Beyond ChatGPT: How big tech is changing lives (and fortunes)

In the same way Amazon is so much more than a retail company, so too are healthcare companies more than flasks and petri dishes.

Investors wanting exposure to artificial intelligence (AI), for instance, will be doing themselves a disservice if they restrict their investable universe to pure plays.

Today's leading healthcare companies leverage elements of AI, automation and machine learning to deliver the best drugs, care and, ultimately, patient outcomes.

Dr Bianca Ogden, portfolio manager for the Platinum International Health Care Fund, is at the coalface of this transformation. And she's been there for some time.

I recently had the opportunity to sit down with Ogden to learn more about the changes afoot in the healthcare sector, the companies she's most excited about, the outlook for M&A, and biotech theme she'd "bet the house on".

Tech nexus

Drug discovery is at the edge of the technological envelope within healthcare.

"Where I look in particular at artificial intelligence, automation and machine learning is in drug discovery," says Ogden. "How can you, for example, design experiments using machine learning? A lot of that really comes down to the quality of your data and where the data comes from, how you source it."

It's not about designing a drug by the computer. It's more about reducing timelines to come up with molecules that are optimised, so you don't have to screen hundreds, you can reduce it to around 20.

Three companies Platinum owns that leverage the elements above include Exscientia (NASDAQ: EXAI) in the UK, Recursion (NASDAQ: RXRX) in the US and a smaller Canadian company called Absci.

"These are at the forefront of the combination between biotech and tech because it's another issue to meld the cultures of the two - computer/data scientists and 'drug hunters'. They think quite differently and these companies have managed that really well."

Recursion is focused on imagery and mapping biology, and has recently made an interesting deal with Nvidia (NYSE: NVDA) to work together. Nvidia itself has quite a significant healthcare division.

IPOs are just the beginning of life in the public eye

Platinum does invest in IPOs, but they're particular about how they do it.

Namely, there needs to be an investment roadmap post-listing.

"One of the key things for us is that an IPO is really just the start of public life for a company."

You need to know where investors are coming from in the next couple of capital raises a company may need to do. To us, that's absolutely key, and so we pay close attention to who the next investor base is.

Platinum is more likely to invest in overseas IPOs, and here opportunities are starting to present themselves.

"Particularly in the US, we are seeing solid management teams, a clear path to next-round funding and really strong insider support of those raises. The books are very tightly controlled to make sure investors are there for the long term. That's very important to us."

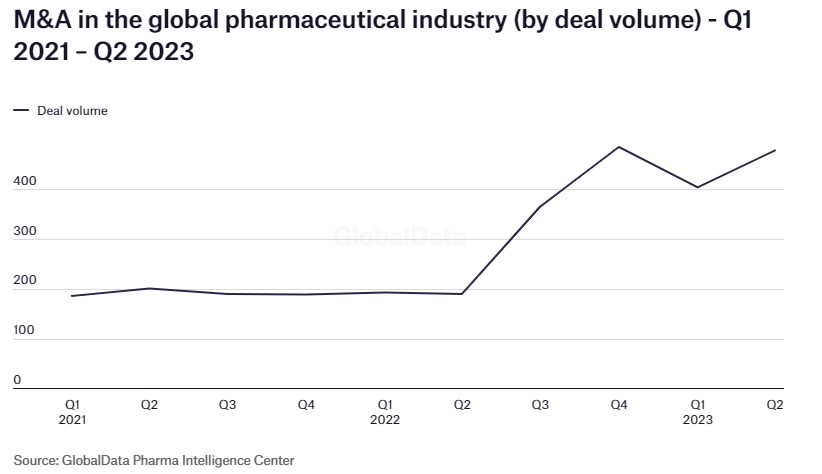

Let M&A do its thing

Think of mergers and acquisitions (M&A) in healthcare as the cart, not the horse.

"M&A is part of what happens," notes Ogden. "In the end, usually the good companies will get acquired."

Biotech is the engine of innovation in healthcare.

"That's where the excitement is and pharma knows this; all pharma companies have venture capital arms.

"Big pharma companies like Merck and Sanofi have to diversify at some stage because of patent cliffs, so they will need to make acquisitions, and the competition now is much stronger. Merck (NASDAQ: MRK), for example, most recently spent over $11bn on acquiring Prometheus Biosciences. We were fortunate to invest in this company in its IPO in 2021."

"Bet the house on" this healthcare theme

Drug discovery is one area of healthcare that's ripe for disruption. And machine learning is driving that disruption.

"Pharma have to embrace these tools coming from computer science. It's not going to happen tomorrow, but we're seeing companies like Roche (SWX: ROG) who work with Recursion, Sanofi (NASDAQ: SNY) who work with Exscientia, start to think 'how can we make this better?'"

On the other side, you see biotechnology companies, emerging tool companies, trying to do things slightly differently. For example, in manufacturing, they are making bioprocessing better, getting better yields out of less starting materials and moving overall towards making more with less.

Beyond machine learning, Ogden still believes neurology, neurobiology and neurodegeneration is a big theme. It's a difficult space with longer lead times.

"[But] we now have an antibody commercially available for Alzheimer's disease, for instance. We look more at biomarkers to improve patient screening.

All of these things come together slowly. People need to remember it doesn't happen overnight in this space. Long-term investors like us take advantage of downturns and gradually build positions.

Biotech is recalibrating

Biotech has had a few quite difficult years, but companies are now reprioritising cashflow, and what they do with it.

Ogden divides biotechs into emerging tool companies and therapeutics.

"There are a lot of interesting emerging tool companies out there and some really focus on preserving cash and going to cashflow positive situations," she says.

"We're seeing a focus on gross margins and we're also seeing highly regarded senior executives moving from big companies like Danaher (NYSE: DHR) and Thermo Fisher (NASDAQ: TMO) to smaller companies to take them to the next level, either via an IPO or trade sale."

The therapeutic side, meanwhile, is refocusing.

"Clinical data is looking quite good, we're seeing M&A happening, which has always been part of this sector, and things are slowly getting better. We're also seeing reverse mergers. Overall, it's healthier. We're not there yet if you look at gene therapy, but we're going in the right direction."

Companies are run by people, and healthcare's no different

One of the things that always fascinates Ogden is the human side to these companies.

"We had a meeting with Roivant Sciences (NASDAQ: ROIV) the day they announced their data for a particular asset. There were balloons at reception and many happy faces. This is a company that has a strong business development team, who licensed the asset from Pfizer, after having closely watched it for some time."

Once Pfizer was ready to sell, Roivant was right there to buy and develop it, and then they had this positive result.

It's such a big deal and you sometimes forget the hard work that goes into it a new drug. I think that's something a lot of people don't think about because they just see stock prices.

For more information about Dr Ogden's strategy and the companies she invests in for her portfolio, please select below:

Disclaimer

Platinum Investment Management Limited ABN 25 063 565 006 AFSL 221935 trading as Platinum Asset Management (“Platinum”). While the information in this article has been prepared in good faith and with reasonable care, no representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates, opinions or other information contained in the article, and to the extent permitted by law, no liability is accepted by any company of the Platinum Group or their directors, officers or employees for any loss or damage as a result of any reliance on this information. Commentary reflects Platinum’s views and beliefs at the time of preparation, which are subject to change without notice. Commentary may also contain forward-looking statements. These forward-looking statements have been made based upon Platinum’s expectations and beliefs. No assurance is given that future developments will be in accordance with Platinum’s expectations. Actual outcomes could differ materially from those expected by Platinum. The information presented in this article is general information only and not intended to be financial product advice. It has not been prepared taking into account any particular investor’s or class of investors’ investment objectives, financial situation or needs, and should not be used as the basis for making investment, financial or other decisions. You should obtain professional advice prior to making any investment decision. You should also read the latest Platinum Trust® product disclosure statement and target market determination before making any decision to acquire units in the funds, copies of which are available here.

4 topics

8 stocks mentioned

1 fund mentioned

1 contributor mentioned