ASX stocks leap low bar despite miners weighing

Wilsons Advisory

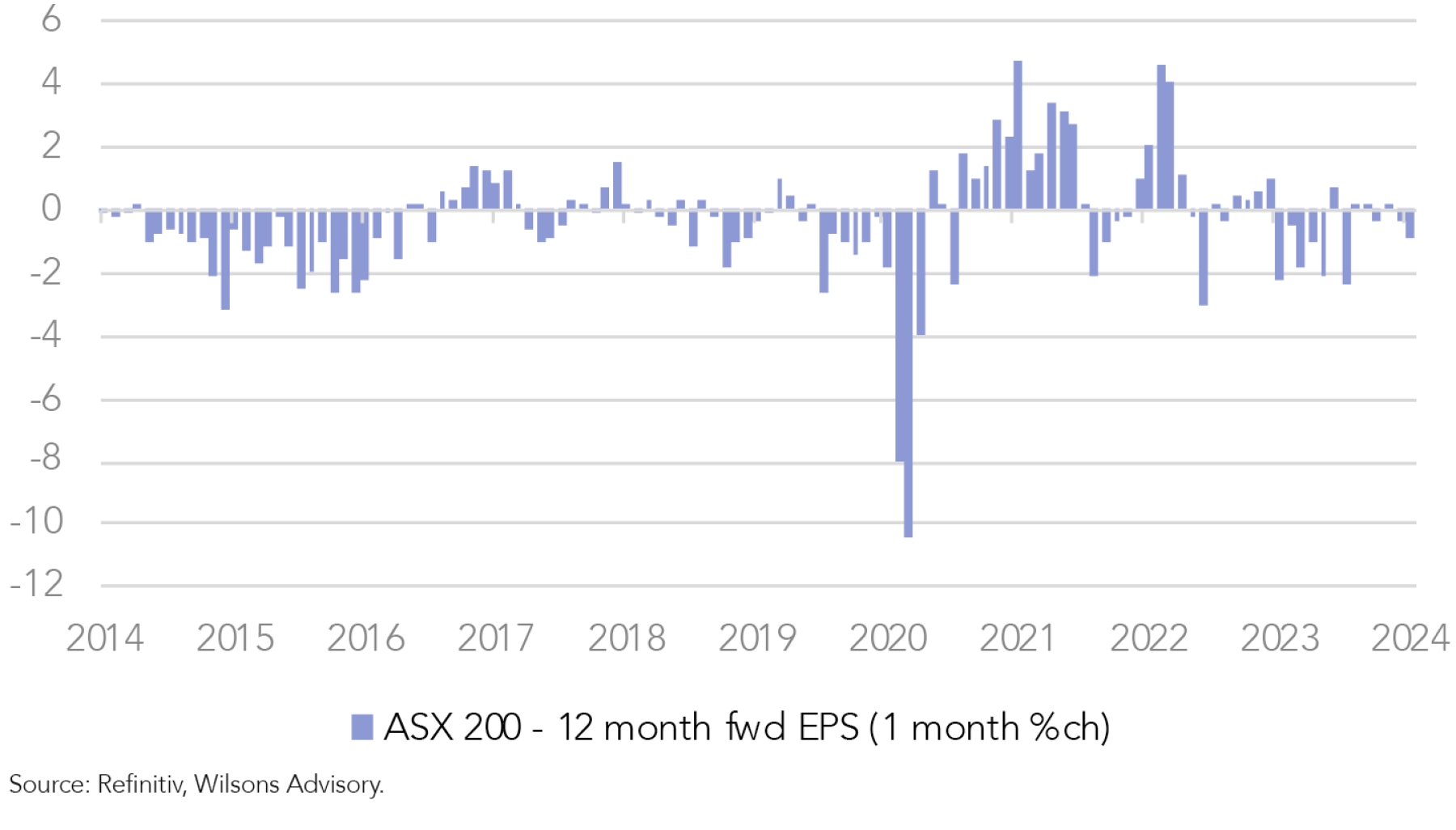

While the overall ASX 200 index is experiencing earnings downgrades, a closer look reveals a more nuanced picture. This decline is primarily driven by the resources sector facing lower commodity prices.

Excluding the resources sector, the overall reporting season has been better than feared.

Figure 1: Index level earnings downgrades are not telling the whole story

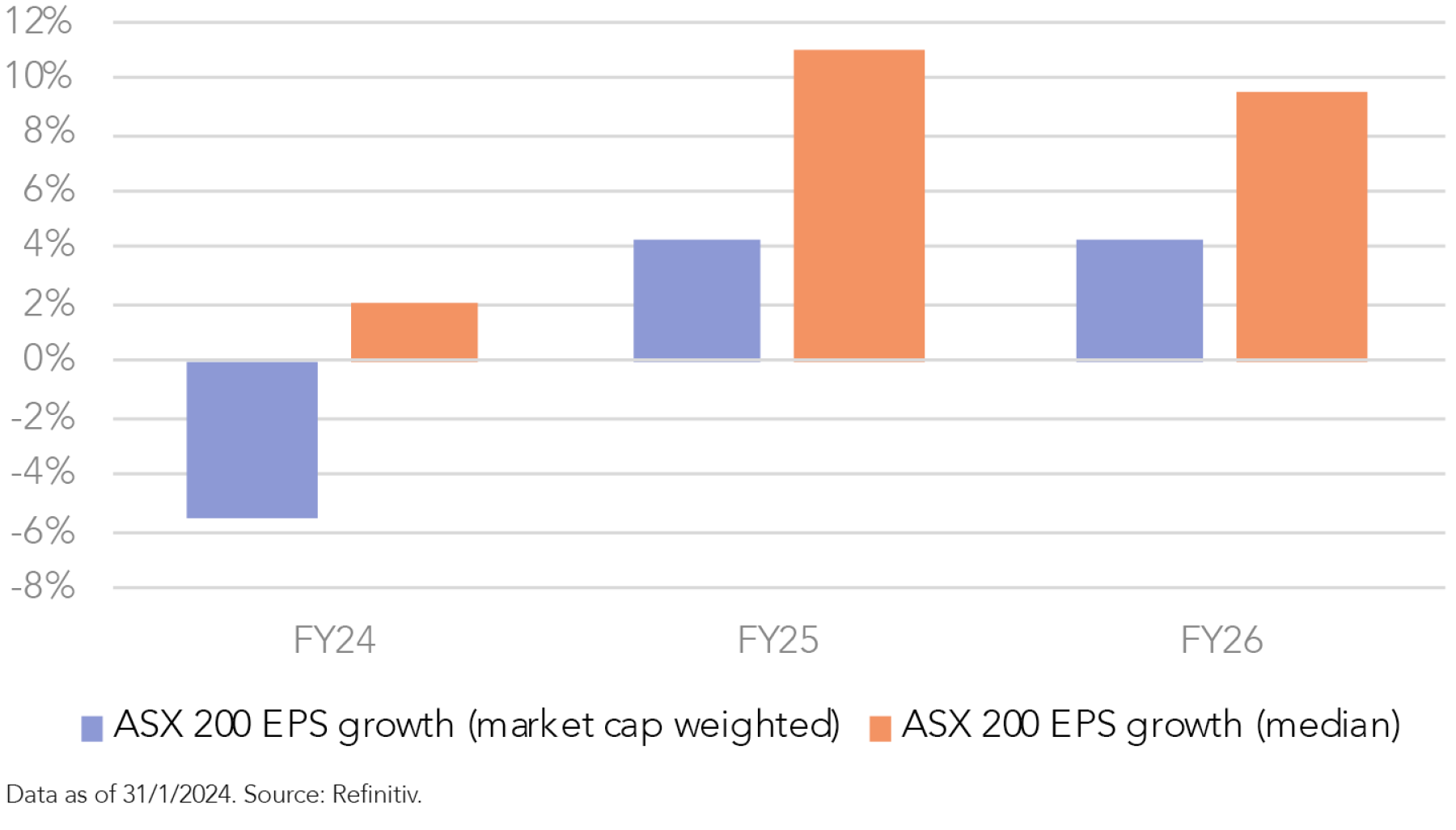

Figure 2: FY24 growth expectations were low going into reporting season

The ASX 200 industrials have demonstrated surprising resilience in this reporting season. Analysts have upgraded 12-month forward EPS forecasts for more industrial companies (54%) than they've downgraded (46%).

This positive trend stems from low expectations heading into earnings season. The market anticipated sluggish growth for FY24. As a result, companies that simply met or slightly surpassed these modest predictions received a positive reception, leading to a net increase in forecast upgrades throughout February.

The reporting season has delivered a welcome surprise for the market by exceeding the subdued pre-season outlook.

We have identified some key themes from reporting season, from both the upside and downside. The key underlying theme of reporting season has been costs.

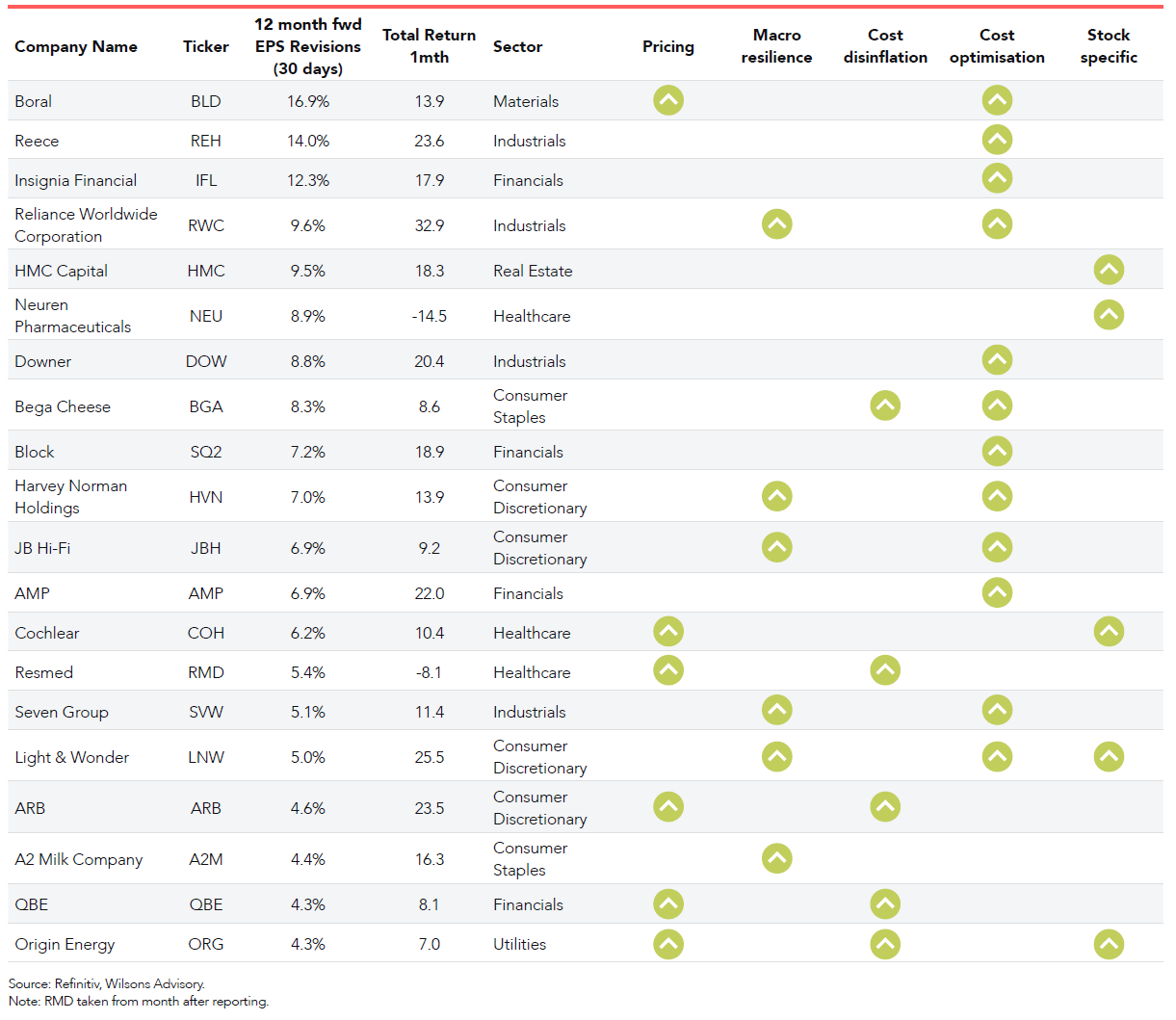

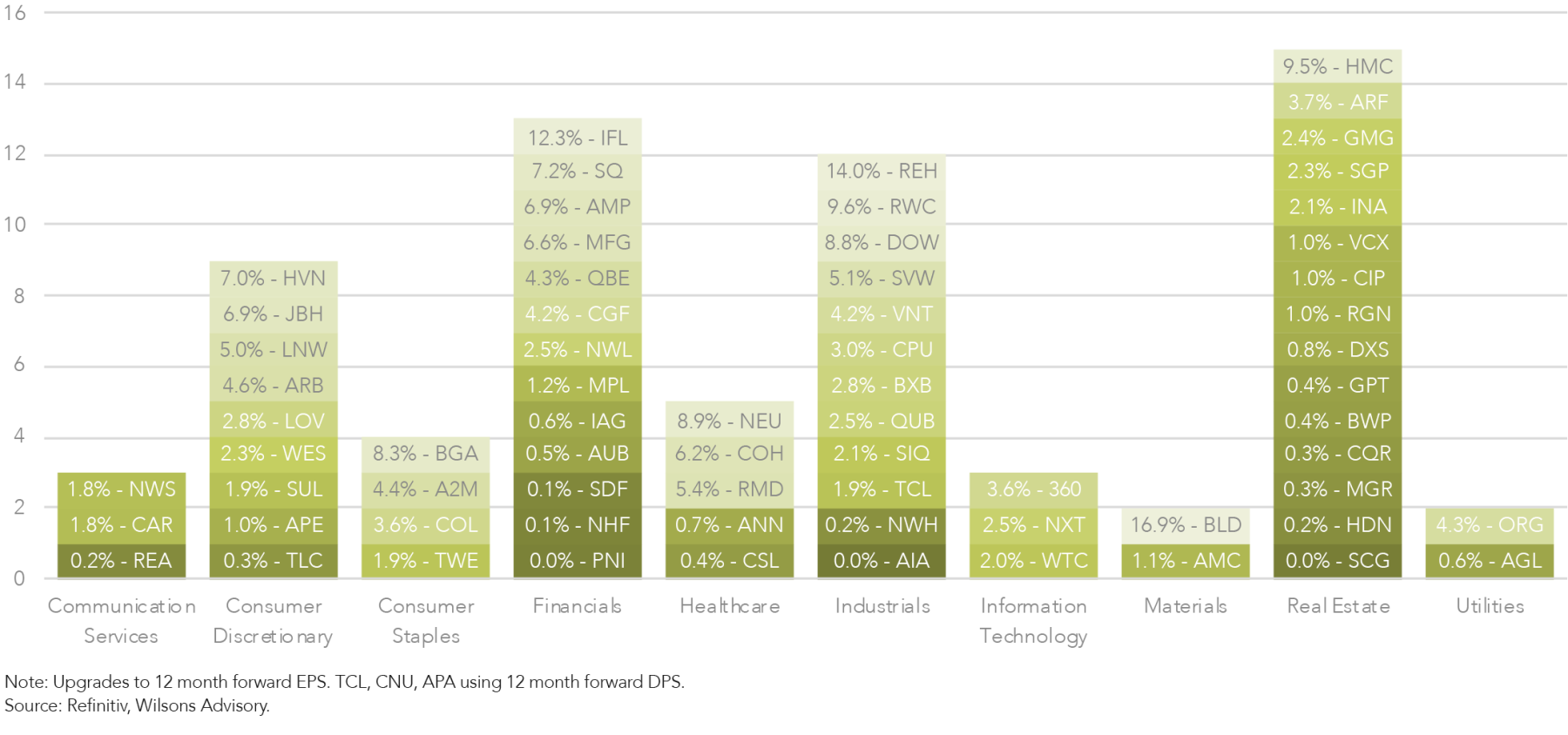

Figure 3: ASX 200 industrial upgrade table - top 20 upgrades

Trimming the fat

Cost management has emerged as the central theme of this reporting season. Cost pressures are still persistent, but cost control strategies have been the key differentiator of winners and losers.

Companies across various sectors, from building materials (BLD), consumer (JBH), industrials (RWC, REH) and tech (SQ2), have demonstrated an impressive ability to adjust to a shifting economic landscape or adjust to investor preferences. This agility is reminiscent of the swift pivots made during the COVID-19 pandemic. It highlights the resilience and adaptability many companies have built into their operations.

The current economic climate, though challenging, has also spurred some companies to excel in cost management. Reliance (ASX: RWC) and JB Hi-Fi (ASX: JBH) are prime examples. While both companies experienced a decline in sales volume, they implemented effective cost-cutting initiatives and productivity improvements.

Despite a year-over-year EPS drop exceeding 20%, both Reliance and JB Hi-Fi surpassed analyst expectations. This performance demonstrates their ability to navigate difficult economic conditions, showcasing the underlying strength of their business models and quality of management teams.

Meeting the rule of 40%

After a period of prioritising rapid growth, many tech companies are shifting their focus towards profitability. This trend is fueled by a financial metric known as the "Rule of 40." This rule suggests a healthy tech company should have a combined growth rate and profit margin exceeding 40%.

Block (SQ2) is already taking concrete steps to achieve the Rule of 40 by 2026. SQ2 projects at least 15% YoY growth in gross profit in FY24, and has demonstrated a commitment to profitability with its 7th consecutive quarter operating expense beat, supporting a profit beat.

This is becoming a key focus for tech companies around the world and Australian tech is no different. Xero (ASX: XRO) has also set targets to achieve the rule of 40 in its recent strategy day. This is going to become increasingly important to achieve over the next few years for tech stocks to perform.

Cost disinflation still a key theme

As we have discussed previously, cost disinflation is a key theme that we see running for the next 6-12 months. In this reporting season freight and raw material deflation have provided gross margin relief for industrials.

For freight, ResMed (ASX: RMD) benefitted from lower freight costs as well as Wilsons Research-covered ARB whose products are manufactured offshore and shipped globally, leading to margin beats.

Raw materials deflation has also supported companies like Brambles (ASX: BXB). BXB stated that deflation in lumber, fuel and US freight costs experienced in 1H24 had supported underlying profit. Management did state that some of these benefts would moderate into 2H24.

Our view is that cost disinflation will still be a key theme over the next 6 months, but many of these impacts will moderate over the course of the next 12 months.

Trading Down and Smaller-Ticket Items

Bellwether retailers Wesfarmers (ASX: WES) and Super Retail (ASX: SUL) showed that consumers were trading down and buying less big ticket items. Shoppers were looking for bargains and this is driving sales at WES' discount chain Kmart, whose Anko brand is a big hit. Kmart sales jumped nearly 5% pcp, supporting a strong result from WES.

Australian shoppers are spending cautiously due to inflation, according to Super Retail Group CEO. They're buying essentials and smaller items like shoes and apparel instead of big-ticket purchases at Rebel. This trend is reflected in Super Retail's sales. Same-store sales have slowed, but some categories like fishing gear (at BCF) and travel apparel (at Macpac) continued to perform well.

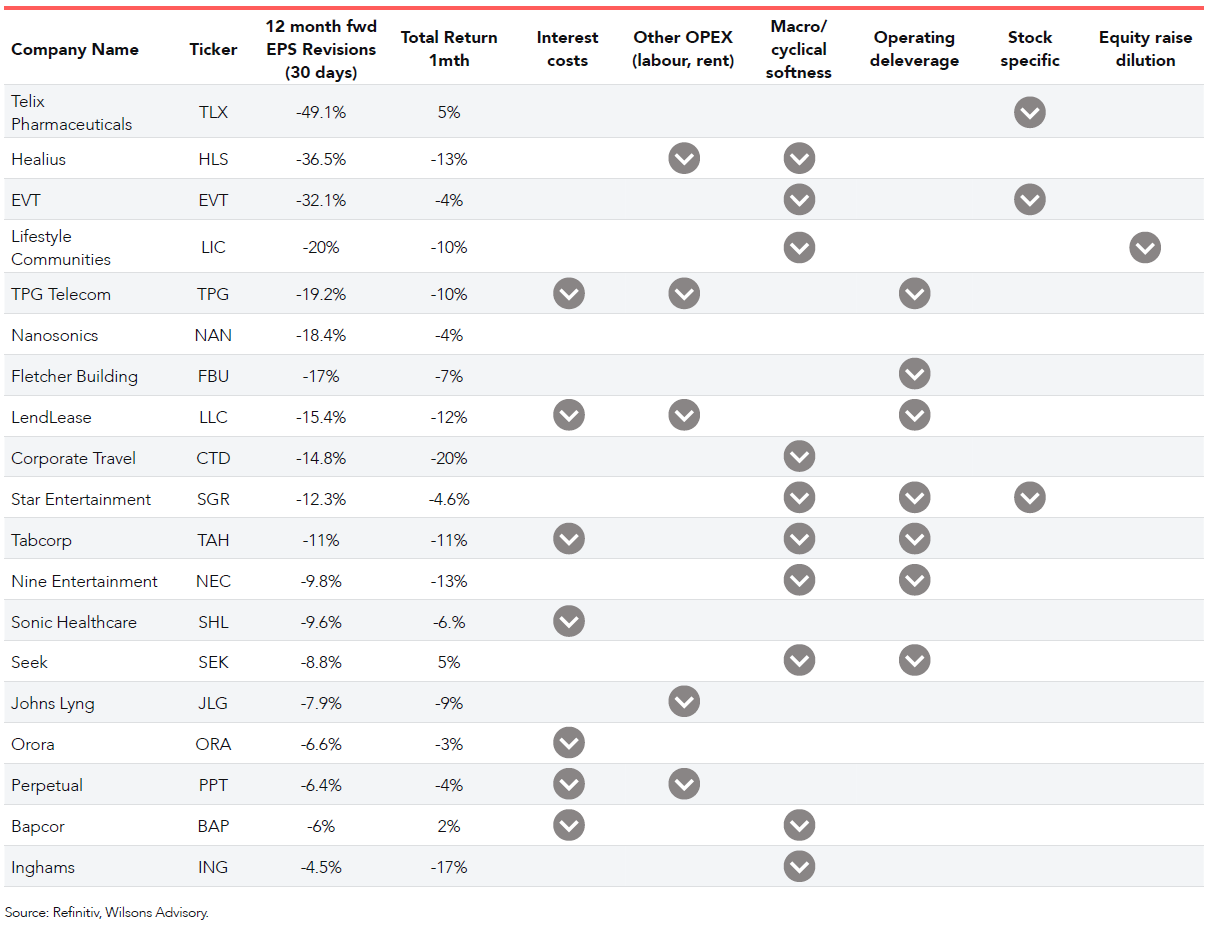

Figure 4: ASX 200 industrials downgrade table - bottom 20 downgrades

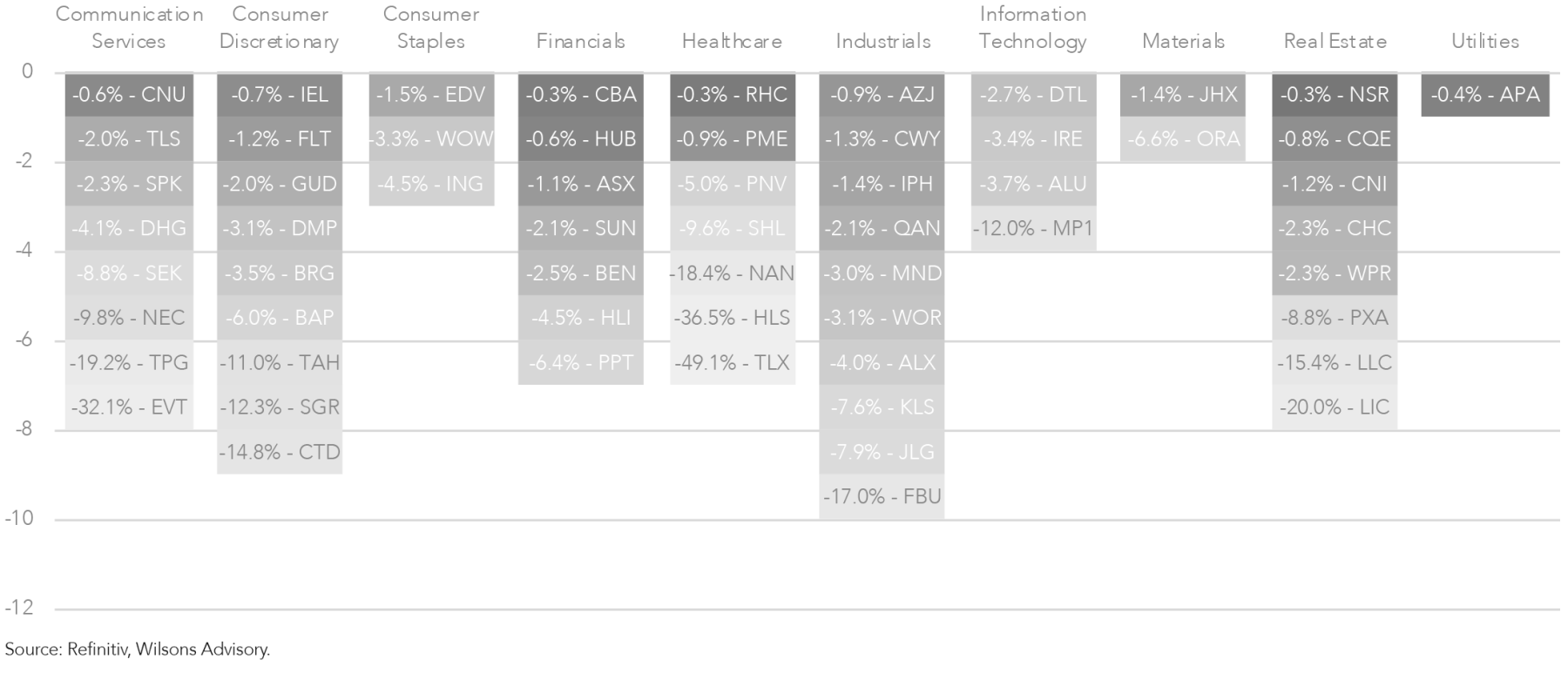

Cyclical softness is driving downgrades in pockets

While the consumer has been reasonably resilient to date, this reporting season has nevertheless demonstrated that cost of living and interest rate pressures are indeed impacting discretionary expenditure in certain pockets. Macro headwinds have impacted the top-line growth of some companies in the more cyclical parts of the ASX including media/online classifieds, travel/leisure, and the consumer discretionary sectors.

Tabcorp (ASX: TAH) pointed to softness in Australian wagering as a result of the impacts of cost of living pressures on consumer spending; Bapcor’s (ASX: BAP) retail segment earnings fell vs the pcp as a result of lower discretionary sales; Seek (ASX: SEK) lowered its guidance for APAC volumes which are now expected to post a mid-teens decline vs pcp in FY24; and Nine Entertainment (ASX: NEC) posted an earnings miss, driven by a challenging macro backdrop which has resulted in softer than expected Free-to-Air TV ad markets.

Other cyclical headwinds were relatively idiosyncratic in nature. For example, EVT Limited (ASX: EVT) saw softer top line growth as a result of poor weather conditions (impacting Thredbo’s operations), while Corporate Travel Management’s (ASX: CTD) earnings miss was impacted in part by an aversion to travel amidst conflict in the Middle East.

Interest costs are biting across a range of sectors

Higher interest costs, reflective of a tighter monetary policy environment, are increasingly putting pressure on the bottom lines of companies with geared balance sheets across a range of sectors.

TPG Telecom (ASX: TPG) saw some of the largest downgrades this reporting season after its 2H interest expenses were +17% above consensus, while the company’s guidance pointed to greater-than-expected cost and interest expense growth in FY24. Sonic Healthcare’s (ASX: SHL) revenues and operating costs were in-line with expectations, although the company’s large downgrades were due to a large miss at the interest expense line. Lendlease (ASX: LLC) also reported sizeable earnings miss which was driven in part by higher net finance costs with the company’s gearing now sitting at 22.9%, above its 10-20% target range.

Other notable examples in which higher interest costs have contributed to sizable earnings downgrades were Orora (ASX: ORA), Tabcorp, Helius, Bapcor, Sonic and Kelsian Group (ASX: KLS).

Operating costs are proving sticky in some cases

Despite cost deflation/disinflation being evident for freight and some raw materials, other key costs of doing business (CODB) line items have remained relatively sticky including wages, rent and other overheads (e.g. energy, IT expenses). A number of these CODB headwinds will remain prominent in 2H24 and FY25.

Woolworths’ (ASX: WOW) Australian food segment saw its CODB increase to 22.8% in 1H24, up from 22.1% in the pcp, driven by higher wages and occupancy expenses (i.e. rents, energy), with management guiding that cost growth will remain high in 2H24. Helius’ total operating expenses (ex D&A) were +47% above expectations driven by higher radiologist (labour) costs and rental inflation as CPI rate increases flowed through. Telix’s (ASX: TLX) FY23 result was broadly in-line with expectations for NPAT although R&D cost guidance for this year was higher than expected, with management expecting 40-50% growth in FY24 aimed at accelerating the development of pipeline assets.

Quality shines through

Maintaining a focus on quality stocks during reporting season helped avoid downgrades.

Top performers and thematic plays

Goodman Group (ASX: GMG), Netwealth (ASX: NWL), and ResMed (RMD) were the highlights, showcasing the strength of their underlying businesses. Given GMG's impressive results, we increased its weighting to 5% to gain more exposure to the growing cloud and data center theme (also supported by NextDC's positive results).

Cost disinflation is likely to continue for another 6-12 months, benefiting Collins Foods (ASX: CKF) (increased to 3% last week) and Amcor (ASX: AMC). While Amcor displayed strong cost control, we expect volume improvements and margin expansion in the coming months. It remains a key pick.

CSL (ASX: CSL) and Telstra (ASX: TLS) have been defensives that disappointed somewhat in their results. We have trimmed CSL and removed TLS to fund higher conviction ideas.

Outlook still challenging this year

While the reporting season was positive overall, the earnings outlook remains challenging due to slowing economic growth. Cost control will be crucial, but companies have limited room to keep exceeding expectations solely through cost cuts.

The market anticipates rate cuts to stimulate FY25 volumes, but quality will still be essential for navigating the next year.

Repositioning for recovery

Anticipating an economic turnaround in 12 months with rate cuts at the end of this calendar year, potentially leading the market to overlook short-term top-line weakness (focusing on FY25), we added Breville (ASX: BRG) and increased our Collins Foods (CKF) weight following a pullback. We'll seek opportunities to add cyclical stocks over the next 6 months if there are further pullbacks.

Figure 5: ASX 200 industrials upgrades

Figure 6: ASX 200 industrials downgrades

Want more insights like this?

Wilsons Advisory thinks differently and delves deeper to uncover a broad range of interesting investment opportunities for its clients. To read more of our latest research, visit our Research and Insights.