Bellbottoms and the Nifty Fifty

It was the 1970s - ‘72 to be exact, and apart from Gough Whitlam coming to power in Australia, Watergate in the US, and bellbottoms everywhere, it was the height of the Nifty Fifty (not to be confused with the Nifty 50 Index of India stocks). The idea that investors needed only to buy 50 of the most popular growth stocks and hold them forever.

Plenty bought in and with good reason, with the index including names such as Xerox, IBM and Coca-Cola - all with proven growth records and continual increases in dividends.

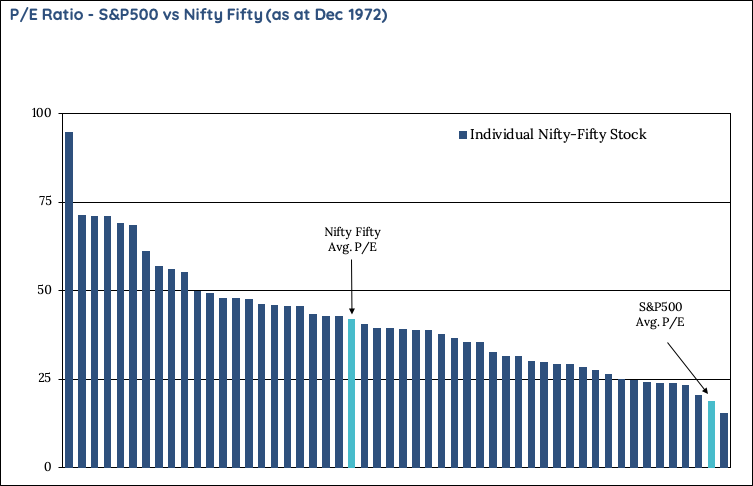

However, at their peak in 1972, the Nifty Fifty traded at 41.9 times earnings, more than double the S&P's then average of 18.9x.

Source: AAII Journal October 1998

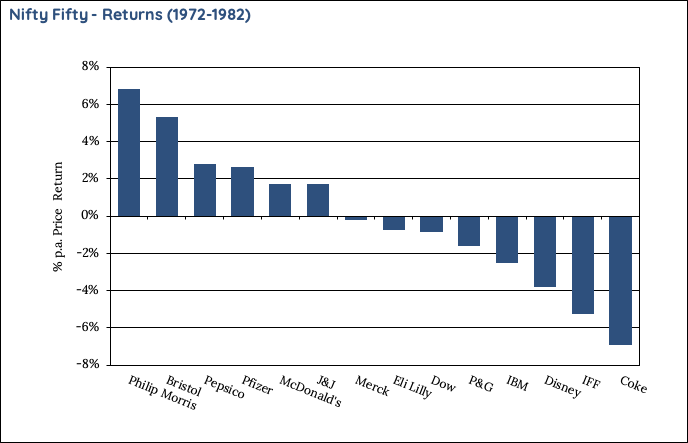

Two years later, the same year President Nixon resigned, those investors who had bought in 1972 had lost 60% of their investment. While they were mostly still good companies, for some of them such as Coke, Disney and Merck they still hadn’t recovered their price 10 years later. By then bellbottoms were also out of favour.

Importantly inflation averaged around 8% p.a. throughout this period, further highlighting the extent of real wealth that was destroyed.

Source: Bloomberg, AAII Journal October 1998

So what drove this lacklustre 10 years?

A combination of factors was likely at play including geo-political tension, inflation, rising interest rates (peaking at 19.1% in June 1981) and a series of oil shocks. These factors are arguably all at play today for those buying the index.

As I’ve written before, the current S&P 500 FAANMGs are dominating and therefore skewing the overall performance of the index, with an average P/E of over 44x, against just around 26x for the index – and 23x for the index excluding the FAANMGs. In addition, the environment today for a period of inflation, even minor is the strongest in decades.

If any of these factors from the 1970s take hold, those that have bought in recently might have a long wait to recover their investment.

3 topics