ASX to rise, S&P 500 swings into positive territory, Deep Yellow joins the ASX 200

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 38 points higher, up 0.49% as of 8:20 am AEST.

S&P 500 SESSION CHART

OVERNIGHT MARKETS

- S&P 500 rallied into the close to finish at best levels, up from session lows of -0.90%

- Major US benchmarks were higher in May after a weak April – Dow +2.3%, S&P +4.80%, Russell 2000 +4.8% and Nasdaq +6.8%

- Big tech stocks pushed the indexes higher, with more than half of the S&P 500’s May gains attributed to Nvidia (+26.8%), Apple (+12.9%), Microsoft (+6.8%) and Alphabet (+6.0%)

- Proportion of S&P 500 stocks trading below the 50-day moving average has fallen from 90% at the beginning of the year to 40%, flagging concentration concerns

- Nvidia has tripled in value over past year and could soon surpass Apple as second-most valuable company (Reuters)

- Penny stocks see a boom in trading, raising worries market becoming overheated (FT)

- Worrisome rebound in US yields casts shadow on stocks at record highs (Reuters)

- China ETFs see first monthly outflows for first time since Feb-2023 (Bloomberg)

- OPEC+ agrees to extend all production cuts into 2025 (Bloomberg)

INTERNATIONAL STOCKS

- Nvidia CEO Huang says company plans to upgrade its AI accelerators every year, highlights next-gen AI platform 'Robin' for 2026 (Bloomberg)

- Facebook attracting highest number of young adults in three years (Reuters)

- Dell results unable to meet very elevated market expectations (Bloomberg)

- MongoDB latest enterprise software name to cut guidance (CNBC)

- Gap rallies with positive comps across all brands (CNBC)

CENTRAL BANKS

- Dallas Fed's Logan says rates may not be as restrictive as they would have been before pandemic (Bloomberg)

- NY Fed's Williams expects inflation to resume declining in H2, rate cut depends on incoming data (Bloomberg)

- Economists dial back ECB rate cut expectations amid inflation risks according to latest survey (Bloomberg)

- BOJ panelist says central bank must steadily hike rates to guard against inflation accelerating above 2% target (Reuters)

GEOPOLITICS

- US slowing AI chip exports to Middle Eastern countries (Bloomberg)

- TikTok preparing a US copy of the app's core algorithm (Reuters)

ECONOMY

- US core PCE inflation rose 0.25% month-on-month in April, in-line with expectations and below prior month’s 0.33% rise (Reuters)

- Eurozone inflation comes in hotter than expected for May (Bloomberg)

- China manufacturing PMI flips into contraction for first time since Feb (Reuters)

- Japan industrial production unexpectedly stalls, retail sales beat while jobless rate steady (Reuters)

- Tokyo core inflation accelerates amid speculation around timing of next hike (Bloomberg)

- South Korea industrial output bounces back, retail sales continue to fall (Yonhap)

ASX TODAY

- ASX 200 set to open higher after a strong lead in from Wall Street

- ASX 200 Index changes effective prior to open on 11-Jun – Deep Yellow (add), Silver Lake Resources (removed)

- Lower yields should see some positive flow for local Real Estate, Utilities sectors

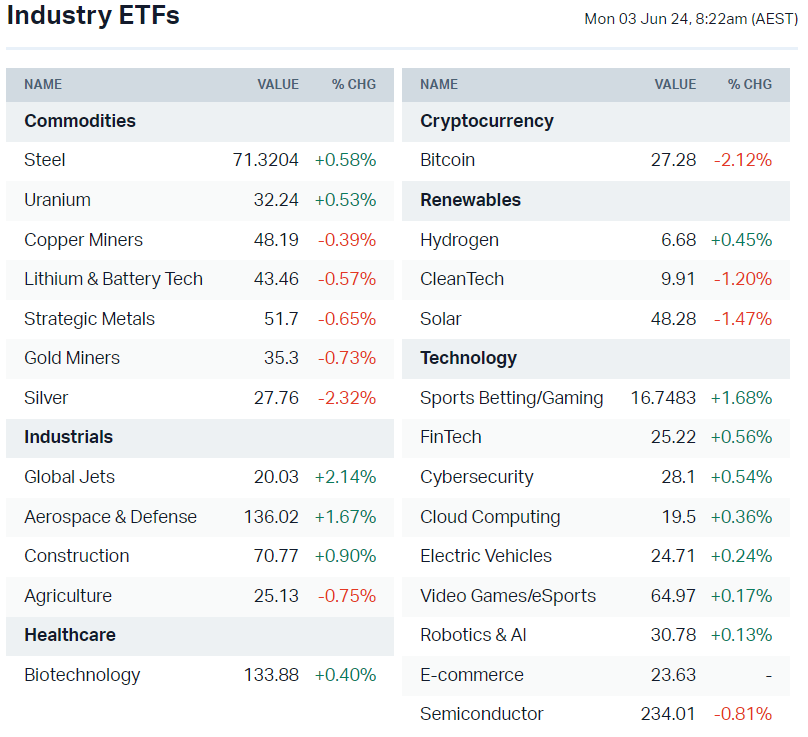

- Materials-related ETFs performed relatively weak overnight as copper, gold and iron ore prices ticked lower

- APM Human Services to be acquired by Madison Dearborn at $1.45 (AFR)

- Northern Star Resources CEO Stuart Tonkin sold 35,000 shares (NST)

- Vulcan Energy raises 40m euros from three investors – CIMIC, Hancock Prospecting and Victor Smorgon Group (EQS News)

BROKER MOVES

- Brickworks upgraded to Buy from Hold; target up to $29.50 from $29 (Bell Potter)

- Dicker Data upgraded to Neutral from Sell; target cut to $9.85 from $10.50 (Goldman)

- DroneShield initiated Buy with $1.40 target (Shaw and Partners)

- Duratec initiated Buy with $1.50 target (Shaw and Partners)

- Fisher & Paykel downgraded to Underweight from Neutral; target cut to NZ$23 from NZ$24 (JPMorgan)

- Ingenia Communities upgraded to Overweight from Neutral; target up to $5.50 from $4.80 (JPMorgan)

- Reject Shop downgraded to Overweight from Buy; target cut to $5.80 from $6.0 (Jarden)

- Stanmore Resources initiated Buy with $4.0 target (Citi)

KEY EVENTS

Companies trading ex-dividend:

- Mon 3 June: Newmont (NEM) – $0.268

- Tue 4 June: None

- Wed 5 June: Hancock & Gore (HNG) – $0.01, Infratil (IFT) – $0.017

- Thu 6 June: None

- Fri 7 June: None

Other ASX corporate actions today:

- Dividends paid: Dicker Data (DDR) – $).11, Embark Early Education (EVO) – $0.015

- Listing: None

Economic calendar (AEST):

- 11:45 am: China Manufacturing PMI (May)

- 12:00 am: US ISM Manufacturing PMI (May)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

This recently triggered market signal has never failed to predict gains

Ophir Asset Management