Bargain, value trap or something in between?

Over the last decade, U.S. large cap growth stocks have been far and away the best performing major financial asset in the world. However, as most good contrarians know, the most attractive prospective investment opportunities rarely come from past winners, especially when they have been of this magnitude. In this piece we consider three notable relative equity market underperformers during U.S. growth’s triumphant run: U.S. value, U.S. small, and China. Specifically, we share four avenues of analysis we recommend for differentiating between those assets which are poised to rebound and those which are in danger of continuing to disappoint:

- Valuations – Do these stocks actually look cheap?

- Fundamental drivers of returns – Which sources of underperformance are likely to mean-revert (or not)?

- Changes in group characteristics – Have these groups of stocks become “junkier” or less profitable, which would justify lower fair value going forward?

- And finally, how should investors weigh structural forces that, whether or not they have impacted these groups to date, seem important to incorporate for evaluating future return potential?

Our analysis leads us to the following investment conclusions:

- U.S. large value equities are very attractive today – in fact, they have almost never been cheaper relative to the overall market. Their poor trailing returns have primarily been driven by falling relative valuations, not by deterioration in their underlying businesses. We believe large value stocks are positioned to outperform, especially in long/short portfolios (such as our Equity Dislocation Strategy) where it is easier to control stock-specific risk.

- U.S. small caps are also unusually inexpensive versus the market, but their falling relative valuation is partly deserved due to deteriorating profitability, increasing junkiness, and slowing growth (due to falling rates of IPOs and associated average business maturity). Given these headwinds, where we own U.S. small caps in our asset allocation portfolios we are oriented toward higher-quality businesses.

- Chinese stock valuations appear mildly attractive versus their history and are the cheapest major market today. However, the most meaningful influence on their poor returns has been deteriorating fundamentals and significant shareholder dilution, not falling valuations. Weakening return on capital and quality metrics, along with significant geopolitical and regulatory risks, make us cautious on China. We consider emerging markets outside of China to be a better risk/reward trade-off.

The last decade’s performance

We will admit there is nothing particularly magical about starting our clock for selecting underperforming equity groups in the fall of 2014: the troubles for U.S. large value stocks predated that time, and those for U.S. small and China arguably started later. But 2014 was reasonably near the start of an extraordinary run for U.S. large growth stocks, a meteoric rise which has absolutely captivated the investing world. Since September 2014, U.S. large growth has delivered an annualized return of 12.4% real, more than twice both its long-run average and the return of the MSCI All Country World Index (of which it is a very substantial part). (1) While during this period U.S. large value and U.S. small caps haven’t done especially badly – on an annualized basis U.S. large value (as defined by GMO) delivered 8.8% real (2) and U.S. small delivered 5.8% real – they gave the worst returns relative to their markets of any style groups.

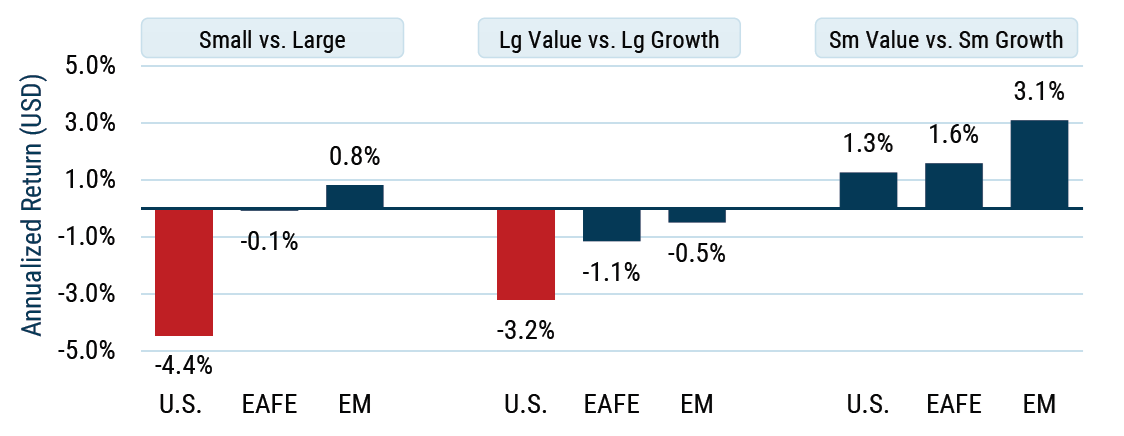

Exhibit 1 shows the relative performance of various size and value factors within U.S., EAFE, and emerging markets over the last decade. While small caps did “ok” outside of the U.S., particularly in emerging markets, within the U.S., small lagged by a painful 4.4%/year. It is a reasonably well-known fact that nearly half of the underperformance of small versus large in the U.S. can be explained by the outperformance of the “Magnificent 7” stocks, but even if one were to exclude the 10 largest U.S. stocks from this analysis, U.S. small still trailed large by 2.5%/year, hence making our list of the “also-rans” featured in this paper.

Exhibit 1: Performance of various styles within major equity regions

September 2014 - September 2024

As of 9/30/2024 | Source: GMO

Outside of small caps, the above exhibit also demonstrates why we are focusing our attention on U.S. large value. Value actually had a pretty good decade within small caps, with small value outperforming small growth by 3.1%/year within emerging markets, 1.6%/year in EAFE, and 1.3%/year in the U.S. Within large caps, however, value’s performance looks less rosy everywhere, but particularly in the U.S. where value trailed growth by 3.2%/year (again, based on GMO’s definition) and by -4.5%/year based on MSCI USA Large Cap Value versus Growth indices. We discussed some of the problems with traditional value indices in our recent white paper, Beyond the Factor: GMO’s Approach to Value Investing. Correcting for those problems made things somewhat less bad for U.S. large value as a strategy, but the decade was still one of the worst in history for the group on a relative basis.

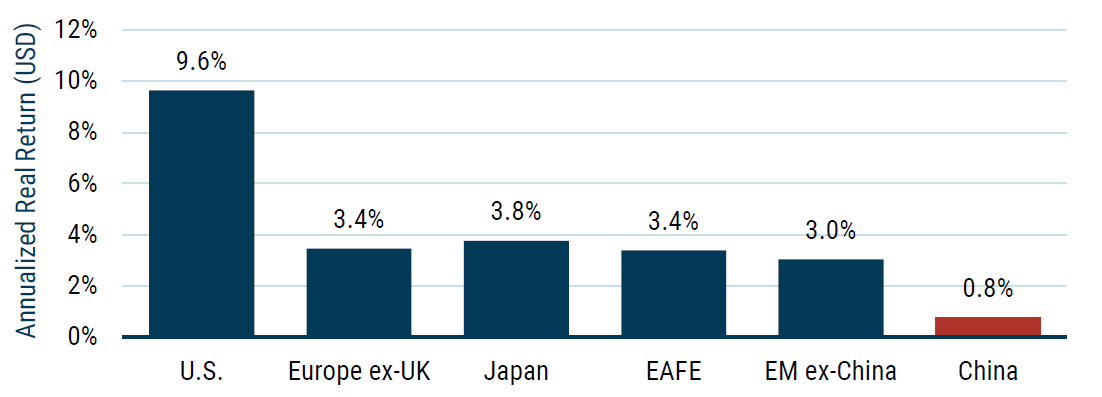

Our final pick for the list of also-rans is China. As Exhibit 2 illustrates, while it is true that no other region came particularly close to matching the returns of the U.S. equity market (with annualized returns of 9.6% real over the last decade), China was decidedly the worst performing major market, returning 2.6% behind EAFE and 2.2% behind the rest of the emerging markets.

Exhibit 2: Performance of major equity regions

September 2014 - September 2024

As of 9/30/2024 | Source: GMO, MSCI

Now that we have our examples of the three groups that have notably disappointed over the last decade – U.S. value stocks, U.S. small stocks, and China – we are going to lay out the analytical framework we use in Asset Allocation to assess the likelihood of subsequent rebound. Applying our analysis to all three groups would make for an unavoidably long paper, even if we tried to be as concise as possible while doing justice to the topics and groups (rest assured, Reader, we did try…and failed…with our best attempt producing a treatise twice as long as the digestible limit recommended by our marketing department). Hence, in this paper we will primarily focus on the framework, picking and choosing examples from our three groups to illustrate its applications, while also providing a summary of high-level conclusions across all three groups at the end of each section. While we will not go into quite as much depth on each topic as some readers might like, we welcome those interested in a little more depth to contact their GMO representative for access to a replay of our 2024 GMO Conference presentation on this topic.

Step 1: Valuations. Are these groups actually cheap?

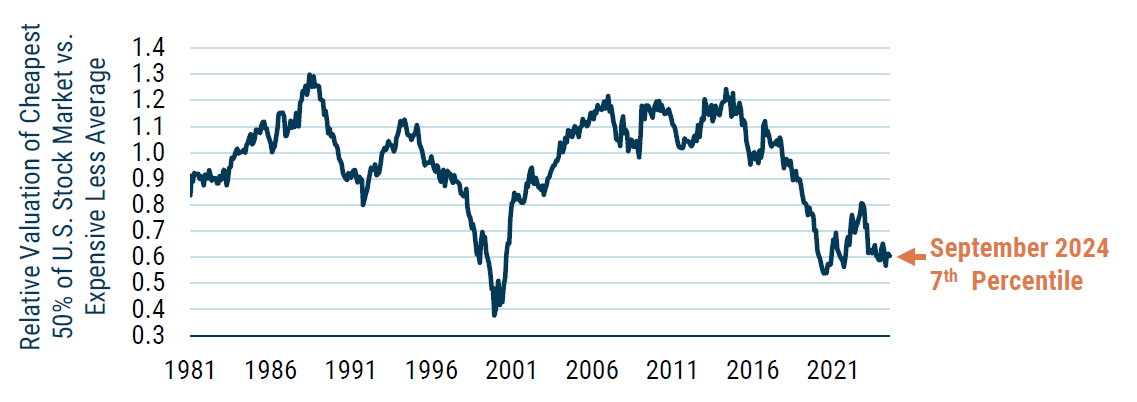

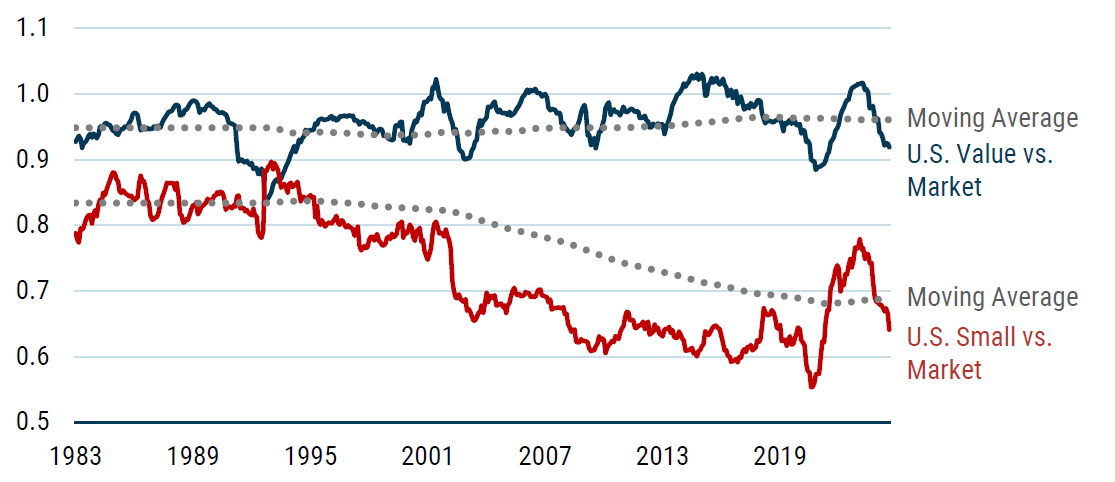

Last decade’s losers are generally a nice place to look for undervalued assets, but not all underperformers are actually cheap. To take one example, as early as 1993 Japanese stocks had underperformed the U.S. and Europe on a trailing 10-year basis. But having peaked out at over 70 times Shiller P/E just a few years earlier in 1989, Japan was still trading at about twice the valuation of the rest of the developed world at the time. In the case of today’s also-rans, however, the valuation story looks much better. Exhibit 3 shows the valuation of U.S. value stocks relative to growth stocks. As we have done before, we are renormalizing the valuation so that 1.0 is the long-run average of the series.

Exhibit 3: Relative valuation of U.S. value stocks

As of 9/30/2024 | Source: GMO. Stock valuations are calculated on a blend of Price/Sales, Price/Gross Profit, Price/Book, and Price/Economic Book.

While value was expensive vs. its own history back in 2014, it is quite cheap now, at the 7th percentile versus history and a valuation of 0.6. That implies a 67% outperformance versus U.S. growth stocks, were value to revert to its historical average valuation tomorrow.

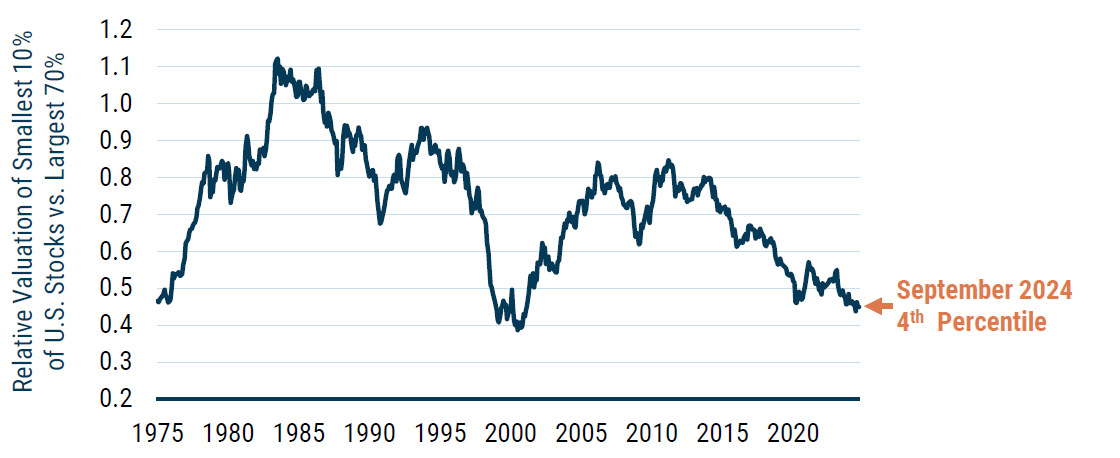

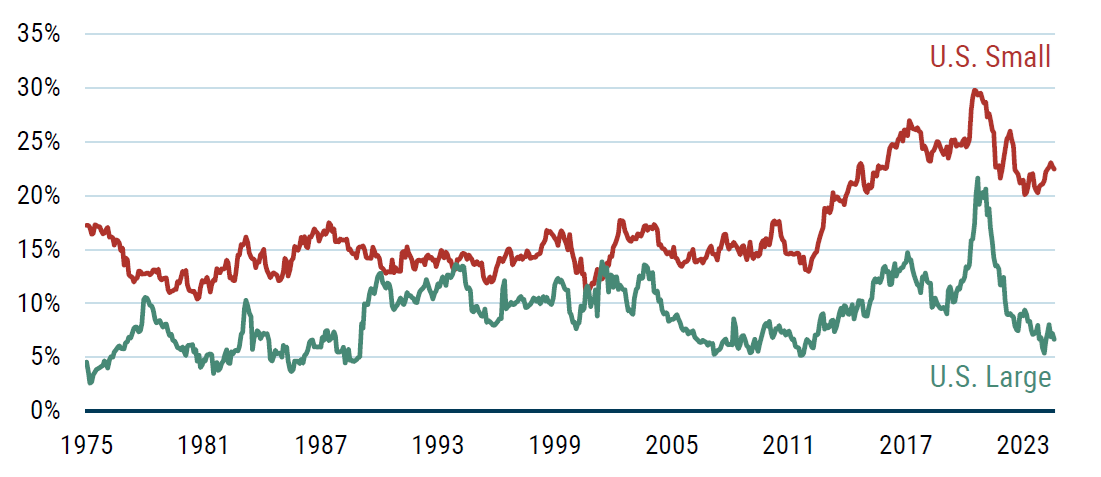

U.S. small stocks also look particularly cheap. Exhibit 4 shows their valuation relative to U.S. large cap stocks, which implies small outperforming large by about 60%, were small to revert to its historical average over this period.

Exhibit 4: Relative valuation of U.S. small cap stocks

As of 9/30/2024 | Source: GMO. Stock valuations are calculated on a blend of Price/Sales, Price/Gross Profit, Price/Book , and Price/Economic Book.

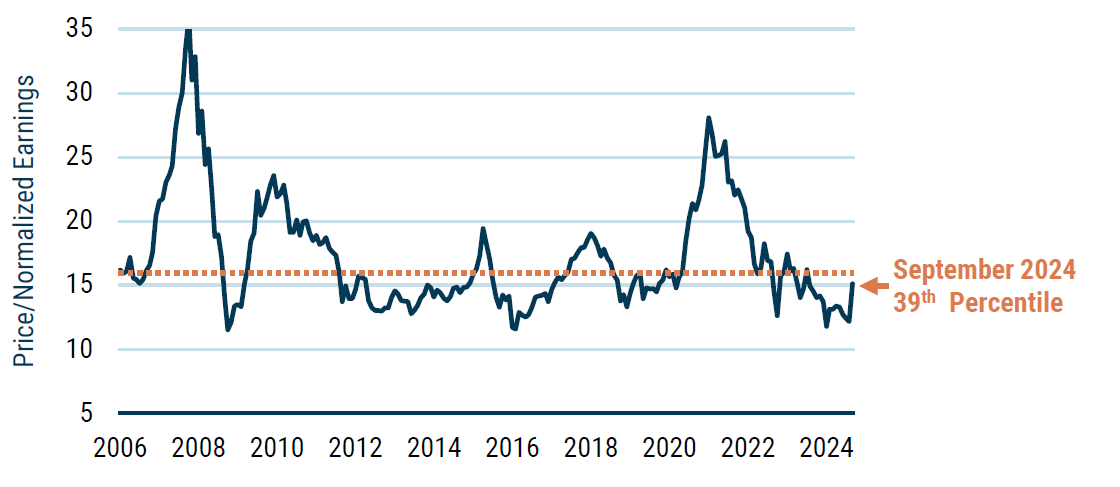

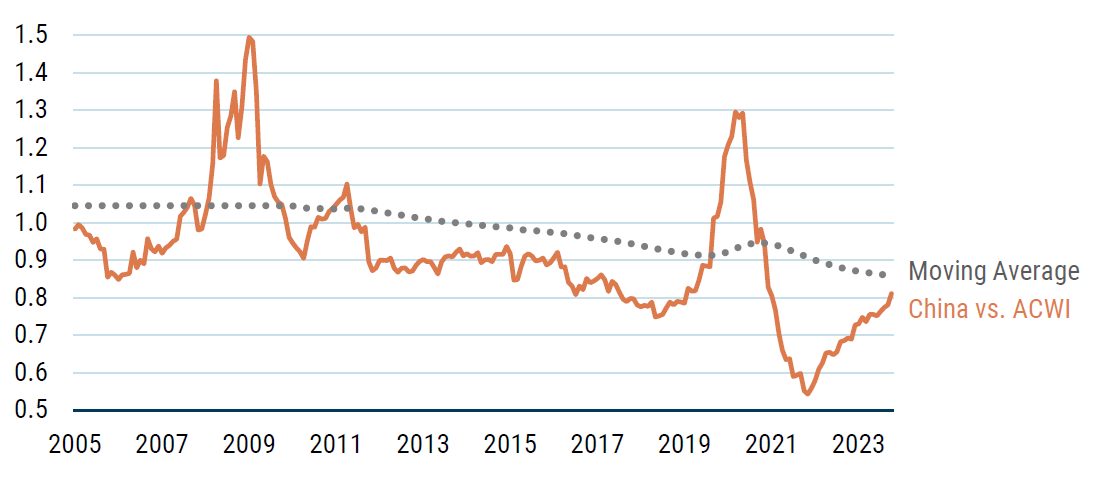

A couple of months ago, we could have said almost the same for China. But with a very strong rally in the second half of September (now partially reversed), Chinese equities only look moderately cheap versus their history, as we can see in Exhibit 5.

Exhibit 5: Absolute valuation of China

As of 9/30/2024 | Source: GMO. Price/Normalized Earnings is a composite Price/Earnings measure using Shiller P/E as well as earnings normalized based on average return on book, return on economic book, return on gross profits and return on sales. Group is MSCI China ex-Financials and resources, with individual stock weights capped at 2% of index.

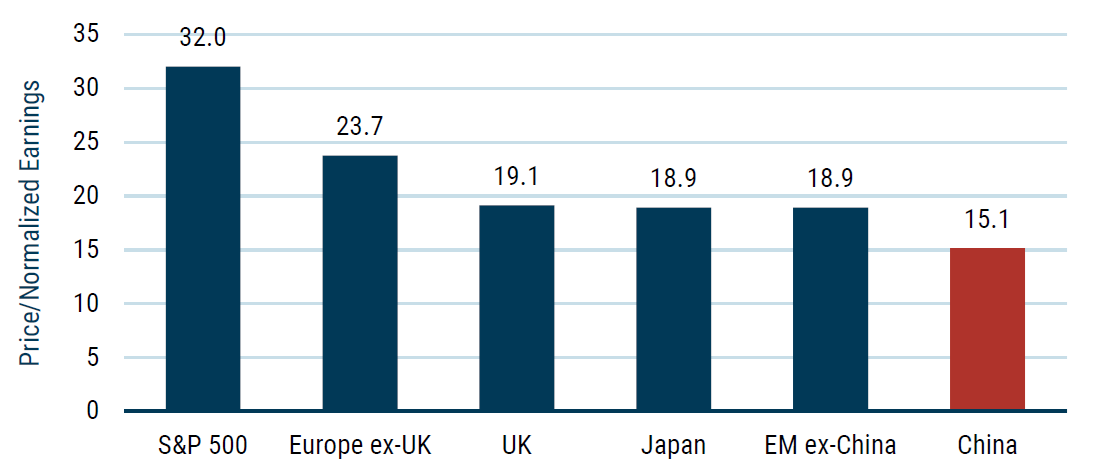

On the other hand, stocks elsewhere around the world are not especially undervalued today, and China does have the distinction of being the cheapest major market globally, trading at less than half the Shiller P/E of the U.S. and at about a 25% discount to the rest of the world (Exhibit 6).

Exhibit 6: Absolute valuation of major regions

As of 9/30/2024 | Source: GMO. Price/Normalized Earnings is a composite Price/Earnings measure using Shiller P/E as well as earnings normalized based on average return on book, return on economic book, return on gross profits and return on sales. Groups other than S&P 500 are MSCI indices ex-Financials and resources, with individual stock weights capped at 2% of index. For S&P 500, group is S&P 500 ex-Financials with individual stock weights capped at 2% of index.

Step 1: Conclusions

To summarize, on valuations, our three also-rans fall into two camps. Both U.S. value and U.S. small are extremely cheap versus their histories, at least on a relative basis. China is less cheap versus its history, although it is the least expensive major market in the world today by a decent margin.

Step 2: Understanding fundamental drivers of returns and their stability

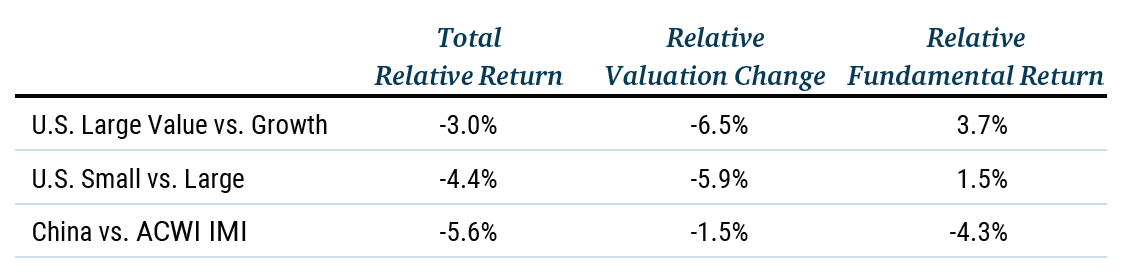

Cheapness is a necessary feature of a decent contrarian play, but it is not a sufficient one. A stock on its way to bankruptcy almost invariably spends time looking cheap versus history along the way. While it would be close to impossible for groups as broad as our also-rans to go bankrupt en masse, they could still be “broken” in the sense of having their poor performance driven by deteriorating fundamentals rather than falling valuations. To analyze whether this is the case, we break realized performance down into two underlying components: changes in valuations and fundamental returns. (3) What we typically look for are the situations where a) underperformance is mostly explained by the changes in valuations (asset getting cheaper), while b) fundamental returns remain stable and consistent with history and our priors. Our confidence in a potential contrarian play is higher when both conditions are satisfied, so let’s look at how our also-rans measure up on this basis.

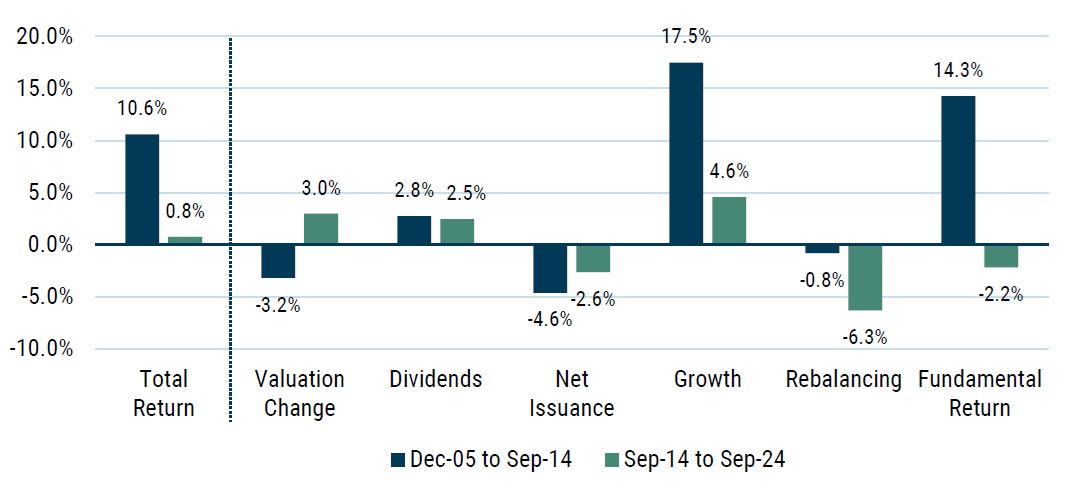

Exhibit 7 shows the decomposition of the total realized return for our groups of interest into the valuation change and fundamental return components. In this graphic we have chosen to show China relative to ACWI to home in on the drivers of its relative underperformance. Did all our groups get cheaper as they underperformed? Yes, they did, including China, which saw its valuations increase over the past 10 years, but not by as much as ACWI’s. However, China’s underperformance versus global equities was different as it was primarily driven by the weaker fundamentals (not falling valuations) and that, in our framework, presents a red flag that warrants further investigation.

Exhibit 7: Total relative return decomposition

September 2014 - September 2024

As of 9/30/2024 | Source: GMO, MSCI

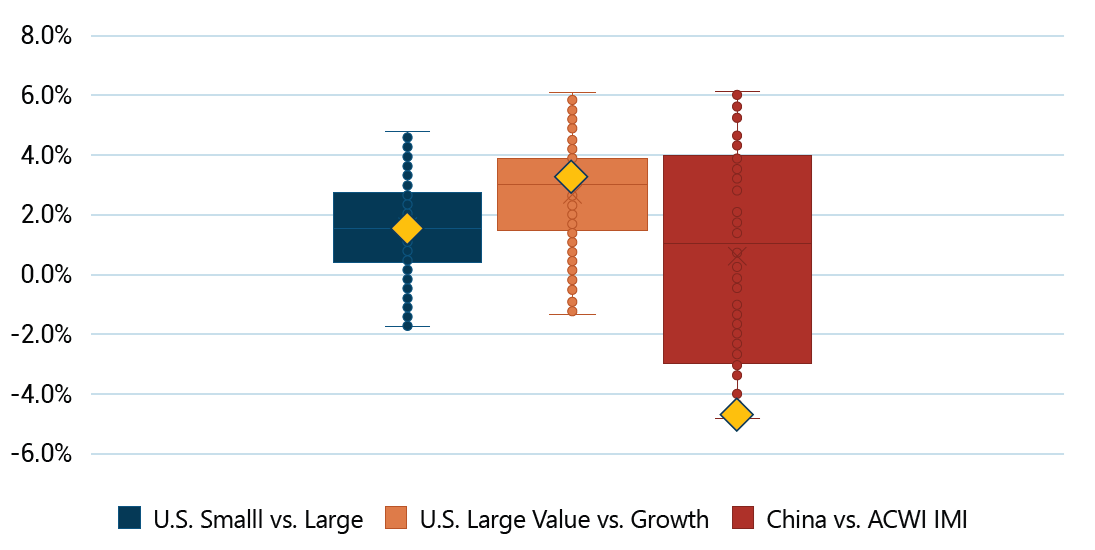

How stable have the fundamental returns been for these groups and how special (or not) is the past 10-year period when compared to the groups’ history? The answer is once again more worrying for China.

Exhibit 8: Distribution of 10-year relative fundamental returns

Data 1/1975-9/2024 for the U.S. and 12/2005-9/2024 for China | Source: GMO, MSCI

Exhibit 8 summarizes the distribution of 10-year rolling realized relative returns for our three groups in a form of a box and whisker plot. Fundamental returns of U.S. value and U.S. small have been well-behaved: positive in more than 75% of all 10-year periods with reasonably tight inter-quartile range (IQR) of about 2.3%, and the most recent 10-year fundamental return (shown as yellow diamonds) in-line or above the median outcome. China, on the other hand, has seen a much wider range of relative outcomes despite a much shorter history. (4) Though on average China has delivered a relative fundamental return of 0.6% versus global equities – which is consistent with what we would expect from an emerging market in the long run – the extremely troubling part to us is the stark contrast between China’s “boom” fundamental outperformance of the first decade of 6%/year, followed by a disastrous relative fundamental return of -4.5% over the last decade. While the fact that the recent underperformance is an outlier offers a bit of hope – presumably the last decade involved a certain amount of fundamental bad luck for China – China has been broken for the last decade in aggregate. For China to prove a decent asset over the next decade, we will definitely want to see some evidence that it can fix itself.

To better understand the drivers behind China’s fundamental deterioration, we turn our attention to the fundamental return decomposition into underlying components for extra insights: income (net issuance/buybacks and dividends), growth, and rebalancing (changes in valuations explained by changes in group membership).

Exhibit 9: China absolute return decomposition (USD real, annualised)

As of 9/30/2024 | Source: GMO, Computstat, Worldscope, MSCI. Total Return = Valuation Change + Fundamental Return. Fundamental Return = Dividends + Net Issuance + Growth + Rebalancing

In the first (roughly) nine years of our analysis, returns were very strong at 10.6% above inflation for a U.S. dollar investor. This was driven by extraordinarily robust growth at an amazing 17.5% real annualized. Despite a reasonable dividend payout ratio, dividends and net issuance combined to be a negative due to large levels of dilution as Chinese companies consistently increased their share counts. Rebalancing, which doesn’t seem like it should be an issue for a country index, was modestly negative as well because companies entering the MSCI China Index did so at higher valuations than those exiting the index. One can certainly understand global investors’ excitement about China in the early 2010s. China’s fundamental returns from 2005-2014 were the best in the world by a large margin, and unlike Japan’s world-beating returns in the 1980s that were fueled by ever rising valuations, China’s stock market was cheaper in 2014 than it was in 2005 despite its strong performance.

But the results have been very different over the last decade. The extremely strong growth came down to more pedestrian levels – real growth of 4.6% isn’t bad, per se, but it is a far sight worse than 18% real. Primary net issuance tempered off somewhat but remained negative as Chinese companies continued to dilute their shareholders at -2.6%/year. And rebalancing turned even more negative at a fairly stunning -6.3%/year.

This deterioration in rebalancing was driven by two primary factors: index additions and the negative impact of free float changes on index-level valuations. Once again companies coming into the MSCI China Index were coming in at higher valuations than those companies leaving the index. Rebalancing took a particularly large hit in 2015-2016, when MSCI China added USD-listed stocks (Alibaba, Baidu, JD, etc.) and then again in May 2021 with another big round of China-centric index reconstitution. These two rebalancing episodes alone explain nearly all the additional hit to rebalancing related to index additions, without much subsequent boost to growth beyond what has been the historical norm.

The biggest negative drag on rebalancing in the most recent decade has actually come from the impact of changes in companies’ free float percentages. (5) In the early history of the Chinese market, increasing free float of relatively cheap stocks within resources and industrials actually led to a positive rebalancing effect – these cheaper stocks became a larger piece of the index due to more of their shares being available for purchase. In the second half of the sample, rotation into more expensive sectors with higher (consumer staples) and increasing (communication services) free float meant that as those companies gradually saw more of their shares available for purchase, the index got more expensive. It is not entirely clear which decade would be more representative of the rebalancing dynamics going forward, but we would encourage investors to err on the side of caution and expect that China IPO activity, index reconstitutions, and free float adjustments will continue to be a negative source of return on aggregate – hopefully less so than what we’ve observed over the past 10 years. The net result of all these factors was that China went from delivering the best fundamental returns of any major market to delivering the worst, destroying value to the tune of -2.2% per year.

For those interested in delving into more detail on U.S. small and U.S. large value, we break things down more fully in Appendices A and B. For those less interested in the nuances, our conclusions follow.

Step 2: Conclusions

Our analysis of the fundamentals gives us varying conclusions. Both U.S. value and U.S. small have seen positive valuation-adjusted returns across the periods we looked at – neither one of them looks broken in a fundamental sense based on what we can see historically. In the case of U.S. small caps, fundamental returns were extremely consistent across our periods and nicely positive, consistent with a continued return premium for U.S. small. We also see positive fundamental returns for U.S. value, although as Appendix A shows, over the last few years those returns have been disappointing on a market capitalization weighted basis. That disappointment has been driven by low turnover between the value and growth groups. That low turnover, in turn, was very strongly driven by the dominance of the Magnificent 7 and a couple other mega cap growth stocks rather than a fall-off in movement between value and growth more generally. Implementations that are more equally weighted have also performed much better, powered by strong rebalancing returns. China has seen its fundamental fortunes change much more drastically. After a decade of world-beating fundamental returns from 2005-2014, the last decade has been a disaster. Any hope of a lasting turnaround for China will require markedly better fundamental returns than we have seen recently.

Step 3: Changes in group characteristics

We know all three groups have gotten cheaper in recent years, and in the case of U.S. small and U.S. value, that falling valuation has been the driver of their underperformance – absent those declines, those stocks would have outperformed. But it’s still possible that they deserved those falling valuations and that the current constituents of the groups are not actually any cheaper today relative to their true fair value. To determine whether that is the case, we need to look at what has happened to their return on capital and other elements of quality.

Ultimately, return on capital is the most important driver of acceptable valuation for a company. Our definition of return on capital is based on a proprietary blend of estimators of a company’s earnings relative to underlying economic equity value. The only way that a company can support a higher-than-market P/E and still perform well is if the company has investment opportunities that will have a higher return on capital than the company’s cost of capital. Such investments are accretive to company value. Growth that comes without that high return on capital is actually value-destroying for investors, as they would have been better off if that money had been returned to them via dividends or buybacks. (6) A company with a lousy return on capital is not worthless, but it should trade at a lower valuation than the average company. There is an important interaction with what the company does with its earnings. A company with a low return on capital that pays out 100% of earnings to shareholders should trade at a low multiple of capital, but not a particularly low multiple of earnings. A company that has a low return on capital and nevertheless retains much of its earnings to reinvest needs to trade at an even lower multiple of capital because it also needs to trade at a significant discount on P/E as well. (7)

So, where we see a significant trend up or down in returns on capital, we can adjust our estimate of fair value for the group for that shift.

Exhibit 10 shows return on capital over time, relative to the overall U.S. market, for U.S. value and U.S. small.

Exhibit 10: Return on capital (relative to the U.S. market)

As of 9/30/2024 | Source: GMO Computstat, Worldscope, MSCI

There is definitely some cyclicality to the U.S. value chart – the profitability of value tends to be lower in bad economic times than it is in good ones, although the low and high points don’t necessarily line up with the lows and highs of the business cycle. But as the dotted moving average line shows, there is no noticeable tendency for value stocks to have had deteriorating profitability over time. Their profitability is on average slightly worse than the overall market, which implies that they should trade at a discount, and they do trade at a discount – that is, after all, what makes them value stocks. Judging from this chart, however, there is nothing that has been systematically going on within the group that suggests their required discount should grow with time.

The pattern for U.S. small stocks looks significantly different. Small stocks have never been as profitable as their larger cap peers. But in the 1980s and 1990s they had about 80-85% of the return on capital of large caps, whereas over the last twenty or so years it has fallen to around 65%. Given that small stocks pay out relatively little of their earnings to shareholders, this means that their supportable relative valuation needs to have fallen on both a price-to-capital and price-to-earnings basis. Assuming a payout ratio of 40%, this fall in return on capital implies a fall in fair value relative to economic capital of about 30% versus large caps, and a fall in price to earnings of about 20%.

China has also seen a fall-off in its return on capital relative to the rest of the world, as we can see in Exhibit 11. While in the first half of the sample China’s return on capital looked pretty normal versus the rest of the world, in the second half of the sample China has struggled to keep up.

Exhibit 11: China return on capital (relative to MSCI ACWI)

As of 9/30/2024 | Source: GMO Computstat, Worldscope, MSCI

Unlike the case of small caps, where the deterioration has been going on for long enough that it’s hard to imagine there isn’t a secular shift involved, it is possible that China can turn this around. But they will have to do so for us to expect a recovery in China’s valuations relative to the rest of the world. In China’s case the stakes on the return on capital are particularly high. Because Chinese companies on average reinvest close to 100% of earnings, earning a low return on capital is particularly problematic. If such low payout ratios were imagined to be permanent, this below-average return on capital would imply that China should trade at perhaps a 60% P/E discount to the rest of the world. That assumption is unreasonably harsh, however. Surely China will not have idiosyncratically high reinvestment rates 50 or 100 years from now. But the longer China retains the bulk of its corporate earnings, the bigger a discount it needs to trade at, unless it can get that return on capital up. If China were to boost its payout ratio up gradually to 50% over the next 20 years and its return on capital were to stay constant, it would need to trade at a 23% discount to P/E and a 35% discount to economic capital to earn the same return as the rest of the world.

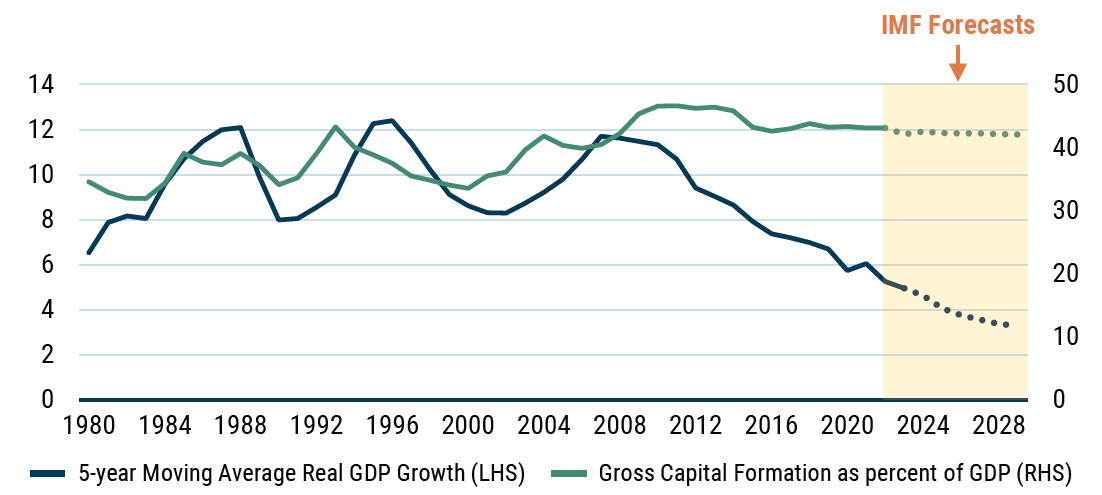

Of course, if China were to improve its return on capital, these discounts should disappear. One can certainly make an argument that China’s economy is relatively weak and there should be a cyclical improvement in return on capital. But it looks as if the structure of China’s economy will make it hard for such improvements to stick. Starting with Deng’s reforms in the late 1970s, China became the fastest growing economy in the world, reallocating vast amounts of labor from subsistence agriculture into the formal economy and industrializing with speed and scale that the world had never seen. Real GDP growth averaged close to 10%/year from 1980-2010. Such heady rates of growth both required and justified massive rates of aggregate investment, and China’s gross capital formation averaged around 40% over that period, almost twice as high as we see in the U.S. or Europe. But since 2010, China’s growth has slowed materially, down to around 5% on average over the last 5 years. Gross investment rates, however, have not come down, as we can see in Exhibit 12.

Exhibit 12: A recipe for deteriorating ROC

To improve ROC, China must reduce its aggregate rate of investment

Data as of 2023 | Source IMF World Economic Outlook, China National Bureau of Statistics

This is a recipe for a falling return on capital. When the Chinese labor force was growing strongly and China was still in a catch-up mode of increasing capital per worker, it made sense to invest at very high rates. With their labor force starting to fall and the easy gains of capital deepening behind them, China should slow its investment rate. It has not, and it does not look to be on a path to do so, at least according to the IMF forecasts.

Forecasts are by no means guaranteed to come true, but if China is to come to grips with the implications of their slowing aggregate growth, they simply must reduce their aggregate rate of investment. Keeping it at current levels – far higher than any other major economy, including some, such as India, that are growing substantially faster than China – is a recipe for deteriorating return on capital, not the improvement that China’s equity investors are looking for.

But there is more to life than return on capital. The other side of the valuation coin is risk – the higher the economic risk of a group of stocks, the higher the return investors should demand from them in the long run. Our basic proxy for that economic risk is quality. Return on capital is a piece of our quality score, but cyclicality and leverage figure in as well. The lower the quality of a group of stocks, the more extra return we demand to be willing to hold them.

Outside of deteriorating profitability there was one more quality-related trend we wanted to highlight as a risk for U.S. small, and that is increase in leverage. Exhibit 13 shows the percentage of U.S. small and U.S. large with high leverage, which we define as a debt-to-EBITDA ratio in excess of 4x. The chart shows that small companies are generally riskier, which is quite intuitive, and that over the last decade the percentage of small cap with dangerous levels of leverage has increased to an all-time high. Given the deterioration of profitability and increase in the group’s leverage, where we own U.S. small caps in our asset allocation portfolios, we are focusing on selecting stocks from the higher quality tier of small cap firms.

Exhibit 13: Percentage of investable market cap with debt/EBITDA ratio in excess of 4x

As of 9/30/2024 | Source: GMO Computstat, Worldscope, MSCI

Step 3: Conclusions

While the discount investors demand in compensation for lower quality does vary, we would struggle to imagine either Small or China moving back up to their historical average relative valuations without these characteristics meaningfully improving. For value, on the other hand, whatever has driven its discount to widen isn’t obvious in looking at its quality or profitability.

Step 4: Structural issues

Of course, future valuations will also be affected strongly by future fundamentals. Should a group’s return on capital or “growthiness” change in the future, it will surely have an impact on valuations. Such future changes are difficult to predict, but we can look for structural changes that suggest potential shifts. Today we do see structural issues that are likely to affect the economic performance for both U.S. small and China.

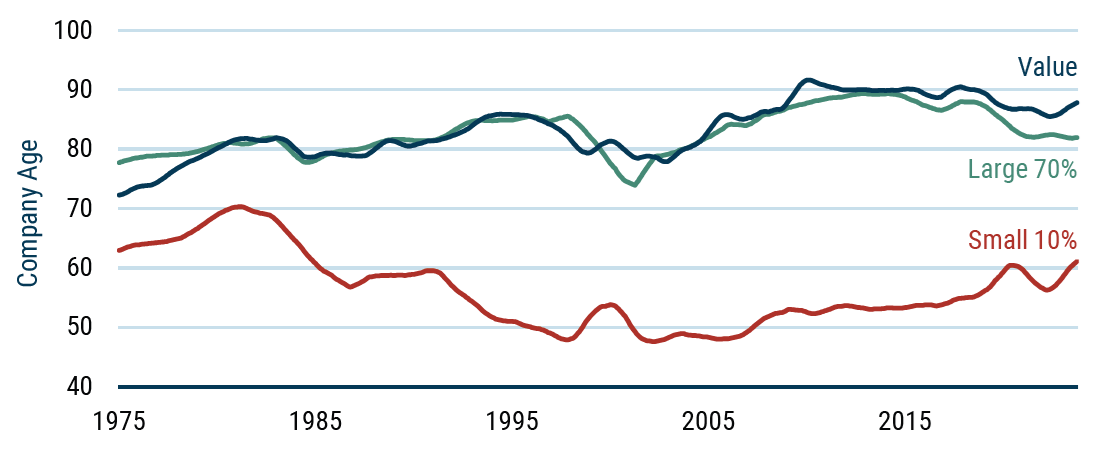

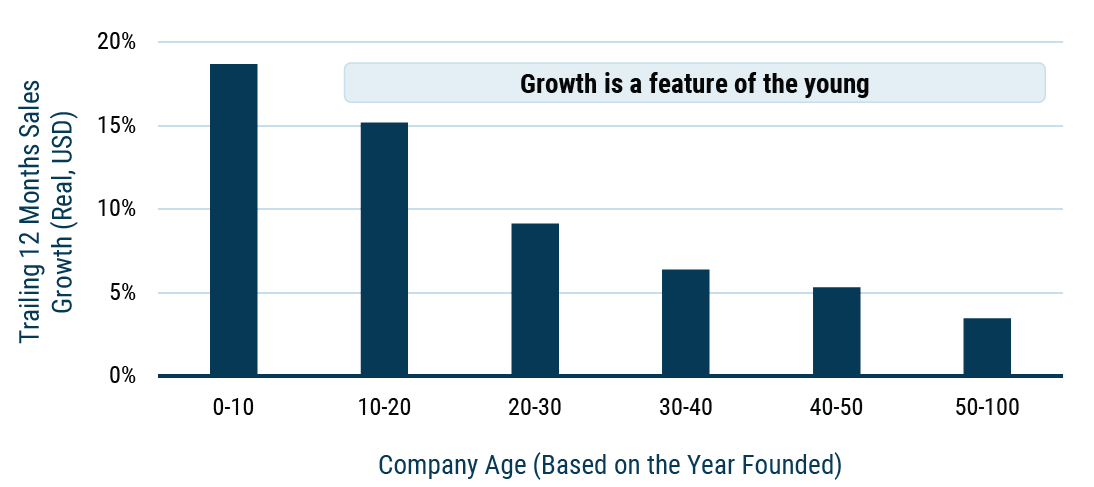

In the case of U.S. small caps, an obvious structural shift is that there are simply fewer of these companies than there used to be. In the late 1990s there were about 8,000 publicly trading companies in the U.S., whereas today there are less than 5,000. But beyond the smaller number of publicly traded companies, we’ve seen another shift which is possibly more fundamental for small caps: the falloff in IPOs. The 1980s and 1990s saw large numbers of companies go public, but ever since the bursting of the tech bubble in 2000, those numbers have fallen off considerably. What’s more, the existence of large venture capital and growth equity pools has meant that those companies that go public often do so at a later stage of their maturity, meaning that the companies that do go public bypass the small cap universe entirely and come to market as either mid cap or large cap firms. This has caused a meaningful shift in the average age of small cap public firms relative to large caps, as we can see in Exhibit 14.

Exhibit 14: Average of public firms (fundamentally weighted)

As of 9/30/2024 | Source: GMO, ChatGPT. Sample period: Jan 1975 - Present

The IPO boom years of the 1980s and 1990s caused the average age of small caps to fall sharply relative to large caps. But since the early 2000s, small caps have on average become about 15 years older, while large caps have become a little younger. (8) All else equal, firms grow less as they age. An aging cohort of small cap firms, and particularly a substantially shrinking cohort of truly young small caps, should be expected to lead to less growth. We can see the connection between firm age and median growth in Exhibit 15.

Exhibit 15: Median % sales growth per age bucket

As of 9/30/2024, U.S. Market 1/1975-9/2024 | Source: GMO, ChatGPT

We have already seen some impact from this in the growth rates of small caps in the most recent decade relative to the 1983-2014 period (see Appendix B). In that earlier period, which coincided with the youngest average ages for small caps, small outgrew large. In the earlier and later periods, when small caps were relatively older, we saw negative relative growth. Absent a reignition of an IPO market that resembles days of yore, we would expect that undergrowth to continue. It’s only been a couple of points of growth – and some of it was countered by relatively better dividends and issuance – but today’s small cap universe is an older, less growthy universe than it used to be.

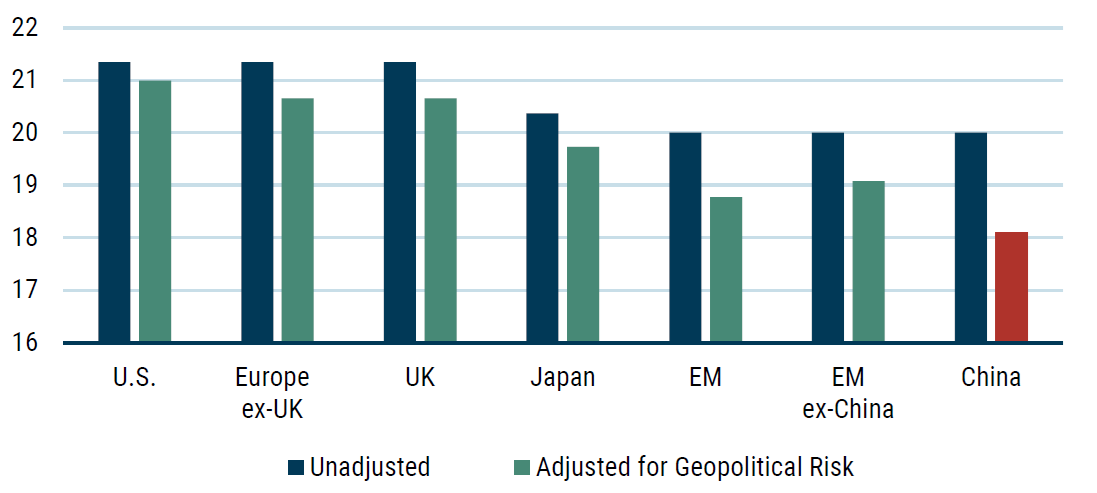

In China’s case, we’ve already seen one structural issue – high investment rates seem likely to lead to continued disappointment in aggregate return on capital. But there are two other risks which, while perhaps hard to quantify, are likewise hard to ignore. One of them is geopolitical. Even before Donald Trump’s re-election, geopolitical tensions between China and the West were high. China has already seen its share of U.S. goods imports fall from over 22% in 2017 to 12% so far in 2024, and there may well be continued downward pressure if the incoming administration goes ahead with its plans for high tariffs on Chinese imports. But to us the most worrisome risk for U.S. investors investing in China is the potential for conflict over Taiwan. Economically, a conflict that restricts or cuts off the supply of IT goods from Taiwan could be devastating worldwide. And for Western investors, the prospect of trading in Chinese companies being outlawed in a manner similar to the rules on Russian equities after the Ukraine invasion would be a further headache. We assume that the likelihood of such a conflict remains quite low, but we don’t think we can afford to rule it out. As a result, we’ve added an additional premium to Chinese assets to account for this risk. This “Taiwan conflict” risk premium actually hits all stocks since no region seems likely to remain unscathed from such an event, but the impact on fair value is much larger for China than it is for developed markets, dropping our estimate of fair price/normalized earnings by 2 points from 20 to 18 (Exhibit 16).

Exhibit 16: Fair price/normalised earnings assumptions by market

As of 9/01/2024 | Source: GMO

Another risk that seems difficult for investors to ignore when contemplating investing in China is regulatory risk. The Chinese government has not been afraid to target companies and whole industries where it felt there were important societal issues at stake, and that seems likely to continue to be a risk going forward. It’s not even clear whether the favor of the Chinese government for an industry is necessarily a plus, as overcapacity in industries targeted by the Chinese government, such as EVs and solar panels, have hurt profitability for many of the companies involved. On the other hand, this isn’t actually a new risk in China and the falling return on capital and quality scores for Chinese companies already reflect the impact of the government’s past decisions here. We currently view those impacts as decent proxies for the potential regulatory risk going forward and are not making a further adjustment. (9)

In the case of U.S. value, we haven’t been able to come up with obvious structural changes that will impact the group going forward, but it’s always possible that we are missing something. Honestly, the most striking thing that has changed the value/growth axis in the U.S. has happened not in value at all, but on the growth side, with the growth group’s very high concentration in mega caps. There is nothing that requires the largest stocks to be growthy definitionally, and indeed some mega caps briefly scored cheap on traditional valuation metrics by late 2022. But if we live in a “winner-take-all” economy in which only a handful of companies will make the lion’s share of the profits, this is probably a bad thing for value as such winners are more likely to be growth companies, and the process of profit concentration will help their profit growth even if it occurs in sectors that aren’t growing all that fast. While we see rising concentration across several industries in the U.S. and globally, that has been going on for quite a while and has yet to show up in the profitability of value relative to the market. Also, as the mega cap winners have become ever more dominant across the global economy, those companies face tightening restrictions on their behaviour by regulators worldwide. While history suggests that such anti-trust activities are unlikely to massively damage the franchises of such companies, it does seem likely to interfere with their ability to dominate further areas of the economy, which would probably be necessary for them to continue to grow at substantially above-market rates.

Step 4: Conclusions

Small caps are not the young dynamic group of stocks they were 30 years ago due to falling numbers of IPOs in the U.S. In China’s case, in addition to the structural issue of high investment rates, there are geopolitical and regulatory risks that are hard to quantify but should not be ignored.

Conclusion

We’ve covered a lot and it is easy to lose track of the big picture here. Putting it all together in a table helps to clarify what we’ve learned.

U.S. large value generally looks to be in the green. Large value stocks are very cheap versus their history, and we haven’t seen any changes to their return on capital or quality that would warrant the fall they have experienced. Their underlying fundamental returns have continued to be positive. Those fundamental returns have admittedly been disappointing on a market capitalization weighted basis over the last few years, although they have been much better on an equal-weighted basis, as we discuss in Appendix A. We believe the equal-weighted performance is probably a better guide to future prospects than the market capitalization weighted performance, given the extremely strong and probably unsustainably good performance by the mega cap growth companies. An indefinite continuation of a winner-take-all bias across industries would almost certainly be a problem for value on a market capitalization weighted basis, but the economy has been through multiple cycles of consolidation and its reverse over history, and value has weathered them all, fundamentally speaking. Even the recent extremely strong outperformance of the mega cap growth names didn’t actually drive the fundamental returns for value negative. Any hint of mean reversion in mega cap performance looks likely to give value the opportunity to see strong rebalancing gains of the type we would expect with such a wide discount for value.

Caution strikes us as warranted for U.S. small caps. They are very cheap versus their history and their underlying fundamental returns have been good. But it does look as if a decent portion of their fall in relative valuations has been warranted due to falling profitability and deteriorating quality, making them significantly less undervalued than they look. They also are not the young dynamic group of stocks they were 30 years ago. Where we are buying U.S. small caps, we are very focused on the higher quality companies, whether exclusively in our Small Cap Quality Strategy, or with a strong bias toward quality in our U.S. Small Cap Value Strategy. Since higher quality small cap stocks have not seen the same deterioration as the group as a whole, we think they are less risky than the overall small cap group and are thus a better buy.

Stating the obvious, of our three also-ran groups, China has the most red flags for investors. It is decently cheap today, but sustainable strong returns from here will require important changes to the Chinese economy and the fundamentals of Chinese companies. We wouldn’t make the case for asset owners to divest from the country, but investors who are coming in on the assumption that its poor past returns are setting it up for success would be well advised to recognize important risks to that scenario.

1 fund mentioned