Livewire Summer School: Build your ark before the flood

Investsmart

Recently a friend described investing over the past eight years since the GFC as investing for the journey. With the world economy currently enjoying a rare patch of synchronized growth, we’ve now arrived. That means it’s a good time to review your battle plan should markets become far less accommodative than they have been.

First, we must acknowledge that asset prices across virtually every market are either at fair value or significantly over-valued. As US investor Jayme Wiggins said in an interview last year in Value Investor Insight, ‘we think [US small cap] valuations today make those we saw in the housing bubble look tepid’.

If history is a guide, that means investing in passive strategies right now guarantees pygmy returns at best, and large losses at worst. Investing in an index fund or ETF that mimics the S&P500 was intelligent in 2008/2009 when valuations compensated you for the risks.

But whether it’s slow growing mature stocks whose best days are behind them, or fast-growing new wave stocks without much in the way of earnings, following the herd into passive funds that keep buying more of these overvalued stocks will end poorly.

The businesses themselves may be safe, but their current valuations make them dangerous for people that can least afford to lose money, which are usually the same people that are seduced by the perceived safety of passive strategies.

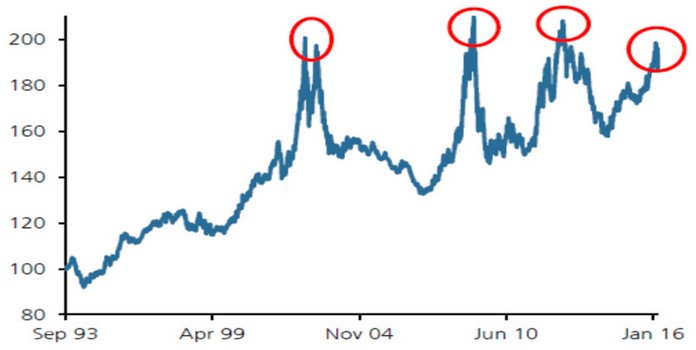

In fact, with a tidal wave of $725bn washing into US passive strategies in 2017 alone, the rebalancing of so many huge funds have added another major source of potential market volatility. You can see the ominous premium investors are prepared to pay for perceived safety in the chart of European stocks shown below.

Relative Performance of European high vs low quality stocks

Source: UBS

Avoiding yesterday’s winners is particularly important for Australian investors due to their large exposures to high-yield stocks, such as banks, infrastructure stocks and A-REITs, all being the prime beneficiaries of low interest rates.

Global healthcare stocks have also been huge winners, but their valuations already reflect heady growth and the benefit of a lower Aussie dollar. BHP and Rio Tinto’s earnings and dividends also remain susceptible to a credit rout in China.

The key point is that you must always be looking forward. What’s worked wonderfully for the past 25 years since the last recession may not be the correct strategy for the next decade. At best, you’ll need to accept far lower returns.

In overseas stock markets in particular, corporate balance sheets that were in excellent shape three years ago are being weakened by large share buybacks at overvalued prices funded with debt. It gooses earnings per share growth which, unsurprisingly, is usually a key element of management bonuses, but diminishes the company’s value and leaves it vulnerable to cyclical downturns and fresh competition. It’s the classic type of short-term thinking synonymous with market tops. Remember nothing changes in finance, only the participants.

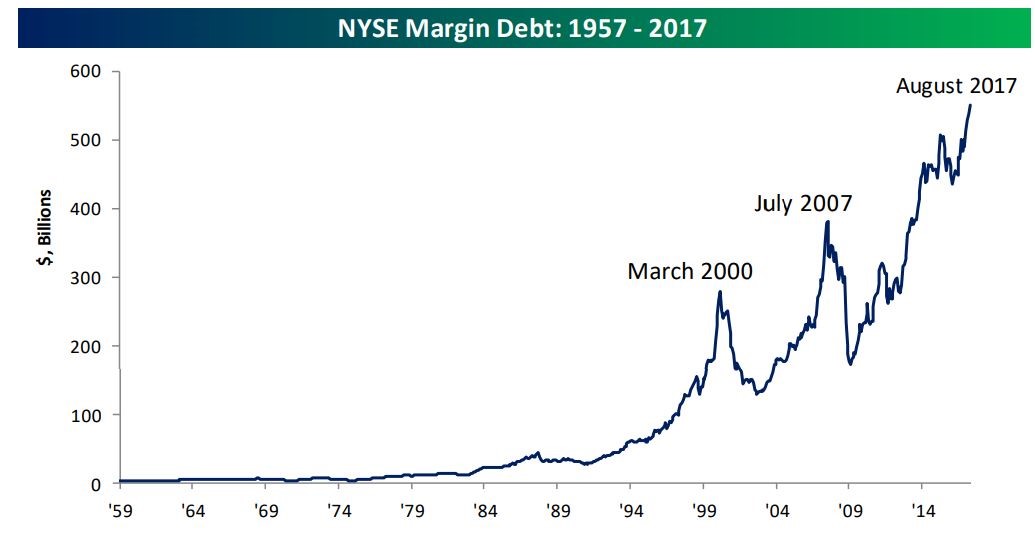

Lastly on the risks, US margin debt is making new highs. While this bull market doesn’t have a sense of euphoria about it (hence its billing as ‘the most hated bull market ever’), the facts suggest otherwise.

US margin debt

Source: MarketWatch

An intelligent approach

Fortunately, staying relaxed and away from trouble as an investor needn’t be complicated. First, favour active managers with long track records that have proven their ability to protect and grow your investment through many cycles.

Don’t be bothered if they’re holding some cash. You’re not paying them to invest in cash, rather you’re paying them to put it to work when the right opportunities come along, which is usually when other investors are running for the hills.

Unfortunately, research shows that if you wait for a major downturn to invest, you’ll likely wait until things have dramatically improved and valuations are much higher. Many of those same people are the ones that bailed out in 2009 and are now wondering how they’re going to live a comfortable retirement while Australian interest rates remain so low.

Eventually, volatility will increase from its current (near) record lows. That will produce more opportunities to buy low and sell high. Most ETFs and index funds don’t offer this ability, and will perform poorly in this environment. And while growth has outperformed for many years, the tide is turning toward value as investors recognise the risks of overpaying for even the best businesses. Temporary paper losses are one thing; permanent losses of capital are quite another.

Plan and act before the panic

Noah built his ark before the flood, and before the panic that followed. While markets are calm, now is the time to make sure your debts are manageable under all conditions.

Heaven help the poor lady in last year’s ABC Four Corners special on the housing market, who admitted she was lousy with numbers and couldn’t add up her three investment property loans that exceeded $1m despite her low income. I doubt she is alone in gambling her financial future on ever-increasing property prices.

Be careful about locking all your cash up in term deposits. Cash isn’t valuable for the measly interest it attracts, but rather for what assets you can buy at distressed prices when others are forced to sell for reasons unrelated to value. Cash is one of the most undervalued assets right now, but you’ll need instant access to it to realise the value.

Make sure you’ve considered your overseas exposure. When the Aussie dollar becomes a safe-haven despite our economy having the second highest consumer debt levels in the world and a possible property bubble, take advantage.

Our central bank is following the same playbook as the US, Europe and Japan, so having some overseas currency exposure will help maintain your purchasing power abroad. Australia is lucky to have a handful of overseas fund managers with excellent long-term track records.

Make volatility your friend

Lastly, make volatility your friend, and consider businesses that can increase your dividend income over time as they grow. It may mean forfeiting some income in the short-term, but it may work out better in the long run. There’s no point buying a stock that pays a 5% dividend today if it’s overvalued, as the capital losses will eventually consume the dividends and your precious savings.

Having a written investment plan will help stop you from making emotional (rather than rational) decisions if your finances come under pressure. But as a mentor once told me, if you’re going to panic, panic early.

Now is the time to build your ark and protect what you’ve got, stay flexible, stick to your plan and prepare, rather than try to predict and unknowable future. As Roman philosopher Seneca said, ‘Luck is what happens when preparation meets opportunity’, and the next great opportunity may not be far away.

Disclaimer

Peters MacGregor Capital Management Limited do not take into account the investment objectives, financial situation and advisory needs of any particular person, nor does the information provided constitute investment advice. Any information, material or commentary by Peters MacGregor Capital Management Limited is intended to provide general information only. Please be aware investing involves the risk of capital loss. Before acting on any advice, any person using the advice should consider its appropriateness having regard to their own or their clients’ objectives, financial situation and needs. You should obtain a Product Disclosure Statement relating to the product and consider the statement before making any decision or recommendation about whether to acquire the product. Past performance is not a reliable indicator of future performance.

2 topics

Nathan has over 20 years' investment experience. Before joining Peters MacGregor, he worked for 9 years at Intelligent Investor, including 4 years as a Portfolio Manager. Nathan is a CFA charterholder

Expertise

Nathan has over 20 years' investment experience. Before joining Peters MacGregor, he worked for 9 years at Intelligent Investor, including 4 years as a Portfolio Manager. Nathan is a CFA charterholder