ASX 200 to fall, S&P 500 tries to bounce + Oil prices surge to 11-month high

ASX 200 futures are trading 13 points lower, down -0.18% as of 8:20 am AEST.

S&P 500 SESSION CHART

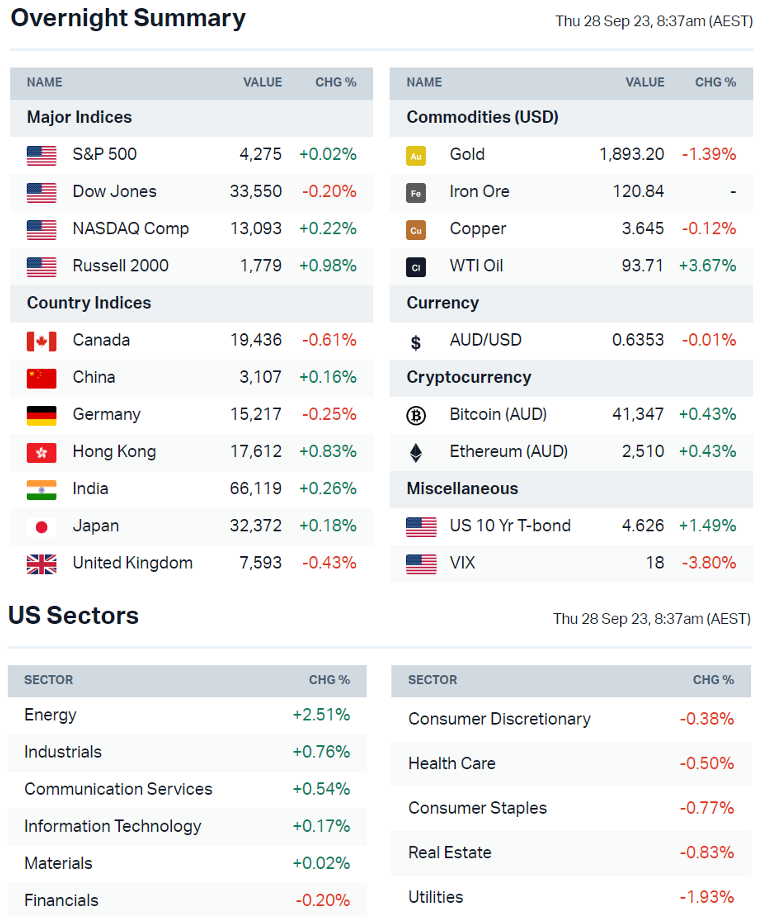

MARKETS

- S&P 500 finished around breakeven but well off session lows of -0.82%

- Bond yields briefly pulled back but finished higher, with the 10-year up 7 bps to 4.61% – The highest since October 2007

- Gold settled 1.3% lower, now down 2.6% in the last three sessions and marked its first closed below US$1,900 since 10 March

- WTI crude rallied above US$94 a barrel for the first time since August 2022, set for an almost 30% gain for the quarter

- Goldman Sachs raised its US government shutdown odds up to 90% but says any shutdown will end after two to three weeks (Yahoo)

- Goldman Sachs says ~90% of S&P companies likely to be in their buyback blackout periods by the end of the week as Q3 earnings season approaches

- European stocks close at a six-month low as global data continues to cause concern (CNBC)

- Treasury 'term premium' gauge positive for first time since 2001, underscoring the potential for rates to stay higher for longer (Bloomberg)

- US small-cap stocks wilt in the heat of higher rates (FT)

- Oil climbs 3% as steep US crude stocks draw add to supply concerns (Reuters)

STOCKS

- Costco Q4 earnings top estimates, sales hold steady amid high gas prices (Yahoo)

- OpenAI seeks $90bn valuation in possible share sale (Yahoo)

- ArcelorMittal sees global steelmakers buoyed by China output limits (Bloomberg)

CENTRAL BANKS

- Kashkari says Fed may do less if risks like shutdown hit (Bloomberg)

- ECB's Holzmann says shocks from energy prices may force ECB to raise rates again (Bloomberg)

- BOJ members differed on hitting price target as YCC was tweaked (Bloomberg)

CHINA

- China property stocks slide to lowest since 2011 (Bloomberg)

- China investor gloom on property reaches record, investors plan to cut property exposure, survey shows (Bloomberg)

- PBoC to use 'precise, forceful' policy to bolster recovery (Reuters)

- China's industrial profits posts strong rebound in August (ChinaView)

- Major Evergrande creditor to seek liquidation if no new debt plan soon (Reuters)

- China Evergrande's Chairman Hui under police surveillance (Bloomberg)

ECONOMY

- US durable goods orders beat expectations in boost to economy in Q3 (Reuters)

- German consumer sentiment unlikely to recover this year, GfK says (Reuters)

- Australia CPI rose to 5.2% in August on higher oil prices (Guardian)

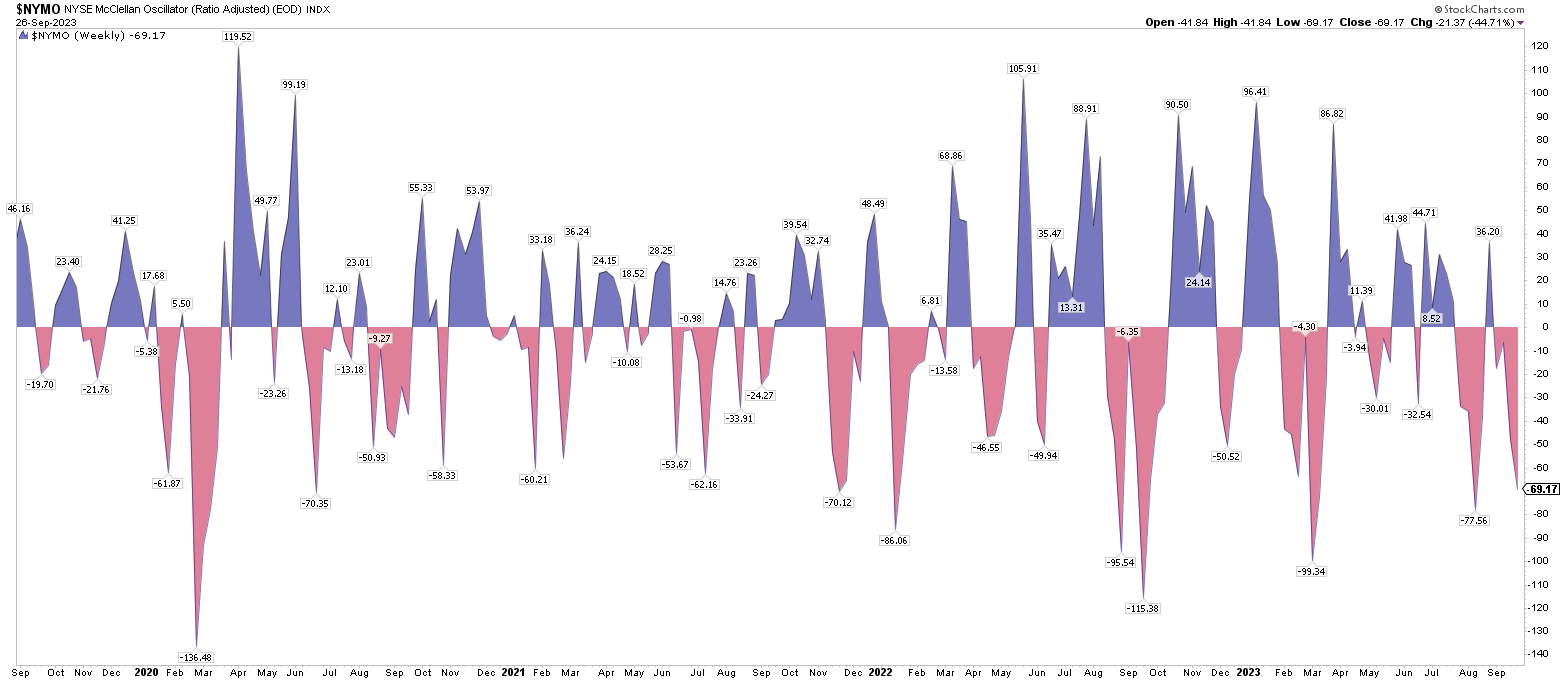

Market Breadth In Question

The percentage of S&P 500 stocks trading above their 200-day moving average is at multi-month lows.

While the percentage of S&P 500 stocks trading above their 50-day is now only 12%. The only times we've seen readings at such depressed levels was:

- The market low of October 2022

- The Covid lows in 2020

- Taper tantrum in 2018

The indicator also suggests that the consensus is growing ever more bearish, supported by the fact that hedge funds are loading up on bearish bets. Could this be another market low? Or is the market in a terribly unhealthy state?

Another indicator (McClellan Oscillator chart below) suggests the S&P 500 is - temporarily at least - oversold. So while there may be some window dressing for the end of the month/quarter, any bounce may be short-lived. And as for any further sell-down .... well, good luck.

Goldman Sachs and Banks

Back to our local market and Goldman Sachs has undertaken its regular review of the Big Banks' earnings forecasts. The big change is an upward revision to its base case around loan growth for both businesses and individuals (i.e. mortgages) but a further decline in net interest margins. Remember, NIMs, as they are called, are one of the most important metrics for banks beyond the dividend and cash profit.

- "While we’ve seen some relief in mortgage competition, we do not expect this to be sustained over the remainder of CY23 and into 2024."

- "Our major banks’ (+BEN) FY23/24/25e cash EPS moves by between -2% (ANZ FY25E) and +2% (CBA FY24E), with more elevated downgrades for BOQ on costs."

- Bank of Queensland (ASX: BOQ) is downgraded to a SELL with a new $5.60 price target

- Preference for ANZ (ASX: ANZ) over the other majors

CLSA's Double-Moves

One last point of interest before I let you get on with your day. CLSA did something relatively unusual yesterday.

It issued a double downgrade for Qantas (ASX: QAN) from Overweight to Underweight (with a $5.60 price target).

Then, it issued a double upgrade for Pro Medicus (ASX: PME) from Sell to Outperform with a new price target of $88.80.

It smells like a classic case of playing catch-up but only time will tell.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: There are 40 stocks trading ex-div today. See a full list here

- Dividends paid: There are 24 companies paying out dividends today. See a full list here

- Listing: Pioneer Lithium (PLN) at 11:00 am

Economic calendar (AEST):

- 11:30 am: Australia Retail Sales

- 10:00 pm: Germany Inflation

- 10:30 pm: US Q3 GDP

This Morning Wrap was written by Hans Lee and Kerry Sun.

4 stocks mentioned

2 contributors mentioned