Bullish on Gold? The case for bullion and gold ETFs over ASX gold stocks

In a research report released on Monday, Goldman Sachs stated something that has been a long-held hunch of mine: “Australian gold equities have in recent times broadly underperformed the gold price”.

I note Goldman’s use of the word “recent”, but this statement did get me thinking. If one is bullish on gold, is one better served by buying ASX gold stocks or by buying physical bullion? 🤔

I’ve always believed the latter, but I thought I’d better find some facts to justify my case!

Gold versus ASX gold stocks

The most obvious place to start is basic price performance. How have ASX gold stocks stacked up over the short and long term against the gold price?

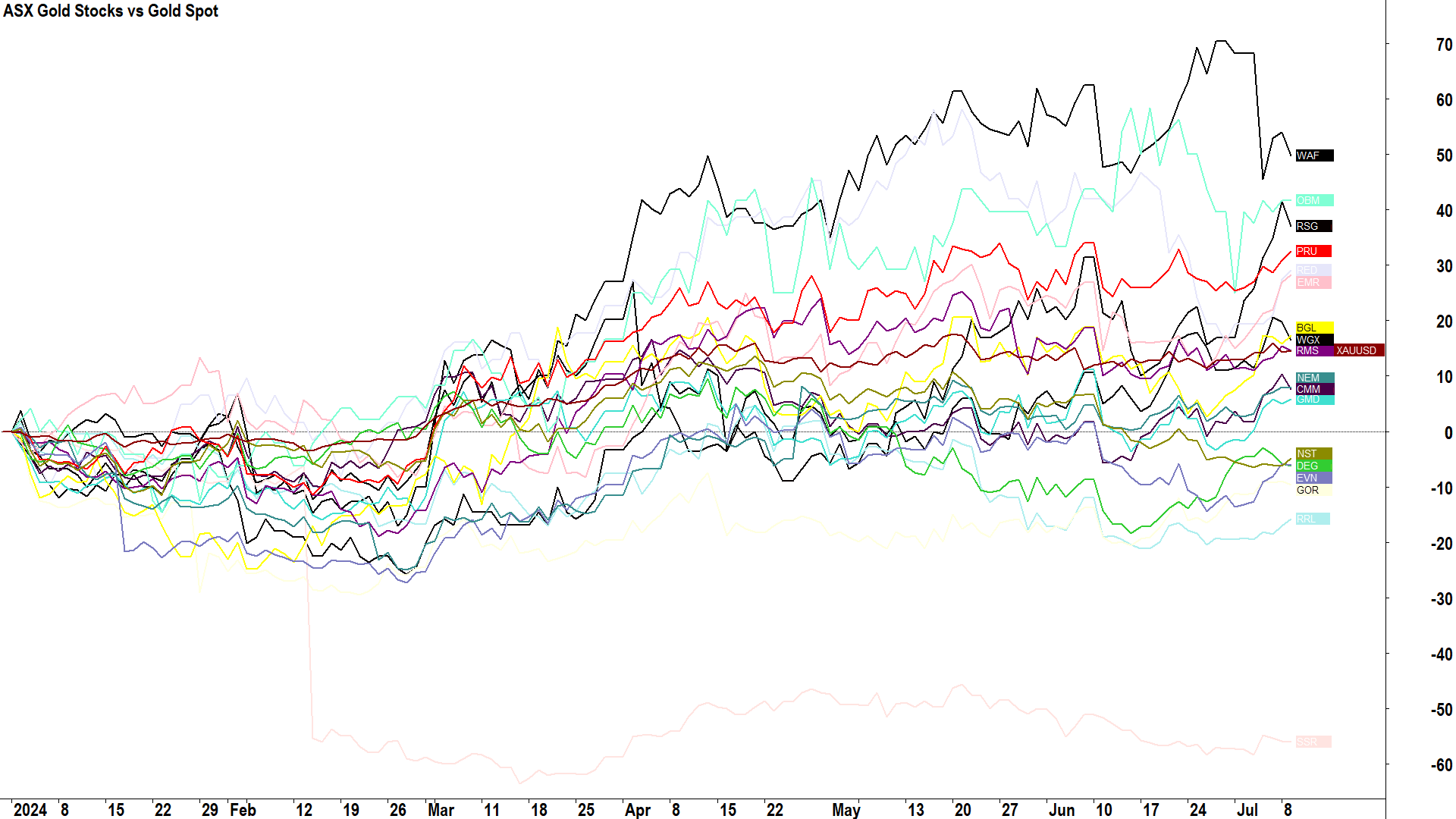

I could show you a chart like the one below that contains the 18 ASX biggest gold stocks by market capitalisation and the price of spot gold. I’ve plotted performance since the start of this year for starters.

Just 7 stocks beat gold’s 14.6% gain since the beginning of 2024, but to be fair, only 5 of these beat it by an amount I suggest is material: West African Resources (ASX: WAF) (+49.7%), Resolute Mining (ASX: RSG) (+37.1%), Perseus Mining (ASX: PRU) (+32.4%), Red 5 (ASX: RED) (+29.0%), and Emerald Resources (ASX: EMR) (+28.2%).

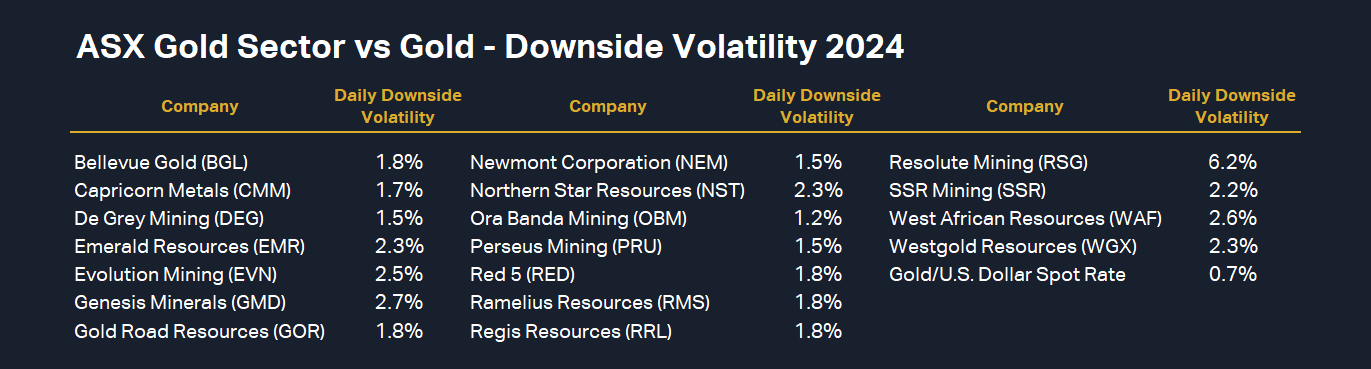

What’s the relevance of beating gold by a material amount? Well, there’s an equity risk premium one really must be compensated for when investing in ASX gold stocks. They typically experience more downside volatility than gold. We’ll talk more about this later, but for now, note the substantial difference in downside volatility of those same 18 ASX gold stocks versus gold since the start of the year.

So, for the most part, I suggest these two studies above validate my argument that ASX gold stocks consistently underperform the gold price on a risk-adjusted return basis.

But! I just heard you mutter:

But number 1: What about dividends?

But number 2: What about other time periods?

No worries, let’s do these as well!

ASX gold stocks aren’t renowned for their dividend yields. For starters, only 6 of the 18 currently pay a dividend (PRU, WGX, RMS, NEM, NST, EVN, and GOR), and none of them are presently showing a dividend yield greater than 2.4% p.a. (NST), with most around 1% p.a.

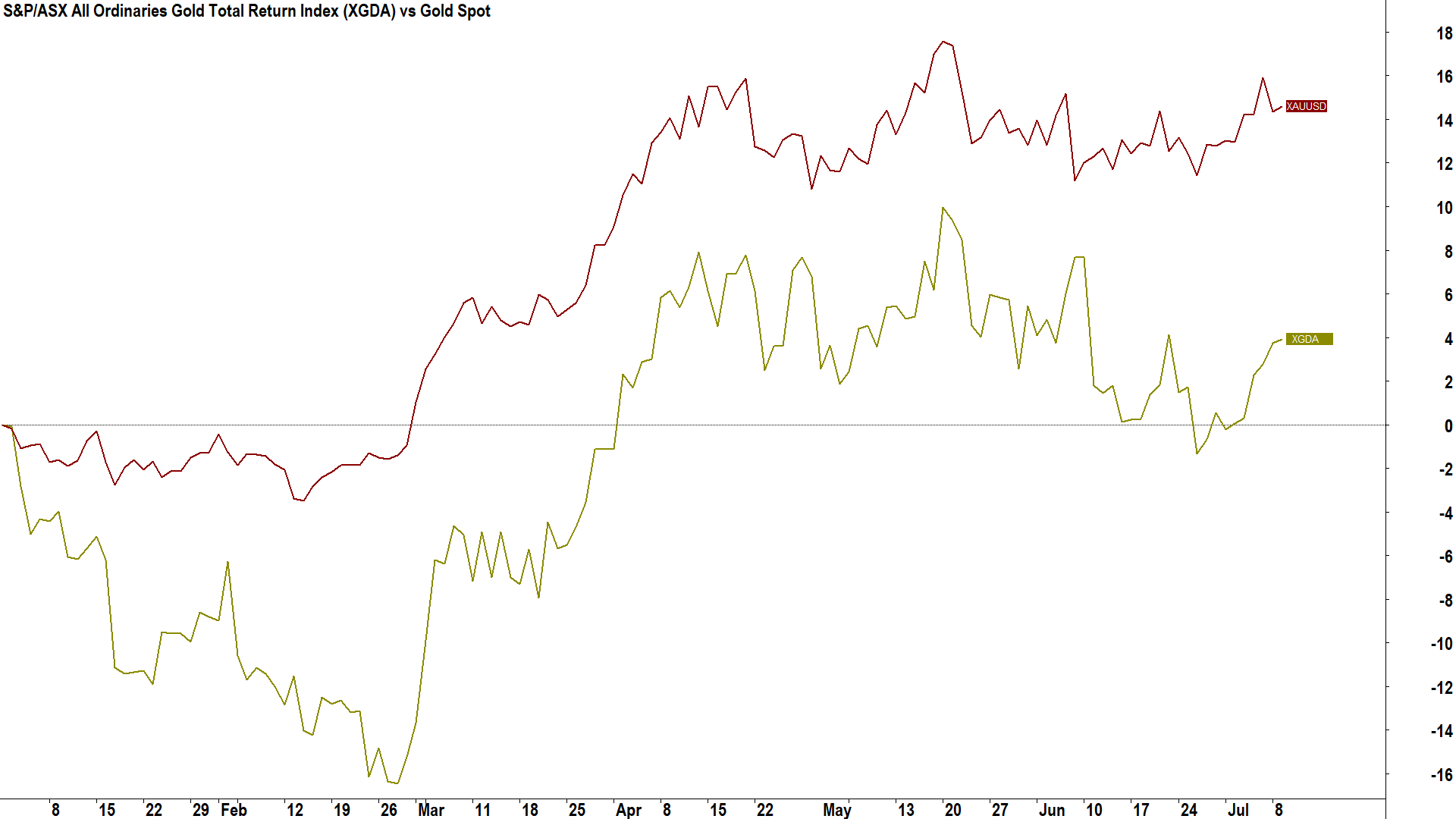

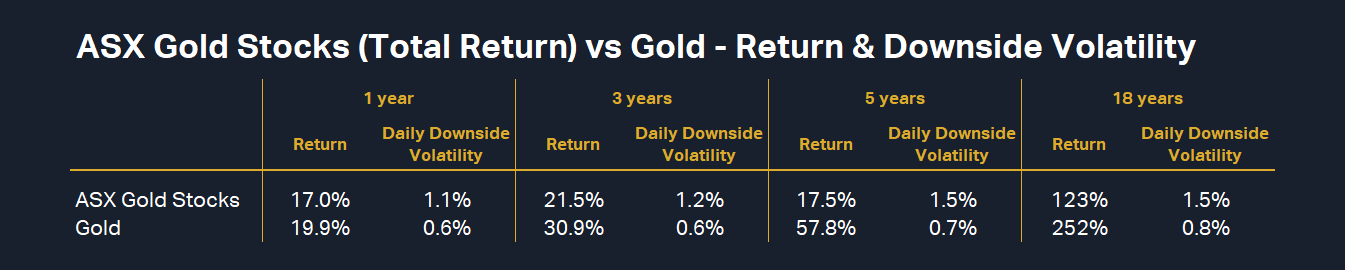

I agree, though, over the long term, dividends will make a difference. I don’t have the data to show you a chart like the first one for dividend-adjusted returns, but I can show you how gold compares to ASX gold stocks on an aggregate basis.

Let’s compare using the S&P/ASX All Ordinaries Gold Total Return Index (XGDA). This index accounts for the performance of every ASX gold stock, both in terms of price performance and any dividends paid (hence the “total return” bit).

%20vs%20Gold%20Spot%20Performance%20in%202024.png)

See, I told you so! Gold stocks have underperformed the gold price by around 10% since the start of the year on a total return basis. For completeness, let’s investigate the relative performance of the two over longer periods, so for example, 1, 3, 5, and 18 years (i.e., all the data I have for the XDGA). The underperformance of ASX gold stocks compared to the gold price is even more stark!

%20vs%20Gold%20Price.png)

Reasons why ASX gold stocks consistently underperform gold

I’ve shown you that gold stocks deliver an inferior return to gold with greater risk. Why?

The main reason gold stocks tend to underperform the gold price is gold companies either have to find the stuff or dig it out of the ground and refine it. The bottom line is: Finding and producing gold is an expensive and risky business.

It requires major investment and taking great operational and sometimes geopolitical risks. Then there’s weather, mine collapses (look at the SSR price!), machinery breakdowns, fires, labour shortages, COVID, supply chain chaos, inflation, regulatory changes, and probably a bunch of other things I can’t think of right now – but I think you get the point!

If you’ve been investing in Aussie gold stocks for any length of time, you’ll be able to think of at least a couple of times when one of your holdings ran into trouble of some sort.

The upside is, every now and then, you’ll find a gold stock in a sweet spot where production is straightforward, highly profitable, and growing, expenses are in check, exploration is adding extra value, and all of this is being handsomely rewarded in the stock market with a rising share price (in excess of any rise in the gold price!).

And therein lies the challenge. Good luck with that!

How to invest in gold

Which brings me to this next bit where I answer the question that’s been burning in your brain since I had you at “ASX gold stocks underperform gold”!

Ok smarty pants, how do I buy physical gold?

There are a few ways you can get exposure to physical gold without having to resort to trying to pick the best ASX gold stocks.

The first is obvious, just buy gold. It’s not that hard to do, especially if like me, you live around the corner from the Perth Mint. Take it home and stick it under the mattress, between a couple of steaks in the back of the freezer, or your other most favourite place to store your valuables.

The best bit about this strategy is that you know exactly where your gold is and you don’t have to pay anyone to look after it. The drawbacks are pretty clear: Your gold is vulnerable to theft and/or you’ll lose some valuable freezer space.

Of course, in this modern age of the internet, you can also buy gold online from the Mint from anywhere in Australia, and you can even store it with them. If you don’t care whether your gold is numbered and allocated to you specifically, it’s even a free service (if you do care then it will cost you about 1% p.a.).

The next option is ASX-listed ETFs whose shares typically represent a specific amount of physical gold held in a vault somewhere. The pros include: easy buying and selling from your broking account at standard broking rates, and no need to store or look after physical gold.

The cons are: bid-ask spreads might be wider than buying physical gold, transaction costs might be higher, and invariably, there is going to be an ETF management fee. The latter is typically charged as a percentage of the fund’s net asset value (NAV), accrued daily, and deducted from the assets of the fund.

Here are five of the most popular ASX-listed physical gold ETFs:

The underlying assets of this ETF are backed by physical gold bars held in the vaults of J.P. Morgan in London.

Tracks the performance of the spot price of gold (i.e., in US dollars ($US))

Management Fee: 0.18% p.a.

Seeks to provide investment results that correspond generally to the price performance, before fees and expenses, of the Gold Price (PM fix) in Australian dollars ($A)

Authorised participants create and redeem Global X Physical Gold Securities by delivering or receiving gold that conforms to LBMA standards

Management Fee: 0.40% p.a.

Backed by physical Australian origin gold bullion bars (so tracks the gold price in $A)

Can be converted into physical gold bullion

Management Fee: 0.25% p.a.

Backed by physical gold bullion bars, which are held in a vault of JP Morgan Chase in London (so tracks the gold price in $US)

Hedged, so less likely potential for adverse currency moves impact

Management Fee: 0.59% p.a.

Tracks the international price of gold in $A

Holdings secured on behalf of investors in PMGOLD are covered by WA State Government guarantee.

Can be converted into holdings in a Perth Mint

Management Fee: 0.15% p.a. (lowest cost gold ETF on the ASX)

Footnote: Goldman Sachs’ Top ASX Gold Picks

Given I cited this research note in the first sentence of this article, I thought I’d better elaborate for those of you stubborn enough to still want to buy ASX gold stocks!

Goldman Sachs is only moderately bullish on the gold price, seeing little growth this year before approximately 8% upside to their peak target price of US$2,570 in 2026.

.png)

They do see some value, however, in several ASX gold stocks, with Evolution Mining (ASX: EVN), De Grey Mining (ASX: DEG), Gold Road Resources (ASX: GOR), and Bellevue Gold (ASX: BGL) being their top picks.

I guess the message here is that Goldman Sachs sees greater upside in these particular gold stocks than in the gold price – and that’s kind of the point of this article – it’s the only time you’d ever want to invest in them.

This article first appeared on Market Index on Thursday 11 July 2024.

5 topics

17 stocks mentioned