ASX 200 to fall + Why Morgan Stanley thinks copper prices have found a floor

ASX 200 futures are trading 13 points lower, down -0.18% as of 8:30 am AEDT.

The US and UK markets were closed overnight so the format will be a little bit different this morning.

ASX 200 DAILY CHART

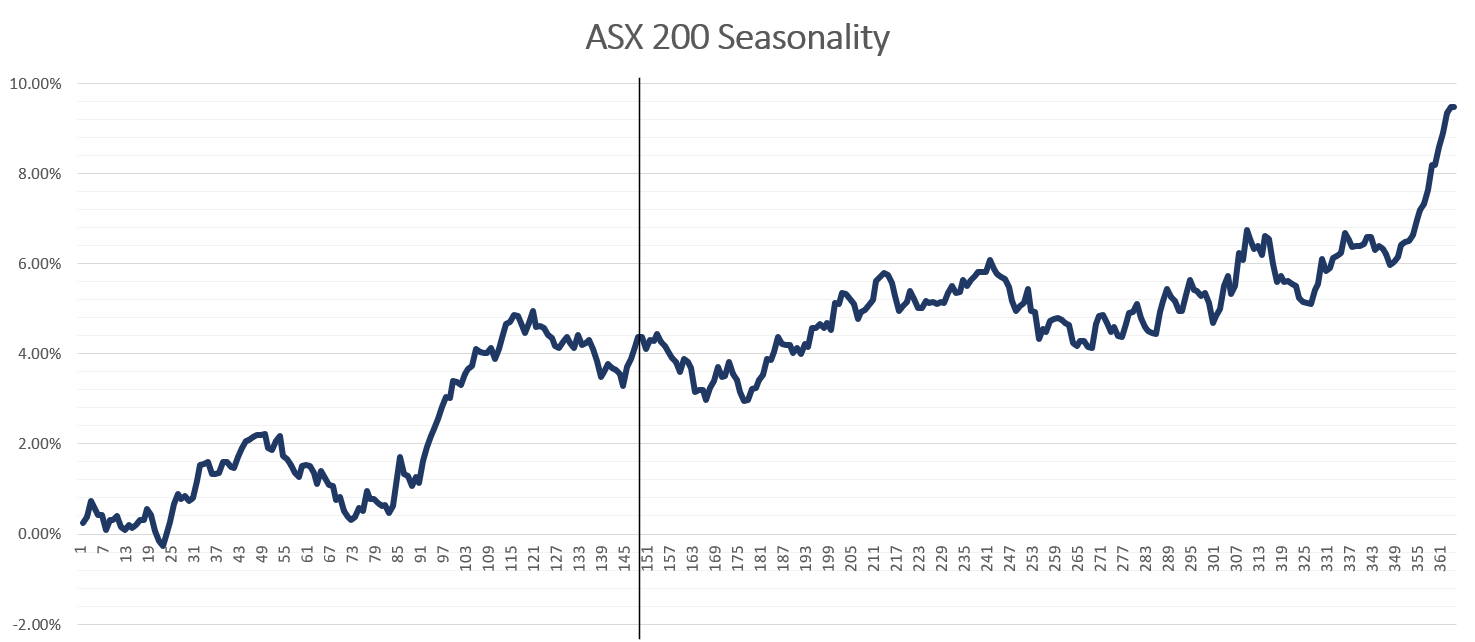

ASX 200 SEASONALITY

MARKETS

- US markets were closed in observance of Memorial Day

- S&P 500 futures currently up around 0.3%

- Liquidity thin with US, UK markets closed for holidays (Bloomberg)

- Traders ready to embrace riskier assets after debt-cap deal (Bloomberg)

- Canada’s stock exchange edges higher on US debt ceiling optimism (Reuters)

- European benchmarks fade early gains (CNN)

STOCKS

Nvidia unveils more AI products are US$184bn rally (Bloomberg)

ECONOMY

- Machin slips multi-billion dollar natural gas pipeline deal into debt bill (Bloomberg)

-

Biden, McCarthy forge debt deal in bid to average US default (Bloomberg)

Deeper Dive

Hans' Research Roundup

Normally, Kerry and Chris are in charge of the charts. But today, I'm going to give it a go. First, let me show you a chart that you may very well have seen in recent times.

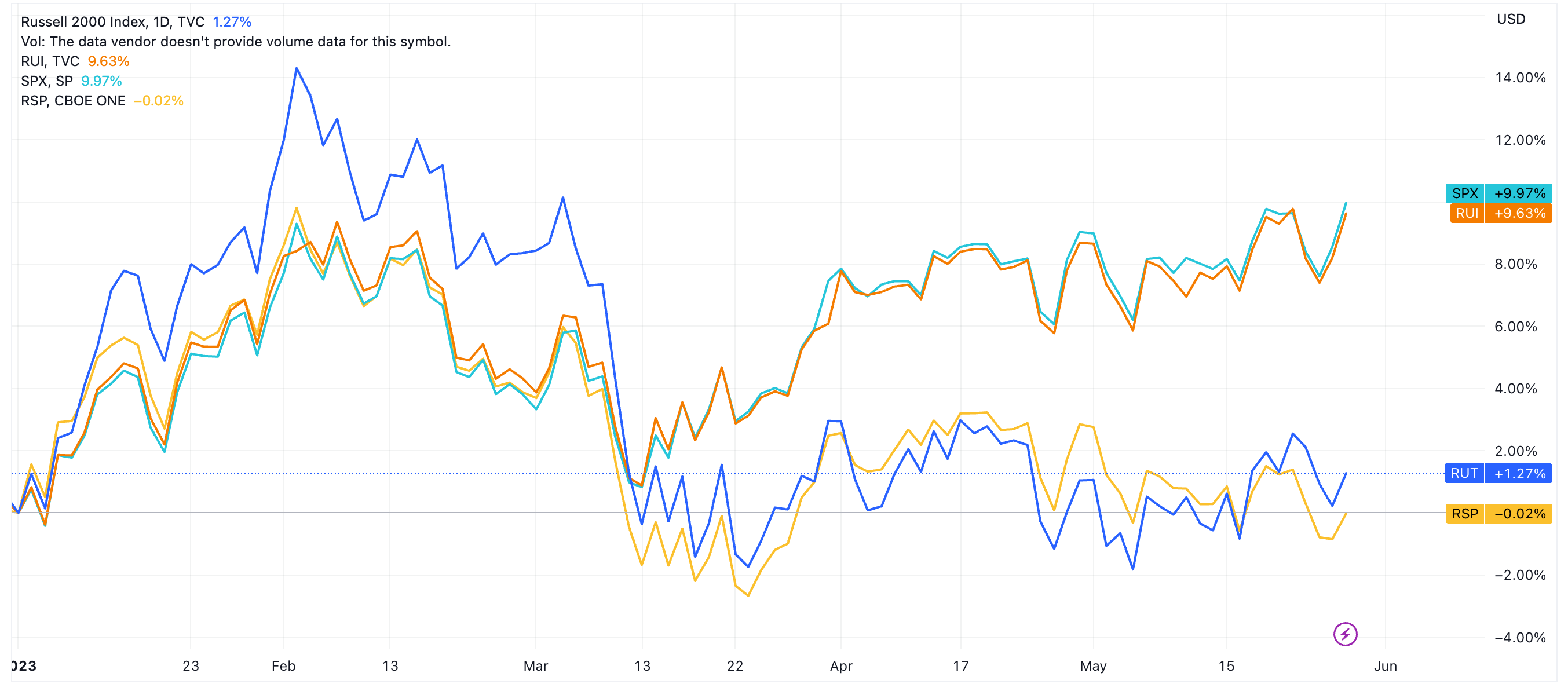

This first chart is the Russell 2000 and the capitalisation-weighted S&P 500 vs the Russell 1000 and the equal-weight S&P 500. The Russell 2000 (RUT) vs 1000 jaws are the widest since 1997. Apple and Microsoft are also 13% of the Russell 1000 (RUI). The capitalisation-weighted/regular S&P 500 is also up nearly 10% year-to-date but the equal-weight S&P 500 is actually flat. All we are proving here is that the breadth in this market is small (historically small, actually).

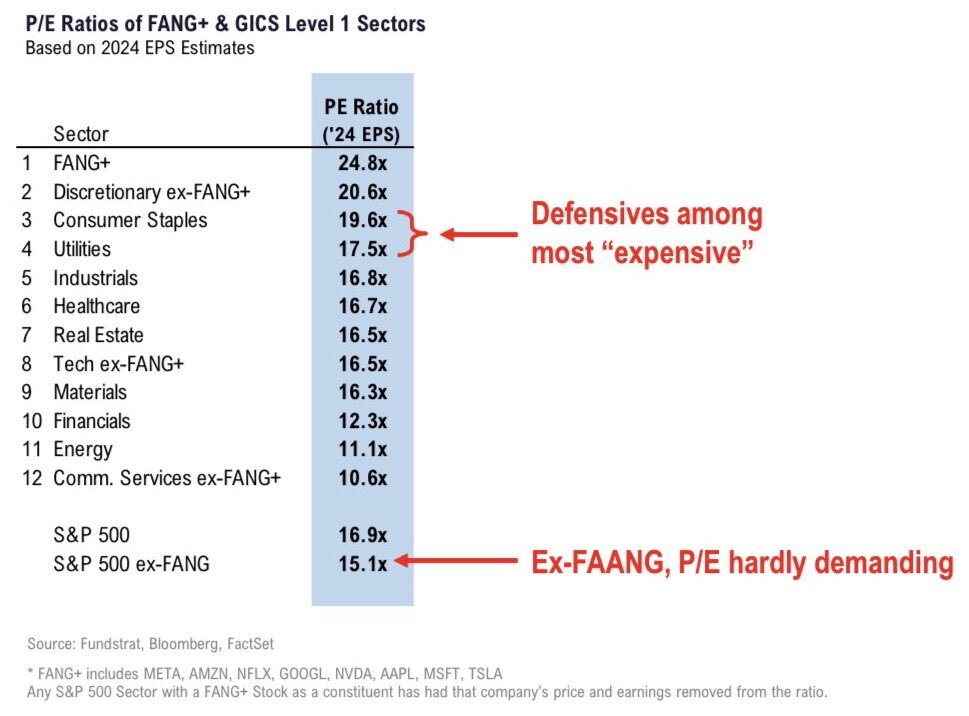

Now, a table for the bulls. Fundstrat's Tom Lee argues that the stock market is cheaper than it looks, especially at the S&P 500 Ex-FAANG level. Equities in two of the more "defensive" sectors trade at a higher forward EPS than the S&P 500 (incl. FAANG names). Lee has been incredibly bullish on the FAANG names so far this year. So far, that trade has paid off with some strong earnings from names like Nvidia and Meta.

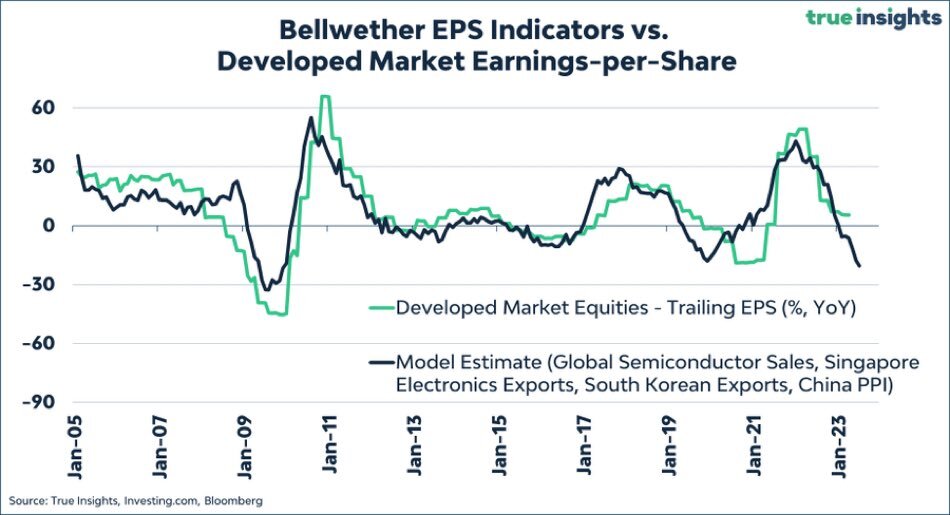

For the bears, they also look at forward EPS estimates but turn to the macro. Enter this chart from Jeroen Blokland at TrueInsights, who believe that a collection of macro indicators don't look so good. Blokland's model uses four economic indicators (semiconductors, two measures of exports, and Chinese producer inflation). He argues that the model is a good leading indicator of what will happen to the S&P 500 EPS going forward.

I'm just here to give you some notes on what the professionals are thinking. Whether this makes you more bullish or bearish, is up to you dear reader.

Morgan Stanley and Copper

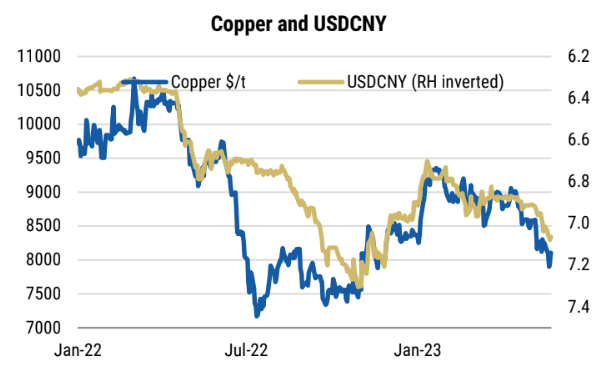

Speaking of correlations between macro and assets, the team at Morgan Stanley have been putting out some ripping thematic research of late. Today's feature suggests copper prices have some serious upside in them.

"Copper is down 11% in 4 weeks, now just 2.5% above our $7,800/t Q4 forecast. There are plenty of bearish factors, including slow growth in China, weak Eurozone PMIs and US debt ceiling risks [published before the debt ceiling risk was resolved]. But not all the data is bad. Timing a bounce is challenging, but upside price risks could be growing."

So will copper establish a floor, and if so, where? In the last 15 years, the price of copper has only broken below its "90th percentile" twice (2009 and 2016). Currently, the 90th percentile of the cash cost curve sits around $5,200/t, according to Wood Mackenzie. With a price of US$8,000/t, this suggests that copper won't fall US$2,800/t in one fell swoop. But stranger things have happened before.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Gryphon Capital Income Trust (GCI) – $0.014, 360 Capital Enhanced Income Fund (TCF) – $0.035, KKR Credit Income Fund (KKC) – $0.011, Perpetual Credit Income Trust (PCI) – $0.007

- Dividends paid: None

- Listing: None

Economic calendar (AEST):

- 11:30 am: Australia Building Permits

- 5:00 pm: Spain Inflation

- 7:00 am: Eurozone Economic Sentiment

This Morning Wrap was first published for Market Index by Hans Lee and Kerry Sun.

2 contributors mentioned