AUD the global risk barometer

Elizabeth Moran Consulting

The AUD dropped harder and faster than other Asian currencies on Friday reinforcing its position as a liquid and flexible proxy for the Asia region. Right now the Australian economy is performing at its best in years which should be good news for the AUD, but the currency is sending a foreboding signal that winter is coming. US based foreign currency expert, Greg Gibbs wrote this note for FIIG Securities.

AUD the global risk barometer

Some people like "Doctor Copper" as their barometer of global growth risks, but the Aussie dollar has been a remarkably prescient sage, and it is telling us that we are approaching a snapping point in the global financial system. Doom may not be imminent or unavoidable, but the tension is tight, and is being ratcheted up.

You don't have to be a sharp observer to see that there are problems in global financial markets, Turkish and Argentinian markets are in turmoil, among a few others, but the rapid slide in the AUD in the last month is telling us the risks are spreading to the mainstream.

The dive in the AUD on Friday last week after failing to draw strength from an impressive set of GDP numbers is a sign that we should baton down the hatches.

Clear and present tariff danger

The clear and present danger is President Trump's tariffs. The market has been bracing itself for US tariffs on an additional USD200bn of goods (on top of 25% tariffs already imposed on USD50bn of goods in "industrially significant technologies").

We are still waiting on these next USD200bn of goods, but Trump knocked Asian currencies down a peg on Friday by saying he is ready to impose tariffs on a further USD267bn of goods, for a total over USD500bn, which basically means all of Chinese exports to the USA.

Nothing is certain beyond the first USD50bn in tariffs. In early August, Trump said he was considering a tariff rate on the next USD 200bn tranche of 25%, up from an initially proposed 10%. The rate, the volume, and the timing are still up in the air, but like a dark cloud, they hang over the global economic outlook, especially that of China, and the USA, whose consumers will face higher prices for many goods.

There may even be a relief rally in the AUD if Trump reverts to a 10% rate or applies them to less than USD 200bn of goods. But the market can see that Trump has set his sights on China's trade and industrial policies, and there is no easy middle ground for the two sides in this trade dispute.

The fact that the AUD dropped harder and faster than other Asian currencies on Friday is a testament to its position as a liquid and flexible proxy for the Asia region.

Australia yet to feel the pain

But before we pile into a short AUD position let’s first acknowledge that Australia has not yet been much affected by the trade dispute. In fact, the price of Australia's main exports have gone up; coal, natural gas and iron ore. Australia's trade balance is in a relatively strong surplus, mining sector profits are up significantly over the last year, Government revenue is stronger, and mining companies are even talking about new capital investment.

This illustrates that the fall in the AUD in recent weeks has a lot to do with the risks of global fallout from this trade dispute rather than a fallout due to actual damaging tariffs or lower commodity prices for Australia.

Australian external accounts in relatively good shape

Australian commodity prices holding up

Tightening global liquidity

The other global risk is the steady rise in US rates. This has been going on since 2015, but this year it has started to have wider implications for borrowing costs in emerging markets and Australia. Credit has got tighter and more expensive for significant parts of the global economy.

There may be several causes of tougher financing conditions; higher US rates, more issuance by the US government to fund its rising deficit, US tax policy designed to force US companies to repatriate retained foreign earnings, and the wind down in the Fed's balance sheet (quantitative tightening).

The weaker global credits (Argentina and Turkey) were early casualties, but troubles have spread to other emerging markets. Weaker EM currencies have had a self reinforcing effect, raising the cost of refinancing foreign currency (mainly dollar) denominated debt.

Many emerging market currencies are facing higher borrowing costs, and several have raised domestic interest rates to stabilise falling currencies. The result is that economic growth in these countries will slow and undermine confidence in the global economy.

There has been some contagion to major economies. Italy has experienced a significant rise in bond yields, and bank share prices in Europe are depressed. Risk for the European economy and asset markets are increasing as the market prepares for the planned taper of the ECB’s asset purchases from EUR30bn to EUR15bn in October and to zero in January. This may place further upward pressure on credit spreads in the region and globally.

There are still other risks to global investor confidence including:

· US sanctions on Iran and Russia

· A crisis brewing over Brexit

· China's efforts to rein in credit excesses

· US political uncertainty heightened by the Mueller investigation and mid term elections in November

A troubling divergence

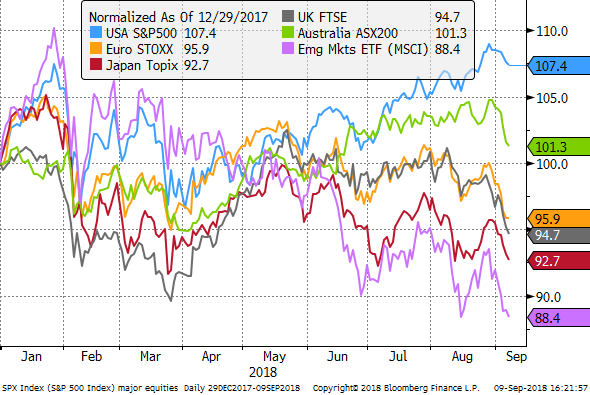

In the meantime, the US economy is powering on, and the US stock market is in a record bull run, diverging dangerously from global assets. The relative strength in the US dollar and assets is a reflection of late-cycle fiscal expansion and Trump's America first policies; including tariffs and sanctions. But this divergence is causing problems, and sooner or later we should expect broader contagion, including on US equities, and eventually the USD. Be prepared for further, significant global market upheaval.

US equities diverge from the rest

Australia still in the firing line

Australia has felt some of the pain of tighter global credit conditions. The rise in Australian bank funding costs that has led to out of cycle increases in Australian mortgage rates appears to be closely related to less abundant global liquidity.

Because Australian banks still rely on wholesale financial markets for around 40% of funding, the whole country is susceptible to global financial market upheaval. This is a corollary of Australia's high levels of household debt and high house prices.

During the 2008/09 GFC, Australian bank funding costs blew-up requiring the government and RBA to step in to stabilise borrowing costs in Australia, but of course, the AUD sunk like a stone. There has only been a modest rise in bank funding costs this year, relative to the GFC, but it is enough to highlight that Australia and the AUD are still in the firing line.

Late-cycle adventures

A third risk for the global economy is inflation in the USA. As RBA Governor Lowe so aptly put it in his speech in Perth last week, "The United States is experiencing a large fiscal stimulus at a time when the economy is at full employment and is growing quickly. This is an unusual combination to say the very least. Past experience suggests that it could lead to inflation increasing significantly. Financial markets are, however, heavily discounting this possibility, which means that if it did take place it would come as quite a surprise, with repercussions for markets and the real economy."

And on cue, US wage inflation crept to a new high in August in the payrolls report on Friday, sending US rates and bond yields higher, even as US equities fell modestly. The risk is that the prospect of higher inflation keeps the Fed tightening policy with the aim of cooling the economy; driving up US rates and the dollar, further tightening global credit conditions and piling on more risks for global financial markets and the global economy.

Winter is coming

Right now the Australian economy is performing at its best in years, the RBA sees progress towards soaking up spare capacity, Australia's external position is the best in decades, and the government is on track to surplus. This should be good news for the AUD, but the currency is sending a foreboding signal that winter is coming.

4 topics

Nationally recognised expert in fixed income asset class. Career spans more than 25 years in banking and finance in diverse positions including: education, communication, media, credit research, credit ratings and retail and commercial lending.

Expertise

Nationally recognised expert in fixed income asset class. Career spans more than 25 years in banking and finance in diverse positions including: education, communication, media, credit research, credit ratings and retail and commercial lending.