ASX rises, bond yields and rate bets fall as Australian inflation comes in cold

While it doesn't present a complete picture of inflation in Australia, prices are decelerating far more quickly than even economists were expecting – and that's great news for the Reserve Bank of Australia.

The monthly CPI indicator rose just 4.9% in the 12 months to October 2023. Economists were expecting a 5.2% year-over-year increase, making this the most substantial beat on inflation for many months. The trimmed mean print, which is what the RBA looks at most closely, came in at 5.3% year-over-year which was also less than what economists were expecting and down a touch from last month's 5.4% print.

In this wire, I'll break down the key insights from the latest ABS monthly inflation indicator and explain what it means for the RBA. But first, let's take a look at the market reaction to the print (Spoiler alert: if you like your investments going higher, you're going to like these charts).

ASX 200

.png)

3-Year and 10-Year Bonds

Australian Dollar

| 12mths to Sep 23 % change | 12mths to Oct 23 % change | |

| Headline inflation | 5.6 | 4.9 |

| Food and non-alcoholic beverages | 4.7 | 5.3 |

| Alcohol and tobacco | 5.8 | 6.6 |

| Clothing and footwear | -0.1 | -1.5 |

| Housing | 7.2 | 6.1 |

| Furnishings/Household Equipment | 2.3 | 0.4 |

| Health | 5.4 | 6.3 |

| Transport | 9.4 | 5.9 |

| Automotive fuel | 19.7 | 8.6 |

| Communications | 1.2 | 1.8 |

| Recreation and Culture | 3.5 | 2.7 |

| Education | 4.8 | 4.8 |

| Insurance and financial services | 8.6 | 8.6 |

| CPI excl volatile items | 5.5 | 5.1 |

| Annual trimmed mean | 5.4 | 5.3 |

Source: ABS

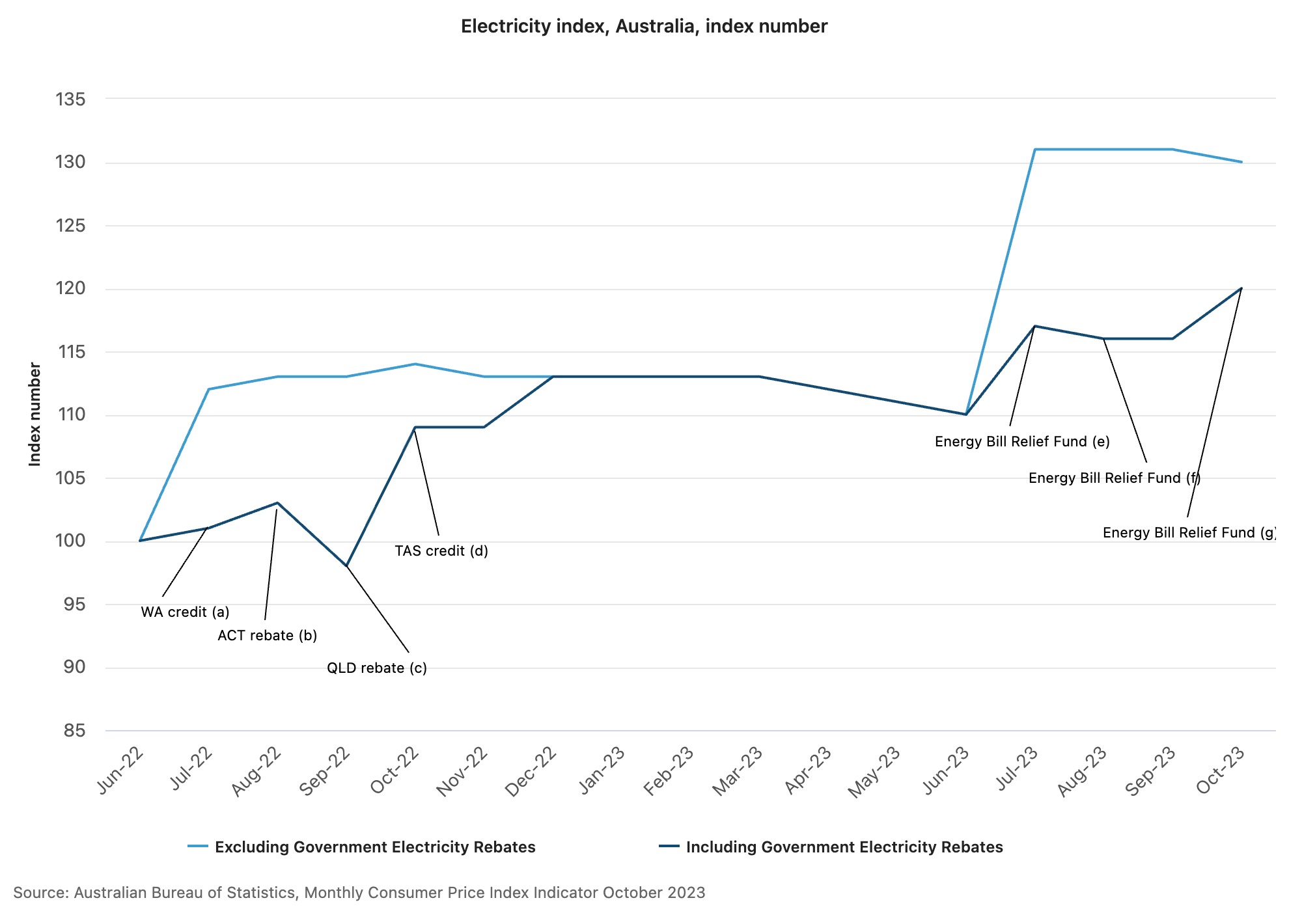

Insight #1: Thank you lower energy prices (and rebates)!

The price of petrol nationally has collapsed, which in turn has been caused by lower crude oil prices. In the last month alone, WTI (New York) crude oil prices have fallen by more than 12%.

Electricity prices have also fallen nationally. In September, the increase was 18% year-on-year while last month, it was a 10.1% year-on-year increase.

The small caveat in this part of the inflation report is that the full petrol excise tax (46 cents per litre) showed up in the September report but not in the October report. The lack of the tax's effect plus a near-3% fall in petrol prices itself explains the huge fall.

On the flip side, a slew of Commonwealth energy rebates has helped the cause for electricity prices. Officially, electricity prices are up more than 8% since June 2023. But if it were not for those rebates, electricity prices would have increased by nearly 19% in the same time period.

- a) Introduction of the WA $400 household electricity credit

- b) Introduction of the ACT $50 rebate for concession households

- c) Introduction of the QLD $175 Cost of Living rebate

- d) Introduction of the TAS $119 Winter Bill Buster electricity credit

- e) Introduction of the Energy Bill Relief Fund for concession households in NSW, SA, TAS, NT and ACT, and for all households in QLD and WA. Introduction of additional ACT $50 rebate for concession households.

- f) Introduction of the Energy Bill Relief Fund for concession households in VIC

- g) Introduction of the Energy Bill Relief Fund for newly eligible households in NSW, SA, TAS, NT and ACT.

All the rebates and credits that were introduced to lower power prices are in the list above. (Source: ABS)

Insight #2: Rents are down (but they may not stay down)

One of the biggest contributors to the inflation report is housing - and specifically, reported rents. New dwelling prices are up nationally by 4.7% in the 12 months to October 2023 and rent prices are up 6.6% in that same time frame.

In monthly terms, the ABS says rents increased by 0.4% month-on-month. That 0.4% is important because the fall in rents this month was due to the remaining impact of the changes to Commonwealth Rent Assistance. An increase in rent assistance reduces rents for eligible tenants. Without those changes, the ABS argues rents would have risen 0.7% in October.

Insight #3: Blame the melons and bananas

Headline inflation would have been even lower than 4.9% if it were not for the melons and bananas. Yes, I'm serious - and this quote from the ABS media release proves it:

“While annual inflation continues to ease across most food categories, fruit and vegetable prices are higher this month compared to 12 months ago, driven by price rises for melons and bananas,” Leigh Merrington, acting ABS head of prices statistics said.

So, where now for the RBA?

The cooler-than-expected inflation print should take a December rate rise off the table. However, and I stress this, it doesn't significantly diminish the prospect of another rate hike at the first meeting in late February 2024. The reason is that the RBA still primarily uses the quarterly inflation print to make its interest rate calls. The Q4 inflation print will only be released in late January and will feature more information about prices than the ABS monthly indicator provides.

Live rates pricing (as provided by Westpac's Martin Whetton) suggests as little as a 36% chance of another rate hike by May 2024 before rate cuts start in late 2024.

The combination of cooler-than-expected inflation and a slowdown in retail sales are signals that the RBA's rate rises are working. But if the RBA is given another nasty shock in the quarterly inflation print, along with no significant signs of let-up in the labour market between now and February, it makes a 4.6% interest rate by March 2024 a very real possibility.

2 topics