Ben Griffiths: The one thing that needs to happen to confirm a new major bull market

It hasn't been an easy quarter for investment markets. But luckily, for investors and finance journalists alike, markets move quickly.

As Eley Griffiths Group's Ben Griffiths explained, the Bank of Japan announced a surprise hike in interest rates which prompted an unwind of the popular yen carry trade (where investors borrow in yen and deploy their cash into higher-yielding foreign currencies). 60% of yen short positions were covered during this unwind. The Japanese stock market sold off 16% in response to the move.

Meanwhile, the US Bureau of Labour Statistics released softer-than-expected employment numbers, with several economic commentators swearing that the Sahm Rule was coming to fruition (a recession confirmation signal based on the rate of change in unemployment), Griffiths said. Bond markets rallied and stock markets retreated, but by the second week of August, the share market had recovered and continued to rally into the Federal Reserve's 50 basis point rate cut in September.

Then several Chinese agencies announced economic stimulus to encourage the country's 5% growth target. Chinese and Hong Kong-listed stocks rallied, as did local resources stocks, at the news, he added.

Locally, the August reporting season was mostly ahead or in line with analyst expectations - despite an environment of rising costs.

"Investor sentiment shifted from indifference in the wake of reassuringly soft inflation in early July to being overwrought in response to slowing US payroll data in August and weaker construction activity updates in September," Griffiths said.

"The market sell-off from August 1 would prove cathartic for investors with bad news actually being bad news, a reckoning evidenced by an aggressive deleveraging across financial assets in several markets."

All in all, global markets have had a surprisingly strong year. The S&P/ASX All Ordinaries has lifted around 20% over the past 12 months, while the S&P 500, the FTSE, the Nikkei 225, and the Shanghai Composite have soared 36%, 12%, 23%, and 10% respectively.

As Griffiths explained in his latest The Encyclical update, the world's major global share indices have now closed the September quarter more or less at all-time highs, despite some wobbles in the quarter.

So, what needs to happen for investors to feel comfortable that this truly is a new bull market? Griffiths believes that the AUD/USD cross rate is at a watershed moment, with either a binary stall or rally on the horizon.

"Technical support from the COVID lows has been rock solid and the perennial short futures positioning has been unwound to highlight a neutral stance from professional investors," Griffiths said.

"The Aussie dollar will need to close convincingly above $0.6905 to confirm the commencement of a major bull campaign."

For context, the AUD is currently worth $0.6644 US dollars.

In this wire, I'll outline some of the major lessons Griffiths distils in his latest The Encyclical update, as well as why this market rally could be supported from here.

.jpg)

Technical summary

Griffiths believes that most of the US market's indices are conforming to their 100-day moving average, indicating the market remains in an uptrend. In addition, investment sentiment is tracking above average but remains shy of euphoria. It also helps that the "presidential cycle" effect is chiming in with its positive influence.

Back in June, Griffiths predicted that we could see investors move away from the top 10 mega-cap tech companies, as the "law of large numbers" begins to take effect.

"New stock leaders will be sought out from sectors whose earnings begin to recover from depressed levels. Materials/energy, healthcare and industrial sectors might be where the hunting is best," he predicted in June's The Encyclical.

"The de-concentration (rotation) process once underway historically runs for multiple years."

Griffiths now believes this process may have commenced, thanks to the "extraordinary" relief rally across Chinese stocks and global materials (most of which has been funded by the sale of previously outperforming banks and finance stocks. Small caps have also outpaced their large peers post China's stimulus announcement.

"Take a look at how constructive the chart of the Shanghai Stock Exchange 50 A-Share Index is," Griffiths said.

"A support line originating from 2005 has survived repeated tests along the way, including early in 2024 and again this month. The Williams % R oscillator clearly highlights the oversold condition (highlighted below in green), enhancing the set-up for patient investors."

Meanwhile, the Aussie share market lost some ground in early August before making a recovery and is now trading at all-time highs.

"The ASX Small Ordinaries looks bullish and is now marginally outperforming the ASX 20, a situation unthinkable heretofore. Small caps have work to do before they can reclaim the highs of early 2022," Griffiths added.

Commodities

Griffiths noted that futures positioning in the gold market remains extended - with new highs almost a daily occurrence throughout the quarter.

"At the time of writing, upside momentum appeared to be abating and US$2685/oz safe from a fresh challenge," he said.

"Gold equities appear fatigued and in need of consolidation. A ten-month-long rising wedge suggests investor torpor might reasonably result in lower prices for gold stocks."

The price of silver has also lifted in step with increased futures positioning.

"The journey through to the historic high of US$49.50/oz was always going to involve whipsaws and not without misadventure. This is how the script is currently playing out," Griffiths said.

Meanwhile, the Bloomberg Energy Index (made up of several oil and gas contracts) broke down during the early weeks of the quarter and since then, price action has been "unconvincing".

Outlook

Quoting the late German economist Rudi Dornbusch, Griffiths notes that, "In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could."

With the US Federal Reserve cutting rates by 50 basis points, and then China announcing stimulus three days later, Griffiths believes the outlook for risk assets, such as stocks, is "unequivocally positive".

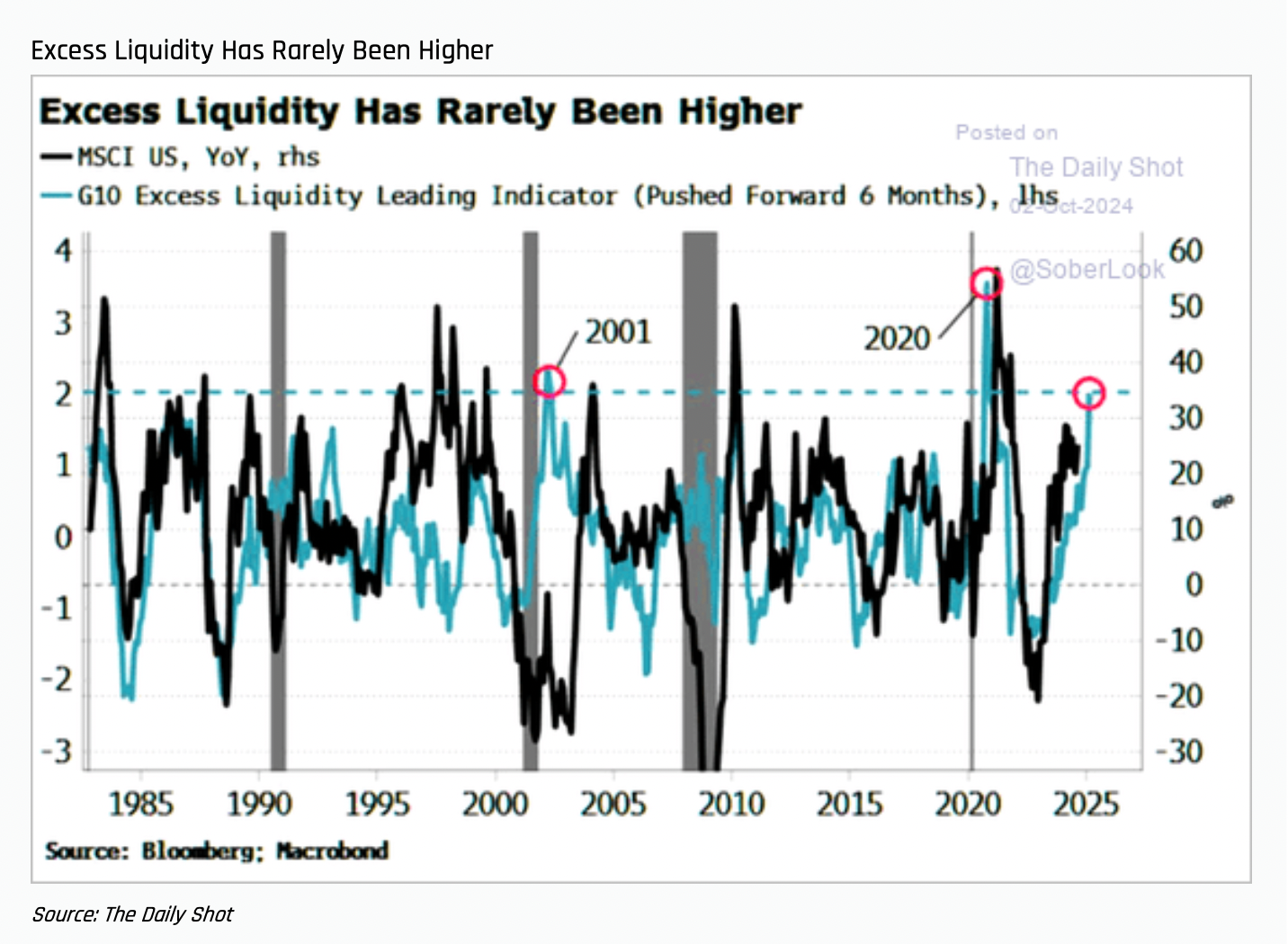

This is especially powerful when viewed alongside increasing financial market liquidity and benign credit spreads, he adds.

"Liquidity is the lifeblood of markets and right now it is providing a significant underpinning to markets," Griffiths said.

"A recent Bloomberg/Macroscope commentary by Simon White reminded investors of the simple Marshallian K principle that market liquidity is the final product when economic growth (nominal GDP) is deducted from Monetary Supply growth (M1)."

Below, you can check out White's chart which highlights the recent positive momentum in US markets thanks to liquidity being at levels last seen in 2020 and 2001.

Monetary supply growth typically contracts during rate hikes and rises during easing cycles, with increased bank lending adding to the measure, Griffiths explained.

"Economic multipliers then do their thing in this environment of reducing rates and investors need to be alert to what this might mean for market dry-powder and its effect on short-medium term equity prices," he added.

Find a full version of the 'The Encyclical September Quarter 2024' here.

4 topics

1 contributor mentioned