Aussie Dollar may have seen its low

K2 Asset Management

The Australian Dollar (AUD) has fallen a fair way against the US dollar. It is down by 7% YTD, and 11% from its peak in January 2018. However, could it have seen it's low?

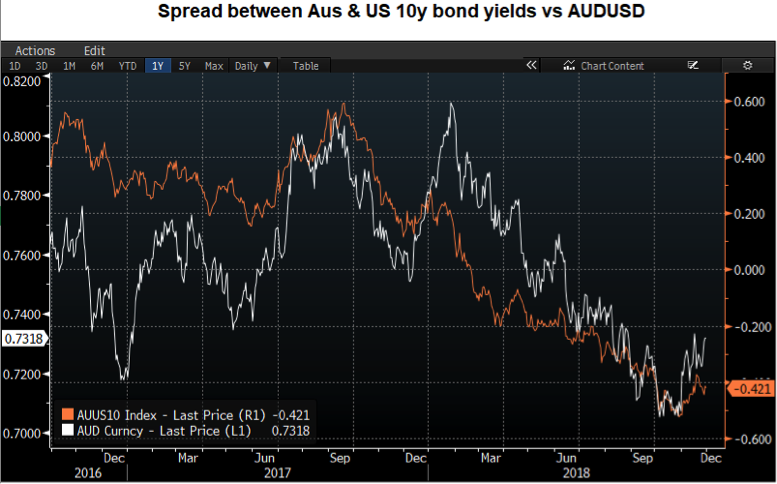

Risk assets such as the AUD have fallen, as concerns increase over an Australian economy riddled with excess debt and housing bubbles. Furthermore, rising interest rates in the US have caused the interest rate differential to fall into negative territory.

Higher interest rates in the US attract capital inflows, as the returns are relatively more attractive than in Australia, which benefits the USD. Rising US rates are also a sign from the Federal Reserve that the US economy is experiencing a period of relative strength.

Source: Bloomberg.

Australia has entered a period of tighter credit, as regulators look to bring down reliance on the housing market. The Royal Commission has made this scenario worse, as banks under intense spotlight retreat from the public eye. Australians have considerable wealth stored in housing and weaker house prices is curbing consumer spending, as mums and dads tighten the belt on discretionary items. Added to a list of external pressures has seen the AUD fall over the year:

- Credit squeeze as Royal Commission curbs bank lending

- Sustained housing price declines

- Slower China growth raises questions on Australian export demand

- US economy growing more quickly than Australian economy, and

- Interest rate differentials favouring the USD.

Unlike dynamic share price fluctuations, currencies, on the whole, are a relative valuation to one another. Changes in rhetoric, fundamentals or even the prevailing view about the future can influence the cross rate. With the AUD not far off its recent lows relative to the USD, a number of factors are coming into play that could provide short to medium term relief for the struggling AUD:

- Conclusion of the US-China trade deal

- Moderation of US interest rate rises signalled by the Federal Reserve, and

- Major Chinese economic stimulus announcements.

Any of the above catalysts could see risk assets come back in vogue. Risk assets include equities, especially in emerging markets (ie, ASEAN), as well as currencies such as the AUD.

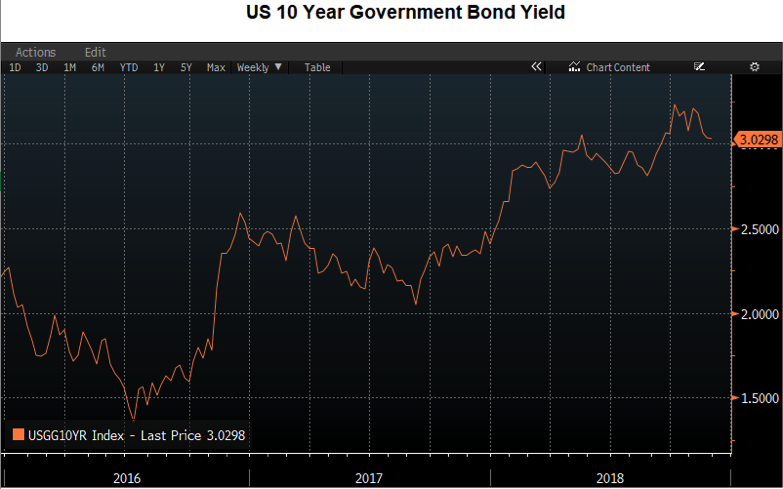

Source: Bloomberg.

Importantly, there is also a change in tone emanating from the US Federal Reserve. The constant rhetoric of higher US interest rates with a possibility of four 25bps rate hikes in 2019 has faded with dramatic speed.

Markets are now looking at between one and two rate rises in 2019. Rhetoric from Federal Chairman Jerome Powell sighting that he believes that rates are now “just below” neutral has driven the yield on 10-year US Government bonds back down to 3%.

In light of the precipitous fall in the AUD/USD cross rate, the potential catalysts noted above and others expected to emerge in the short term, K2 has partially hedged its portfolio back to AUD.

Long-term, concerns still exist within the Australian economy over a normalising of property prices and the negative wealth effect that may follow.

1 topic

Mark is a Co-Founder and Executive Director of K2 Asset Management. He is also the Joint-CIO for the K2 investment funds and focuses on the portfolio management of the Asian equity strategy.

Expertise

Mark is a Co-Founder and Executive Director of K2 Asset Management. He is also the Joint-CIO for the K2 investment funds and focuses on the portfolio management of the Asian equity strategy.