Attractive yields with low volatility. Fixed income ticks the boxes in 2024

Normalised interest rates and generally higher for longer yields have restored attractive returns across all segments of fixed income. With inflation now coming off its multi-decade highs, the potential for modest rate cuts in the back half of 2024 should see longer-duration, high-grade bond portfolios perform.

In the credit market, 2024 appears to be a year where active managers should be rewarded for superior security selection. We expect to see rising impairments in high yield/private debt. The role of Investment Grade (IG) credit is expected to be re-established, with strong yields akin to equity market averages.

In addition to attractive income, higher IG credit yields also provide enhanced defence, with portfolio yields of between 7% and 8%, combined with three to four years of spread duration. This would require an improbable GFC-style event to generate negative returns over a 12-month period. Overall, 2024 looks set to be another year of strong performance for fixed income.

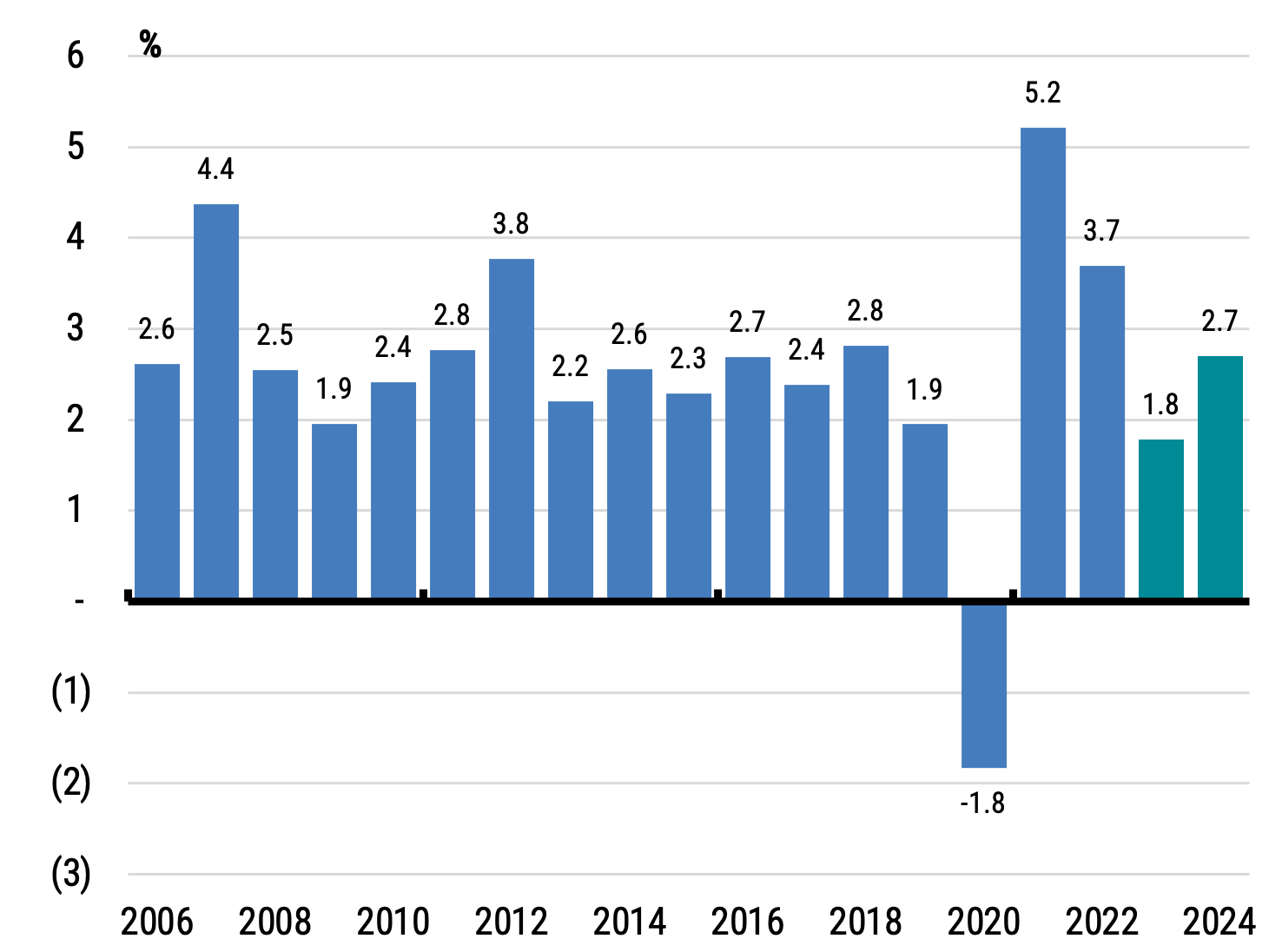

Australia’s Real GDP supports the credit environment

Australia’s economy is heading for a soft landing, with growth reaccelerating back towards trend in 2024. Source: YarraCM, ABS

What are the biggest risks for fixed income in 2024?

In our view, the most significant risk for fixed income is inflation remaining above target for longer than anticipated, leading the RBA to continue to hike rates through 2024. This scenario could trigger new waves of bond market volatility, which would negatively affect the performance of longer-duration portfolios. It would also potentially lead to the following:

- household stress,

- credit impairments,

- recessionary conditions, and

- wider credit spreads.

Overall, though, we see a very low likelihood of this scenario playing out. Inflation is moderating, with Australia’s CPI likely to follow the path of the United States (albeit with a lag of between six to nine months).

We anticipate modest rate cuts from the RBA in the second half of 2024 as inflation continues to moderate towards the 2-3% target band. Moreover, despite a rise from current low levels, we expect unemployment to remain at a low of around 4.5% by the end of 2024.

A 4.5% unemployment rate accompanied by slower growth and moderating inflation, creates an attractive environment for strong performance in fixed income. If we are proven wrong and economic conditions materially worsen, the defence offered by current high yields should still generate positive returns over the course of 2024.

How are we positioned?

Yarra Australian Bond Fund

The content below was contributed by Darren Langer, Co-Head of Australian Fixed Income

In our longer duration/high-grade strategies, we believe the risks are more skewed to steeper yield curves and lower yields as shorter maturities begin to price in cash rate cuts. Timing is tricky, particularly if we see higher yields in the early part of the year. If that does occur, the risk of central banks overtightening becomes more likely, and we may see cash rates fall faster in the latter half of 2024.

Spread markets may widen, particularly if a recession occurs, but we mostly see idiosyncratic risks in credit markets rather than broad systemic risks, as occurred during the GFC. As such, in our longer duration/high-grade strategies, we are holding shorter maturity credit as it is well protected against higher spreads.

Additionally, we favour holding 12-15-year semi-government bonds, given elevated yields and attractive spread dynamics in that part of the yield curve.

We believe fixed income will have an important role to play in investors’ portfolios, and with risk-free yields at or near 4.5%, high-quality fixed income is likely to contribute to returns, rather than detract. Given some uncertainty about how 2024 will play out, remaining nimble in terms of sector allocation will be an important driver of any excess returns.

Yarra Enhanced Income Fund

The content below was contributed by Roy Keenan, Co-Head of Australian Fixed Income

In higher-yielding IG credit, we expect bank and insurance Tier 2 to continue to outperform into 2024. Depending on the outcomes from the APRA discussion paper on the challenges of using AT1 capital instruments, we may also have the opportunity to switch into Tier 1 at some point during 2024. We are well positioned for any ensuing volatility, given our current bias to Tier 2, and would look to rotate into Tier 1 at better entry levels for bank and insurance names.

Despite the APRA uncertainty and questions around the prospects for an economic soft landing, we suspect that hybrid spreads will continue to grind tighter over 2024. The risk-return opportunity in hybrids seems compelling today, and we expect to see strong investor demand throughout 2024. We also expect to see opportunities in A-REITs hybrids, with our research suggesting the sector needs to raise capital or sell assets to repair balance sheets and preserve credit quality.

With raising equity at heavy discounts to net tangible assets or selling assets at deep discounts both unpalatable options, we expect A-REITs will explore subordinated debt (hybrids) issuance in 2024 to support their credit ratings. If these deals are priced correctly, we would likely be willing participants.

Yarra Higher Income Fund

The content below was contributed by Phil Strano, Senior Portfolio Manager

In residential mortgage-backed securities (RMBS), where credit spreads effectively doubled in 2022 and are only now starting to normalise, we invested in AA-BBB rated tranches at attractive yields (7-9%) with near bulletproof collateral protection through the course of 2023. It’s a similar story in private warehousing, with margins on revolving mezzanine credit facilities at very attractive levels. Both segments are expected to be important drivers of outperformance in 2024, with population growth putting a floor under house prices and underpinning credit quality for RMBS and associated warehousing.

We remain more discerning in the syndicated loans and private debt segments, with a portion of consumer-facing levered loans and private property debt likely to become impaired next year.

Why should investors consider fixed income above all others in 2024?

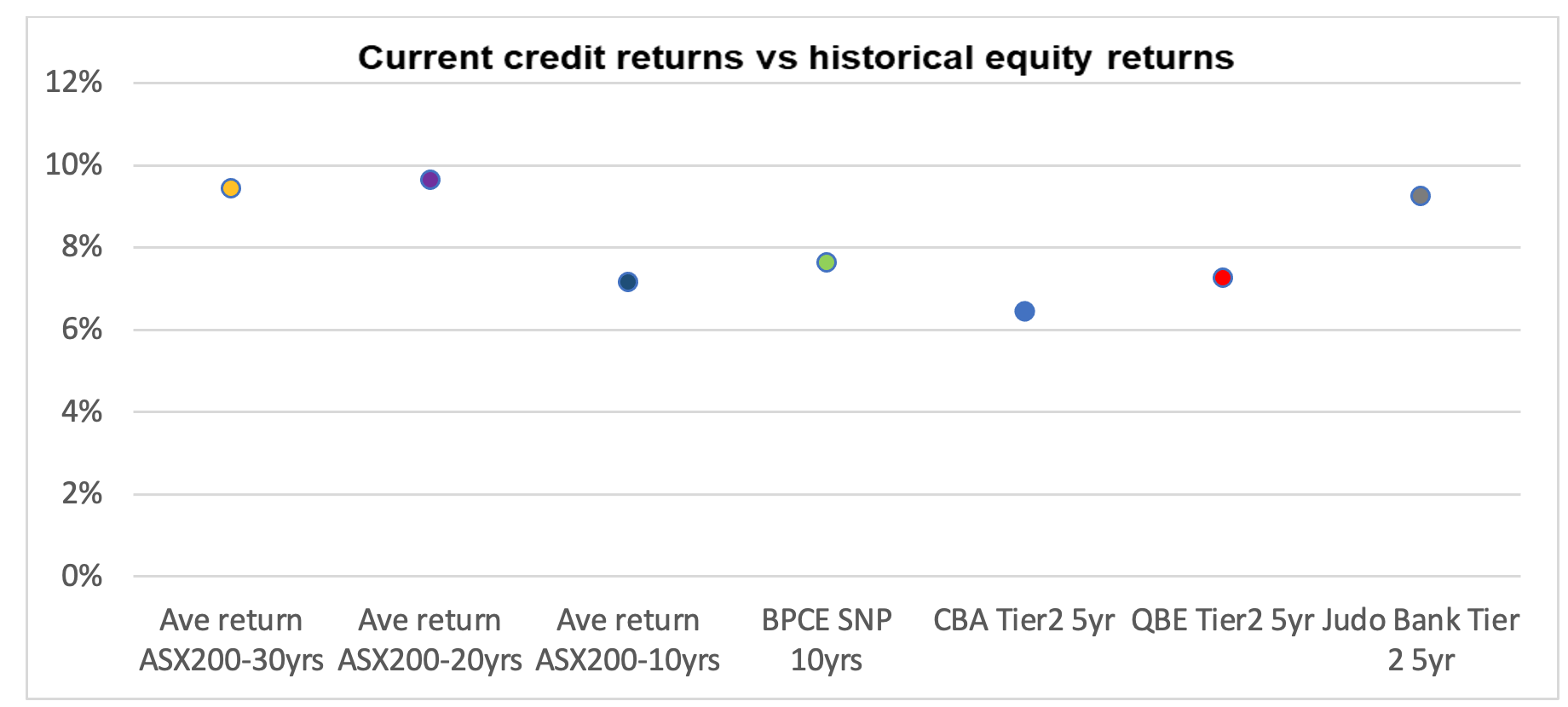

Because investors can expect equity-like returns from IG credit! Attractive yields on credit securities with low volatility and minimal impairment risk are comparable to the more volatile and uncertain equity market averages. For example, BBB+ rated CBA T2s, issued at a fixed 6.45% yield, compare favourably to the 7.14% 10-year average return for the ASX200 index.

Equity-like returns from IG credit

Outright yields in IG are very attractive, offering investors the prospect of higher risk-adjusted returns. As evidenced by more recent $A issuance, new IG-rated Senior and Tier 2 bank and insurance bonds are offering investors attractive yields akin to the 10-year average ASX200 equity return (7.1%). So, IG yields are currently at longer-term equity average levels without the associated volatility and with significant potential to outperform as spreads and yields normalise over the near to medium term.

Furthermore, in being IG-rated, investors are likely to extract equity-like returns in 2024 without the prospect of the impairments that are more commonplace in high yield during economic slowdowns.

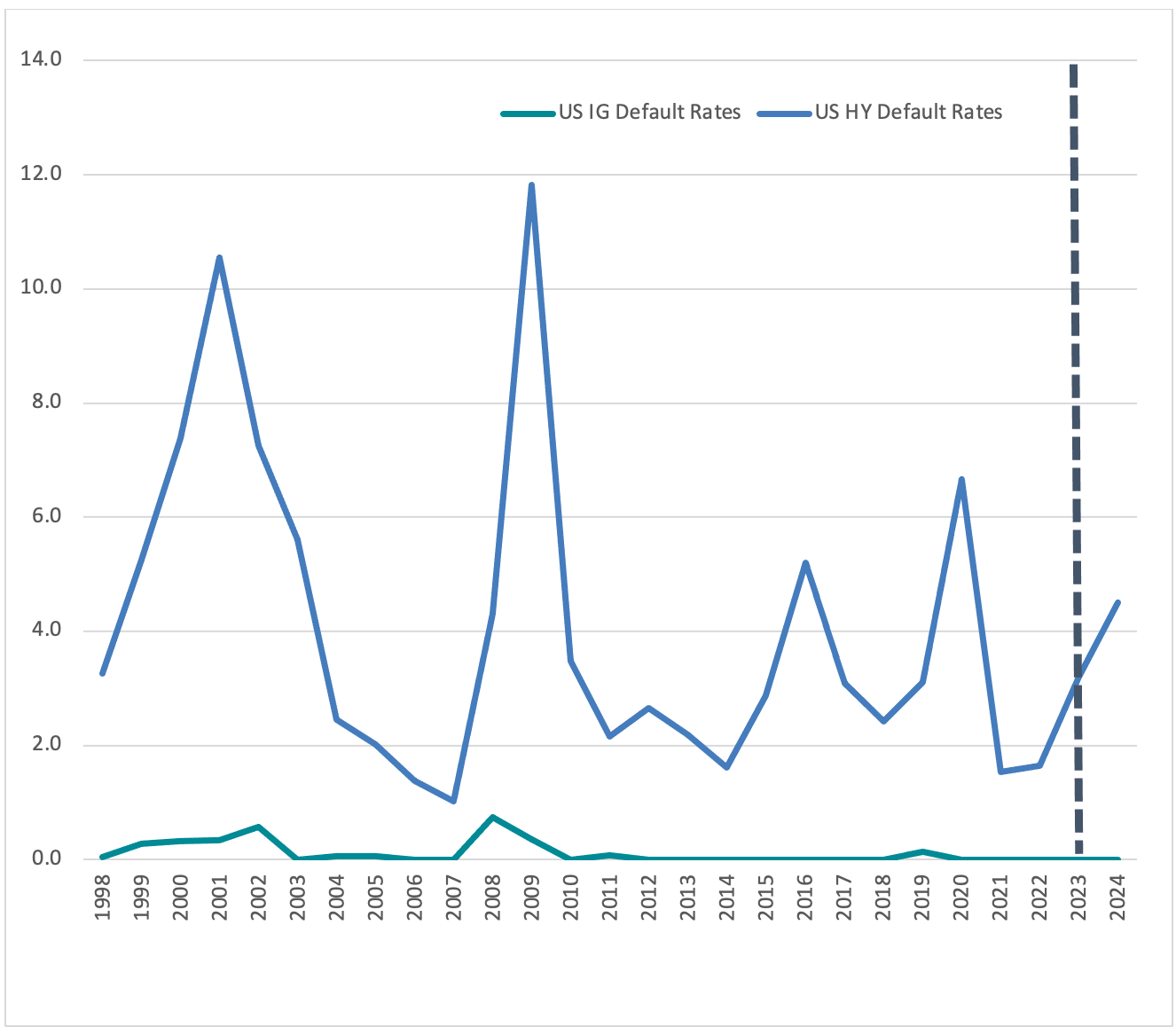

IG credit does not default, providing income certainty

Highly compelling IG yields, coupled with no tangible prospect of impairment, provide income certainty. The same cannot be said for high yield or equities.

Source: YCM/ASR/S&P Global/Refinitiv Datastream

Learn more

We offer a range of fixed income and multi-asset products, aimed at meeting the needs of investors seeking regular stable income, diversification benefits and capital stability.

2 topics

3 funds mentioned

3 contributors mentioned