Australian inflation surprises on the downside - but the RBA’s conundrum isn’t solved

The good news is that inflation is trending down on a monthly basis. The bad news is that some of the factors that are affecting the way inflation may trend in the future remain entrenched. For the Reserve Bank, it may be a sign that the effect of interest rate rises are starting to finally show up in the data. But with the market (and the economics consensus) pricing in a cash rate of 4% or more, the biggest question of all remains unanswered:

Has the Reserve Bank done enough to save us from a recession?

In this wire, we’ll break down the two major data prints and how markets have reacted.

Down, down, inflation is down

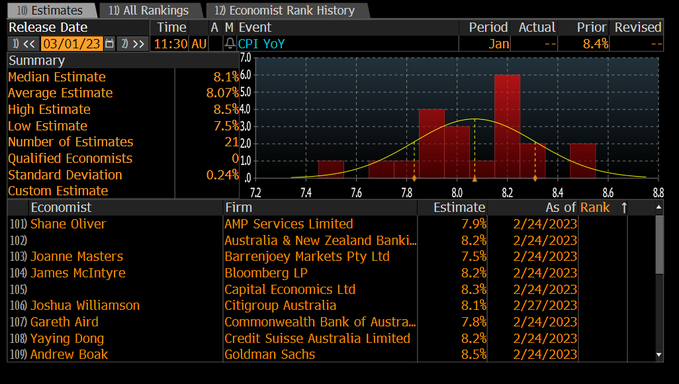

The ABS’ monthly inflation indicator fell to 7.4% over the year to January. That is way down from last month’s print of 8.4% and a long way from economist expectations of 8.1%. In fact, the Bloomberg estimate found that only one economist came close to the actual figure (Jo Masters at Barrenjoey).

The market reaction has been resounding to say the least. The ASX 200 rallied from session lows of -0.45% to around breakeven shortly after the inflation print, while the Australian 3-year yield fell eight basis points to 3.55%.

Australia 3-year Treasury bond yield and ASX 200 intraday (Source: TradingView)

But a closer look reveals that it’s not all chips and gravy. Here’s why:

- Housing, the biggest single contributor to the survey, did decline but not by much.

- Residential prices are still up 9.8% year-on-year, with rental prices up 0.7% month-on-month.

- Rents are accelerating, and given the time lag for rents to show up in inflation, we can expect this to last some time.

- Accommodation and holiday price rises fell in January but these figures are highly variable, and are often reliant on published airline ticket prices. Case in point: January saw a fall of 7.2% but December saw a 29.3% rise.

- Food prices are still up 8.2% year-on-year, only fruit and vegetable prices fell month-on-month. (i.e. Every other sub-sector rose)

In short, it’s great news but don’t get too excited.

Economic activity is up (and for now, still above zero)

In contrast, Q4 GDP missed expectations. The consensus expected a 0.6% rise quarter-on-quarter, but the ABS read came in at 0.5%. But the number that counts is the year-on-year figure. With the economy humming at 2.7%, we’re right in the sweet spot for economists and the government.

What recession!

The one thing worth noting is that this read marks the second straight quarter of decelerating growth at the headline level. That is, there is still growth but there’s less of it.

As has become the story over the pandemic, household resilience and our commodity exports were the two main factors in getting the economy over the line. Or in simpler terms:

- Prices are up but so are our terms of trade. Our export-to-import ratio is up 7% through to the end of 2022, driving the proverbial national bank balance higher.

- Exports rose for the third straight quarter while a decline in good imports (that is, importing tangible products) led falls in that part of the survey.

- Household spending grew (again) but it softened last quarter to 0.3%.

- But… the household savings ratio has declined for a fifth straight quarter. It’s now just 4.5%, proving the RBA’s rate hikes are crimping Aussie wallets as people are able to save less of their existing income.

- Employee compensation grew 2.1%, a slowdown from the 3.2% we saw last quarter. That’s a big relief for the Reserve Bank, which couldn’t afford a wage-price spiral and an inflation fight on its hands.

What does this mean for the RBA and my money?

In the immediate aftermath, celebrate! In the long run, some very important questions remain unanswered.

- At 7.4%, inflation is still way too hot. But a decline this large may also be a relief for Governor Lowe.

- The major economic houses now have a terminal cash rate of 4.1%. The RBA’s current cash rate target is 3.35%. This implies there are three more rate hikes in the pipeline, and possibly four.

- Wages are going up at just a quarter of the rate of inflation. With the household savings ratio declining, can consumers really afford three more rate hikes before it all goes to crumbs?

And most importantly, even if exports continue to remain strong and unemployment is below 5%, you can still have a recession at the street level. The question now is whether the RBA will stop in time to avoid an Australian recession. Remember, the Federal Reserve’s hiking path is its own and the Australian economy is absolutely distinct from that of the US.

With assistance from Kerry Sun.

1 topic

1 contributor mentioned