Aussie miners set to benefit from tighter US tariffs

As the US Presidential race heats up, incumbent President Joe Biden last week announced tighter tariffs on the import of China’s critical metals. Affecting US$18 billion of imported Chinese goods, the new measures include:

“I want fair competition with China, not conflict. And we’re in a stronger position to win that economic competition of the 21st century against China than anyone else because we’re investing in America again,” US President Biden said last week.

Focusing on the implications for Australian miners, Macquarie analysts noted iron ore producers were largely unaffected. That’s because iron ore and coking coal are primiarily driven by ex-US market factors.

“In graphite the tariff rate on natural graphite will increase from 0% to 25% in 2026, a tailwind that could directly increase prices, albeit the benefits are for natural graphite only,” Macquarie says in a recent report.

This also aligns with the US’s “foreign entity of concern” timing on cutting down its reliance on Chinese controlled graphite (which is around 95% of the market).

Secondary implications for lithium and rare earths

“In 2024, the tariff rate on EVs will increase from 25% to 100% while the rate on lithium EV batteries will rise from 7.5% to 25%.

“While this could be positive for non-China EV and battery makers, we highlight higher levies could be partially offset by productivity improvement at Chinese companies. Lithium and rare earths materials a secondary impact, in our view,” says Macquarie.

On the back of these measures, demand for Australian critical metals is expected to dip temporarily. That’s because Australia exports about 90% of its extracted critical minerals to China. But the longer-term backdrop is expected to improve as the US diversifies critical minerals imports toward markets outside of China.

The Macquarie report looks at some of the potential winners among Australian miners.

Graphite producers the clear winners

Macquarie calls out graphite producers as clear winners, given the US measures directly increase graphite prices.

Syrah Resources (ASX: SYR)

- Rating: OUTPERFORM

- Price target: 90 cents

- Latest close: 52 cents

Already in production, “SYR is well-placed to capture the earnings upside,” Macquarie says. “Minor winners include Talga Group, Blackrock Mining, and Renascore Resources, due to not yet being in production.”

Talga Group (ASX: TLG)

- Rating: OUTPERFORM

- Price target: $2

- Latest close: 82 cents

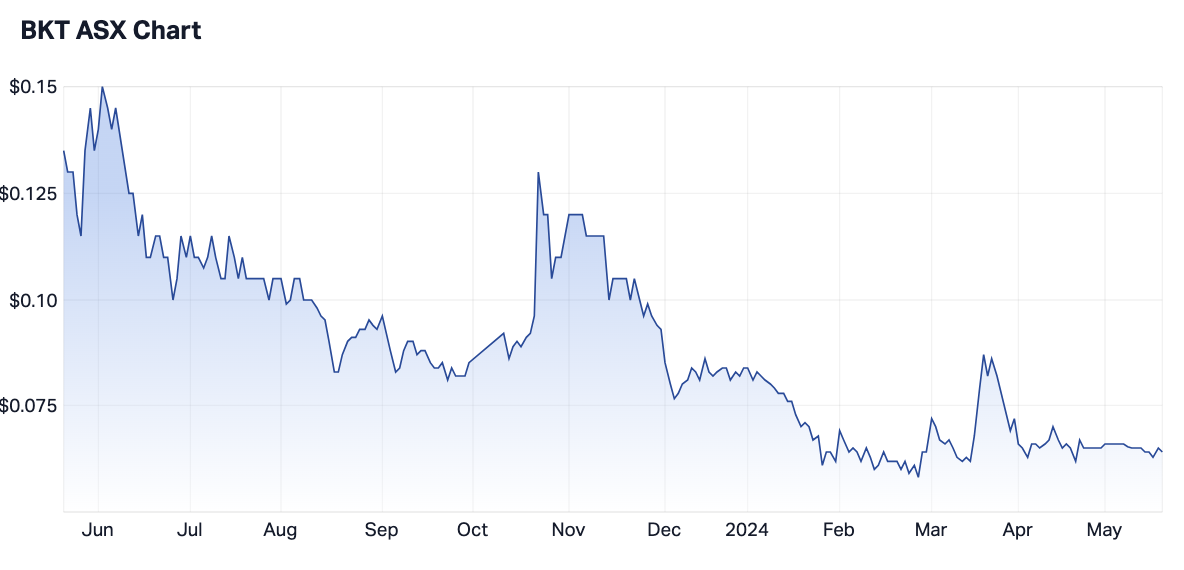

Blackrock Mining (ASX: BKT)

- Rating: OUTPERFORM

- Price target: 25 cents

- Latest close: 6 cents

Renascore Resources (ASX: RNU)

- Rating: OUTPERFORM

- Price target: 25 cents

- Latest close: 12 cents

Aluminium producers

The tariff measures are also a positive for aluminium smelters, Macquarie noting Rio Tinto has 30% exposure to aluminium.

Rio Tinto (ASX: RIO)

- Rating: NEUTRAL

- Price target: $121

- Latest close: $134

Alumina (ASX: AWC)

- Rating: NEUTRAL

- Price target: $1.40

- Latest close: $1.71

“Alcoa’s portfolio could expand with the completion of the (Alumina (ASX: AWC) acquisition.

South32 (ASX: S32)

- Rating: OUTPERFORM

- Price target: $3.90

- Latest close: $3.76

"We note ~45% of S32’s net present value is aluminium, the tariffs could help the company to further re-rate, in our view,” says Macquarie.

Positive for rare earths and lithium

“Higher tariffs following (Inflation Reduction Act) IRA indicate a systematic approach by the US goverment to secure its critical minerals supply chain,” says Macqaurie.

Arcadium Lithium (ASX: LTM)

- Rating: OUTPERFORM

- Price target: $9.40

- Latest close: $7.11

“While lithium prices are unlikely to lift as a result of higher tariffs, we believe Arcadium Lithium (ASX: LTM) could receive increased floor prices in its future LiOH contract renewal as gigafactories try to secure supply,” says Macquarie.

“Piedmont Lithium and Sayona Mining are also well-placed on lithium supply chain which have operations and projects in North America. There is not much magnet production capacity (~11%) outside of China.”

Piedmont Lithium (ASX: PLL)

- Rating: OUTPERFORM

- Price target: US 36 cents

- Latest close: US 23 cents

PLL 12-month share price (Source: Market Index)

Sayona Mining (ASX: SYC)

- Rating: NEUTRAL

- Price target: 4 cents

- Latest close: 5 cents

Rare earths

With independent rare earths supply again under the spotlight, Macquarie cites Lynas Rare Earths as a potential key winner given its light and heavy rare earths development plans in the US.

Lynas Rare Earths (ASX: LYC)

- Rating: OUTPERFORM

- Price target: $7

- Latest close: $6.97

“There is not much magnet production capacity (~11%) outside of China. However, independent rare earths supply is again under the spotlight,” Macquarie says.

This article was originally published on Market Index on Monday 20 May.

4 topics

10 stocks mentioned