Bond markets and opportunistic investments

Now that the US Federal Reserve (Fed) has lifted off zero interest rates, and the Reserve Bank of Australia (RBA) is expected to follow suit in 2022, I felt it would be helpful to provide our perspective and describe some of the opportunities we have been identifying in the market.

The three preconditions the RBA set for cash rate lift-off (unemployment close to 4%, inflation sustainably within the 2-3% band, and wages inflation above 3%) are likely to be satisfied within the coming six months. This has come at a time of heightened inflation, including an oil price shock, war, and a general ‘risk-off’ phase in risk assets like equities and credit. Conventional thinking would favour short duration or defensive strategies. Yet, amongst the volatility lies some great targeted investment opportunities by taking both interest rate risk and spread risk.

Bond investing is rarely about the direction of cash rates, but rather about what’s already priced in relative to how fundamentals may eventuate.

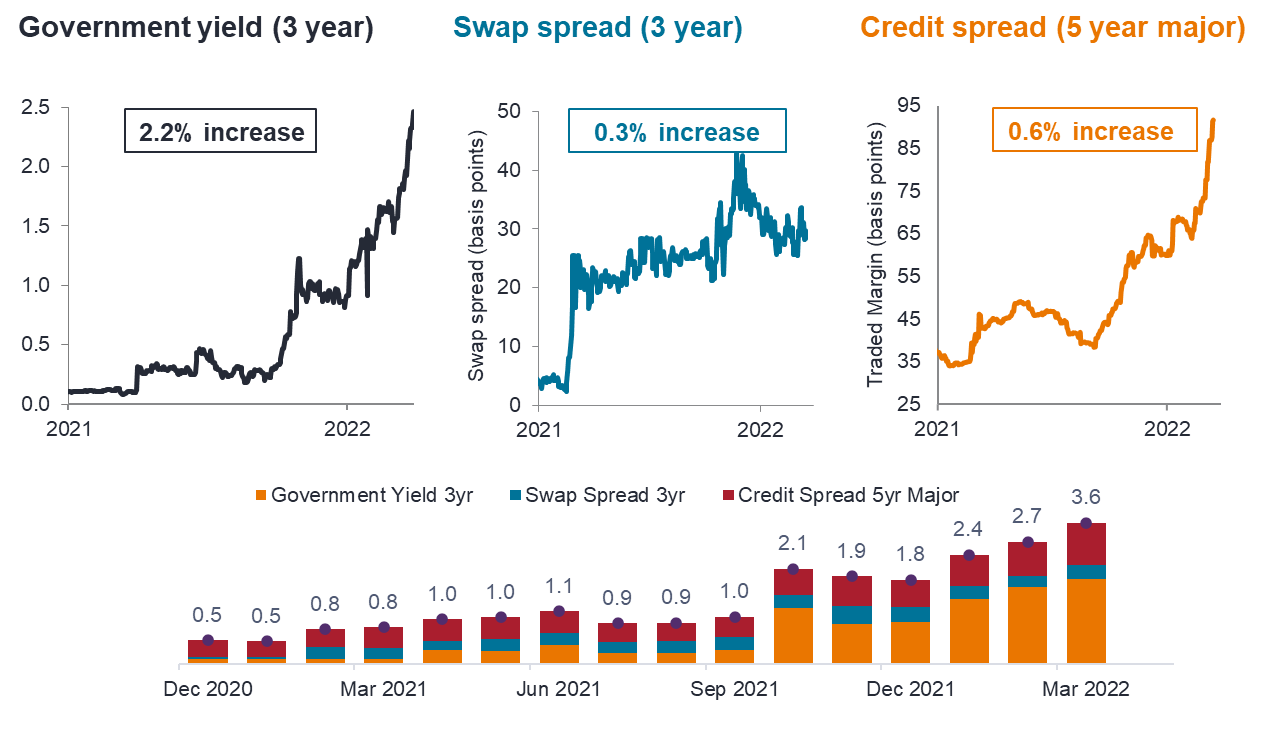

The recent lift in bond yields, swap spreads and credit spreads have, in our assessment, created a unique opportunity to effectively ‘lock in’ investor outcomes at reasonably attractive levels.

Put simply, a combination of these factors offers investors the ability to access circa 3%+ yields, with some upside from a total return perspective by combining three-year high quality (AA/A rated) senior financials (such as major banks) and three-year swap rates.

By contrast, just 18 months ago investors were piling into the same assets at all-in yields of around 0.5%. Much has changed and value has been restored within the Australian fixed interest asset class. While the potential exists for risk-free yields and credit spreads to rise further, our assessment is that the risks are asymmetric at present and provide investors some defence over a 12-month investment period.

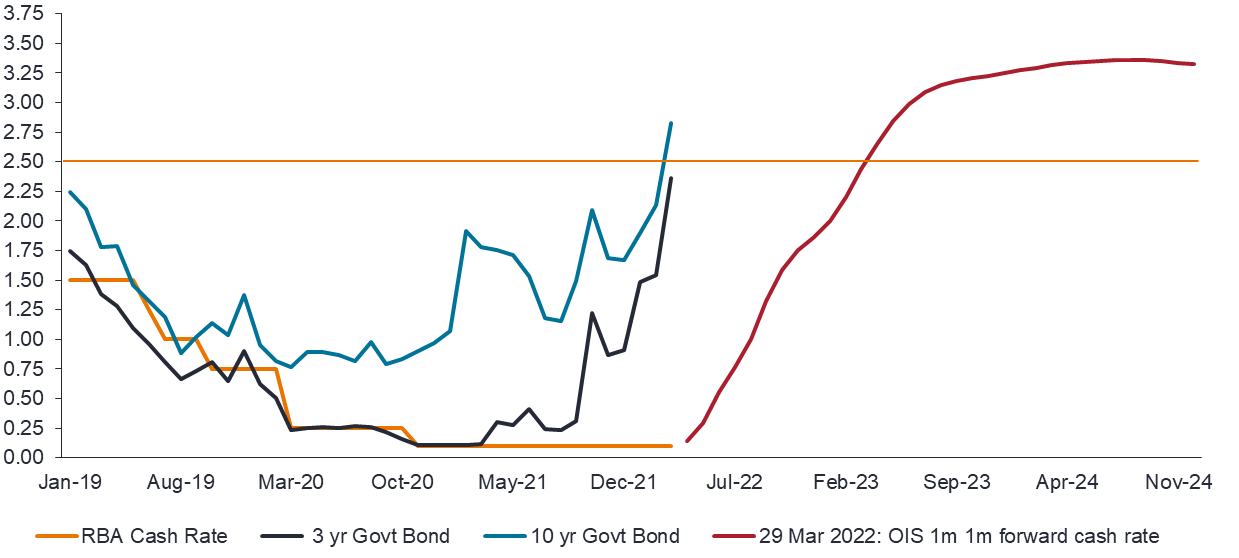

Market pricing of cash rate expectations

Markets have now fully priced in a cash rate of 1.75% by the end of the year and around 3% by mid-2023, well above most estimates of the neutral cash rate. This 300bps of tightening implies a rapid lift in the discounted standard variable mortgage rate to around 6% at a time when the majority of current fixed rates would have expired.

Labour market improvements and the receding grip of the pandemic suggest that the time is coming for the RBA to begin unwinding the 0.75% of 2020 emergency pandemic cash rate cuts. Given near-term cyclical inflation risks, we look for the RBA to lift the cash rate to 1% by the end of this year. Our view is that the economy can absorb such a move, but we suspect that market pricing for a 3% cash rate by mid-2023 is too much and risks tipping the economy back towards recession. The most likely scenario is one where the RBA removes policy accommodation gradually with the goal to extend, not end, the current cycle.

Therefore, in our assessment, there is a very real prospect that the full extent of current market pricing for the future path of cash rates isn’t fully realised. Further, we see the risk of another 100bps of tightening to a cash rate of 4.40% inside the next 36 months as remote.

Chart 1: Australian yield curve and implied overnight indexed swap (OIS) forward 1m cash rate (%)

Source: Janus Henderson, Bloomberg. As at 29 March 2022.

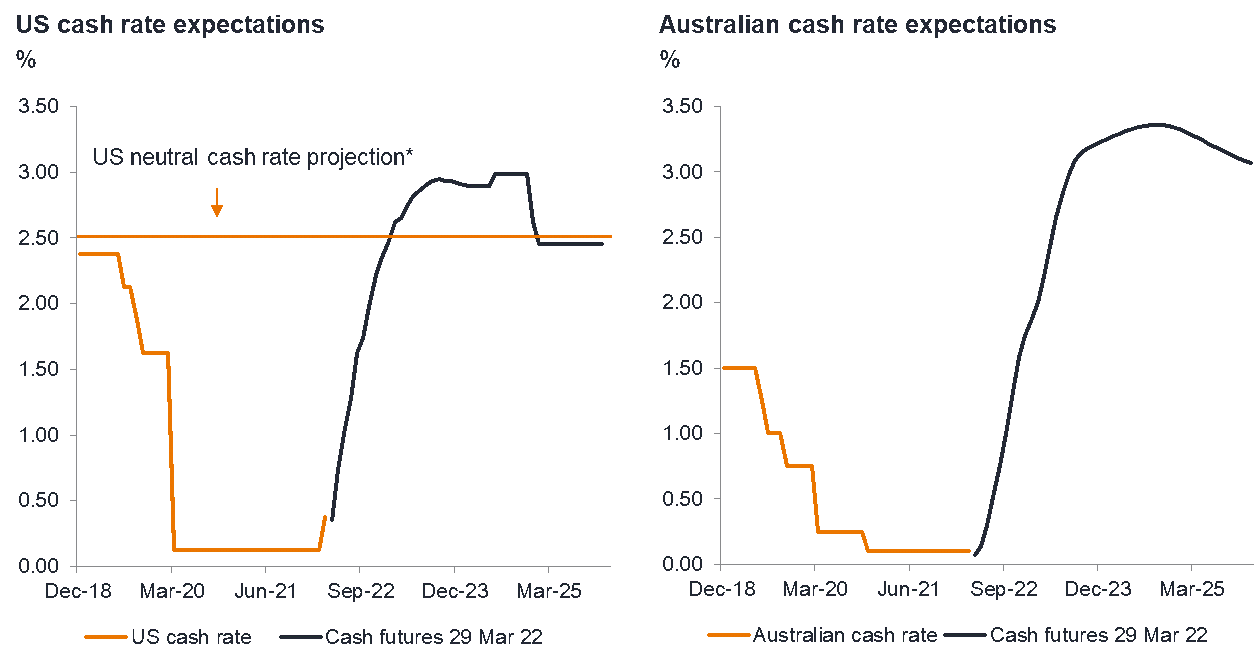

Given the differences in fundamentals between the US and Australian economies, it would also seem to us that perhaps US markets aren’t pricing in the full extent of cash rate rises and potential upside risks, while in Australia we have over-priced the tightening cycle.

Chart 2: US and Australian Cash Rate Expectations

The Fed gets the normalisation ball rolling, but markets don’t believe the RBA’s ‘patience’ stance.

Source: Janus Henderson Investors, Bloomberg, as at 29 March 2022. *US Federal Reserve FOMC projections.

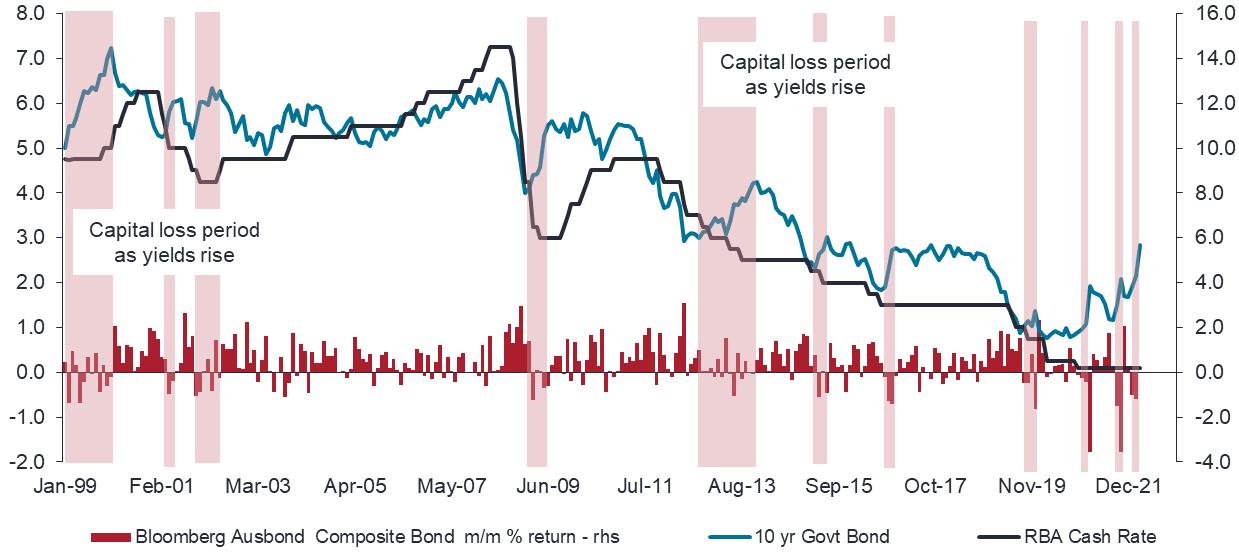

As a cross check, it is worthwhile reflecting on how bond markets behave early in cash rate tightening cycles. Typically, bond yields have peaked by or before the first cash rate lift-off. Further, bond yields tread sideways or retreat back down as the central banks’ tightening phase progresses. Chart 3 demonstrates this behaviour over previous periods.

Chart 3: Australian interest rates and sector returns (%)

Bond markets lead cash rates – Markets typically fully priced before first hike

Source: Bloomberg, monthly to end February 2022, spot 29 March 2022, Bloomberg AusBond Composite 0+Yr Index. Past performance is not a guide to future performance.

Much of the capital loss in bond markets from rising yields occurs before the first cash rate tightening, as represented in the shaded areas. Where markets overshoot or get it wrong, bond yields can fall more sharply, delivering capital gains.

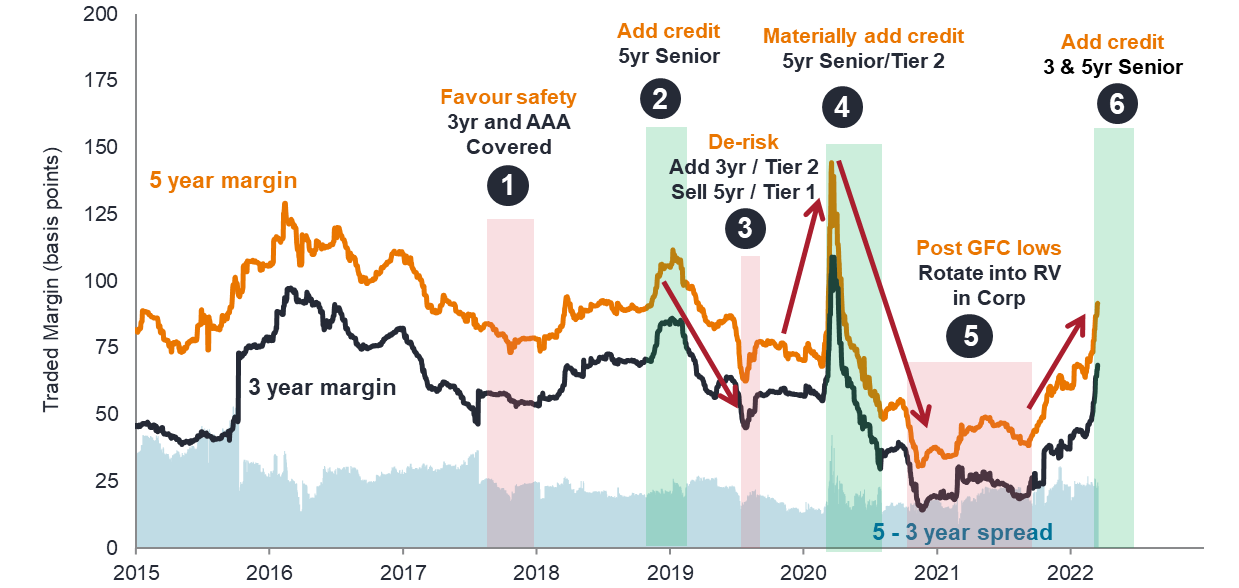

SENIOR FINANCIAL SPREADS

Following the unwinding of the Term Funding Facility (TFF) and monetary policy, as well as general risk-off period resulting from inflation/war, credit spreads have been driven wider. This has been more pronounced in senior financials, which have greater liquidity and primary market activity, leading to better price discovery and more contemporary mark to market valuations.

Chart 4: Australian major bank on the run margin

Source: Janus Henderson Investors, Bloomberg. As at 16 March 2022.

INVESTMENT OPPORTUNITY

Combining the above two developments of elevated bond yields / swap rates and elevated high quality senior debt spreads allows investors to access yields of above 3% with a carry, rolldown and potentially move (lower all-in yields) benefit suggesting possible total returns of 3-4.5% over a 12-month period.

The same combination of high-quality credit and swap rates just 18 months ago was yielding around 0.5%, with heavy investor demand at that time. Today, with a yield equivalent to 6X and a potential return of 6X to 9X, investors are wary. Market conditions of this nature create strong opportunities for active investors able to take well considered risks with conviction. These are not riskless ideas, nor are they free of opportunity costs, but on balance we feel this is a good risk-adjusted opportunity for investors, with potentially limited downside.

Chart 5: Government yields and credit spreads (%)

Source: Bloomberg, Janus Henderson Investors. Government yield, Swap spread, and Bank credit measured from 1 January 2021 to 29 March 2022.

As is evident in the chart above, the 'Great Normalisation' of monetary policy is swiftly restoring value within the fixed interest asset class. Our aim is to actively and opportunistically navigate this environment for investors, particularly given that the path back to normality isn't likely to be a straight one.

2 topics

.png)

.png)