Beware of a cyclical sell-off

Are stock prices in a bubble that could be pricked at any time – either by rising interest rates, a rapid end to central banks' monetary stimulus or some other external shock (and few would discount the latter given what's happened since last March)?

The “bubble” calls were almost deafening after the rapid rebound that followed last year’s sell-off. They’re still there, but three Aussie reporting seasons later – February saw company earnings overwhelmingly beat expectations and a return of dividends; last month’s results were, broadly speaking, more balanced but still positive – they’re far quieter.

In part two of this three-part series, I asked a few fund managers what they think of stock prices now. Are valuations better or worse than they were a year ago, and where are they headed over the next 12 months?

Though such questions are often met with an “it depends” answer, they each gave solid responses. Two of the three believe we can expect a pullback in share prices over the next year or two – largely because of an impending fall in cyclicals – and the other has a surprising view on the mining boom. Read on to find out what they said.

Stocks are cheaper than they were, but…

Bruce Williams, executive director and portfolio manager, Elston Asset Management

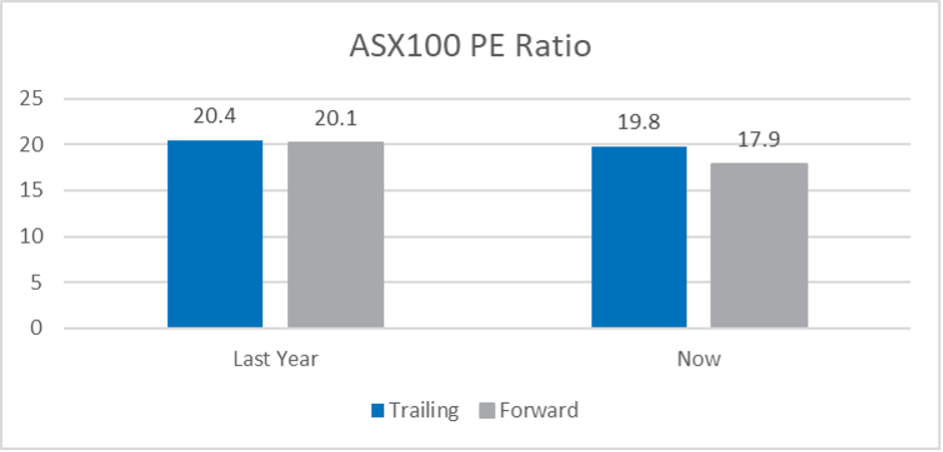

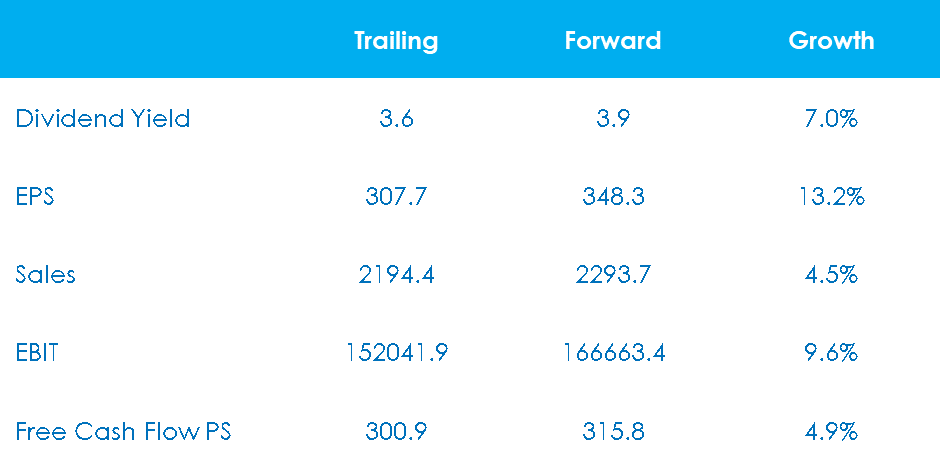

The market is less expensive than it was a year ago, as earnings rebounded on a combination of both strong revenue growth and good cost control.

Source: Elston Asset Management

It is worth noting that you cannot take these broad-based metrics at face value. The impact of the large iron ore miners is embedded within these numbers, where very high prices for their main commodity leads them to look inexpensive at a time when they are reporting inflated earnings. In our view, it is unlikely that this tailwind will be repeated, and cycling such strong earnings will be incredibly difficult.

The performance of the banks also had a big effect. They received a large bounce in profitability from the reduction in bad and doubtful debt provisions, which is not generally a recurring event.

We don’t expect a significant change in valuations over the next 12 months, as the COVID skews and particularly monetary support are likely to remain in place. But we think it is unlikely we’ll see further broad-based multiple expansion from these levels and that further gains must be driven by earnings growth – return expectations should be tempered accordingly.

Looking at our three-year-plus horizon, these points feed into our bias toward bond yields increasing from current levels.

There will also be differing contributions depending upon the sector. The COVID winners will struggle to repeat their stronger earnings, while COVID losers should continue their recovery. It is worth noting that this is broadly expected by the market, so is reflected in their valuations.

Across all sectors, there are pockets of cost inflation coming through. One of the best examples of this is in supply chains – businesses in shipping, warehousing and transport. As such, we are actively seeking inflation protection through our portfolio holdings, particularly in their customer contracts. An example of this is Brambles (ASX: BXB), which includes input cost recovery mechanisms in its contracts.

Write-off the miners at your peril

Emanuel Datt, founder and principal, Datt Capital

Valuations vary widely across different sectors. Some we consider quite overvalued, for example, the travel sector, especially given the lack of physical travel that is occurring. Looking at Qantas (ASX: QAN), its shares are still trading a very hefty premium, in contrast to the real-world conditions where planes just aren't moving effectively. And this effect also extends down to the travel agents, like Webjet and others.

On the other hand, we're seeing sectors like coal and other commodities, where companies are absolutely minting money in this price environment, and we think they’re being materially undervalued by the market. There are always sectors that are in vogue and others that aren't, despite what the fundamentals indicate.

Over the next 12 months, to maintain these current valuations in expensive sectors, we expect continued monetary stimulus by the governments, to keep the markets and liquidity flowing. I think the government has made the decision and there’s also probably a moral obligation to support the economy as we come out of these current restrictions, so I'm not expecting there to be an immediate stop. I think it will be a gradual tapering off over the next two to three years. That should bode well for the market, assuming that you are invested in the right sectors.

In terms of the sustainability of this buoyant commodities sector, ultimately, commodities are a scarce resource. Despite the push towards clean energy by governments worldwide, the fact is that you need fossil fuels and other dirtier energy resources just to build the capacity in the first place.

And on the demand side, that’s going to increase over the next five to 10 years, while we expect supply to contract due to the difficulty of permitting new mineral resource developments. For example, in NSW we’ve seen that approvals for new coal mines are very difficult to get over the line.

Our investment selection and focus on broader themes are driven by the supply and demand fundamentals, the transition in the energy mix and what the government is trying to achieve.

Beware of a cyclical sell-off ahead

Chris Demasi, co-founder portfolio manager, Montaka Global Investments

We generally avoid trying to predict 12 months ahead, but we might see a selloff in some of these reopening stocks – the cyclicals and value stocks as many people categorise them. But I also said that at the end of last year, just before we went through a period of huge excitement about economies reopening after all the shutdowns and the “fits and starts” of 2020. There was a lot of anticipation and expectation that manifested itself in expectations for earnings growth, which has in turn seen PE multiples expand in these types of stock.

And that’s why we don't focus on those short-term market rotations, because picking which stocks were oversold, or maybe overbought, in any period is quite difficult.

The market is forward-looking and has already priced in that expectation; that reversion to the mean has already played out. To the extent that investors are willing to pay ever-higher multiples, this means they’re expecting share price growth to catch that up.

The 100% or even 50% earnings growth that you’ll see from some of these companies over the next year won’t repeat – that would require a replay of what happened last March when they really sold off. That’s why we instead look at paradigm shifts, those large trends that are playing out.

Some marketplaces can continue to grow 30%, 40% and 50% or more. For example, you’re still seeing that in China today and that's much more exciting. That's how earnings can compound over a long period of time and investors can make multiples of money.

The structural growers trading at a fraction of their multiples look attractive to us – now and for years to come. For example, when we look at cloud computing, digital advertising, or at some of these new markets that are being opened up by Tencent or Alibaba in China – except for the regulatory noise that's happened there – these are the types of markets that are growing at a healthy double-digits year in, year out. Not because they're re-basing, but because there's a change in the way people live, how businesses operate and the uptake of technology facilitating that. It’s a paradigm shift, not just a reversion to the mean. That can last so much longer and can be more powerful and valuable.

Parting thoughts

In my background research on this topic, I discovered some interesting recent research into one of the most famous bubbles of recent history: the global financial crisis. In the context of the US housing market, Gabriel Chodorow-Reich, a Harvard economist, suggests the sub-prime mortgage boom and bust perhaps wasn’t a bubble after all. He suggests the fact that US house prices have continued rising since the great bust of 2007-2008, now far higher than they were then, points to the fundamental underpinnings of the pre-GFC boom. But this view is far from universally accepted, with many including GMO’s Ben Inker refuting it.

Who knows – maybe there’s more substance to the current stratospheric stock price levels than many of us suspect? This possibility doesn’t give much comfort to those of us trying to figure out where markets are headed – if bubbles are this hard to predict in hindsight, and even the experts are undecided, what hope do we mortals have of clearing out before they pop?

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified of the upcoming entries of this series. In part one, the three fundies reveal whether they’re bulls or bears. And in part three, they will provide a short watch-list of stocks they plan to buy if the market sells off again.

3 topics

2 stocks mentioned

3 contributors mentioned