ASX 200 to rise, Chip sector rally lifts the S&P 500 + Fed hints at possible rate cut

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 17 points higher, up 0.21% as of 8:30 am AEST.

S&P 500 SESSION CHART

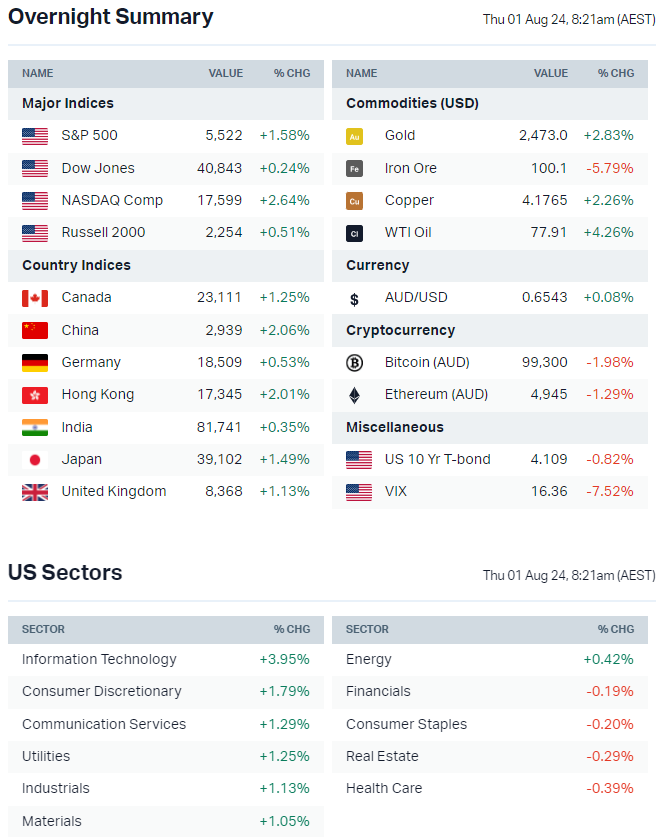

OVERNIGHT MARKETS

- Major US benchmarks finished higher but ended a little bit off session highs

- Tech bounce attempt in focus amid several dynamics including i) upbeat takeaways from latest round of earnings; ii) Microsoft missed Azure growth expectations but highlighted expectations for a reacceleration in the second half; iii) Microsoft’s aggressive capex was viewed as a positive for semiconductor stocks and iv) Reuters report that a new US rule on foreign chip equipment exports to China will exempt key allies

- More than 55% of S&P 500 companies have now reported, with Q2 earnings growth rates running at 10.2%, with over 78% of companies beating consensus expectations

- US 2-year falls below 4.30% for the first time since February, 10-year back below 4.10%

- Brent crude snapped three-day losing streak, up 3.8% on ramp in Middle East tensions

- Gold is within 1% of all-time highs on Powell’s remarks, geopolitical tensions

- US oil inventories fall for fifth consecutive week (Oilprice.com)

STOCKS

- AMD revenue guidance tops expectations with company raising forecast for AI accelerators (Bloomberg)

- Intel to cut thousands of jobs in bid to reduce costs (Bloomberg)

- Nvidia shares have shed more than US$750bn in market cap across recent selloff (FT)

- Samsung's net profit tops forecasts as higher memory prices and demand for HBM chips drives chip unit higher (Bloomberg)

- CrowdStrike hit with shareholder class action lawsuit over IT outage (Bloomberg Law)

- Delta Airlines CEO confirms massive IT outage cost company US$500m and plans to seek damages (CNBC)

CENTRAL BANKS

- Powell says rate cut ‘could be’ on table at Fed’s next meeting (Bloomberg)

- Rate futures pricing in 95% chance of September cut after latest FOMC announcement, up from 89% before release (Reuters)

- BOJ hikes interest rates and flags more to come, reveals JGB taper details (Bloomberg)

POLITICS & GEOPOLITICS

- Harris draws level with Trump in race for the White House (Bloomberg)

- Middle East tensions escalate after Hamas leader Ismail Haniyeh killed in Iran and Israel strikes Beirut (Bloomberg)

- Assassination of Hamas leader upsets ceasefire hopes, raises fears of a regional Mideast war (Reuters)

- Ukraine passes law allowing suspension of foreign debt payments (Reuters)

- US rule on foreign chip equipment exports to China to exempt some allies like Netherlands, Japan and South Korea (Bloomberg)

ECONOMY

- Eurozone inflation sees surprise uptick to 2.6% in July vs. 2.4% consensus (Bloomberg)

- China manufacturing PMI loses further momentum, services stall (Bloomberg)

- Australian underlying inflation eases, raises RBA rate cut bets (Bloomberg)

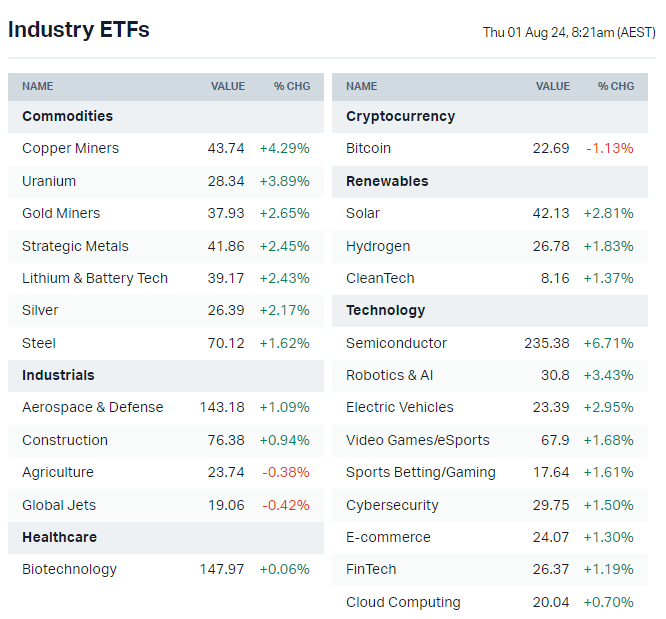

US-listed sector ETFs by iShares, Global X and VanEck (Source: Market Index)

ASX TODAY

- ARN Media and Southern Cross Media merger prevented by Kerry Stokes (The Aus)

- Experience Co reports unaudited Q4 underlying EBITDA of $2.4m vs. $3.2m a year ago amid disruptions including unfavourable weather conditions across Australia (EXP)

- Poseidon Nickel reported Q2 after-hours, flagged $1.4m cash or less than one estimated quarter of funding available, currently running processes on various assets to raise funds (POS)

- Westpac reportedly looking to divest retail auto loan back book (The Aus)

WHAT TO WATCH TODAY

ASX set for another strong session. Several overnight ETFs like Copper Miners, Uranium and Gold rallied overnight. But it's worth noting that most of our stocks moved first (e.g. on Wednesday – SFR +4.0%, PDN +3.0% and NST +1.4%). That said, the strong overnight lead in should still see some positive flows for these sectors, especially for gold.

- Quiet morning: The market was hit with a massive influx of announcements on yesterday, as 31-Aug is the last day/cut off for quarterly reports.

- Rio Tinto follow-up: Rio Tinto rallied 2.4% on Wednesday after reporting an operationally strong first-half (calendar year) result. The dividend was a little soft (177UScps vs. 179UScps) but all other financial metrics tracked in-line or slightly ahead of consensus. Let's see if this drives any 'day two' buying.

BROKER MOVES

- PointsBet upgraded to Buy from Overweight; target remains $0.85 (Jarden)

- SiteMinder downgraded to Overweight from Buy; target cut to $5.85 from $6.02 (Jarden)

KEY EVENTS

Companies trading ex-dividend:

- Thu 1 Aug: Several ETFs trade ex-dividend over the next two days. See a full list here

- Fri 2 Aug: None

- Mon 5 Aug: PRL Global (PRG) – $0.05, Perpetual Credit Income Trust (PCI) – $0.007

- Tue 6 Aug: BKI Investment Company (BKI) – $0.04

- Wed 7 Aug: Amcil (AMH) – $0.03, Mayfield Group (MYG) – $0.02, Pacific Smiles (PSQ) – $0.07

Other ASX corporate actions today:

- Dividends paid: None

- Listing: None

- Earnings: Pinnacle Investment Management (PNI)

- Quarterlies: ResMed (RMD), SSR Mining (SSR)

- AGMs: None

Economic calendar (AEST):

- 11:30 am: Australia Balance of Trade (Jun)

- 11:45 pm: China Caixin Manufacturing PMI (Jul)

- 9:00 pm: UK Interest Rate Decision

- 12:00 am: US ISM Manufacturing PMI (Jul)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Funds

Bruce Williams on the art of resilient investing

Livewire Markets

Equities

What a 40% year taught us: 4 lessons from the past 12 months (and 3 new stocks to buy)

Seneca Financial Solutions