ASX stocks Trump Trade Playbook

As we close out the week after the US election result, there are clear patterns emerging with respect to which stocks are major winners and losers from the Trump + Red Sweep outcome. This refers to the Republicans enjoying winning the presidency, as well as control of both bodies of US Congress.

“Make America great again” (“MAGA”). Not Europe, not Australia, and perhaps most clearly, not China. Markets are betting that the sweep of power in Washington makes it far easier for President-elect Trump to implement his policies aimed at boosting the US economy via tax cuts, the application of tariffs on imported goods, and boosting US-domestic manufacturing and innovation.

The logical extension of these policies is that they’ll likely benefit companies that have a large exposure to the US economy. Indeed, so far, markets have marked up stocks that derive a significant portion of their earnings in the USA, while punishing those that derive a significant portion of their earnings in geographies that will be disadvantaged by MAGA policies.

For many Australian companies that have an exposure to the US economy, the prospect of greater revenues from their US operations is a tantalising prospect. But there’s potentially an extra kicker. President-elect Trump’s proposed cut to the corporate tax rate to 15% from the current 21% could turn out to be the cherry on top.

More revenue and less tax. Sounds fantastic, but the tax kicker only benefits those that pay tax on their US earnings to the US government, as opposed to translating back into Aussie dollars and paying it here. In this article we’ll take a look at which ASX companies derive the greatest portion of their revenues in the US, but also which stand to benefit the most from a US corporate tax cut.

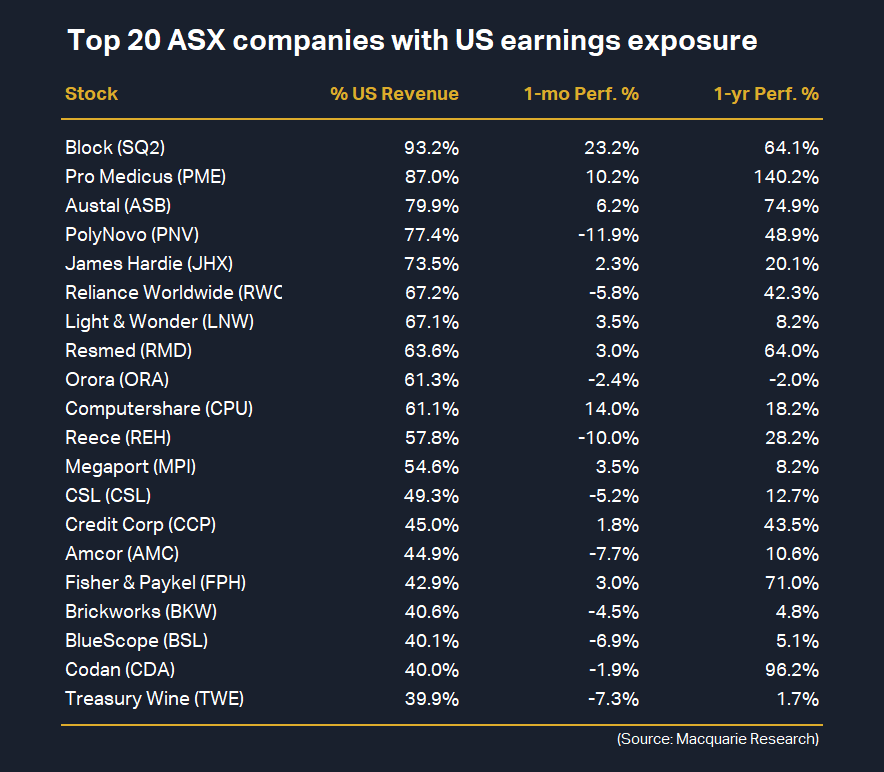

Top 20 ASX companies with US earnings exposure

New research from major broker Macquarie investigates both which ASX companies have the greatest revenues derived from the US economy, as well as which companies stand to benefit the most from a potential corporate tax cut. See below their list of Top 20 ASX companies with US earnings exposure:

Macquarie notes that the Trump + Red Sweep basket it identified just before the election is going gangbusters. FYI, it includes stocks the broker presently has an OUTPERFORM rating on and that it feels has the greatest exposure to Trump policy changes: Block (ASX: SQ2), James Hardie Industries (ASX: JHX), Light & Wonder (ASX: LNW), Computershare (ASX: CPU), Bluescope Steel (ASX: BSL), Treasury Wine Estates (ASX: TWE), Northern Star Resources (ASX: NST), and Worley (ASX: WOR).

The basket has beaten the broader S&P/ASX 300 by 3.6% since the election, Macquarie proudly notes. It’s not too late for investors to buy the basket, though, as the broker goes on to say the basket “should still provide exposure to Trump policy changes”.

It would make one change, however, suggesting clients switch out NST for mining analytical and testing services business ALS (ASX: ALQ). It will likely be reassuring for gold bugs that Macquarie is still bullish on gold, believing that MAGA policies are likely to be substantially inflationary in the long run. The main reason for turfing NST for ALQ is that the latter company still has exposure to gold, but it’s also more likely to “benefit directly” from a US corporate tax cut.

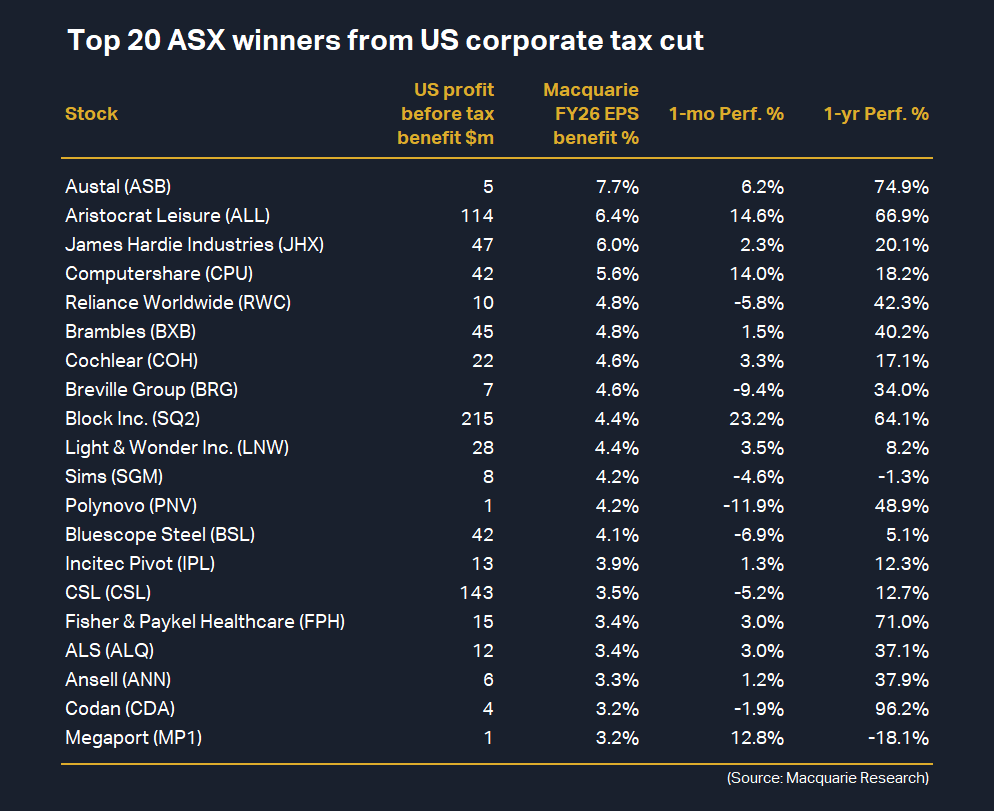

Top 20 ASX winners from US corporate tax cut

This idea that not all companies with US exposure will benefit equally from MAGA policies is an interesting one, as Macquarie points out only those companies that pay tax on their US earnings in the US will get the full benefit of the proposed corporate tax cuts. Consider that many ASX companies with US earnings translate them back to Australian dollars and pay tax locally.

Taking everything into account, Macquarie’s Top 20 ASX winners from proposed US corporate tax cuts are listed in the table below.

The third tent peg of the ASX stocks Trump Trade Playbook

So far, we’ve investigated US earnings winners and US corporate tax cut winners. The final tent peg of the ASX stocks Trump Trade Playbook suggests Macquarie, is which companies can also dodge the negative impact likely to be felt by the implementation of President-elect Trump’s proposed tariff regime.

Some companies will suffer as a result of experiencing higher costs on goods and services their US operations import from China, suggests Macquarie. This will likely create earnings “headwinds” that would offset any benefits from tent pegs one and two.

The broker notes Reliance Worldwide Corporation (ASX: RWC) (67% US revenue exposure and +4.8% likely earnings benefit from corporate tax cut) and Breville Group (ASX: BRG) (32% revenue exposure and 4.6% likely earnings benefit from corporate tax cut) as falling into this category.

In closing, Macquarie also notes its preference for other OVERWEIGHT rated US-earners like Aristocrat Leisure (ASX: ALL), CSL (ASX: CSL), Megaport (ASX: MP1), Amcor (ASX: AMC), Goodman Group (ASX: GMG), and Resmed Inc (ASX: RMD).

This article first appeared on Market Index on Friday 15 November 2024.

5 topics

27 stocks mentioned