Bulls are bucking, bears are hunting

Livewire Markets

Since 23 March lows, my colleagues Patrick Poke and Vishal Teckchandani have regularly argued their case for markets on our Zoom catch-ups. Vishal, a steadfast bull, relentlessly argued that we will not see the market bottom again, whilst Patrick disagreed, arguing that the bear was out of hibernation, and here to stay. The rest of the participants on Zoom – mere spectators. So the pair decided to put their thoughts on paper and create Livewire's exclusive Bulls vs Bears series.

Together, we reached out to seven fundies split across the bull and bear camps. Across a series of four wires, I will provide context to the discussion; Pat will argue why you should fear the big bad bear; Vish will contest why markets will charge higher, and I will cover where our fundies think you should invest $10,000 right now.

WANT FIRST ACCESS TO THESE WIRES? If you'd like to be immediately notified when we publish these wires, view my, Patrick Poke, and Vishal Teckchandani's profiles, and click the FOLLOW button (it's there on the left). Read on for the plot and the fundies we've lined up.

Setting the scene

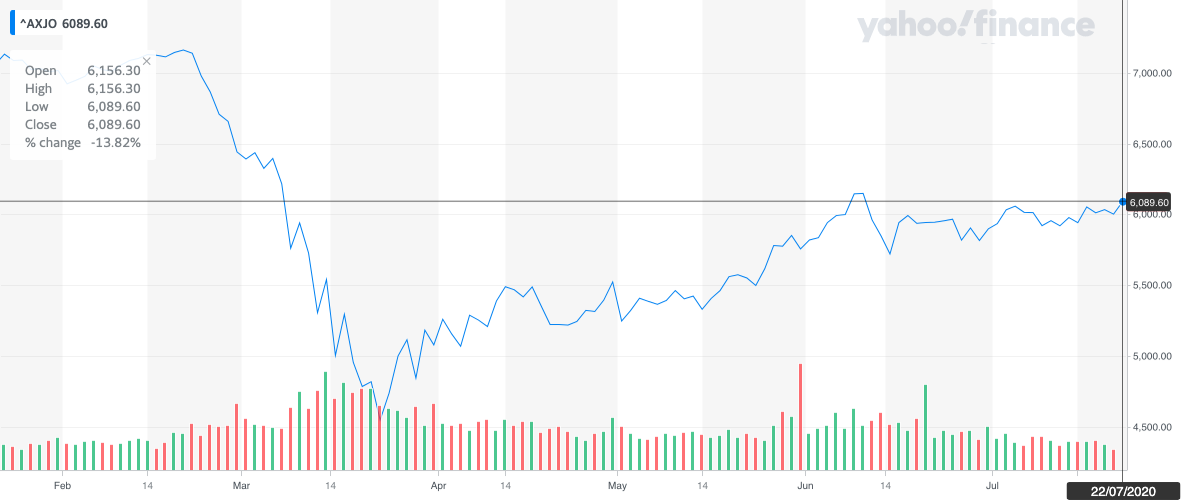

The ASX was carving out its path of glory in 2019 and early 2020. Records were set as investors enjoyed stellar returns. Yet, on March 23, 2020, Australian markets plummeted to 8-year lows. That month will go down in history as one of the biggest market drawdowns globally.

Yet since the March lows, investors have been bewildered with a stunning recovery despite a second wave creeping up on us, valuations soaring as earnings collapse and no sign of a return to normalcy. Amid this uncertainty, there are a handful of burning questions. What on earth is driving this rally? How invested should you be? Will the ASX meet its pre-COVID highs in 2020, or was March 23 a teaser for the next big pullback?

Source: Yahoo Finance

The bear case

With the rally continuing on the ASX, should investors fear the big bad bear? Patrick Poke reached out to Kate Samranvedhya, Deputy Chief Investment Officer at Jamieson Coote Bonds; Anton Tagliaferro, Investment Director at IML; Donald Amstad, Head of Investment Specialists for Asia Pacific at Aberdeen Standard Investments to get their thoughts on what is driving this market rally.

The bear case is based on investors misunderstanding the economic impact of government and central bank policies, and being overly optimistic about potential outcomes. These fund managers warn that markets will buckle given the lack of a vaccine, dangerously high valuations, and the consequences of indefinite government stimulus being pumped into the economy, and that's going to hurt those overly exposed to risk assets.

“Some companies may not be profitable in a new normal and owners of corporate bonds and equities of these companies will bear the consequences. Policies are here to buy time, so people and companies can avoid sudden death and adapt to a new future. Policies are not meant to keep zombie companies hooked on life support forever.” Kate Samranvedhya

Patrick Poke will be releasing his wire Why you should fear the big bad bear tomorrow. You can be notified by following his profile.

The bull case

The bulls seem to be charging ahead, leaving the bears behind scratching their heads. Since March lows, the ASX/S&P 200 is up 1,544 points (as of July 22). Those who bought in March have been rewarded with fantastic returns. And while the future is uncertain, particularly when considering a vaccine, the market just keeps performing.

Vishal Teckchandani reached out to three bulls - Emanuel Datt, Managing Director at Datt Capital; Jun Bei Liu, Portfolio Manager at Tribeca Investment Partners, and Shane Oliver, Chief Economist at AMP Capital to get their opinion as to why the market has continued to run, and whether current valuations can be justified.

“Shares could go back to their March lows or lower if we have a return to a full-blown lockdown or President Trump escalates tensions with China in an economically debilitating way. But the more likely outcome is that we learn to live with the virus and if a medical solution is found, the recovery will be faster. Either way, the pick-up in economic activity combined with ongoing low interest rates and bond yields as inflation stays down in response to spare capacity, is more likely to see sharemarkets ultimately resume their rising trend." - Shane Oliver

Vishal Teckchandani will release his case for the bulls A re-test of the March lows? The bears are kidding themselves following Pat's wire. Follow his profile to be notified of its release.

Where to invest $10,000 today

Whether you’re strapped on to the charging bull or making friends with the bears, there is a case for either side; but the beautiful thing is that the best ideas come from a diversity of views. Accordingly, I will be incorporating the top investing ideas across both camps, in my wire Where to invest if you’re a bull or a bear. If you'd like to be notified of this wire, you can follow my profile.

Whichever animal you’re cozying up to this quarter, this series is sure to ruffle your feathers, and I hope you enjoy this series.

The Bull versus Bear series

3 topics

7 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.