ASX 200 to open at all-time highs, US inflation cools, Markets rotate into small caps

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 45 points higher, up 0.57% as of 8:30 am AEST.

S&P 500 SESSION CHART

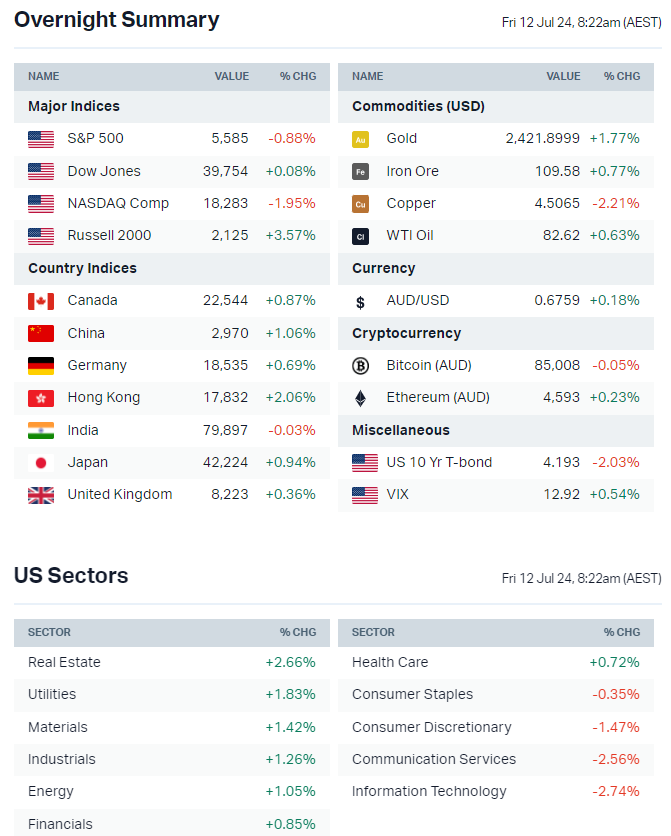

OVERNIGHT MARKETS

- Major US benchmarks finished mixed as cooler-than-expected US inflation data triggered a rotation out of big tech and into small caps and rate-sensitive pockets of the market like Real Estate and Utilities

- Nine of the top ten largest US stocks finished lower, led by Tesla (-8.4%), Nvidia (-5.5%), Meta (-4.1%) and Alphabet (-2.7%)

- Berkshire Hathaway (+1.2%) was the only top ten name to buck the trend

- Bond yields dipped, with the US 10-year down 7 bps to the lowest level since 1-Apr

- Gold prices ripped higher, now within 1% of all-time highs

- IEA says global oil demand slows further as China cools (Reuters)

- JPMorgan now expects September rate cut versus prior prediction for November (Bloomberg)

STOCKS

- Amazon reveals its Prime Day sales amid Walmart's and Target's sales discounting events around same time (Axios)

- Google reportedly abandoning efforts to acquire HubSpot (Bloomberg)

- Costco raises membership fee for first time since 2017 (CNBC)

- Delta Q3 passenger and earnings miss expectations due to weak pricing on industry overcapacity (Reuters)

- Pepsi posts weaker-than-expected earnings as volumes slip (Bloomberg)

CENTRAL BANKS

- Fed’s Daly says today’s inflation data is a ‘relief’ and could warrant some policy adjustments (Bloomberg)

- BoE Mann signals reluctance to cut rates, citing inflation concerns (Bloomberg)

- Eurozone wage growth sparking speculation about how deep ECB can cut (FT)

- Bank of Korea holds rate at 3.50%, examining timing of rate cut (Reuters)

POLITICS & GEOPOLITICS

- Biden losing support from Democratic allies and Hollywood donors (Axios)

- NATO leaders deliver their most serious rebuke against Beijing over its role in Russia's Ukraine war (NY Times)

- Foreign officials warn that Trump mulling cutting back intel sharing with EU if he returns as President (Politico)

- Macron calls for broad coalition, excluding far-left and far-right, to break parliamentary deadlock (Bloomberg)

US JUNE CPI

- Core inflation up 0.1% month-on-month vs. consensus for a 0.2% rise

- Core inflation up 3.3% year-on-year vs. consensus 3.4%

- Headline inflation down 0.1% month-on-month vs. consensus for a 0.1% rise

- Headline inflation up 3.0% year-on-year vs. consensus 3.1%

- Gasoline price index fell 3.8% in June, more than offsetting the 0.2% rise in the shelter price index (smallest increase since August 2021)

- Used cars and trucks index down 1.5% month-on-month, airfares fell 5.0%

- Fed rate cut expectations for September jumped to 84.6% from 69.7% a day ago and 46.8% a month ago, according to CME Group

ECONOMY

- UK GDP rebounded quicker than expected in May (Bloomberg)

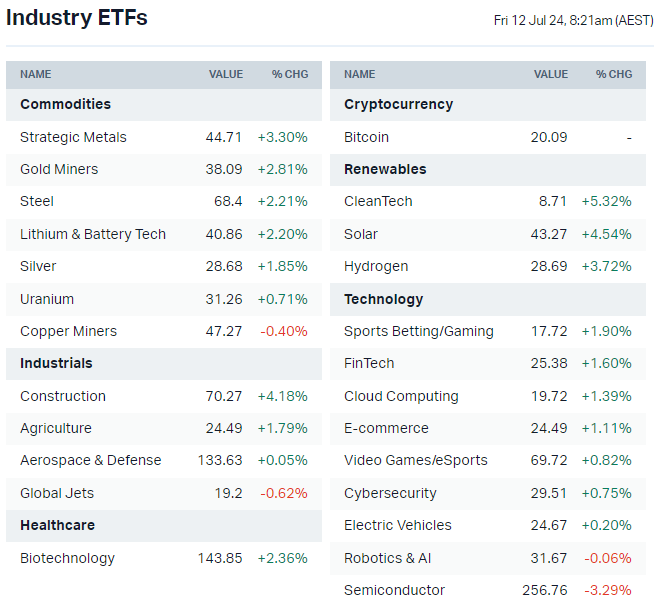

US-listed sector ETFs by iShares, Global X and VanEck (Source: Market Index)

ASX TODAY

- ASX 200 to crack a fresh all-time high today as cooler-than-expected US inflation data propped up value and cyclical pockets of the market

- A2 Milk unlikely to vote in favour of Synlait's recapitalisation plan, including a major equity raising (A2M)

- BHP to temporarily suspend Western Australia Nickel operations from October due to oversupply – plans to invest ~$300m per annum following the transition period to support a potential restart but decision will incur a non-cash impairment charge of $0.3bn (BHP)

- Metals X acquires strategic stake in First Tin, total investment of $4.6m or ~23% of the company (MLX)

WHAT TO WATCH TODAY

- Gold: Gold prices rallied almost 2% overnight and closed above the key US$2,400 level. The VanEck Gold Miners ETF added 2.8% to finish at levels not seen since April 2022. NYSE-listed Newmont shares up 3.8% to a 15-month high. This should draw a strong response for local goldies.

- Real Estate, Utilities: These were the two best performing S&P 500 sectors overnight, up 2.6% and 1.8% respectively. Will be interesting to see if our REITs and utilities experience a similar rotation/outperformance.

- Homebuilders: The SPDR Homebuilders ETF rallied 5.8% overnight in response to falling yields and lower mortgage rates. NYSE-listed James Hardie shares finished the session up 2.4%. Beyond JHX, we've pretty much lost all of our major building and construction names like ABC, CSR and BLD.

BROKER MOVES

- Ampol upgraded to Neutral from Sell; target cut to $37.40 from $38.30 (Goldman Sachs)

- Beach Energy downgraded to Sell from Neutral; target cut to $1.50 from $1.54 (Goldman Sachs)

- Netwealth Group downgraded to Underperform from Hold; target increased to $18.60 from $18.15 (Jefferies)

- Regis Resources upgraded to Buy from Neutral; target remains $2.30 (BofA)

KEY EVENTS

Companies trading ex-dividend:

- Fri 12 July: Prestal Holdings (PTL) – $0.07

- Mon 15 July: None

- Tue 16 July: Metcash (MTS) – $0.085

- Wed 17 July: Turners Automotive (TRA) – $0.069

- Thu 18 July: None

Other ASX corporate actions today:

- Dividends paid: None

- Listing: None

- Earnings: None

- AGMs: None

Economic calendar (AEST):

- 1:00 pm: China Balance of Trade (Jun)

- 10:30 pm: US Producer Price Index (Jun)

- 12:00 am: US Consumer Confidence (Jul)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment