Brigette Leckie: Investing is like a patchwork quilt

Koda Capital is one of Australia's elite wealth management firms, charged with allocating over $11.5 billion of capital on behalf of high-net-worth individuals, family offices, and charitable foundations.

For the past decade, Brigette Leckie has played a pivotal role in shaping the firm's views on where the best opportunities lie across global asset markets. Leckie firmly believes that understanding the macro environment is the starting point for building an investment strategy.

And while it's not every day that investors like you and me get to pick the brains of an asset allocator with Brigette's experience. In this episode of the Rules of Investing, you'll get a front-row seat and learn how Brigette makes sense of the dynamics in global economies and what that means for investors.

With a new regime set to take office in the world's largest economy and Australia's largest trading partner, China, amid a generational economic transition, the macro environment requires careful consideration for investors.

Around the world with Brigette Leckie

Fresh off the back of visits to Europe and the United States, Brigette made these observations.

Europe: Better than the headlines and muddling through

- Traffic is everywhere (yes, worse than Sydney)

- A change in attitudes towards experiences over spending on goods persists.

- Restaurants and streets are buzzing, and with the exception of Germany, economies will continue to muddle along

- Manufacturing in Germany remains sluggish

United States: The gap is widening

- Inflation is real. Flights are at capacity, it's hard to get an Uber, and the streets are buzzing in many cities.

- The gap between the haves and the have-nots is widening.

- Politics remains highly divisive for families and corporations.

"I did see divisiveness in a couple of things I did see on the corporate side. So, for example, getting into a car and asking the driver what his views on the election were, and he said, "Company policy is we don't talk about the election or politics." So that surprised me," said Leckie.

China: Three significant issues to deal with

Leckie says that China has been letting market forces deal with three major issues in its economy, and she expects these will take some time to resolve.

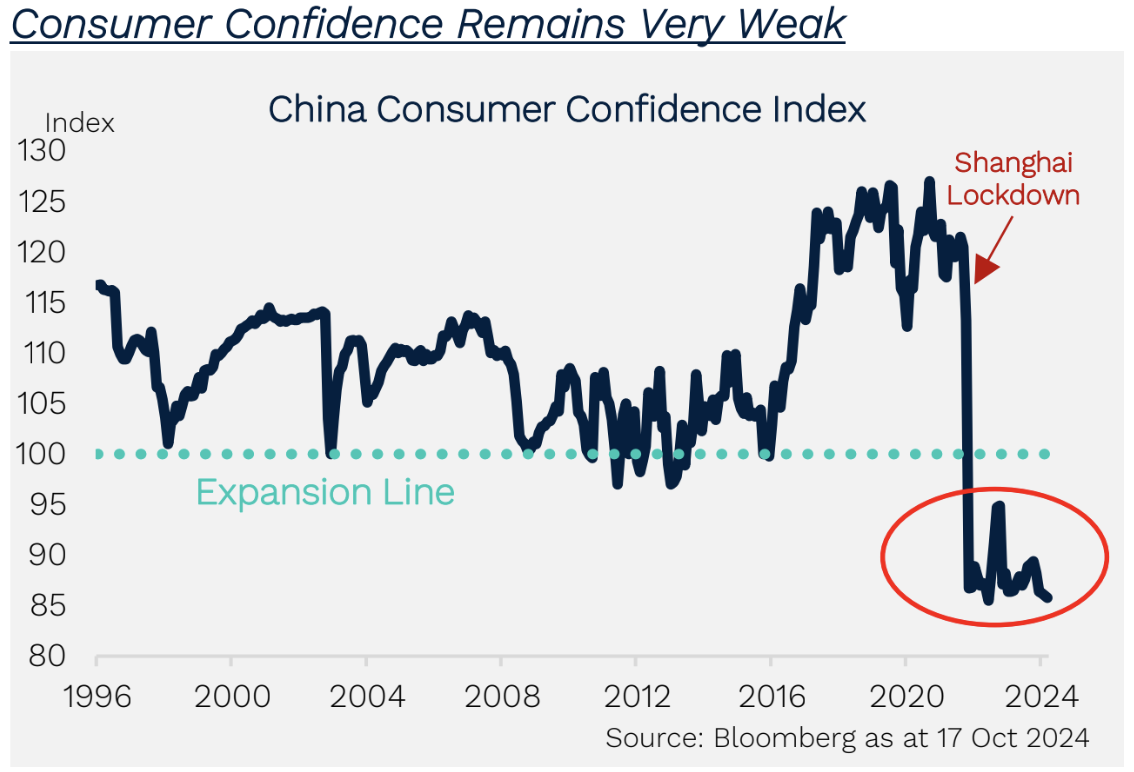

- Deflation: This remains an issue caused by excess capacity in the economy.

- Weak consumer: Consumer sentiment is fragile, creating a downward deflation spiral.

- Excesses of the property market: This is a well-documented issue that will take time to work through.

Historically, China's policy has been boom or bust. Leckie believes that a mindset shift has taken place, and the old approach is being replaced by genuine reform. The goal is to gradually turn China into a more consumer-based economy. A stronger China is good for global economies, especially Australia; however, we should not expect the boom days of the past to return.

So does macro matter?

Leckie emphatically believes that understanding macroeconomics is the foundation of good investment strategy and asset allocation. She cites the example of interest rates near zero or negative as a point in time when the macroeconomics was 'out of whack' and providing a clear signal. Developed market bonds were 'uninvestable' in her eyes—a call that has been vindicated in recent years.

Currency markets can also provide a signal. Most of the time, currencies trade in a narrow range, but there are times when they get to extremes. For example, the Australian dollar was worth less than US50 cents, and equally, it traded at parity. For globally diversified portfolios, these extreme moments matter.

Four points for asset allocation right now

Leckie says returns in recent years have been exceptional, and investors should be mindful not to extrapolate these into the future. Knowing what risk you will tolerate is easy to underestimate when markets are ripping higher. Leckie had these key messages for investors.

- Assume a higher cost of capital for the future. The regime of higher interest rates is entrenched and we're not going back to the days of easy money any time soon.

- Hold your conviction on big calls. If you have a strong foundation for your positions, you need to be willing to ride out short-term noise.

- Investors are too bullish on risk assets and should be cautious about expecting these returns to continue

- Diversification will be crucial over the period ahead. Investors must ensure their portfolios are properly diversified with uncorrelated investments.

To access the full episode of the Rules of Investing please click on the player below.

Listen and Follow

Time codes

- 0:00 - Introduction

- 1:45 - Views from the road

- 7:20 - Political fragmentation

- 8:27 - What’s the value of macro insights?

- 11:50 - The state of play in China

- 16:27 - Can risk assets continue to run post the US election

- 20:03 - Is US sovereign debt an issue for now?

- 22:13 - Australian economy

- 24:30 - Wrapping it up

- 25:17 - Three regular questions