Bonds blow up equity market – again

In the AFR today I write that for years we've argued that investors should not rely on the age-old assumption that fixed-rate bonds are a powerful equity hedge. We cited data showing that over the last 100 plus years, the strong negative correlation between fixed-rate government bonds and stocks was the exception rather than the rule, which only appeared in deflationary shocks, like the GFC.

Excerpt enclosed...

For much of our modern history, a positive correlation between fixed-rate (rather than floating-rate) bonds and equities has held, especially during inflationary cycles, which is where we may be heading. This is why there is merit in diversifying into floating-rate bonds with zero interest rate duration risk, which offer greater protection against rising interest rates than fixed-rate debt. Whereas a fixed-rate bond’s price declines when interest rates rise, the floating-rate security should not be impacted, holding all other variables constant.

The need for this protection will be pressing if policymakers are indeed successful with their ambitious goals of exhausting the persistent excess labour supply that has been evidenced since the GFC, and reigniting much stronger wages growth, which has been elusive in Australia.

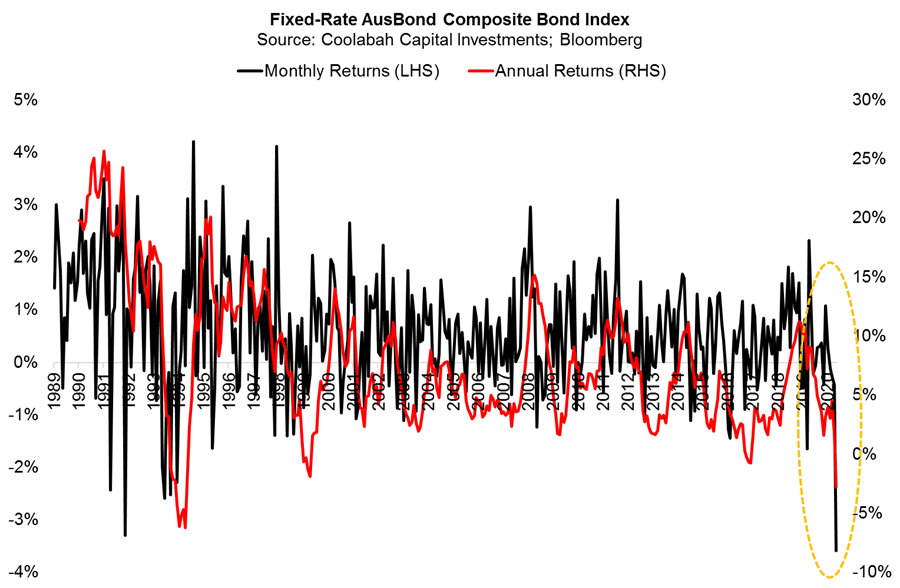

As was the case for a brief period in 2018 when 10 year government bond yields in the US surged above 3.2 per cent as a result of wages growth rising above 3 per cent, a positive correlation between fixed-rate bonds and equities has recently re-emerged. In February, the benchmark fixed-rate bond index, called the AusBond Composite Bond Index, suffered the single worst monthly loss since its inception 31 years ago, falling 3.6 per cent. Since their peak in mid-February, Aussie and US equities are also off about 4 to 5 per cent.

In contrast, the local floating-rate note benchmark, the AusBond FRN Index, was effectively unchanged in February (down only 0.02 per cent) while floating-rate ASX hybrids delivered a solid total return of 0.27 per cent.

The regime-changing increase in long-term risk-free rates has been driven by the predictable normalisation in expectations for global growth as we exit the pandemic care of the roll-out of effective vaccines coupled with the prospect of further fiscal stimulus in the US. And then there is some anxiety about an inflation outbreak, which presupposes a massive reduction in the US unemployment rate to less than 4 per cent.

This has seen the 10-year government bond yield in Australia jump from circa 0.7 per cent in October last year to 1.87 per cent at the time of writing. That means the long-term risk-free rate is now back to where it was in early 2019 when our unemployment rate was 5.0 per cent, notably much lower than the current 6.4 per cent level.

At that juncture, wages growth was also travelling at 2.3 per cent annually, or almost half the 4 per cent pace required to get core inflation back into the Reserve Bank of Australia’s target 2 per cent to 3 per cent band. Today, wages growth has been expanding at a record low 1.4 per cent. In the US, the jobless rate had to decline below 4 per cent before they generated decent wages increases above 3 per cent annually in 2018. While estimating exactly where "full employment" lies is a notoriously tricky exercise, the US experience may cause RBA governor Phil Lowe to wonder if we need a “3 point something”, rather than “4 point something”, jobless rate to stimulate similar earnings growth here. What Lowe knows with greater confidence is that this will take years to achieve. The lesson from the period since 2008 was that the RBA consistently struggled to reduce the jobless rate below 5 per cent with the consequence that wages growth remained anemic.

The normalisation of long-term risk-free rates to what are historically still very low levels (the average 10 year government bond yield in Australia since 2000 has been 4.3 per cent) will also likely be self-regulating. The RBA believes that the real "neutral" (or normalised) cash rate is probably around 0.5 per cent to 1 per cent. Add in 2-point-something inflation, and you get a neutral cash rate in nominal terms around 2.5 per cent to 3 per cent.

If the 10-year government bond yield reflects the market’s best guess of what that cash rate will be on average over the next decade, there would seem to be a ceiling on the reasonable upper-bound somewhere between 2 per cent and 3 per cent (assuming away liquidity and term premia, or compensation for interest rate and liquidity risk).

We are most of the way there today with the current 1.87 per cent yield. Sure yields could rise further, but the more they do, the more likely they will be forced to self-correct, as we saw strikingly in 2018. Higher long-term government bond yields mean loftier discount rates are used when pricing all assets. This is why we saw equities collapse in 2018 as discount rates soared. Rising government bond yields also directly impact the cost of borrowing for both the public and private sectors, which reduces incomes, demand, growth, jobs, wages and inflation. And interest rate volatility of the kind we are currently witnessing crushes animal spirits, or consumer and business confidence, as asset prices revalue downwards.

In 2018, US 10-year government bond yields rose from 2.4 per cent to 3.2 per cent in 12 months, smashing equities, and ultimately forcing bond yields back down to just 1.46 per cent within 12 months. We are observing these second-round effects right now. Equity valuations have started sliding. In the US, where most borrowers use 30 year fixed-rate loans, the nascent housing recovery, which is essential for resuscitating growth and inflation, is being threatened by a spike in home loan rates above 3 per cent.

Well before we see signs of inflation, fiscal policy is likely to have shifted into contractionary mode as the numerous temporary stimulus measures unveiled around the world, like our JobKeeper program, are unwound. This will be reinforced by efforts to fund the massive fiscal deficits globally through higher taxes on businesses and wealthier households, as President Biden is proposing. And the firmer the recovery is globally, the more likely counter-cyclical fiscal policy will be quickly brought to bear.

Markets tend to always overlook these second-order effects in the short-term. In March the world was coming to an end because of a global pandemic. Many supposedly smart investors thought this would precipitate a protracted period of pain for equities and credit. In truth, March was an amazing buying opportunity precisely because of the derivative policy response triggered by the pandemic. The key in March was not the first-order hit from the pandemic, but rather trying to anticipate how monetary and fiscal policy would be harnessed to combat it.

The truth is that both fixed-rate bonds and equities have both been overdue a correction. Ten year government bond yields were always going to gravitate back towards a neutral nominal cash rate as global growth normalised. And this higher discount rate was always going to be a problem for US equities in particular, which have been trading on an unusually high, cyclically-adjusted price/earnings ratio of about 35 times. If you look at the long-term performance of the S&P500 Index when it trades at such a high cyclically-adjusted p/e multiple, the probabilities are very heavily skewed in favour of negative returns over the next 10 years.

One final important lesson that can be drawn from the dramas of the last week has been the importance of liquidity. Or, put differently, the importance of not blindly chasing illiquidity risk to secure better returns. Credit Suisse has had to freeze US$10 billion of its managed funds that were astonishingly all invested in illiquid bonds issued by just one entity: Greensill. Greensill’s bonds were in turn backed by loans to businesses that were highly illiquid, which means they are not traded regularly, which makes them hard to price accurately. To make matters worse, Greensill had a very large exposure to one specific business.

This lack of liquidity is often appealing to investors because it means the bond/loan valuations do not change. Anyone holding illiquid loans or bonds in March 2020 could have told you that their assets were rock-solid because they did not suffer a mark-to-market loss, even though many much safer government and senior-ranking bank bonds fell in value during the month.

The truth is that illiquid loans and bonds are almost always illiquid because they have more complex, and often higher, risks than vanilla high-grade securities that are tradeable, and which do display higher price volatility because they are being properly marked-to-market on a daily basis.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 13 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch

2 topics