Australia's slow inflation descent raises rate risks

The September quarter’s above consensus reading for both headline and underlying inflation materially increases the risk of a November rate hike next week, in our view.

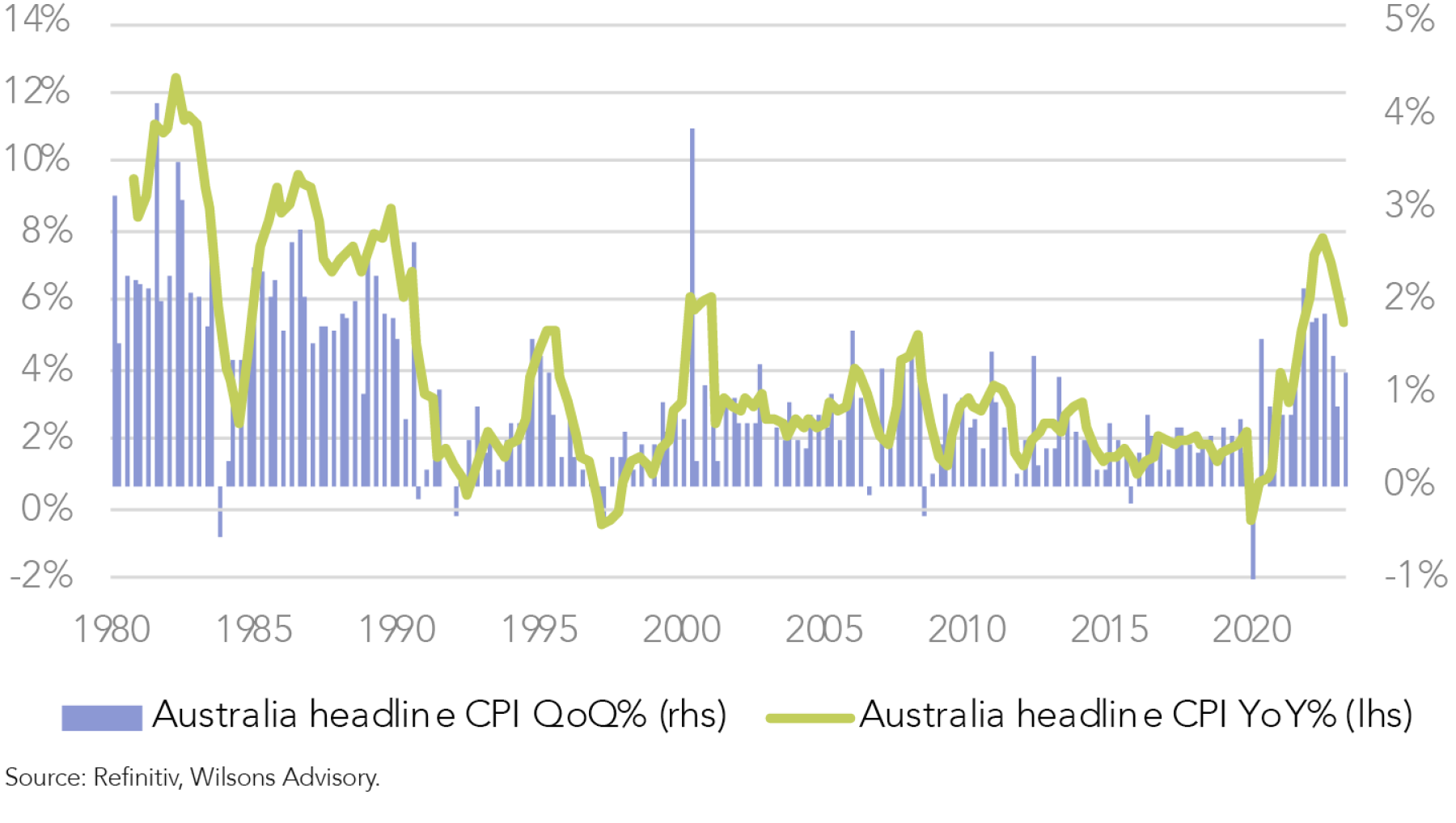

Figure 1: Australian headline inflation is easing but remains elevated

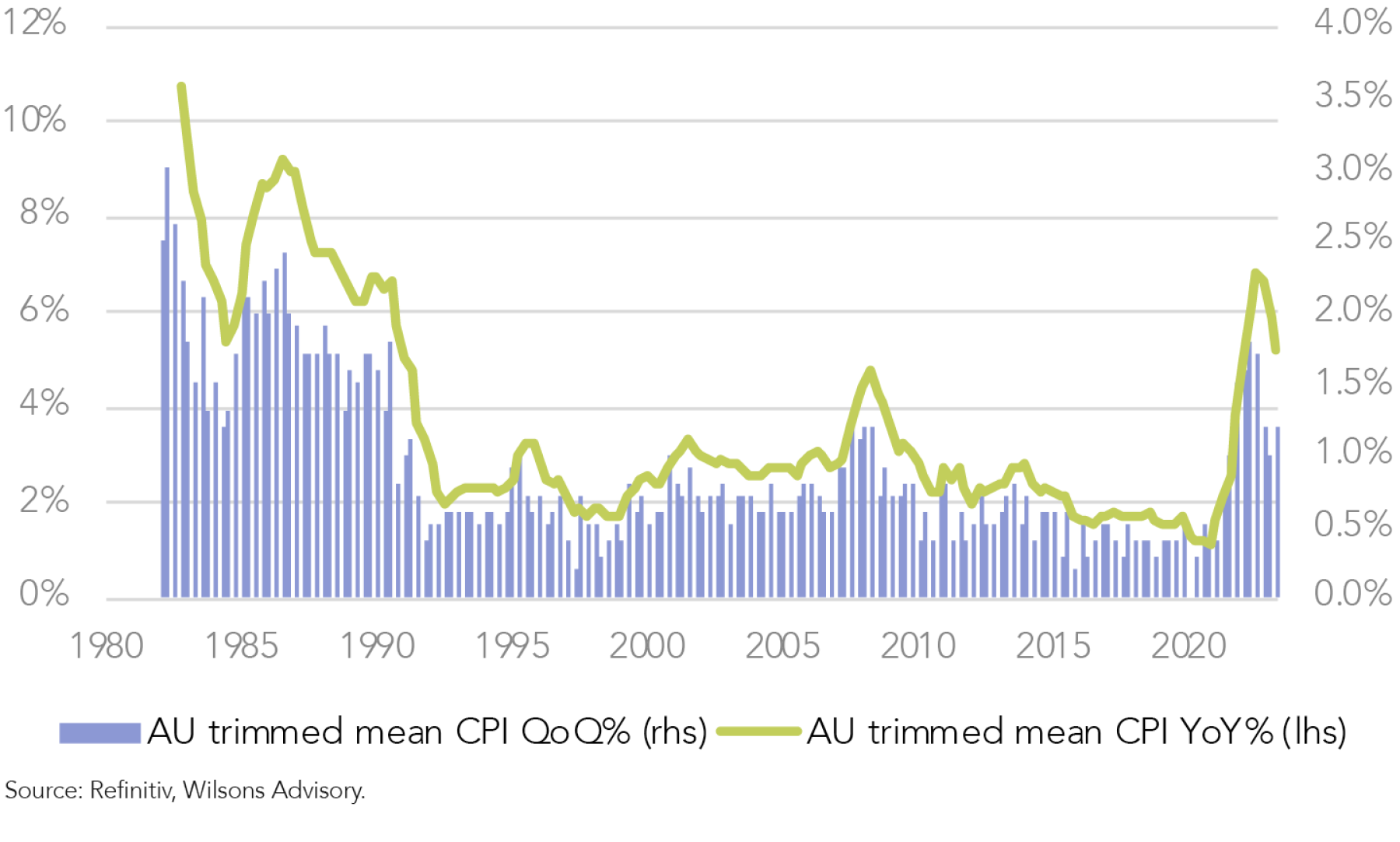

Figure 2: Underlying inflation is also easing in YoY terms, but slowly

Importantly, the quarterly and monthly consumer price index (CPI) trend shows a reacceleration in inflation momentum. So, while year-on-year (YoY) inflation trends are decelerating (albeit slowly), the quarter-on-quarter (QoQ) reacceleration reinforces the conclusion that inflationary pressures are not moderating as fast as the Reserve Bank of Australia (RBA) would like.

RBA governor Michele Bullock said last week that the RBA would not hesitate to raise the cash rate above 4.1% if there were a “material upward revision to the outlook for inflation”, reiterating the RBA’s “low tolerance” for a prolonged period of high inflation.

While there remains some ambiguity around the definition of a “material” upward revision to inflation, there is, in our view, enough to worry the RBA in this CPI report to prompt the RBA to hike rates on November 7.

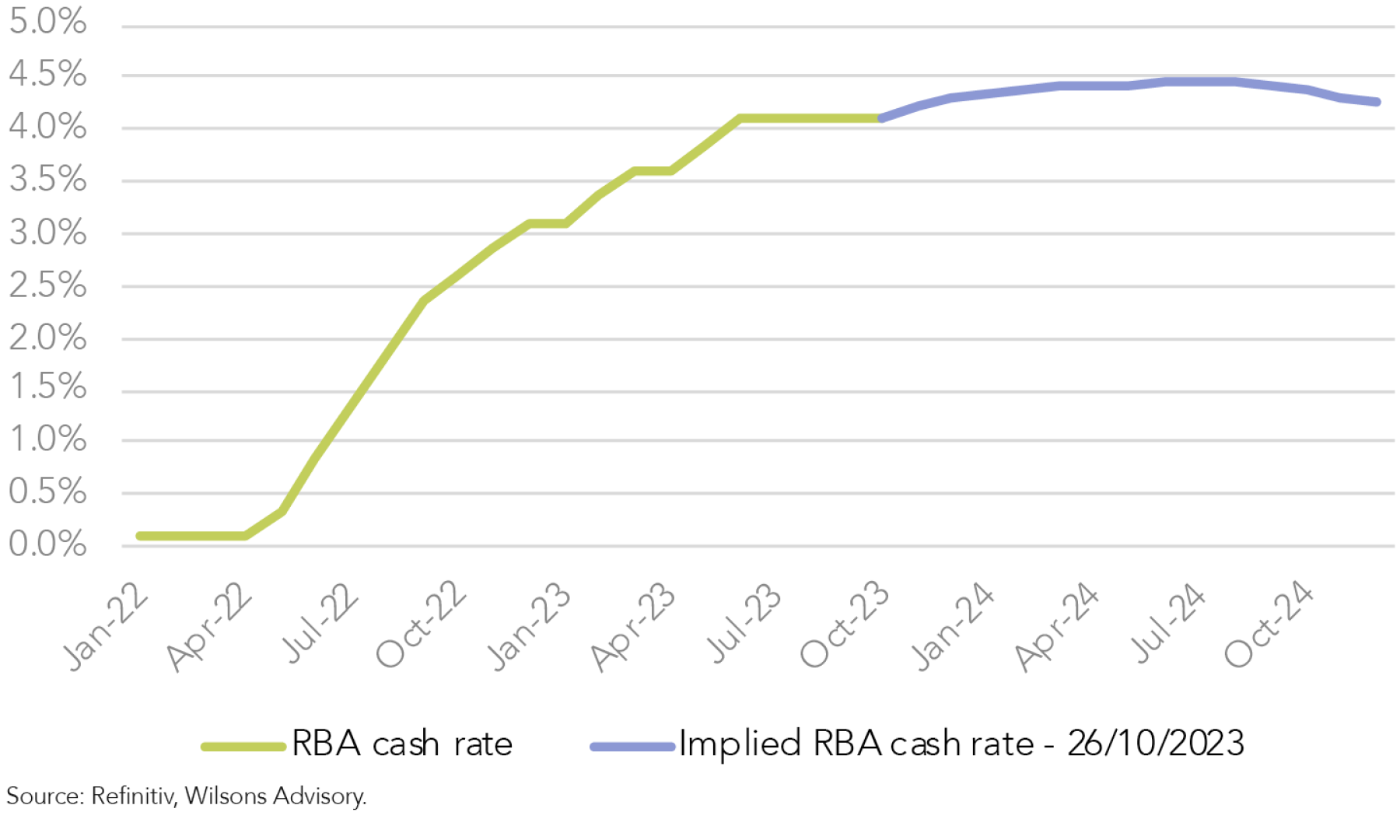

Market pricing has moved up to just over a 60% probability (as at 26 October) for a November hike. This compares to a 35% probability just before the CPI release. The cumulative probability moves to effectively 100% by December, although a November hike is more likely in our view.

We view the bar for a second, follow-up hike beyond November as relatively high (the market has a 40% probability of another hike in Q1 2024). The futures market is not expecting any policy easing for all of calendar year 2024 (see figure 9). With inflation proving stickier than expected, and the economy slowing quite gradually, this higher-for-longer domestic rate profile appears a reasonable expectation at this point.

September quarter inflation reaccelerates

Australia’s headline CPI for Q3-23 rose by 1.2% QoQ, which was marginally above consensus (1.1%). Importantly, this was also a sharp re-acceleration from the 0.8% pace in Q2-23.

The YoY rate of 5.4% was also marginally above consensus (5.3%), and also notably above the RBA's implied forecast of ~5.25% from their Aug-23 monetary policy statement.

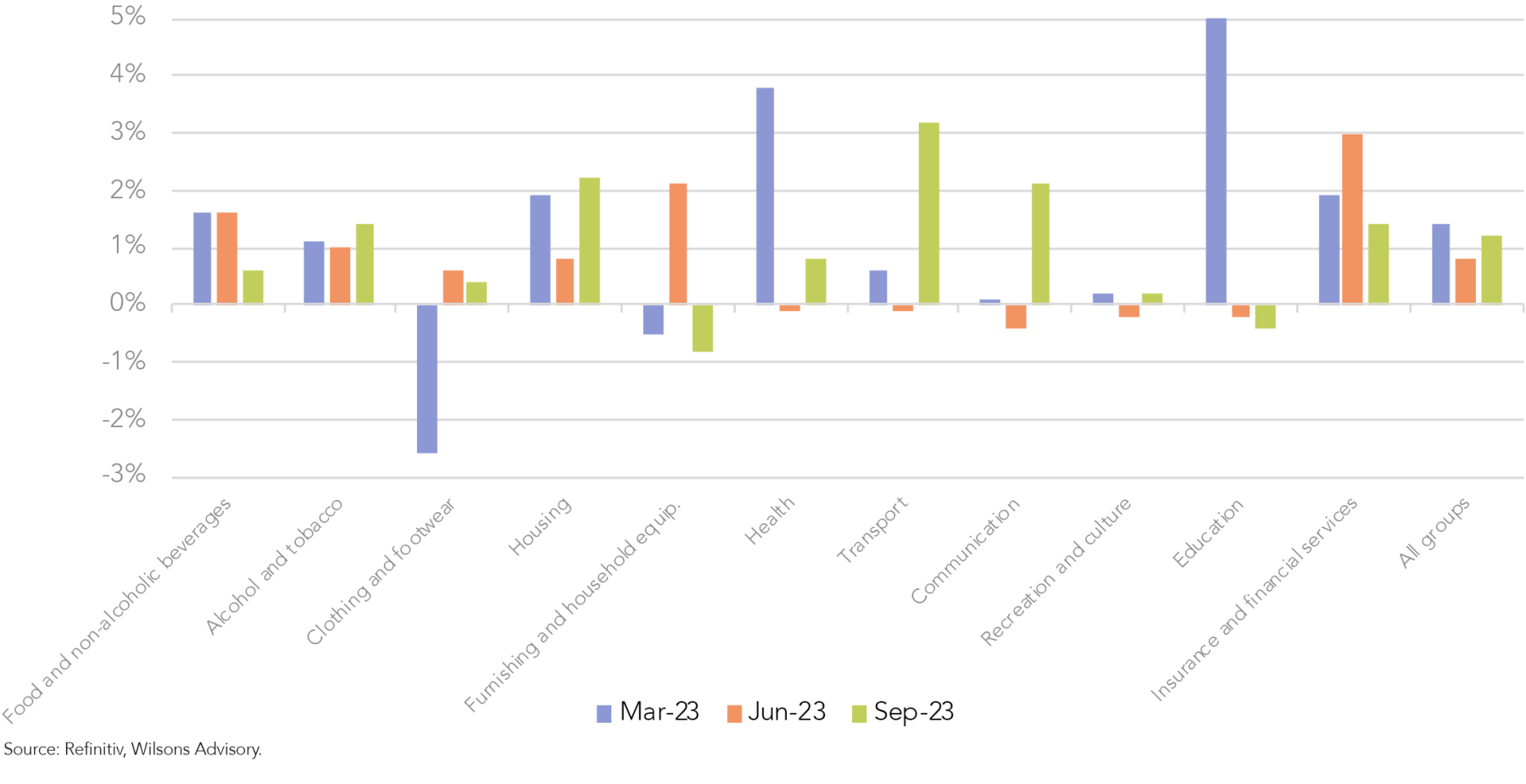

Figure 3: Most categories are still rising at well above 3% YoY

Figure 4: Quarterly trends were disappointing, led by a jump in transport (fuel) and housing

A key upward driver in the Q3 headline inflation rate was automotive fuel, which jumped by 7.2% QoQ. Looking ahead, automotive fuel prices in Q4-23 are tracking to be up by another ~4%.

On the positive side, Q3 inflation is well down from the December 2022 peak of 7.8% and down from 6.0% YoY in Q2-23 but the re-acceleration in quarterly momentum is worrying. This will concern the RBA enough to hike again next week, in our view.

Treasurer blames global forces but plenty of “domestic” inflation is evident

Importantly, even though fuel was a major driver of headline CPI, the RBA's preferred 'underlying' inflation measure, the Trimmed Mean CPI, still lifted by 1.2% QoQ in Q3, which was higher than the consensus estimate of 1.0%. At 5.2%, the YoY trimmed mean was above consensus (5.0%), and well above the RBA's implied forecast (using the Aug-23 statement on monetary policy) of 4.8% to 4.9%.

Less global disinflation evident while domestic inflation trends look sticky

Outside of petrol, there is some evidence of the moderation in global inflation flowing into Australia, such as easing goods prices. However, even goods prices are not decelerating as fast as the US, for example. At the same time, domestic inflation trends remain disconcertingly sticky.

Figure 5: Australian inflation is decelerating more slowing than some key global peers

Figure 6: Good price inflation is easing but more slowly than overseas, while service inflation is stubborn

Lagging the global downswing

Tradable CPI (mostly goods) moderated to 0.7% QoQ (after 1.1%), and the YoY eased further to 3.7% (after 4.4%). However, non-tradables (mostly services) remain stickier at 1.3% QoQ (after 0.8%), and 6.2% YoY (after 6.9%). Overall, goods inflation rose 1.2% QoQ (after 0.9%) and 4.9% YoY (after 5.8%). By way of contrast, core goods inflation in the US has dropped to zero in YoY terms.

Services having a slow slowdown

Australian services inflation stayed elevated at 1.0% QoQ (after 0.8%), and 5.8% YoY (after 6.3%). Elevated readings are evident for a range of services such as veterinary services, restaurant meals and hairdressers. Annual inflation continues to rise for some service categories including rents, dental services and insurance. While inflation for holiday travel fell QoQ, it is still up 6.8% YoY.

‘Material’ risk to RBA’s year-end CPI estimate for 2023

Given the weak AU$, combined with high oil prices and sticky services inflation, there would appear to be 'material' upside to the RBA’s forecast for Q4. For headline inflation, the RBA forecasts 4.1% YoY. For the trimmed mean, the current RBA forecast is only 3.9% YoY.

While inflation in Australia in YoY terms is continuing to moderate, it remains higher than expected. It is well above the RBA’s target band (2-3%), and remains well above the current rate in most other major economies.

Indeed, headline CPI in Australia has now been at or above the RBA's target band of 2%-3% YoY for 10 consecutive quarters. Q3 also indicates a breadth of underlying inflation pressure, with more than 70% of the basket still registering YoY inflation above 3% (see figure 3) (the top of the RBA’s target band). The comparable figure for the US is around 50%.

RBA likely has more to do

The good news is that Australian inflation has peaked and is trending lower. The bad news is that the easing in inflation pressure is happening more slowly than the RBA expected.

Figure 7: Strong population growth is supporting growth but adding to inflation pressures

Figure 8: Most notably through rent inflation

Figure 9: A 25-basis point hike is expected in the near term, with another partially priced

The RBA will remain concerned at the stickiness in a number of key CPI categories (particularly services) and by the slow progress back towards their CPI target band. As a result, a November hike appears likely.

The RBA will release its new inflation and economic growth forecasts in November, after the November rate meeting. September quarter wage growth data will also be released in November. This is unlikely to prompt a follow-on rate hike in December but it will be closely watched.

Overall, the Australian economy is experiencing a declining growth rate, buoyed by very high immigration rates, alongside easing but relatively sticky inflation with a still tight labour market. This suggests an extended period of “on-hold” rates beyond November. The economy will still likely avoid a recession in 2024 but the RBA’s projection of 1.75% real gross domestic product (GDP) growth for 2024 may prove optimistic, in our view.

The domestic equity market has stalled this year. Our view is that it can eke out some moderate gains over the coming year, based on supportive global inflation and interest rate trends, although the domestic earnings cycle is likely to continue to run into headwinds as the local economy slows.

Learn more

WILSONS think differently and delves deeper to uncover a broad range of interesting investment opportunities for their clients. To read more of our latest research, visit our Research and Insights.