Bitcoin LIC is a "golden goose" at war

As Geoff Wilson prepares to go to 'war' with his latest LIC (his "preferred investment vehicle" according to the WAR prospectus issued on Friday), the world's biggest Bitcoin LIC is currently waging its own war. It's going to lose this one.

The Bitcoin LIT earning $756m a year

One of the "stats incredible" pickups of the year was by ETF.com this week, where they highlight that the Grayscale Bitcoin Trust (ticker GBTC) earns revenues of US$756 million per annum off a US$36 billion asset base at a whopping 2% p.a. fee. Those revenues are nearly as much as the US$1 billion Vanguard earns from all of its 82 US-listed ETFs combined, with nearly US$2 trillion of assets. GBTC is truly the Golden Goose of Bitcoin products. This Golden Goose, however, is having its eggs scrambled by the recent arrival of Bitcoin ETFs.

No longer the only game in town

GBTC is a closed-end listed investment trust (LIT) that for many years has been the only way for US investors, in particular, to buy Bitcoin through a traditional brokerage account. This scarcity value coupled with the meteoric rise of the Bitcoin price in the last 12 months has seen the assets under management of GBTC rise 10-times from US$3.5 billion a year ago to US$36 billion today. But something sinister lurks beneath the surface.

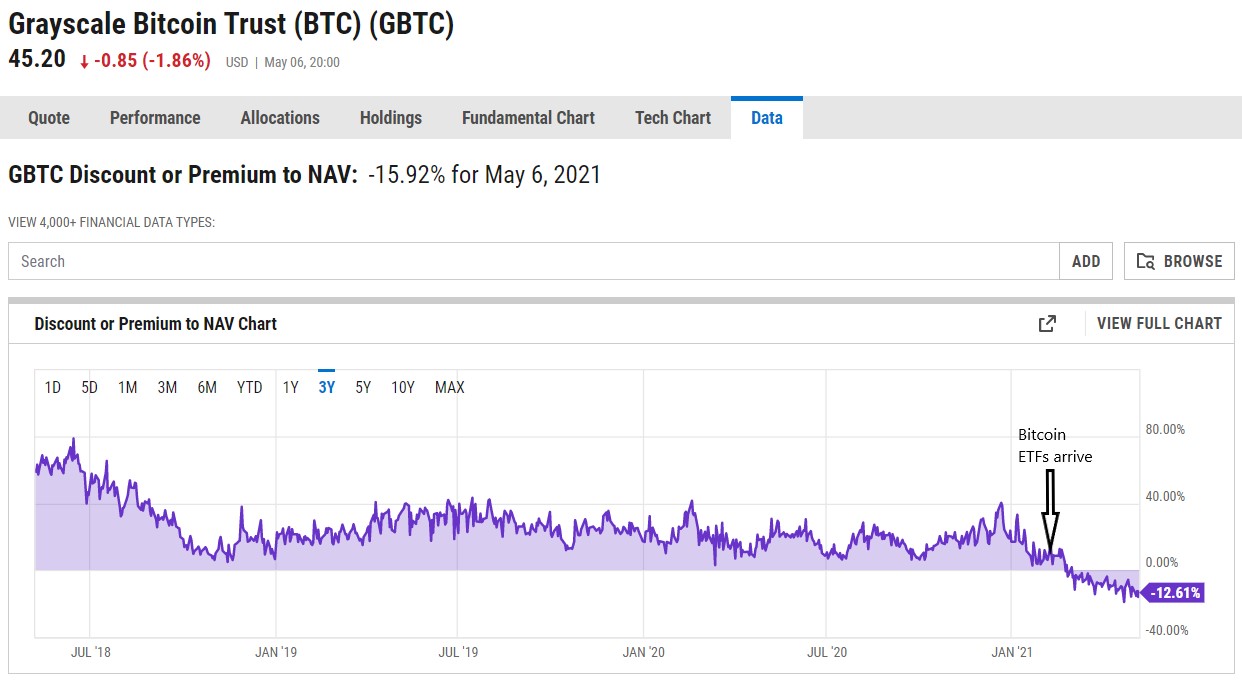

As with any closed-end LIC/LIT, readers will know that the share price of GBTC can trade at a premium or discount to its underlying NAV. While GBTC was the only game in town, it traded at a significant premium to its NAV as the chart shows. At times in 2018, this premium to NAV was as high as 80%. As recently as December 2020 during the recent Bitcoin mania, the premium was still 40%. Investors were seriously overpaying for their Bitcoin exposure paying this kind of premium to NAV.

In February 2021, this all changed, as the ETF industry went to war with this Bitcoin Golden Goose. The war kicked off in Canada with the listing of the first ETF that invests in Bitcoin, as we wrote about in this Wire at the time. These Bitcoin ETFs became an instant hit and the first Bitcoin ETF by Canadian issuer Purpose gathered nearly $1bn of assets in its first month. Investors loved the lower fees (1% vs 2%) and the fact that you could buy and sell at NAV (a hallmark of an ETF vs a LIC).

The GBTC share price almost immediately went to a discount to NAV as these ETFs arrived, and as of 6 May 2021, GBTC was trading at a whopping 16% discount to NAV, a stark reversal from the NTA premium only weeks before. The Bitcoin price has remained strong throughout this period so it's not a collapse in the Bitcoin price that has scared off buyers of GBTC. This is a strong indication that GBTC's scarcity premium has gone.

Where to from here

GBTC now has the classic LIC dilemma. It's tough to give up on the 756 million eggs the Golden Goose lays every year. As investors flee GBTC for cheaper and more efficient alternatives, because of the closed-end nature of GBTC, the assets don't leave the trust so the golden goose keeps laying those eggs.

If new buyers don't show up, however, as they gravitate to Bitcoin alternatives such as these new Bitcoin ETFs (this choice of alternatives will only grow when the US approves Bitcoin ETFs, likely in the next few months) the current NAV discount of GBTC is likely to persist.

While it is still early days, if GBTC is faced with a persistent discount to NAV, it may be forced to undertake some remedial action. Share buybacks, a cut in its fees or at the extreme, converting itself into an open-ended ETF may all be on the cards. Implementing some of these measures, as we've seen in the UK and Australian LIC markets, shows it's better to adapt than die....but the Golden Goose will lay fewer eggs.

Ironically, at a 16% discount to NAV, GBTC today could be one of the best ways to invest in Bitcoin. Buying $1 of assets for $0.80 is one of the rare opportunities that can exist with LICs and is one of the opportunities that exist in the Australian LIC market today, after an annus horribilis in 2019/2020. This investing in "discounted asset opportunities" is in the first sentence of Geoff Wilson's chairman's letter in the WAR prospectus. Perhaps WAR should go to war with the Golden Goose and buy some shares of GBTC.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics