Back in the high life again

Higher real rates and higher valuations can coexist, even for extended periods. Historically, that is relatively common.(1) With the market largely pricing in a Federal Reserve pause, lower rates don’t seem to be a potential catalyst to higher valuations.(2) And that is just fine. Multiples trend higher over time as companies become more efficient—and there is no denying that companies are efficient today, increasingly so.(3)

Concern over valuation levels remains palpable, nonetheless. Just two years ago, equity valuations were back of mind while growth fears gripped the market. Demand for risk and growth assets at almost any price was scant. Since then, conditions have flipped, with sanguine views on growth and headaches from high-altitude multiples.

For the past two years, we have argued that an inflection point was coming that could move the range on equity valuations likely rerating them higher based on improved efficiency from innovation and technological adoption.(4) Rather than focus on catalysts that could push valuations higher, this piece addresses some commonly mentioned risks that could lead to contraction. The risks to sustained equity multiples fall into three broad categories: economic, fundamental, and exogenous. A historical analysis of the first two risks suggests that valuations may prove reasonably robust.

As for the third, there is no shortage of exogenous risks. This week started with a focus on fresh tariffs targeting Canada, Mexico, and China. Just last week, fears of a low-cost, super-efficient AI system put all the billions of AI capex spend into question and sent the market reeling.(5) Two weeks before, equities and bonds sold off on fears of higher tariffs and ballooning debt from further tax cuts. Exogenous risks always wax and wane—some of them might actually become positive catalysts in the coming months. While we watch these risks closely and try to separate the signal from the noise, remember that economic conditions and corporate fundamentals tend to win out over time. In that sense, this piece could also have been titled “Don’t Worry Be Happy”.

Key Takeaways

- Valuations can remain high despite higher real interest rates, provided nominal GDP growth remains strong, and companies remain profitable despite higher borrowing costs.

- Risks to valuations such as irrational exuberance, margin contraction, earnings revisions, and market broadening may prove overhyped.

- Investors may be able to find opportunities in themes selling at valuations below the S&P 500 with improving fundamentals, valuations at S&P 500 levels with better fundamentals, and valuations at a slight premium with superior fundamentals.

Up where real rates belong

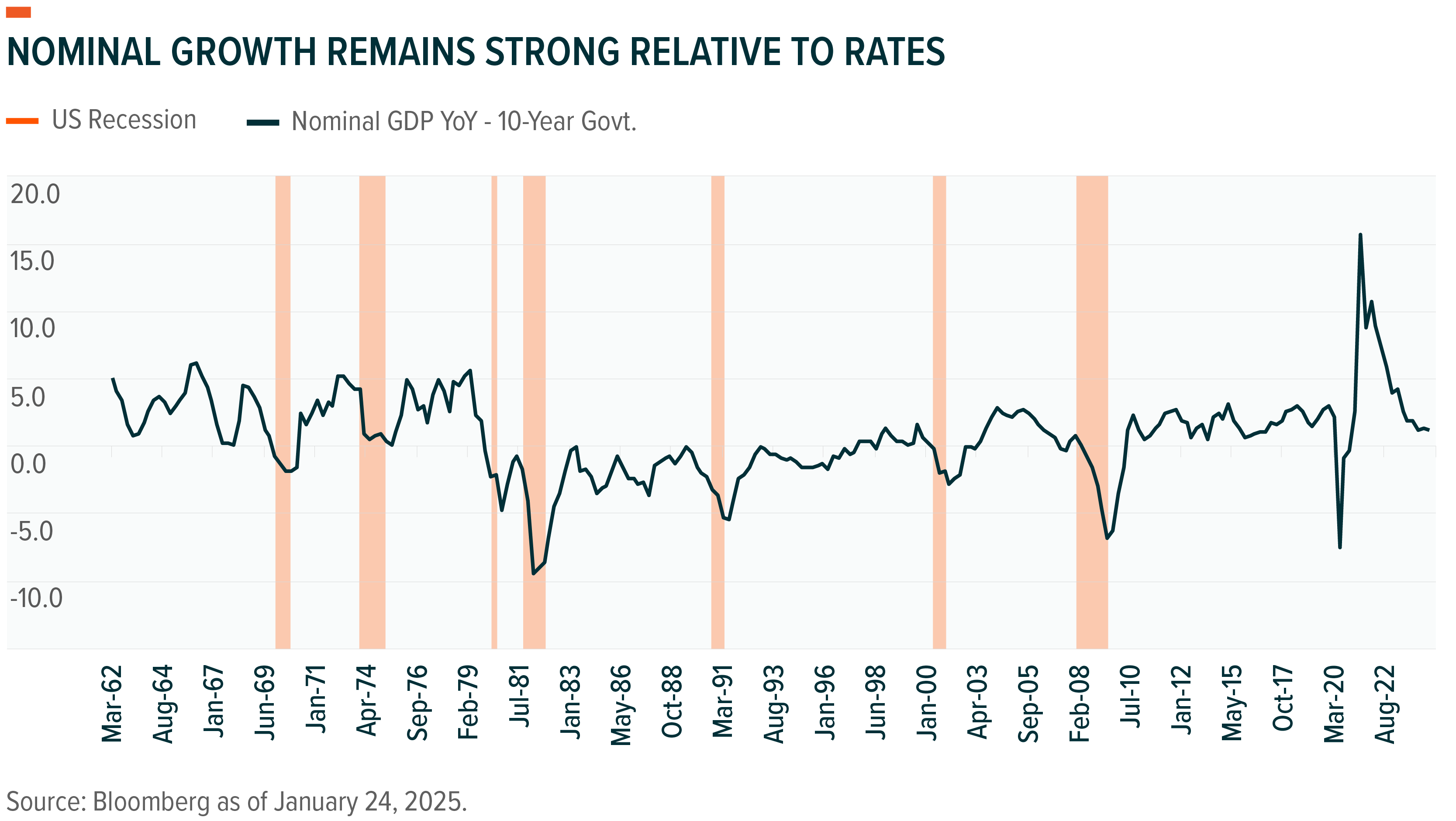

By most metrics, the economy is healthy, and there is little sign of recession despite the backup in rates. The resilient labour market continues to support consumer sentiment and spending, household leverage is still relatively contained, and financial conditions back to October 2021 levels are loose.(6) The service industry continues to expand while also diversifying away from the consumer, with business services accounting for a larger contribution. Manufacturing, the slumping part of the economy, shows signs of recovery according to recent surveys and employment data.(7) Interest rates across the middle and long end of the yield curve have repriced higher since fall 2024, but nominal growth seems strong enough to offset that move. While fourth quarter growth slowed slightly, nominal GDP grew 5.3% in 2024 and above the 4.5% 10-year bond.(8)

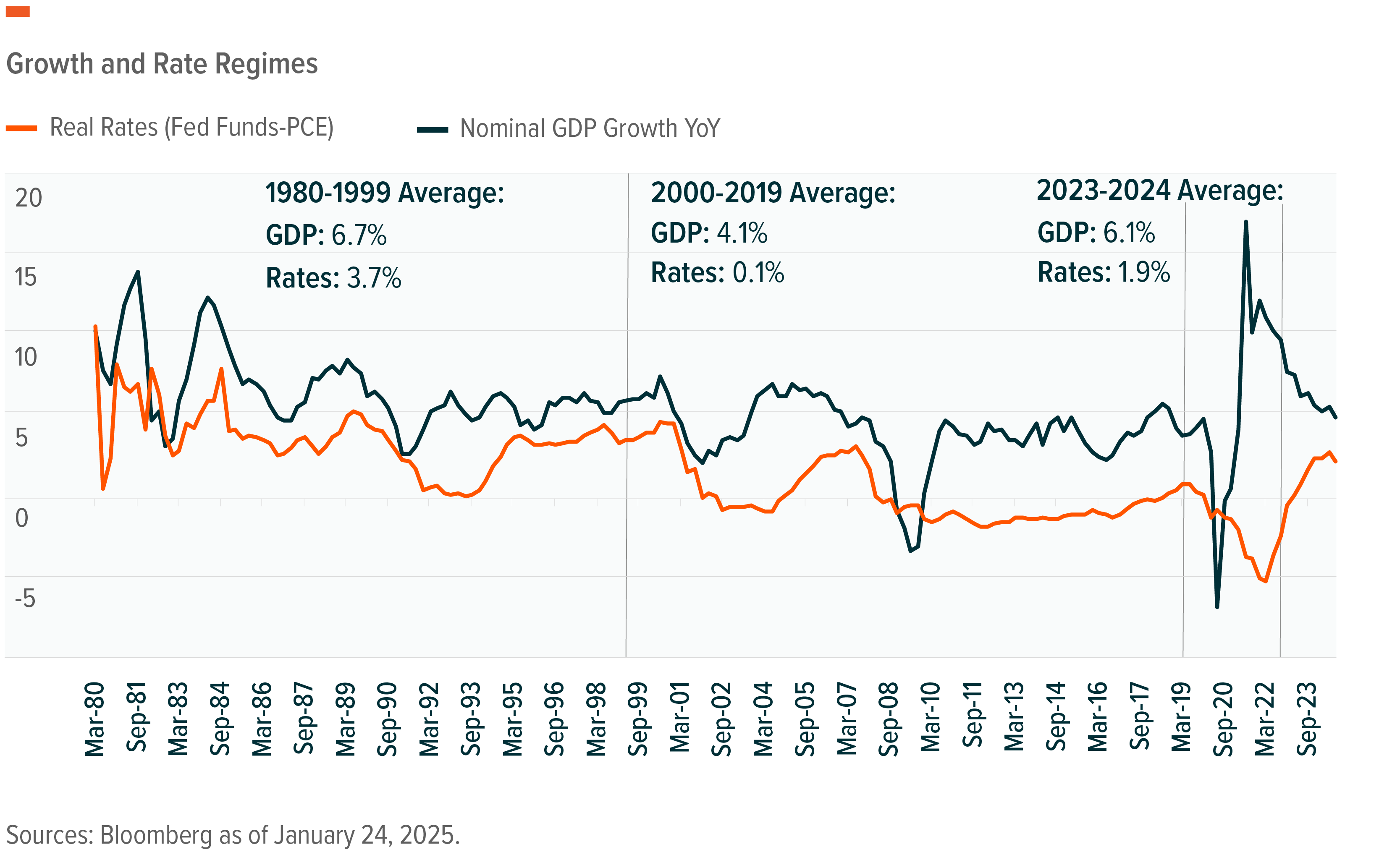

Higher real rates are not necessarily bad for the economy, provided nominal growth is high enough, And the post-pandemic economy has been a welcome surprise. Rather than growth declining to recession levels as forecasted back in late 2022, the US economy has grown faster than expected every quarter since.(9) Nominal GDP growth has averaged 6.1%, well above pre-pandemic levels and closing in on the 1980s and 1990s expansion at 6.7%.(10) Real rates have averaged 1.9% over that time, below the 1980–1999 average of 3.7% but meaningfully higher than the 0.1% of the two decades before Covid.

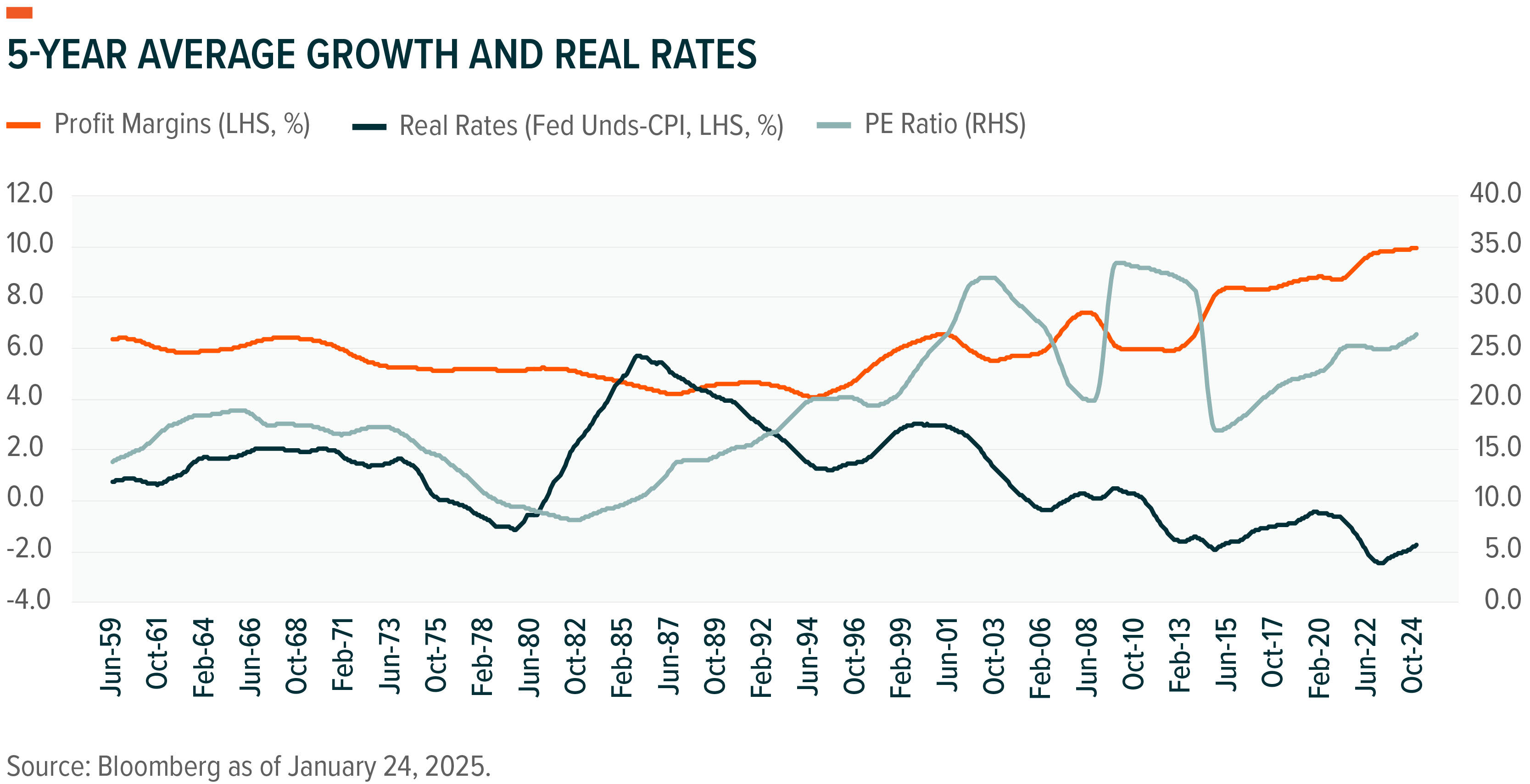

Higher real rates can stifle corporate activity, but that risk has not materialised thus far. Despite interest rates above 5% for more than a year, companies have never been more profitable.(11) Quarterly profit margins have been above 12% since Q2 2021, and above the 10% average in the 2010s. Powerful forces are driving greater efficiency among large cap companies, and this efficiency is carrying over into valuations. Multiples are negatively correlated with interest rates and typically expand as rates go down, but positively correlated profit margins are twice as important in driving multiples higher over the long run.(12) The notion that multiples are range bound, and therefore inevitably contract after hitting an upper bound, is misguided. Historically, multiples trend higher over time, following margins.

Bring me a higher valuation

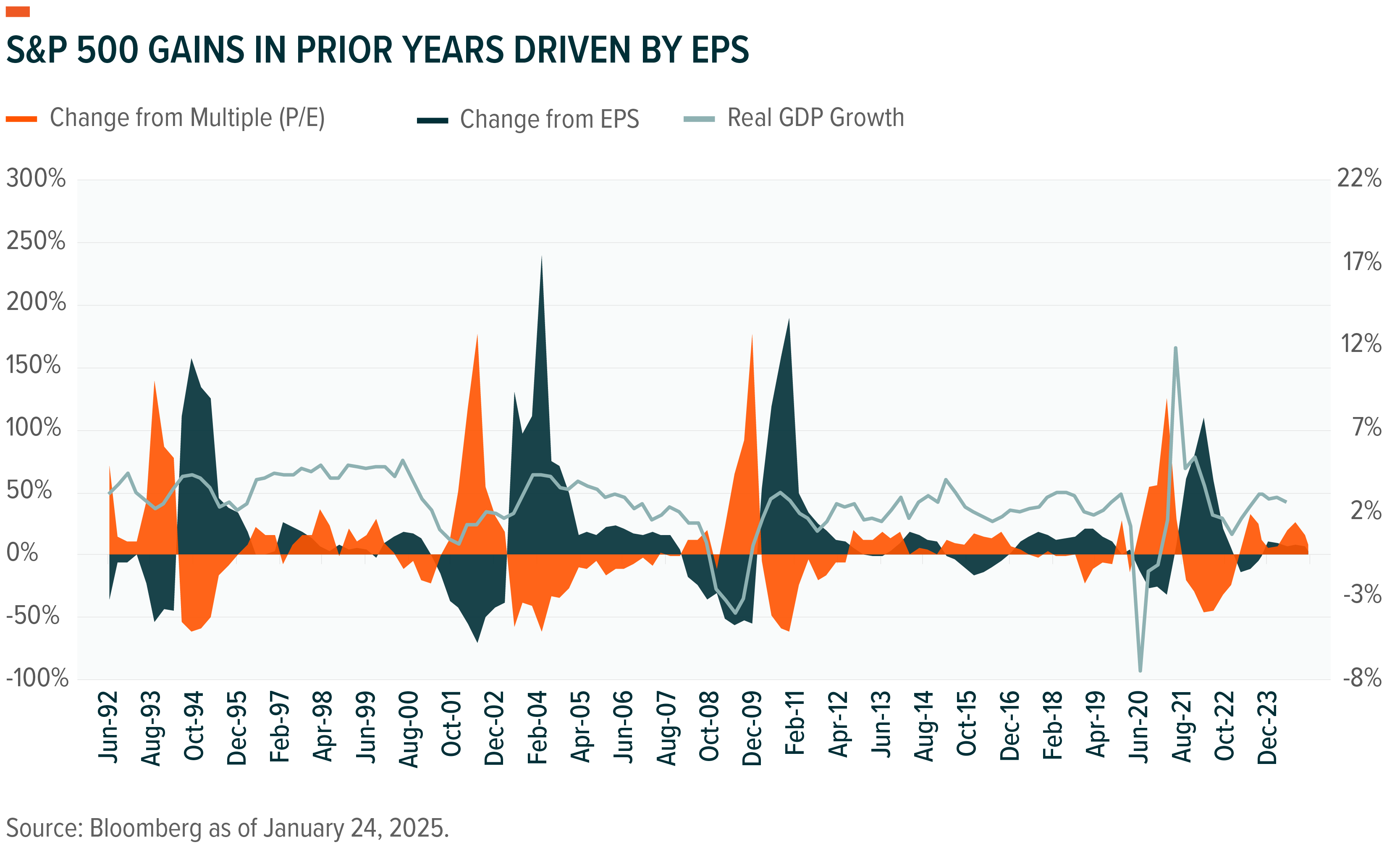

With seemingly modest risks to valuations from economic growth, higher real rates, and range-bound fallacy, what about fundamentals? Multiple expansion typically sustains returns as earnings contract during times of economic stress. During the recovery, fundamentals improve, driving much of the market gains while multiples come down. Markets usually outperform in periods characterised by both modest multiple expansion and earnings growth.(13)

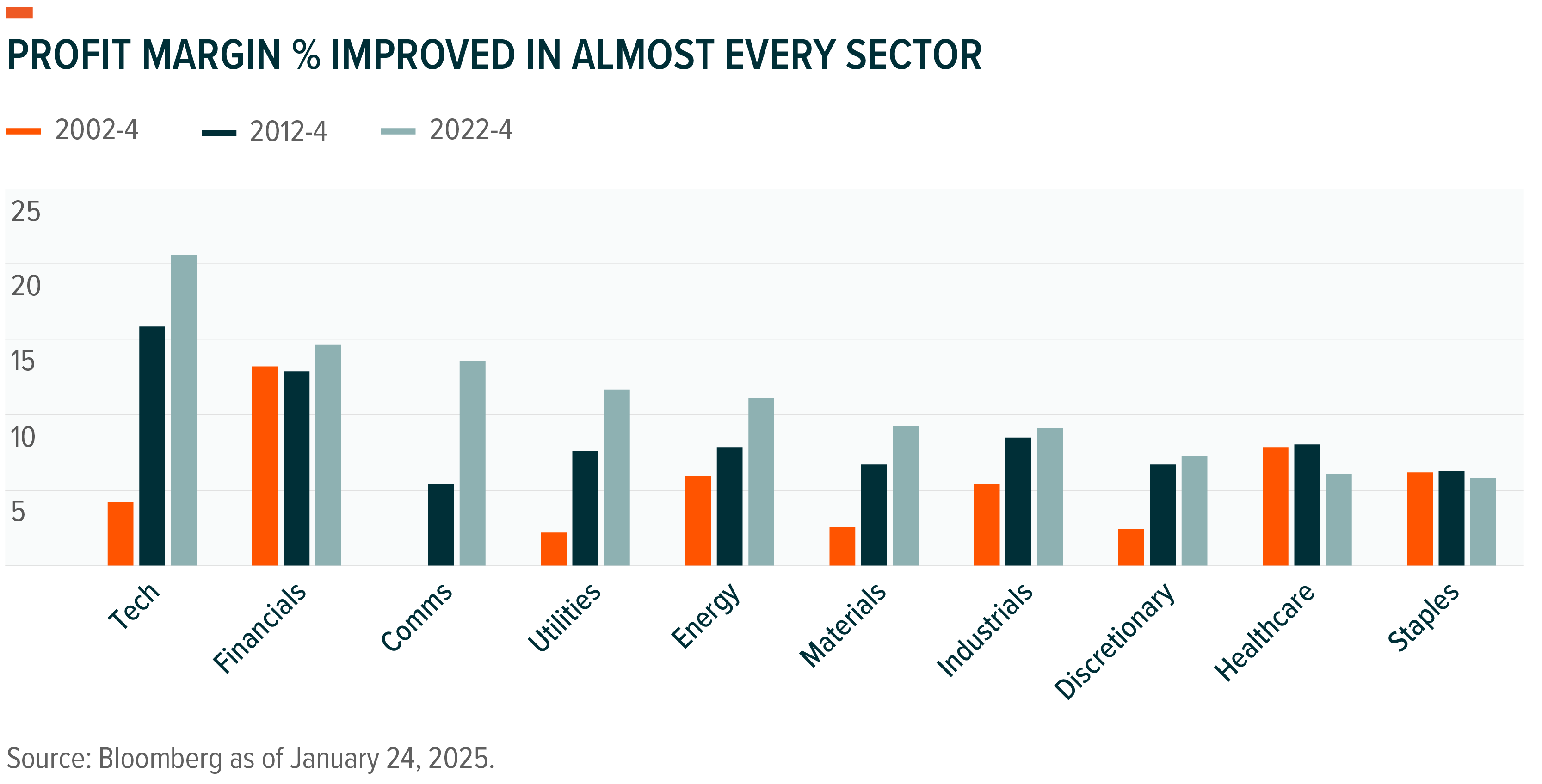

There is a risk that fundamentals soften and profit margins do not hold at these levels. Profit margins have expanded rapidly since the start of the 2020s, running above the historical average since 1990.(14) Margins can and do contract, but they typically move higher over time, meaning there is little reason to assume mean reversion. Profits margins for almost every sector have improved over the past 20 years, boosted by corporate innovation and technology driving change through the economy.(15) Technology and Communications Services are the standouts, but most sectors boast meaningful margin expansion over that span, except Consumer Staples and Healthcare. Improved profitability is not simply a post-pandemic phenomenon, but a long-term trend impacting almost every part of the economy.

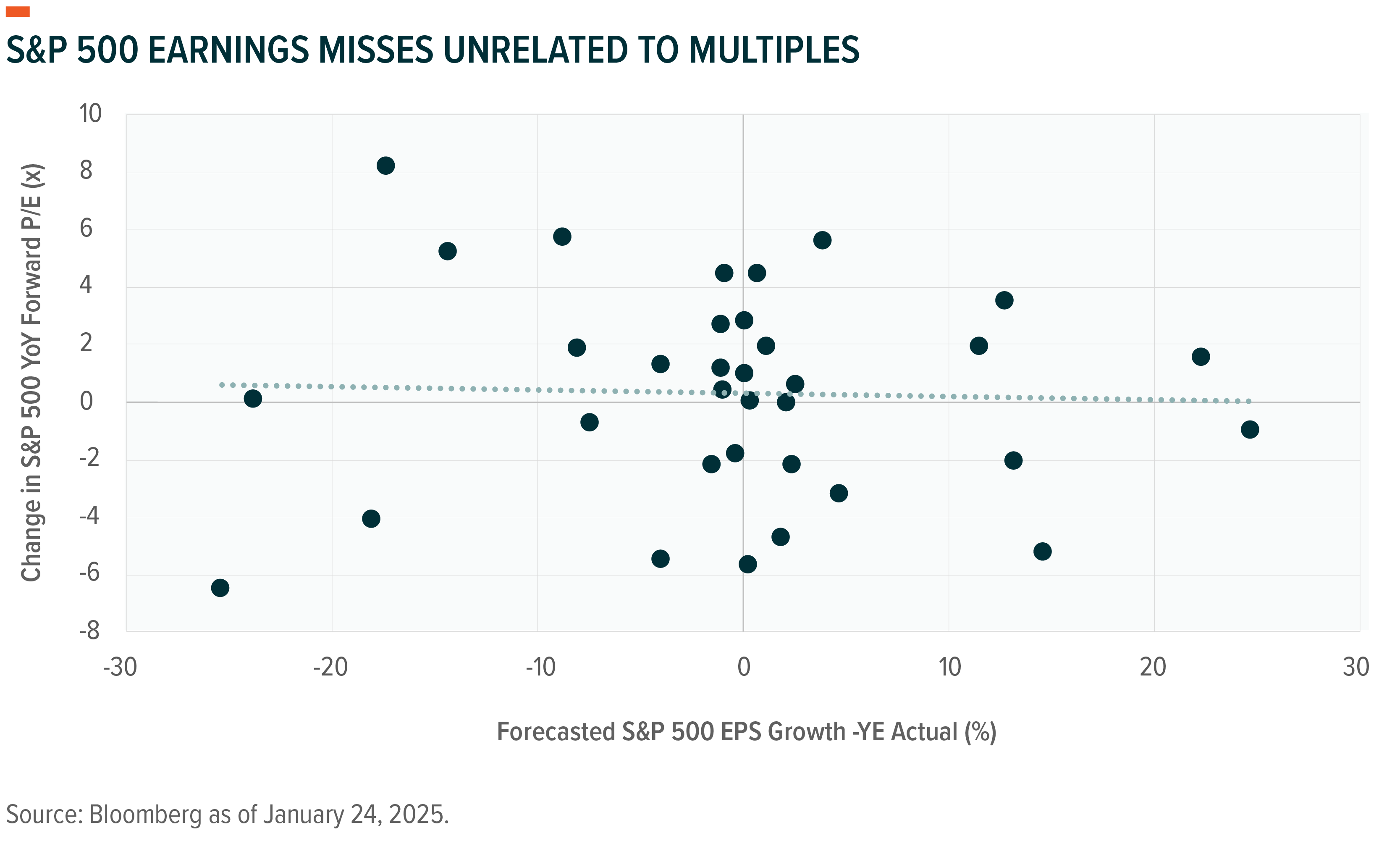

Alongside near-record profit margins, S&P 500 companies forecast 14% earnings growth in 2025, raising concerns that valuations are vulnerable if reported results fall short of targets.(16) Typically, earnings expectations are revised down by a modest 1% over the course of year. The largest sources of revisions are major unexpected events, like the Global Financial Crisis and Covid. Perhaps more importantly, multiples are not particularly sensitive to earnings misses and beats.(17) Total performance may suffer if a plurality of companies fail to meet expectations, but there is no clear relationship between overly lofty earnings forecast and valuation expansion or contraction.

Another potential risk is market concentration and the relative importance of mega-cap tech. These companies exert major influence on markets, making them vulnerable to disappointing results and negative shifts in sentiment. This dynamic was on full display when chipmaker Nvidia led the market lower following the release of China-based large language model DeepSeek.(18)

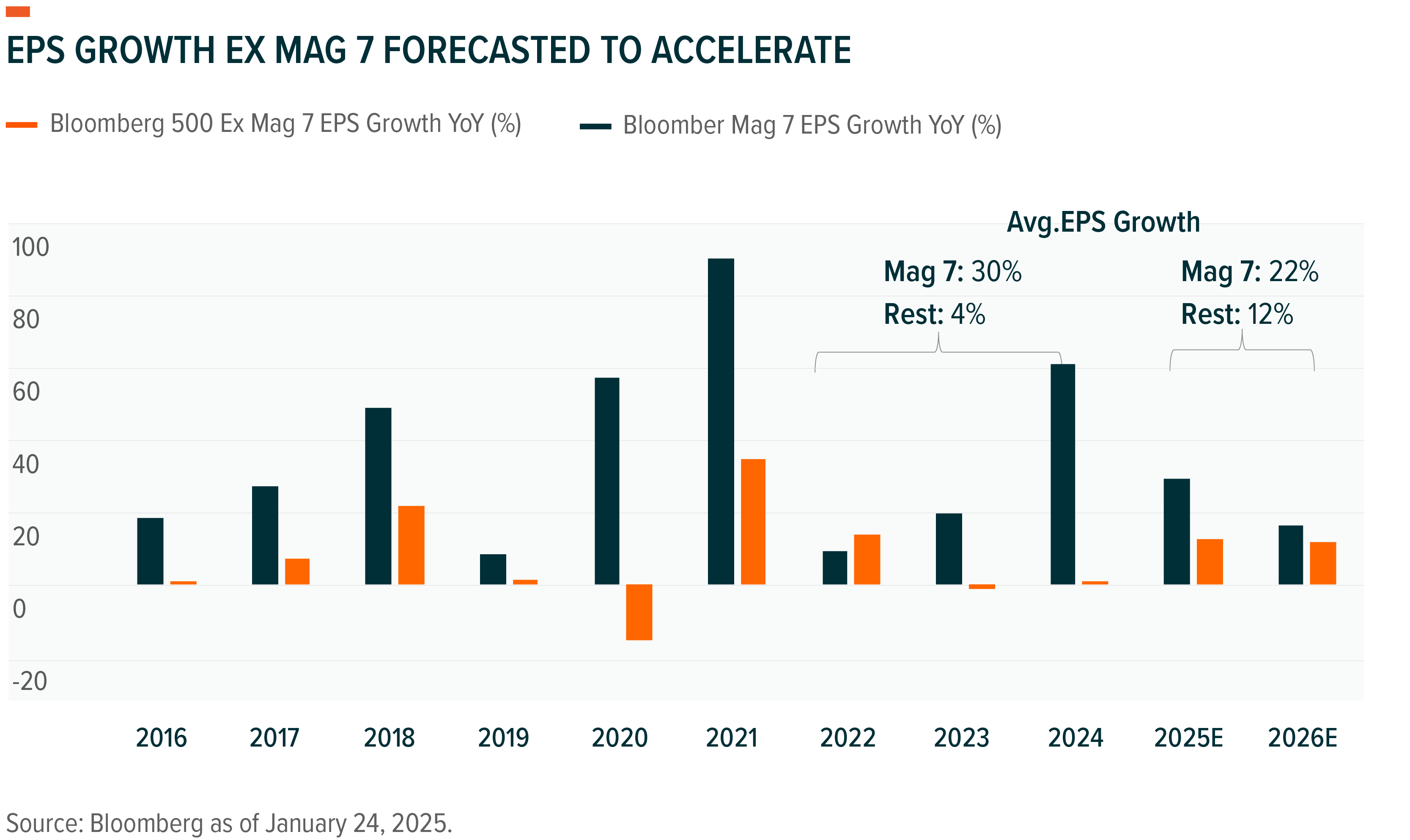

Interestingly, there is already an economic broadening underway, evidenced by the improved profit margins across sectors. What may be more significant is that fundamental forecasts are incorporating the broadening. Beyond the Magnificent Seven, the other 493 S&P 500 companies averaged just 4% EPS growth the past three years, compared to the Mag 7 at 33%.(19) In 2025 and 2026, EPS for the 493 is expected to reach12%, closing the gap as mega-cap earnings slow to 22%, which would help improve ballast and balance from a fundamental perspective.

Better market breadth is good for index returns, with little impact on valuation. In months where the equal weight S&P 500 outperforms the market weighted index, the market weighted index returns 1.5%, compared to just 0.3%.(20) Valuations average around 18 times under either condition. Concerns that challenges to mega-cap dominance are a threat to valuations seem misplaced. With the strong fundamental performance and widespread ownership across portfolios, the mega-cap tech companies likely remain a key part of the landscape, but market valuations should be largely unaffected by accelerated earnings among the S&P 493.(21)

Theme valuations feelin’ alright

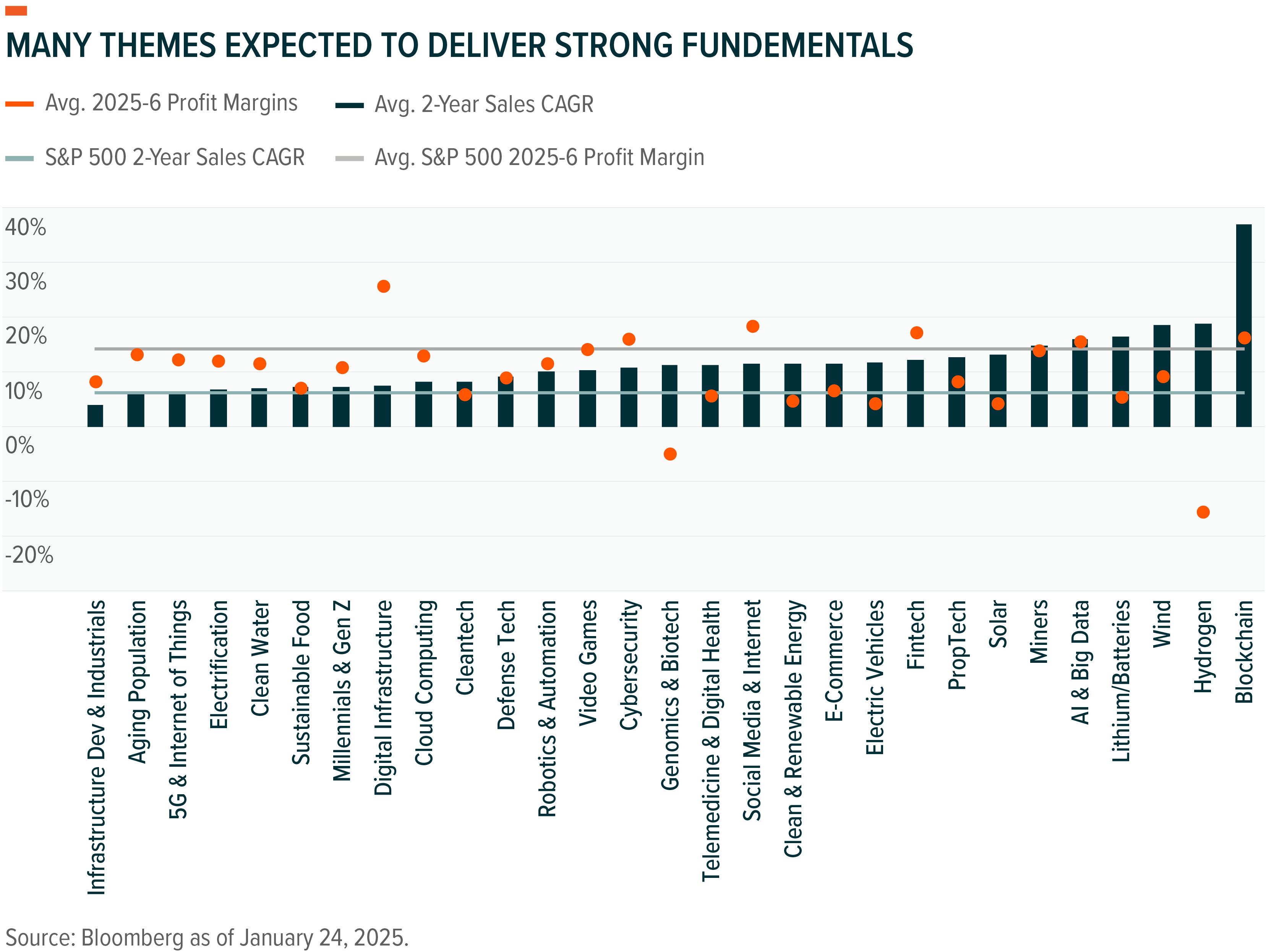

First impressions can be deceiving, especially when something appears extreme. Our analysis indicates that valuations on major indexes seem sensible—but also that certain themes may offer strong fundamentals at reasonable valuations.* Below, we categorise themes in three buckets, based on forecasted S&P 500 two-year annualised sales growth of 6%, profit margins at 14%, and price to 2026 EPS at 19 times.(22)

Valuations below the S&P 500 and improving fundamentals

Themes that fall into this category include Electrification, 5G & Internet of Things, Infrastructure Development & Industrials, and Defence Technology.

Electrification and future energy needs are top of mind amid growth in AI and increased adoption of automation technologies. US electricity demand is expected to rise 47% by 2040, creating the need for more capacity and improvements to the grid.(23) Electrification company sales growth is forecast at 7% annually through 2026, faster than the S&P 500.(24) Profit margins are expected to be a couple points below the broad index and account for the valuation discount.

5G & Internet of Things companies that produce sensors, low intensity processors, and connectivity technology are also tied to adoption of AI and automation tech while selling at a discount to the S&P 500. The connection to smart factories and industrial applications remains underappreciated with industry sales potentially doubling from about $25 billion to $50 billion by 2029.(25) Given industry estimates, sales growth could exceed current expectations of 6%, thereby growing revenues faster than the S&P 500 while generating profit margins around 12%.(26)

US Infrastructure Development & Industrials and Defence Technology are tied to US competitiveness and bipartisan government support. While the government may temporarily freeze spending, strong policy tailwinds in these areas seem likely, as infrastructure development is critical to economic strength and defence technology is critical to international leadership.(27) The fundamentals for Infrastructure Development & Industrials lag the S&P 500, but automation and technology could lead to significant efficiency in the next few years. Similarly, the integration of automation and smart technologies in defence could lead to greater adoption of off-the-shelf products that improve margins.

Valuations in line with the S&P 500 and better fundamentals

Digital Infrastructure, specifically tied to data centers, is forecast to deliver better sales growth and profit margins than the S&P 500, but it sells at similar valuation levels. US data centre capacity is expected to reach 35 gigawatts by 2030, almost doubling from 2022, even if a more efficient training AI algorithm becomes standard.(28) The data produced from AI and the inference involved will still require a significant buildout. Forecasts call for Digital Infrastructure firms to grow sales by 7% per year through 2026 with profit margins well above the S&P 500 at 26%.(29)

Valuations at a modest premium and superior fundamentals

Fintech and AI & Big Data sell at a modest premium to the broader S&P 500, but both are expected to deliver far superior sales growth and margins the next two years. FinTech may benefit from a looser regulatory environment that creates opportunities for new products and technologies. Sales growth is expected to outpace the broad market at 12% with profit margins at 17%.(30)

We expect AI & Big Data companies will continue to grow at a rapid pace. AI software-as-service is set to start monetising across corporate adopters, and those companies are likely to be very cautious when selecting implementation partners. The wave of AI adoption is not about to recede even as the technology underlying the algorithms evolves. AI & Big Data companies are forecast to grow sales by 15% with profit margins at 15%.(31)

Related Funds

Global X Defence Tech ETF (ASX: DTEC) invests in companies at the forefront of defence innovation, including AI, drones, and cybersecurity – all crucial components in today’s modern defence landscape.

Global X US Infrastructure Development ETF (ASX: PAVE) invests in US-domiciled companies involved in the construction, engineering, material procurement, transportation, and equipment distribution processes of infrastructure projects.

Global X Artificial Intelligence ETF (ASX: GXAI) invests in global companies involved in AI development, AI-as-a-service, providing AI compute power, or designing and manufacturing AI hardware.

Global X Fintech & Blockchain ETF (CBOE: FTEC) invests in the financial technology sector which includes innovative companies in industries such as insurance, investing, fundraising, and third-party lending through unique mobile and digital solutions, as well as blockchain and digital assets.

4 stocks mentioned

4 funds mentioned