Australian nickel – 60 years old and the funeral arrangements are being considered

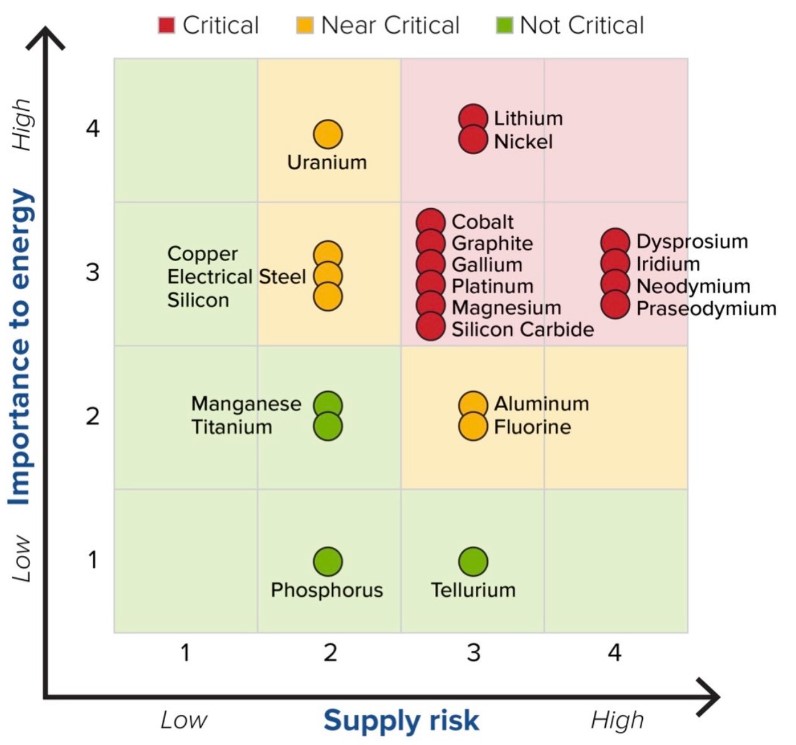

In mid-2023, the U.S. Department of Energy released its Critical Minerals Assessment, and lithium, nickel and a handful of specific rare earths were highlighted as commodities most critical to the energy transition, and with the highest supply risk.

.jpg)

Source: Montgomery Investment Management

Despite the optimistic medium-term forecasts from the rise of electrification, the nickel price has come back from well over U.S.$30,000 per tonne in early 2022 to U.S.$16,600 per tonne today. The world’s largest nickel producer, Indonesia, with the support of Chinese capital, has ramped up its production, and this is causing enormous pain for the West Australian nickel and related industries.

In recent months, we have seen both the IGO Limited’s (ASX: IGO) Cosmos development project and the nickel operations of Mincor Resources (ASX: MCR) owned by Twiggy Forrest’s Wyloo Metals suspended, whilst First Quantum Minerals (TSE: FM) has put its Ravensthorpe nickel operation on care and maintenance.

After investing $4.4 billion in the nickel business since 2020, BHP (ASX: BHP) has similarly announced an about-face. After realising an average U.S.$18,600/tonne and reporting an earnings before interest, taxes, depreciation and amortisation (EBITDA) loss of U.S.$200 million in the December 2023 half-year, BHP wrote down the value of its nickel operations by U.S.$3.5 billion, whereby “the post-impairment carrying value of Western Australian Nickel property, plant and equipment is not material”. BHP will suspend operations until at least February 2027.

This write-down will affect more than 2,000 staff and includes the mines at the Mt Keith and Leinster, as well as the development of the West Musgrave project, the smelter at Kalgoorlie, and the refinery at Kwinana.

These suspensions/closures illustrate the trials and tribulations of the mining and related industries, as highlighted from BHP’s acquisition of Western Mining Corporation in 2006 for $7.3 billion. The run-up in the nickel price in 2007 to over U.S.$50,000 tonne ensured enormous short-term cash flow, however, the Global Financial Crisis (GFC) soon followed, and by December 2008, the nickel price had declined by more than 80 per cent to under U.S.$10,000 tonne. By 2014, BHP deemed the nickel business to be non-core and tried to sell it. With closure liabilities and large capital expenditures upgrades required, the buyers went to ground.

BHP’s nickel suspension will leave Australia’s industry hanging by a thread, less than 60 years from when Western Mining Corporation first discovered nickel in the Western Australian Goldfields in 1966. Unfortunately, it now looks like the funeral arrangements for another Australian industry are being considered.

3 topics

3 stocks mentioned