ASX 200 to rise, S&P 500 and Nasdaq finish flat as bond yields tick higher

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 36 points higher, up 0.45% as of 8:30 am AEST.

S&P 500 SESSION CHART

MARKETS

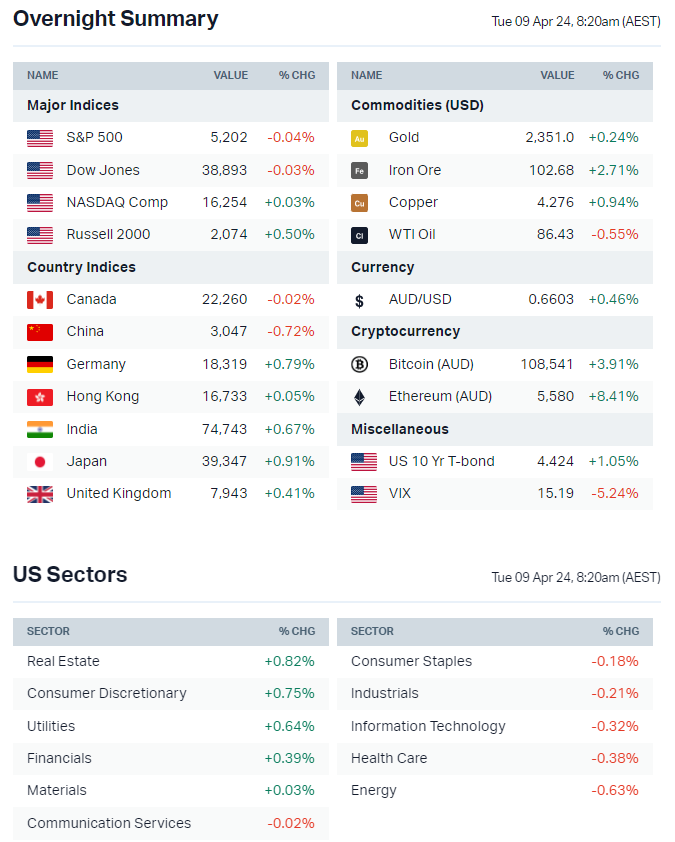

- S&P 500, Dow and Nasdaq hovered around breakeven amid a range bound session while the small cap Russell 2000 outperformed

- Relatively quiet start to the week ahead of US inflation and first quarter earnings season

- Bond yields continued to creep higher, with the US 10-year up 21 bps in April as a firmer US growth backdrop seems to be getting more attention

- Both gold and copper settled higher and reversed early declines of around 1%

- Bitcoin rallied 3.3% to US$71,600 and less than 3% away from recent highs

- Wells Fargo raises year-end S&P 500 target to 5535 from 4625 citing political outcomes that support more M&A, a multi-year easing cycle ahead and further margin growth (Reuters)

- US banks to kick off first quarter earnings season on Friday, with JPMorgan, Citi, State Street and Wells Fargo all reporting (IG)

- Traders eye 4.5% yield threshold as next test with attention on CPI data (Bloomberg)

- Investors continue to reduce bets on Fed rate cuts, now pricing in just two by the end of 2024 (FT)

- Global stock market concentration hits highest in decades, raising risk for passive investors (FT)

- Oil market will get 'extremely tight' in 2H24, says Citadel (Bloomberg)

- AI demand could lift copper demand by 1m tons by 2030, says Trafigura (Reuters)

- Driving force behind gold rally still unclear with sticky inflation and geopolitics the top contenders (Bloomberg)

ASX TODAY

- ASX 200 set to open higher after falling 1.37% in the last five sessions

- Sub-sectors that performed positively overnight include lithium, copper, airlines, steel and fintech while sub-sectors such as uranium, gold miners and energy stocks eased

- Mineral Resources sold 31.5m Develop Global shares at $2.00 per share or 13% of the company to raise cash (AFR)

- Platinum Asset Management reports 31-Mar funds under management of $15.46bn vs. $15.56bn at 29-Feb (PTM)

BROKER NOTES

- Ansell upgraded to Buy from Hold; target increased to $30.85 from $26.0 (Jefferies)

- Ansell upgraded to Outperform from Underperform; target increased to $26.70 from $25.40 (CSLA)

- Flight Centre downgraded to Sell from Neutral; target cut to $18.30 from $20.10 (Goldman Sachs)

- Elders upgraded to Add from Hold; target increased to $9.00 from $7.40 (Morgans)

- MinRes downgraded to Neutral from Buy; target cut to $70 from $72 (BofA)

- Nickel Industries downgraded to Neutral from Buy; target cut to $0.90 from $1.0 (BofA)

- Regis Resources upgraded to Neutral from Sell; target up to $2.15 from $1.90 (UBS)

- Sandfire Resources downgraded to Neutral from Buy; target up to $9.35 from $8.85 (UBS)

- Whitehaven upgraded to Buy from Neutral; target increased to $8.70 from $6.30 (UBS)

INTERNATIONAL STOCKS

- 99 Cents Only Stores files for bankruptcy (Bloomberg)

- Alibaba slashing cloud prices globally (Bloomberg)

- Google planned acquisition of HubSpot likely sparks antitrust challenges (Reuters)

- Taiwan Semiconductor’s Arizona subsidiary will receive up to US$6.6bn from the Biden Administration to support semiconductor manufacturing in the US (CNBC)

- Tesla will unveil its robotaxi concept on 8 August (Bloomberg)

GEOPOLITICS

- Hamas reportedly rejects latest ceasefire deal (Times of Israel)

- Netanyahu confirms there is a set date for Rafah invasion (Reuters)

- Russia claims Ukraine attempted to strike nuclear power plant with drone (Reuters)

- Yellen warns China on aiding Russia's war in Ukraine and ready to sanctions Chinese banks (CNBC)

- Yellen says US has taken major steps to stabilise relations with China with relationship on stronger footing (FT)

- Biden to warn China about increasingly aggressive activity in the South China Sea this week during summits (FT)

ECONOMY

- Japan real wages sink for 23rd consecutive month amid higher inflation (Bloomberg)

- Japan service sector sentiment drops in March as bad weather dampens consumer mood (Reuters)

- German industrial production posts surprise beat, led by construction (Bloomberg)

- OECD data shows food inflation across advanced economies drops to its lowest level since before Ukraine war (FT)

KEY EVENTS

Companies trading ex-dividend:

- Tue 9 April: Brickworks (BKW) – $0.24

- Wed 10 April:

- Thu 11 April: Cosol (COS) – $0.01, Duxton Water (D20) – $0.036

- Fri 12 April: Kogan (KGN) – $0.075

- Mon 15 April: WAM Active (WAA) – $0.03, Cadence Capital (CDM) – $0.03, SDI (SDI) – $0.015, New Hope (NHC) – $0.17

Other ASX corporate actions today:

- Dividends paid: None

- Listing: None

Economic calendar (AEST):

- 11:30 am: Westpac Consumer Confidence (Apr)

- 12:30 pm: NAB Business Confidence (Mar)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment