ASX 200 to tumble, Nasdaq falls into correction on weak US jobs data

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 115 points lower, down -1.48% as of 8:30 am AEST.

S&P 500 SESSION CHART

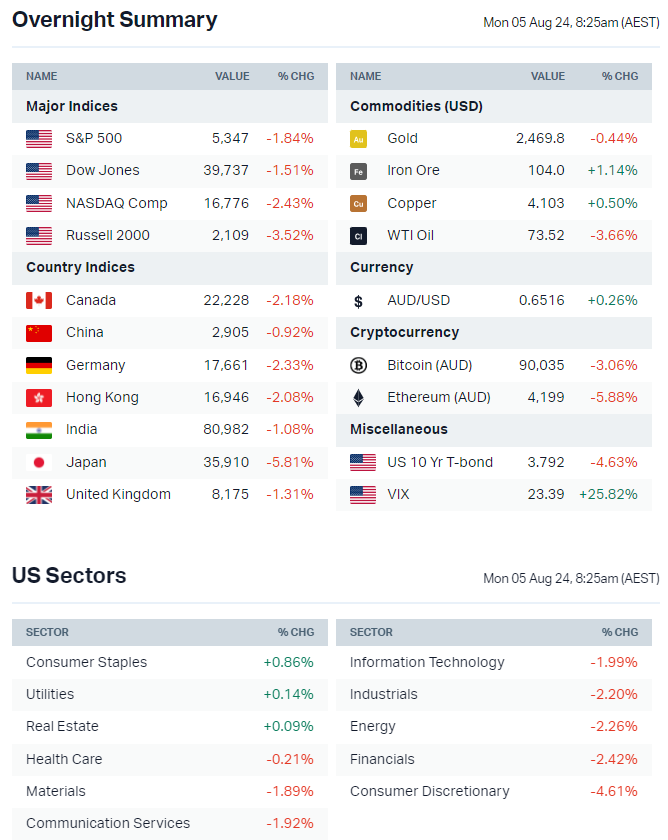

OVERNIGHT MARKETS

- Major US benchmarks finished sharply lower, with the Russell 2000 posting its worst week since March 2023 and Nasdaq now more than 10% off record highs

- US weekly recap: Russell 2000 -6.6%, Nasdaq -3.3%, Dow -2.1%, S&P 500 -2.0%

- Market has flipped to “bad news is bad news” as growth worries (US unemployment rate hits three-year high, ISM manufacturing employment lowest since 2020, initial jobless claims highest in 11 months) outweigh the benefits of growing rate cut expectations (market currently pricing in more than 80 bps of easing this year)

- Soft US unemployment data has boosted expectations for Fed to cut 50 bps in September, with odds currently sitting at 70% from 12% a week ago

- US growth re-pricing triggers rush to exit from equities, spurring pivot toward haven assets of Treasuries and gold (Bloomberg)

- Investors weigh buying the dip vs worries about growing economic weakness (Reuters)

- Goldman says hedge funds lift short bets amid recent uncertainties (Reuters)

- Japan stocks slump to biggest two-day rout since 2011 with tech firms, banks drag on benchmark after BOJ hike (Bloomberg)

- Commodities slump as fund managers cut ~$41bn of bullish bets on natural resources on oversupply, softer China demand woes (FT)

STOCKS

- Apple (+0.7%) Q3 revenue and earnings beat consensus – iPhone, iPhone and Services reported better-than-expected sales, Q4 revenue and GM guidance slightly better, China remains soft, analysts bullish on multi-year replacement cycle for the iPhone on the back of Apple Intelligence demand (Bloomberg)

- Amazon (-8.8%) Q2 revenue a touch weaker-than-expected, operating income beat consensus by 7%, AWS growth accelerated to 19% from 17% in prior quarter, AWS will ramp capex spending in the 2H, Q3 guidance missed consensus (Bloomberg)

- Berkshire Hathaway discloses it sold ~49% of its stake in Apple during Q2 (CNBC)

- Berkshire Hathaway offloads more Bank of America shares, shedding more than US$3.8bn since mid-July (Reuters)

- Nike gets aggressive on Olympics marketing spend with global ad blitz to revive flagging sales (Bloomberg)

- Tesla China-made EV sales rose 15.3% from a year earlier in July (Reuters)

- Maersk lifts guidance on continued shipping disruptions in the Red Sea, forecasts higher profits for third time since May (FT)

CENTRAL BANKS

- Majority of economists expect another BOJ rate hike by year-end (Bloomberg)

- Three of world's biggest central banks diverge on policy amid growing influence of domestic macro factors (Bloomberg)

- RBA widely expected to leave rates on hold next Tuesday, economists see rate cuts from first quarter of 2025 (Reuters)

POLITICS & GEOPOLITICS

- Trump floats end to taxes on social security benefits that would help higher-income retirees, hasten automatic benefit cuts (WSJ)

- Iran reiterates "harsh punishment" to Israel after Haniyeh assassination (NBC News)

- US preparing for "every possibility" regarding Iran retaliation (ABC News)

- Biden and Netanyahu discuss new military strategy to fight off Iranian threat (Axios)

- US recognizes opposition candidate González Urrutia as the rightful winner of Venezuela's presidential elections (Axios)

ECONOMY

- US unemployment rate jumps to a three-year high of 4.3% in July vs. 4.1% consensus, nonfarm payrolls rose 114,000 vs. 175,000 consensus (Reuters)

US-listed sector ETFs by iShares, Global X and VanEck (Source: Market Index)

ASX TODAY

- Calidus Resources's receivers and managers seek urgent expressions of interest for acquisition ad recapitalisation (CAI)

- Hospitals seek right to boycott big insurers, including Medibank, Bupa, NIB, HCF and HBF Health from funding talks (AFR)

- Rex’s PE lender PAG believed to be holding off on a move to appoint a receiver as administrator EY starts preparing documents for a sale of the regional airline (The Aus)

- Vocus back in talks to buy TPG Telecom's fibre network (AFR)

WHAT TO WATCH TODAY

Brace yourself for another >100 pt dip. Plenty of bearish drivers emerging including ramp up in growth concerns, softer discretionary spending trends, AI scrutiny, negative seasonality (first-half of August is the fifth worst two-week period of the year for US stocks), hawkish BoJ takeaways, rising geopolitical risks and election overhang. The path of least resistance for markets has flipped to lower. When will we bounce? These downward drivers are pretty fresh and more often than not, we witness the market overshooting to the downside. Let's see how things unravel.

- ETF watchlist – Pain, pain everywhere: Our overnight ETF watchlist was mostly red, with sub-sectors like Uranium (-6.2%), Semis (-5.3%) and Airlines (-4.2%) leading to the downside

- Extended weakness: S&P 500 futures are currently down -0.82% and Nasdaq futures are -1.30% as markets extend selloff from last week

- Diggers & Dealers 5-7 Aug: Companies presenting today include AIS, ARL, BGL, DLI, DYL, EMR, FEX, GLN, IGO, LYC, MAU, NST, PNR, RRL, WA1, WAF, WC8

BROKER MOVES

- Cleanaway upgraded to Buy; target increased to $3.30 from $2.80 (UBS)

- Lifestyle Communities downgraded to Overweight from Buy; target cut to $11.70 from $15 (Jarden)

KEY EVENTS

Stocks trading ex-dividend:

- Mon 5 Aug: PRL Global (PRG) – $0.05, Perpetual Credit Income Trust (PCI) – $0.007

- Tue 6 Aug: BKI Investment Company (BKI) – $0.04, Amcil (AMH) – $0.03

- Wed 7 Aug: Mayfield Group (MYG) – $0.02, Pacific Smiles (PSQ) – $0.07

- Thu 8 Aug: None

- Fri 9 Aug: Djerriwarrh Investments (DJW) – $0.08, Aloca (AAI) – $0.107

Other ASX corporate actions today:

- Dividends paid: None

- Listing: None

- AGMs: None

Economic calendar (AEST):

No major economic announcements.

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

Buy Hold Sell: 5 ASX playmakers making things happen

Livewire Markets

Equities

Brokers' top picks for October

Livewire Markets