Ausbil's five sectors for dividend growth in 2023 (and Materials isn't one of them)

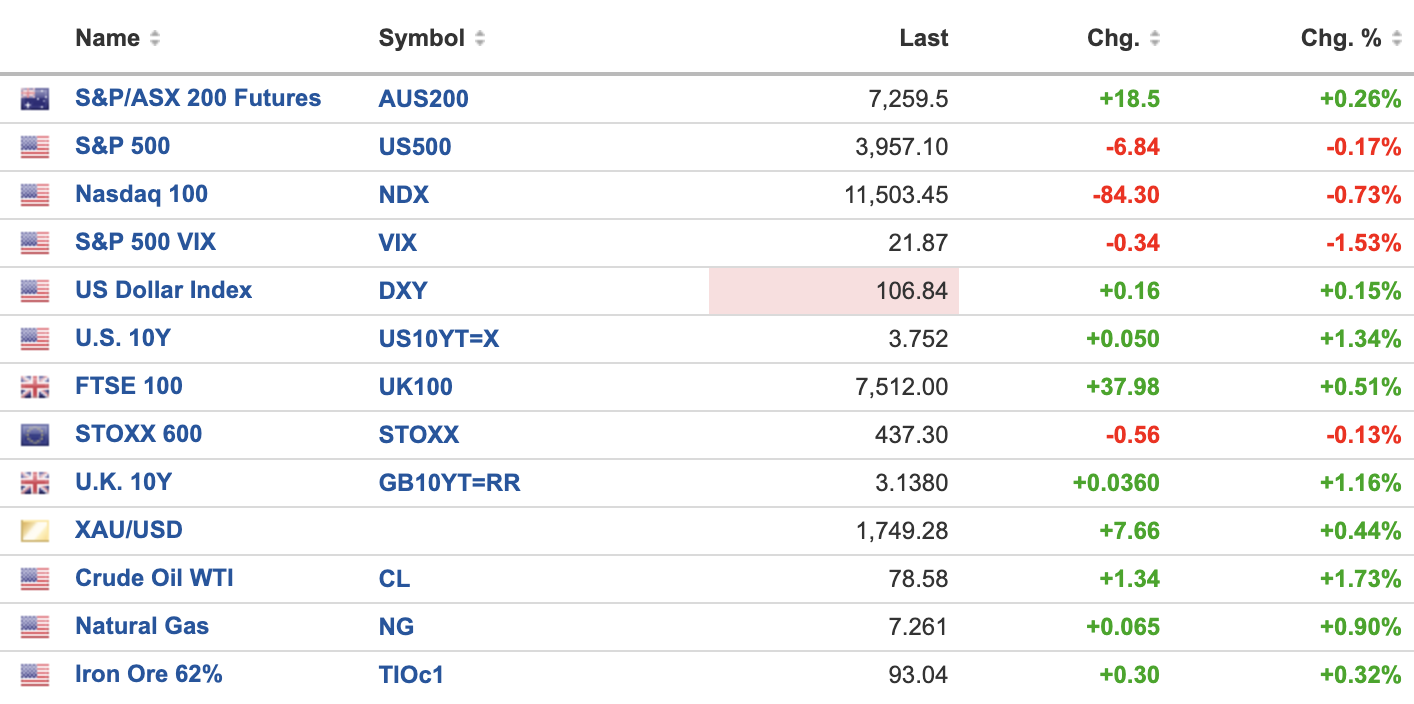

MARKETS WRAP

S&P 500 TECHNICALS

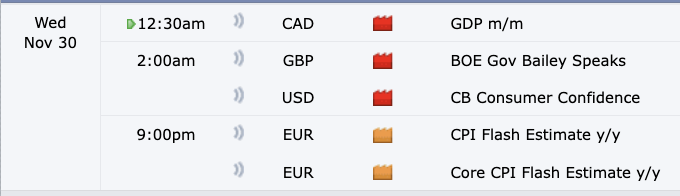

THE CALENDAR

While it might be Eurozone CPI night tonight, all eyes will be on GDP partials and the monthly inflation indicator from the Australian Bureau of Statistics at 11:30 am locally. The big question: how much has inflation continued to rise or has it started to turn some kind of corner? And how much has the rise in inflation generally eaten away at our economic growth prospects for 2022 and 2023?

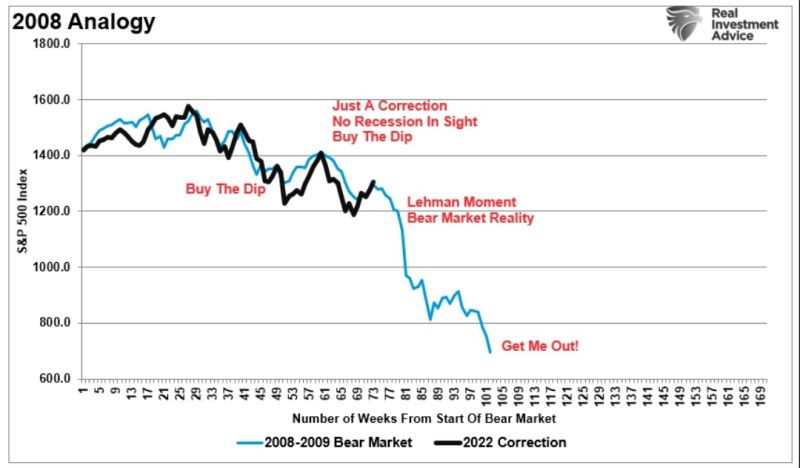

THE CHART

Life just repeats itself in this chart of the day. The 2022 correction has had an extremely close correlation with 2008 so far, but it's the captions that make it really interesting. What will be this market's Lehman Moment? That is, the tipping point where markets will continue to fall with no dip to buy from here on in.

THE QUOTE

"The recession we have been anticipating for nine months draws nearer. Our expectation for a recession in the US by mid-2023 has strengthened on the back of developments since early last spring."

Deutsche Bank was the first of the major Wall Street firms to call for a US recession in the near future. And in its 2023 outlook, they are pulling no punches. The effect in equity markets will be steep as well as they expect declines of as much as 25% from today's levels. The one bit of good news in this projection is that the recovery could also come quickly if the recession doesn't play out for as many quarters as they expect.

And if the major central banks' missions to crush inflation work, then the next bull market could also be a long one.

DIVIDENDS IN FOCUS

Speaking of 2023 outlooks, Ausbil released its 2023 investment outlook for the ASX yesterday. Michael Price, portfolio manager of the Ausbil Active Dividend Income fund, points out that next year will be flat for dividend growth given the resources sector has probably paid out the peak of its payouts in this cycle.

But that doesn't mean there aren't opportunities in other sectors:

"Some ‘all-weather’ dividend payers in the telco and healthcare sectors, and also in consumer staples, are expected to deliver better-than-market dividend outcomes," Price said.

"We are also expecting a strong dividend year in quality energycompanies given the elevated prices and the current supply shock we are experiencing.

"We are also expecting strong dividend performance in select real estate investment trusts (REITs) that have global logistics and warehousing businesses, and some local REITs with near fully leased commercial portfolios that have lease profiles that pass inflation on to tenants through ratchet clauses."

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

2 contributors mentioned