Australian NAB business confidence static at 1, UK GDP m/m grew 0.2% in August

1. Australian NAB business confidence static at 1

Business conditions in Australia remained upbeat for September despite historically high-interest rates. Sentiment surveys came strong at 1, a repeat of the August figure. This was a strong indicator of resilience and showed the Australian economy is absorbing the RBA’s aggressive tightening policy.

2. US core PPI m/m rose 0.3% in September

Inflation markers in the US rose faster than expected with PPI data reported at 0. 3% for the month of September. This was above the 0.2% priced in by markets and ahead of the previous figure of 0.2%. The inference is that soaring energy and petroleum prices are factoring into the cost of production and consumer prices by extension.

3. UK GDP m/m grew 0.2% in August

Growth in the UK economy rallied by a rip roaring 0.6% in August, rebounding off the meagre downward revised figure of – 0.6% reported in July. The figure was well in line with market expectations and was underpinned by a massive expansion in the service sector.

4. US CPI y/y held steady at 3.7%

Inflation in the US is proving much more stubborn than previously thought. Annual inflation remained at 3.7% in the year to September, maintaining the previous uptick figure of August and above the market consensus of 3.6%. While rising energy and petroleum prices are a notable contributor, signs are that the US Federal Reserve could be facing a higher-for-longer scenario with current monetary policy.

5. US unemployment claims unchanged at 209K

The US labor market held strongly in light of strikes and labour actions across the country. Last week’s unemployment claims remained unchanged at 209k, better than the 211K rise priced in by market participants. The inference is that the impact of macro-level headwinds has yet to have notable effects on micro-level employment dynamics.

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Seasonality-induced demand, as well as geopolitical uncertainty in the Middle East, have elevated petroleum prices this week. Better than-expected US employment data from last week further reinforced market confidence as the holiday bonanza draws near. Consequently, the VIX fell significantly as investors returned to the table, causing a rally in global indices while risk currencies sold off broadly, on a rebounding US dollar. US treasuries rose as data released from the US was mediocre.

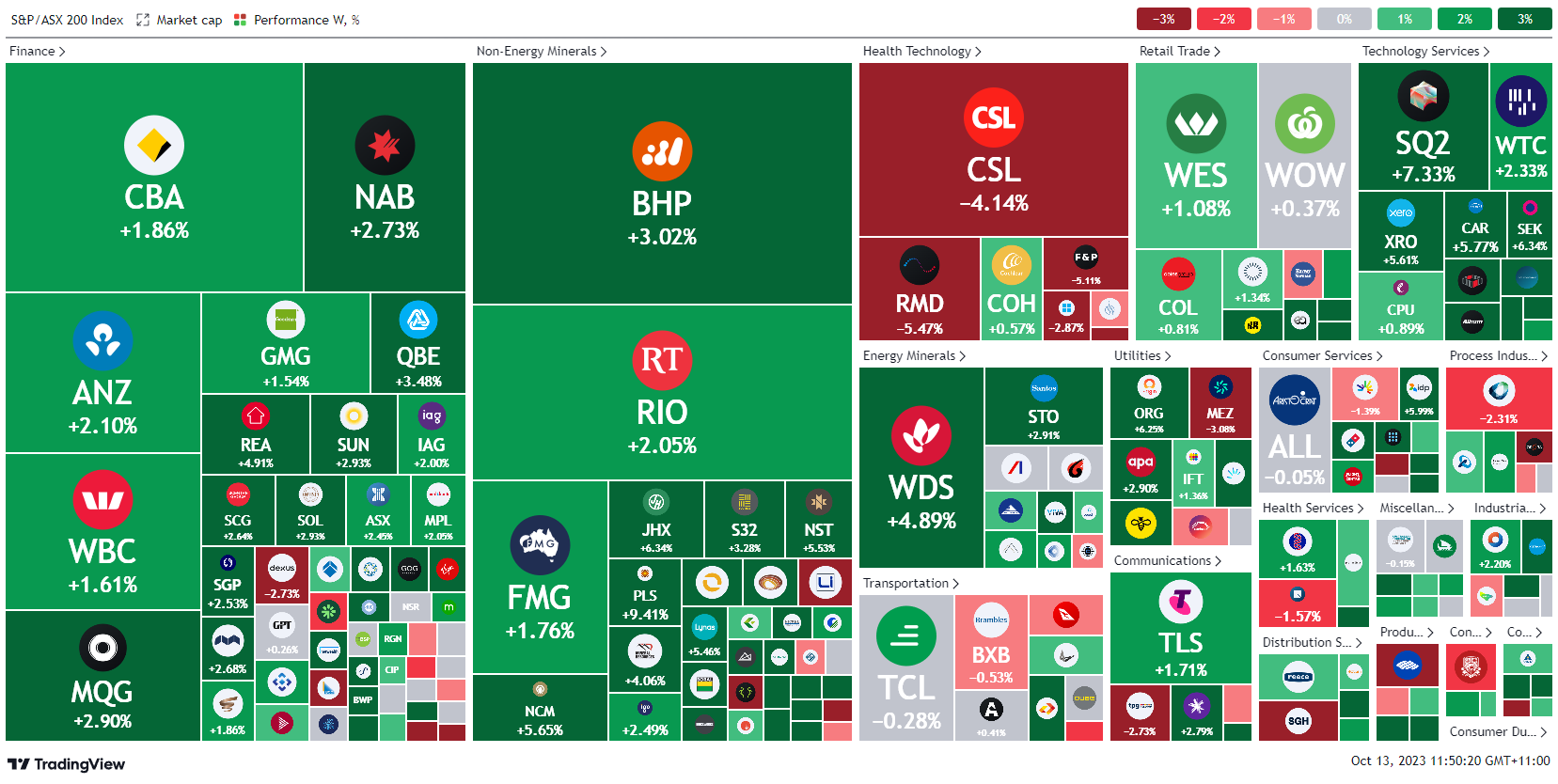

Here is the week's heatmap for the largest companies in the ASX.

The ASX rebounded well this week. After two weeks of heavy selling, the ASX rebounded majorly across most sectors to generate solid performance for the week. Financials led the rally as cash returned on favourable and improving market conditions reported by the RBA. Most stocks were lifted higher, with the big banks, big miners, and energy stocks all leading the way. Retailers, technology, energy miners, transportation, and utilities were all green. Healthcare tech stocks were the only disappointment for the week with all major stocks in the red. We can see money flowing directly into tech with XRO, CAR, SEK, and SQ2 all up over 5%.

Below shows our proprietary trend following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics

4 stocks mentioned