Australian bank shares are booming: How far can the rally go?

“How Much Longer Can This Australian Bank Rally Continue?” This is both the title of a UBS research report released today as well as the big question facing all Aussie investors.

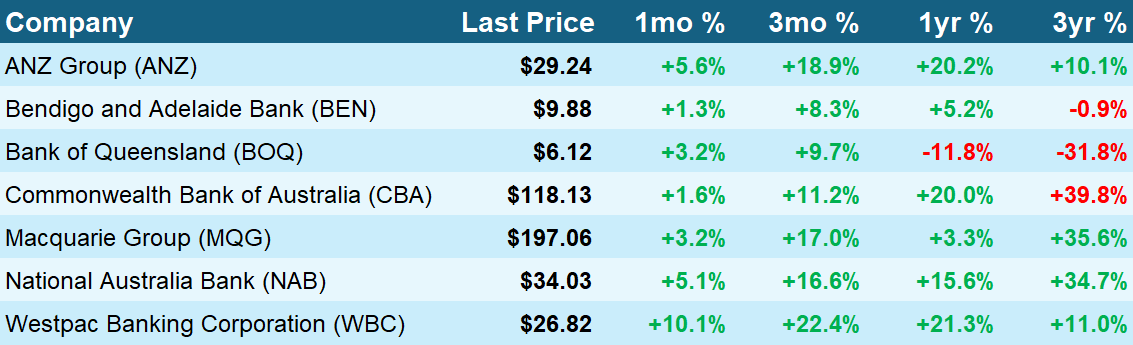

Aussie banks have been on fire lately. They’re up an average of 15% in the last three months, even after yesterday’s sharp pullback. This is more than double the S&P/ASX 200’s performance over the same period, but that’s an unfair comparison given much of the benchmark index’s performance comes from the banks anyway.

This is great news for faithful investors in Aussie banking stocks – and there are many. After all, Aussie banks have a long track record of delivering reliable dividends, and with yields generally better than the interest the very same banks offer their customers.

The recent run in Aussie banking stocks is likely making many veteran banking investors nervous, though. This is because they know Aussie banks have a long history of delivering short periods of very good performance followed by months, and sometimes years of mediocre performance.

The table above shows the performance of Australian banks over various lookback periods within the last 3-years. We can see their stellar performance over the last 3-months accounts for much of their performance over one- and three-year periods. Granted, this data doesn’t include dividends, but in some cases, recent performance is more than investors have received for a long time.

To get a better idea of how Aussie banks have performed over the longer term, let’s consider the chart of the S&P/ASX 200 Banks Industry Group Total Return Index. “Total Return” means we’re now adding back in dividends to get a true picture of the performance of Aussie banks over the last 15 years.

Note there are several long periods, often measured in years, where banks have pretty much done nothing. Remember – this is on a total return basis – so for years in many cases, investors in Aussie banking stocks have received little or even negative returns. Often, these periods of choppy underperformance have come after a short but massive spurt of positive returns.

Market Expectations Are Too Optimistic

UBS believes Aussie banks may be closing on levels where they could be considered priced for perfection. Their view is that current market pricing suggests investors have become “very optimistic” about the prospects for local banking stocks, and as a result, the broker recommends clients take an “underweight” position in the sector.

UBS believes there are three major reasons the local banking sector has done so well recently:

- Markets are increasingly pricing in a “soft-landing scenario”, where the Australian economy muddle through the post-pandemic environment without a recession, and where consumers continue to spend and borrow;

- As a result of the first scenario, expected credit loss (ECL) is likely to be lower than initially expected during the pandemic; and

- There are “signs of lessening competitive pressures (deposits and lending)”

Despite the above, consensus estimates still see Aussie bank earnings dipping 8% in FY24 and 3% in FY25. According to UBS, this means PE multiples among the banks have grown from 13.2 times earnings to 16.1 times earnings on a two year forward basis. UBS questions the relative return outlook of Aussie banks at these elevated multiples, noting “subsequent returns at these PE multiples have proven to be below market (longer term)”

Marking to market updated assumptions

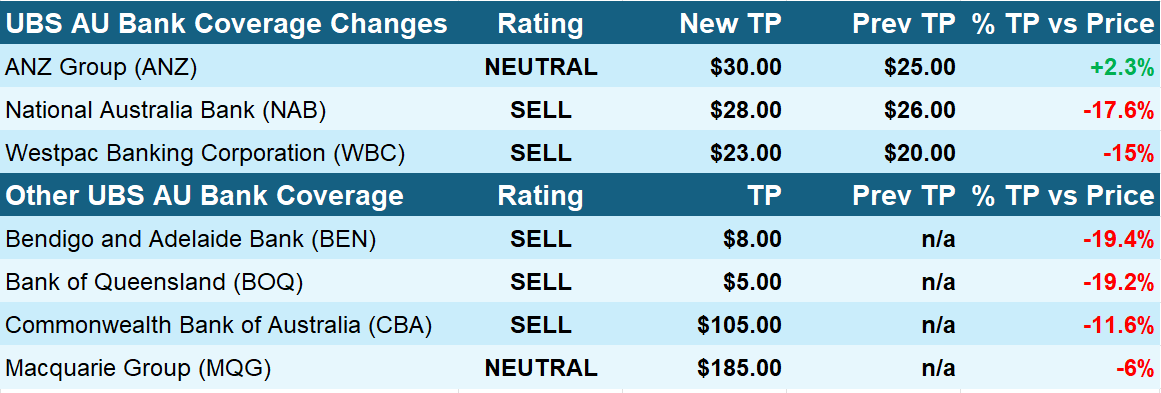

UBS has considered data from their recent UBS Mortgage Day, client and bank management meetings, as well as recent first half and quarterly trading updates, to tweak their 12-month price targets for three of the Big 4 Aussie banks.

They note adjustments to their ECL assumptions (lower), and “revenue trends” which have been “boosted by stronger-than-expected non-NII” performances. NII stands for net interest income, and it’s the interest differential banks earn on loans compared to what they pay on deposits.

UBS’s order of preference among Aussie banks is: ANZ and MQG, which they rate as “Neutral”, then the rest, which they rate as “Sell”. The ratings suggest the broker sees little value in the sector, but in what is potentially a chilling warning for Aussie banking stock investors, UBS goes one step further and quantifies their expected downside at around 14%.

This article first appeared on Market Index on Tuesday 12 February 2024.

5 topics

6 stocks mentioned