWC) – $0.07, Super Retail Group (SUL) – $0.69, Mcmillan Shakespeare (MMS) – $0.66, Smartgroup (SIQ) – $0.155, BHP (BHP) – $1.25, Monadelphous (MND) – $0.25

- See full list of ASX stocks and ETFs trading ex-dividend here

- Dividends paid: Ansell (ANN) – $0.40

- Listing: None

Economic calendar (AEST):

- 11:30 am: Australia Balance of Trade

- 1:00 pm: China Balance of Trade

- 1:10 pm: RBA Lowe Speech

6 stocks mentioned

2 contributors mentioned