Bad year ahead for residential property

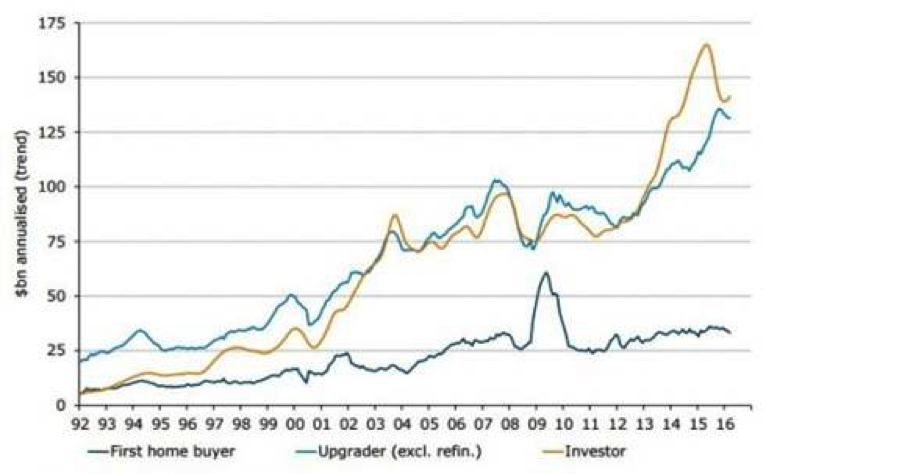

What he was referring to is that many young people now almost take it as gospel that ‘the only way’ to make investment money is to invest in property – borrow some money from your parents, buy an apartment or a house, then buy another, etc. That’s been a great trade for the last 3 years, even when you factor in the substantial frictional cost of stamp duty. Remember if you put down a 20% of total costs, borrow 80% from the bank, stamp duty eats almost 30% of your initial investment. I don’t see the boom continuing. Look at the investor loan activity since 2012-2013. I’d say many of those ‘investors’ are really speculators.

Figure 1: Annualised Australian Housing Loan Data (source ABS, ANZ).

I think the smart money now is selling and renting, but most people don’t have the stomach, the ability or desire to uproot their family. Also if you’d made that call too early (ie one or two years ago) it would not have been a good call, at least not in the short term. Lastly FOMO (fear of missing out) and the ‘property ladder’ are scary phenomena to most.

I read that the overseas buyers are not behind Australian property boom. It would be much better if they were – because it’s often those closest to the feedlot (the locals) that drive the stampede. Crowds do funny things.

All of the above is all talking about property as an investment. As shelter it’s a totally different argument; and let’s face it for most people buying property is the best fiscal management plan you can force upon yourself – useful for that old (maybe forgotten) concept of the rainy day.

The key events, triggers, or data that investors should be watching out for next year include:

- Price Stagnation

- Giveaways

- Who is selling

Thinking first about price stagnation, people think that those that buy property as an investment will just hold it for ever, no matter which way the price goes; and that the Chinese will just buy no matter what, as a store of wealth. Let me lift a little worked example from a recent Credit Suisse note to illustrate what can happen to investor mentality. “Currently the gross rental yield for residential properties (Australia wide) is 3.37% per annum. After deducting council rates, land taxes, insurance, maintenance costs and depreciation, this yield falls to 0.95%. Yet the standard variable mortgage rate, weighted across investors and owner-occupiers is around 5.34% per annum. On the average gearing ratio of the household sector, which is c.27% currently, residential housing is an extremely unprofitable investment on a pure carry”. It’s obvious that everyone is playing for the capital gain, however if the capital growth goes away (and valuations don’t just go up for ever) see how many years investors will tolerate ‘extreme unprofitability’ – not that many would be my guess.

Another key trigger is when incentives are being given away with apartments – when it’s Ferraris and Aston Martins we’re really in trouble. Strange promotions/give-aways are canaries in the coal mine. We’re already seeing it. The other day I received an email about an ‘Investment Opportunity’ that was a 14% per annum return for a marketing bond for an apartment development. Without looking into the detail this is usually what happens when you have an oversupply of apartments; apartments either don’t settle or the second tranche doesn’t sell and the developers run out of money to get aggressive on marketing when they need it most. In my opinion that’s likely to be good money after bad.

One last obvious trigger is when the vendors, rather than the buyers, are the Chinese. The Chinese are smart, they’ll go where there is money to be made; or not lost.

The combination of current valuations of Australian residential property (versus other cities and countries, and versus history); the rise in investment loans; and slower credit growth, all combine to make Australia look strikingly similar to the US in 2007, Japan in 1992 and the Nordics in 1991. The periods after were all unhappy for residential housing values in each country/area. I understand you can’t just ‘hand the keys back’ in Australia, but I think that’s a side argument that ignores the bigger market drivers.

If I was asked which part of the market might present a good opportunity, I would say Melbourne CBD … but only once the trade price is down by 30-40% from the last price or ‘list’ price. There will be some fairly extreme pricing coming out of distressed developers Australia wide. Apartments will go from being the best to the stupidest investments. But when people think you are stupid it’s usually time to double up on your interest, research and evaluation.

4 topics