BHP disappoints across the board, but this fundie is still bullish

Ultimately, commodities businesses can't turn water into wine. They are inherently tied to the commodity cycle. They'll typically perform well when commodity prices are up, and vice versa.

But that doesn't mean commodities companies can't generate relative performance throughout the commodity cycle.

Such is the case with BHP Group (ASX: BHP).

The Big Australian copped a 37% slump in underlying profit to $US13.4 billion, as it attempted to reassure investors on the earnings call that iron ore prices are unlikely to fall below $US80 ($125) a tonne amid softening demand in China.

"We’re going to see cost curves in a number of different commodities lift in the short-term," says Joe Wright from Airlie Funds Management. "Which again, favours a business like BHP which sits at the bottom of the curve, particularly in copper and iron ore."

In this wire, Joe gives us his take on the Big Australian. As you'll see, despite the tough operating environment, he remains a fan.

BHP Full Year Key Results

- Revenue of US$53.82 billion vs consensus of US$54.25 billion

- Underlying profit of US$13.42 billion vs consensus of US$13.68 billion

- Adjusted EBITDA of US$27.96 billion vs consensus of US$27.99 billion

- Net operating cashflow of US$18.7 billion

- Free cashflow of US$5.6 billion

- Net debt of US$11.2 billion

- Gearing ratio of 18.7%

Among ASX200 companies, BHP ranks 9th for Climate Risk Management, 10th for Culture & Conduct, 7th for Credibility, 8th for Effectiveness of CEO, 6th for Effectiveness of CFO, 7th for Leadership Depth, 9th for Operational Management, 6th for Earnings Quality, and 5th for Value via MarketMeter research.

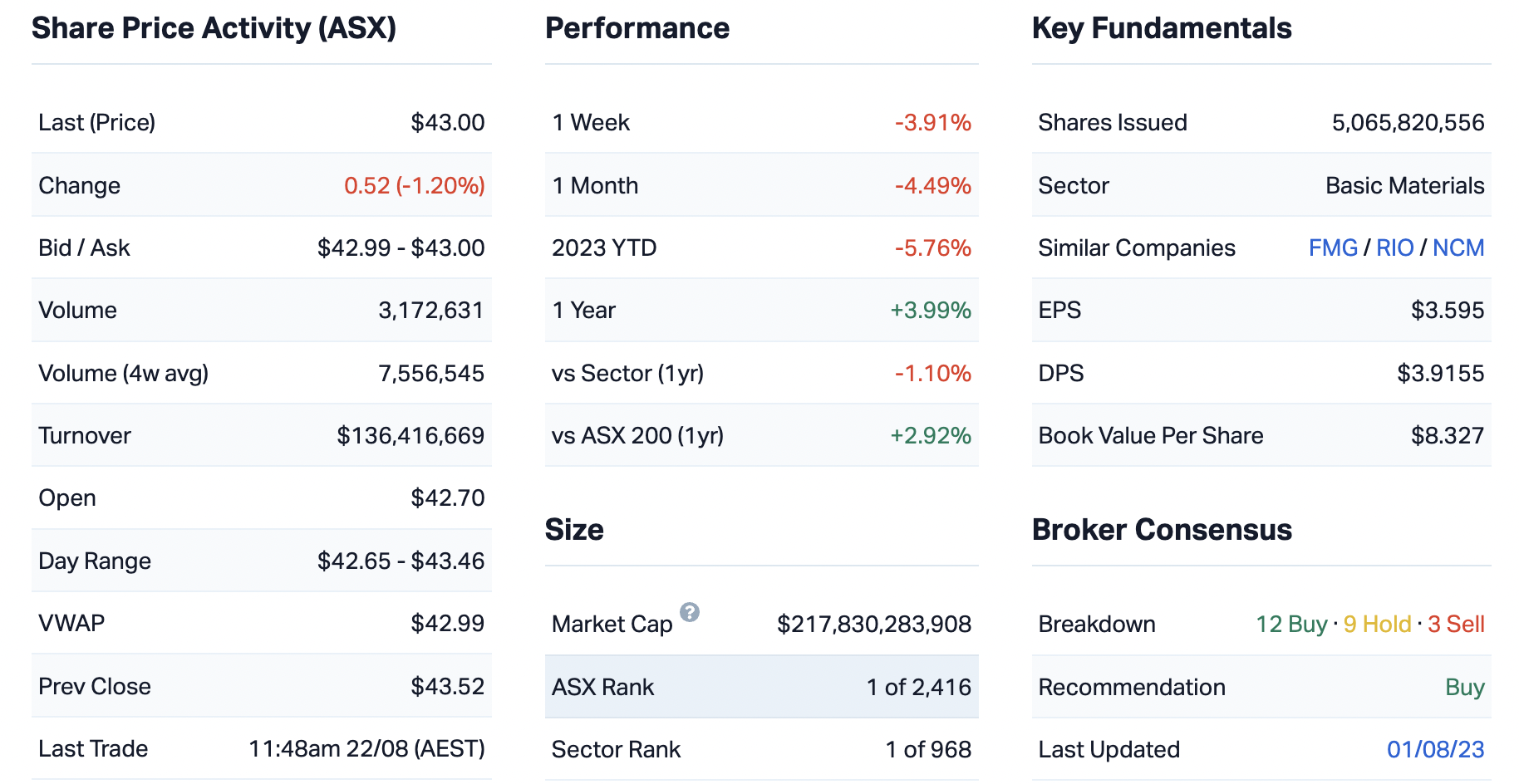

Key company data

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

Relatively in-line from a profit and balance sheet perspective in terms of expectations. Ultimately, though, they have great assets, they’re long duration, at the right part of the cost curve, which means they continue to deliver attractive returns, even as commodity prices came off through the year.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

Rating: Appropriate

The stock is off about 1%. I’d say that’s appropriate. They lifted some cost guidance, both for FY24 and the medium-term. While that’s negative in absolute, it speaks to the industry-wide challenge of cost inflation. We’re going to see cost curves in a number of different commodities lift in the short-term. Which again, favours a business like BHP which sits at the bottom of the curve, particularly in copper and iron ore.

Were there any major surprises in this result that you think investors should be aware of?

The main surprise was probably the lifting of the medium-term cost guidance. Not that it was completely unexpected, but it’s a key change. They also continue to be bullish about the new South Australian copper province, which you’d hope considering they’ve just spent $10 billion on OZ Minerals (ASX: OZL). Some more information as to exactly how they’re going to integrate those assets and create synergies was a positive.

Would you buy, hold or sell BHP on the back of these results?

Rating: HOLD

It’s a high-quality resource company that continues to generate attractive returns through the cycle. The iron ore business is at the bottom of the cost curve and the copper business is world class and keeps growing.

What’s your outlook on the sector? Are there any risks to this company and its sector that investors should be aware of?

For BHP the expectation is they continue to deliver from an operating perspective – controlling what they can regarding costs, maintenance investments etc.

The key risk is always the commodity price. BHP’s profit is inherently tied to the strength of the Chinese economy and in particular the residential sector over there.

But again, having assets at the bottom of the cost curve mitigates those risks.

What is the dividend outlook?

It’s a commodity stock. To treat it as a stable yield stock wouldn’t be fair. But given the strength of BHP’s assets and their duration, they do have more flex than other resources companies with more financial leverage.

Ultimately this dividend is going to move around as commodity prices move. BHP made the comment on the call that they will not prioritise the dividend over attractive growth projects, which is the right thing to do for a commodity company. You’ve got to invest to grow production and keep your operating cost base stable. Inherently that should lead to more attractive dividends during periods of commodity strength in the future.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious about the market in general?

Rating: 3

It doesn’t feel like the ASX as a whole is particularly cheap or expensive. What I would say is we’re getting excited about businesses that historically are high quality fundamentally, but have had a slip up on operating performance and that’s creating opportunities. And I think there’s a few good examples of that in the market at the moment.

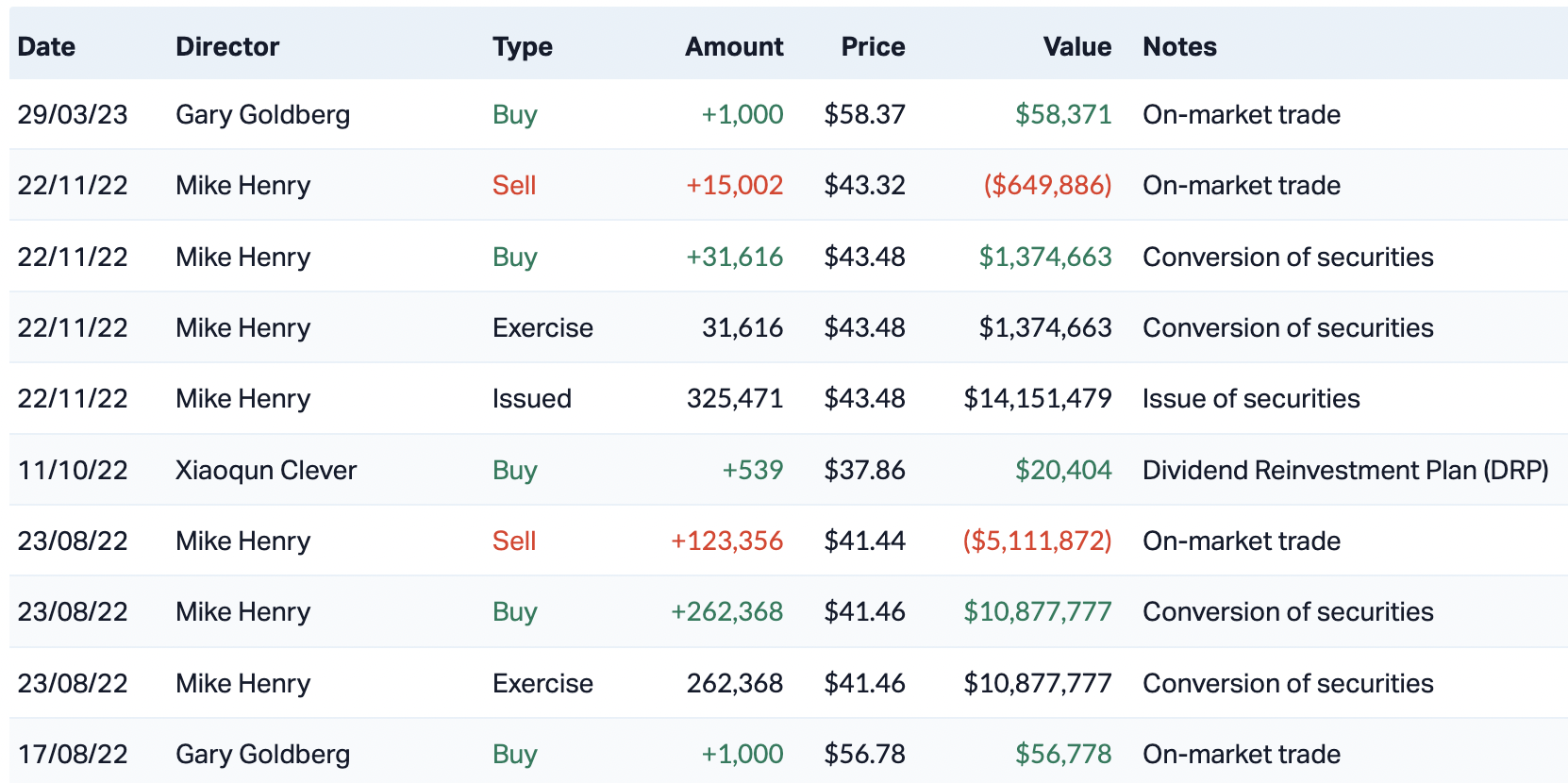

10 most recent director transactions

Catch all of our August 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

3 topics

2 stocks mentioned

1 contributor mentioned