ASX 200 to fall, S&P 500 posts worst day since 2022, VIX hits highest level since Covid

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 27 points lower, down -0.35% as of 8:30 am AEST.

S&P 500 SESSION CHART

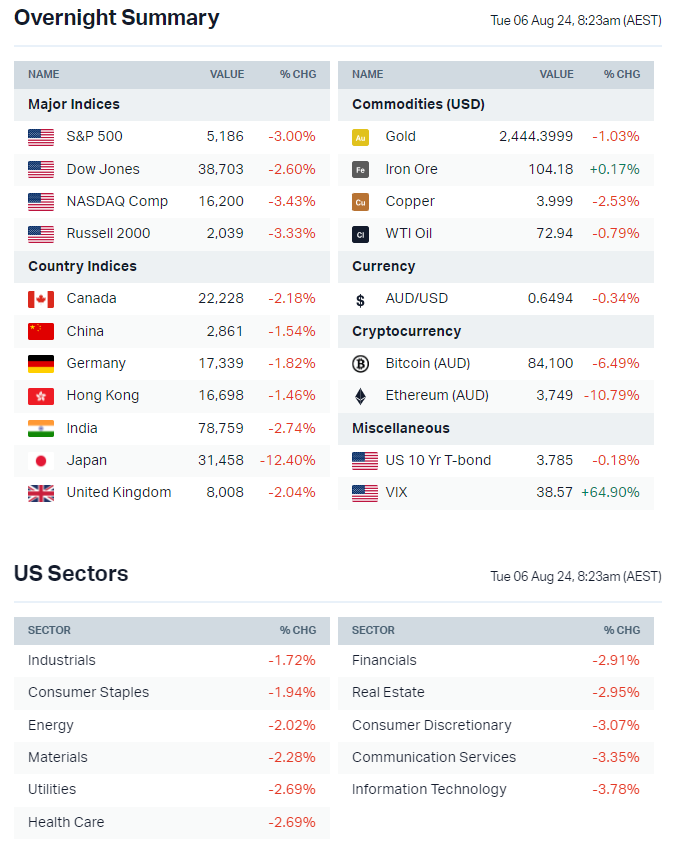

OVERNIGHT MARKETS

- Major US benchmarks finished sharply lower but off worst levels – Approximately US$1.4 trillion was wiped out from the market overnight

- S&P 500 logged its worst session in almost two years, now down 8.5% from 16-Jul record highs

- Broad-based selloff, with all sectors red and only 22 advancers in the S&P 500

- Big Tech was the largest drag on benchmarks, with most names down 3-6%

- Bitcoin down 5.6% but at one point falling 15% and below US$50,000

- VIX briefly spiked to 65.7 – This marks the third biggest jump in history after the GFC and Covid

- Unwinding of Yen carry trade was the key driver of the global risk-off, which was compounded by recent growth worries, the continued unwinding of systematic long/short trades, rising Middle East tensions and US political uncertainty

- Traders assigned 60% chance of emergency rate cut at height of Monday sell-off (BI)

- CBOE VIX logged it largest ever intraday jump on Monday (Reuters)

- Investors pulled over US$800m from commodity ETFs last week, largest outflow since Dec-22 (Bloomberg)

- Asian markets hit circuit breakers and European stocks set for biggest three-day decline in two years (Bloomberg)

- Japan stock market enters bear market territory, exacerbated by yen strength (FT)

- Japanese Yen jumps to 7-month highs against dollar amid worries over US slowdown (Reuters)

- South Korea, Taiwan stock markets hit worst losses since 2022 as circuit breakers activated for first time in four years (Bloomberg)

STOCKS

- Buffett's Berkshire Hathaway unloads nearly half of its gigantic Apple stake (CNBC)

- Elliott says Nvidia is in a bubble and AI is overhyped (FT)

- Novo Nordisk spends record amounts on research to fight off weight-loss rivals taking its market share (FT)

- US utility stocks receive big inflows as the emergence of power-hungry AI drives surge in electricity demand (FT)

CENTRAL BANKS

- Traders assigned 60% chance of emergency rate cut at height of Monday sell-off (BI)

- Soft July employment report challenges soft-landing narrative, raises worries Fed behind the curve (FT)

- Minutes show some BOJ policymakers warned rising import prices from weak yen hurting consumer sentiment (Reuters)

- RBA expected for a hawkish hold, board seen warning about upside risks in inflation (Bloomberg)

POLITICS & GEOPOLITICS

- Harris narrows VP search to Pennsylvania Governor Shapiro and Minnesota Governor Walz (Reuters)

- Israel prepares for possible Iran attack while Washington presses for Gaza ceasefire, deploys additional military (Bloomberg)

- US Commerce Department to propose prohibiting Chinese software in autonomous and connected vehicles in coming weeks (Reuters)

- North Korea says deployed 250 new mobile launchers for ballistic missiles that can deliver nuclear strikes on South Korea, US bases (Bloomberg)

ECONOMY

- US service sector PMI rebounds in July, employment also recovers (Reuters)

- Goldman Sachs raises US recession 2025 risk to 25% from 15% prior (Bloomberg)

- China Caixin services activity continues to expand in July (Reuters)

- UK services sector growing at fastest rate since May 2023 (Reuters)

- Japan service activity returns to growth in July on solid domestic demand (Reuters)

US-listed sector ETFs by iShares, Global X and VanEck (Source: Market Index)

ASX TODAY

- Audinate reports preliminary FY24 EBITDA of $19.5-20.5m vs. consensus $20.5m, drivers of revenue during FY24 not expected to continue into FY25 (AD8)

- Australian government to cap university overseas enrollment to 40% of students, sources say the caps will commence 1-Jan-2025 (AFR)

- Coronado Global reports second quarter results, with $673.8m revenue vs. consensus $657m (CRN)

- Galan Lithium receives $150m takeover bid from EnergyX – This news was leaked to the AFR, driving the share price 15% higher on Monday (AFR)

- Woodside Energy Group to acquire OCI Clean Ammonia for $2.35bn cash (WDS)

WHAT TO WATCH TODAY

Wow. What a wild start to the week. The unwinding of the Yen carry trade is probably the biggest story – You can ready my 'explain it like I'm five' piece here.

If I had to summarise everything in a few simple sentences I would say – We've seen a massive implosion for global markets. This reflects a pivot from inflation worries to recession, and the unwinding of the Yen carry trade has only added further insult to injury. Traders are now pricing in a 60% chance of an emergency Fed rate cut – the US clearly wants none of this. Regardless of what happens, we're now left with a lot of volatility. Even if the market bottoms, this is the prime environment for whipsaw action and wild swings. Unless your thrive off volatility, the current market is not for the light hearted.

Keep an eye out for dip buying price action – Most of our overnight ETFs ticked lower but well off worst levels. (E.g. Global X Copper Miners ETF fell -3.8% vs. session lows of -7.3%). Let's see if this can drive a bit of a bounce for local equities.

BROKER MOVES

- Pro Medicus downgraded to Hold from Buy; target remains $120 (Jefferies)

KEY EVENTS

Stocks trading ex-dividend:

- Tue 6 Aug: BKI Investment Company (BKI) – $0.04, Amcil (AMH) – $0.03

- Wed 7 Aug: Mayfield Group (MYG) – $0.02, Pacific Smiles (PSQ) – $0.07

- Thu 8 Aug: None

- Fri 9 Aug: Djerriwarrh Investments (DJW) – $0.08, Aloca (AAI) – $0.107

- Mon 12 Aug: None

Other ASX corporate actions today:

- Dividends paid: Collins Foods (CKF) – $0.155

- Listing: None

- Earnings: Arcadium Lithium (LTM), Coronado Global (CRN)

- AGMs: None

Economic calendar (AEST):

- 2:30 pm: RBA Interest Rate Decision

- 7:00 pm: Eurozone Retail Sales (Jun)

- 10:30 pm: Canada Balance of Trade (Jun)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Investment Theme

If 24 LICs ran the Melbourne Cup, which ones would we back?

Affluence Funds Management