Bulls v Bears: Why Bridgewater, Citi, Morgan Stanley, and Ed Yardeni are divided on recession outlook

They say that numbers don't lie - but no one ever said that numbers can't be confusing. The signals for a global recession have been mixed, to say the least. On the one hand, soaring inflation is something we are all exposed to daily. Two consecutive quarters of seasonally adjusted negative GDP growth in the US has already been confirmed, fulfilling the technical definition. And consumer sentiment is depressed all around the world.

On the other hand, you cannot deny that we are in an ultra-tight labour market. Unemployment is below 4% in Australia, the US, and the UK. Supply chain issues are easing at the world's major ports. Finally, corporate earnings both stateside and here in Australia have been resilient in the face of challenging headwinds. You would have seen tastes of that in our ongoing coverage - more of which you should definitely read here.

This all begs the key question, to which we don't have a complete answer yet. Which data points do you believe?

The answer to this question will, in all likelihood, inform your base case for whether a global recession is coming or not.

In this wire, I'll take a look at four pieces of research from Wall Street's brightest. We'll compare and contrast their methodologies and their views on where the global economy is heading. Finally, we'll take a close look at what this all means for the rest of the Australian reporting season - and the trajectory for your investments from here.

The bull case: Ed Yardeni, Yardeni Research

July's equity market rally did come down to interest rate expectations, as we wrote about ourselves on this very website. But behind every fundamental reason, there is a myriad of technical indicators to help you confirm or challenge a thesis. That is where Ed Yardeni of Yardeni Research comes in. Yardeni has been in the markets since 1976 and is an alumnus of the Federal Reserve's New York branch, Deutsche Bank, and Prudential Financial - so he should know what he's talking about!

In his most recent markets note, he made some key observations at a technical level:

- A commonly used indicator (50-day-moving average) for 90% of S&P 500 stocks is looking bullish. The 90% figure suggests that it's not only a few stocks doing the heavy lifting.

- One short-term interest rate used by markets for asset pricing is up for a fifth straight week

- The put-call ratio in the options market is also trending bullish

At the fundamental level, Yardeni argues the bear market for equities is over and that a new bull market has started. Here are Yardeni's reasons:

- Bear markets occur when a recession depresses the P/E and earnings get hit hard as both revenues and profit margins fall along with the economy causing the P/E to move still lower.

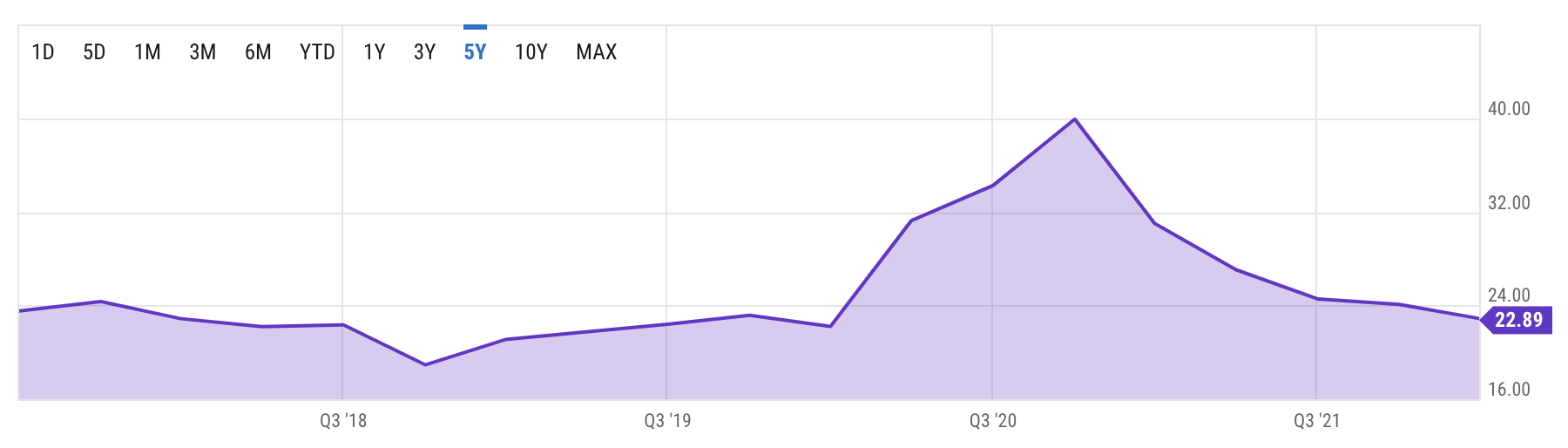

- P/E ratios for the S&P 500 may have bottomed out (though it's worth noting that it's still high on an even longer time horizon, as shown below:)

- The valuation multiple has rebounded just as forward earnings have started to dip.

- The S&P 500 needs to increase by just 0.8% to test its 200-day moving average. Technicians will view a move above it as confirmation of a possible new bull market. If it fails to do so, they will warn that the bear-market rally might be over.

This is all a long-winded and technical way to suggest that the team doesn't believe a recession is on the horizon. In fact, in another note following the most recent July inflation print in the US, Yardeni argued that there was "sunshine" on the way.

Stock investors have been enjoying the sunnier outlook for the economy since June 16. Today's CPI news for July added to their merriment.

I'm sure more than a few people hope he is absolutely right. Now, I'll move on to share the views of three more market participants who probably don't share as rose-coloured a view.

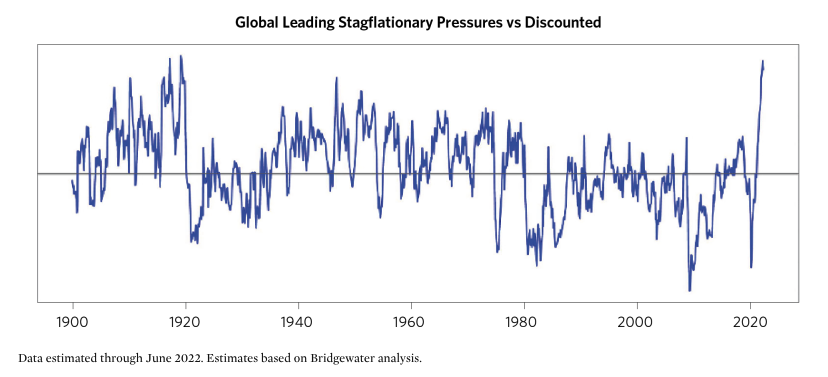

The stagflation call: Bob Prince, Bridgewater Associates

Early-stage is also a theme for Bob Prince, co-CIO and one of Ray Dalio's right-hand men at Bridgewater Associates. Prince argues that we are at the early stages of a market that is discounting too many risks - including sharp, unforeseen turns in monetary policy. In turn, Prince has shifted his base case towards a multi-year stagflationary crisis.

The reasons for his shift are well-known and well-worn: central banks kept the free money tap on too long, leaving central banks in a problematic dilemma.

In managing through this, we see them toggling back and forth in their prioritisation, trying to avoid both an unacceptably deep economic contraction and an unacceptably high inflation rate, culminating in a long period of too-high inflation and too-low growth.

Prince's own view is that asset markets are factoring in a very different scenario - arguing that there will only be one more sharp downturn at most. But Prince's indicators (and charts) appear to suggest that a weakening in real growth has not been flagged. He also thinks that central bankers don't have the gumption to enact policies for bringing down inflation faster. In fact, a pause (under the team's models) in rate hikes would actually create an even greater stagflationary environment.

Some of the ramifications of that can be seen in the following chart:

So what does this all mean for markets? Prince argues more volatility and instability could last for as long as a decade. He predicts more policy errors to come - making this situation a lot worse. The good news, in this case, is that Prince's thesis is extremely US-centric. The bad news is that the world's cold is only made worse when America sneezes even more.

The ultra-bears: Morgan Stanley and Citigroup

There have been calls for a global recession to come either this or next year since April when Deutsche Bank's Peter Hooper and Matthew Luzzetti set the cat amongst the pigeons. As recently as two weeks ago, they were saying that this call has only gained credence in the last few months.

They have been followed in recent months by such names as Morgan Stanley and Citigroup - both of whom have argued that the clouds of recession are "gathering" (in Morgan Stanley's case) or a "clear and present danger" (in Citi's case).

First, the views of Morgan Stanley's Chief Global Economist Seth Carpenter. Carpenter's team recently revised their forecast for global growth lower to just 2.5% in 2022, well below consensus, and their own forecasts just a few months ago. In Europe, the war in Ukraine and the ensuing energy crisis have created the perfect storm for the continent. Carpenter says a recession is now the "base case" for that continent, arguing that:

More hikes are likely [from the ECB] until there are hard data that show economic contraction or normalized inflation. Inflation and rate headwinds are not dissipating any time soon.

In the US, the fabled soft landing is by "no means assured" but "with the help of some good luck", the Federal Reserve might just pull it off. But of course, all those things are still up in the air. Bar China, things are looking quite bleak - and Seth says that it will be hard to see economic activity getting back to its pre-COVID trend even if we avoid a global recession.

Citi's Nathan Sheets had an even more blunt assessment. Despite having a rosier global growth target than the one Morgan Stanley has, Sheets didn't hold back in one of his recent notes to clients:

The risks to our forecast look skewed heavily to the downside. As such, we also reaffirm our 50% recession call articulated.

He finished by adding that global recession is an indisputable and very present danger. One caveat that I would add is that Sheets was the former chief economist at PGIM, a global bond, and fixed-income-centric investment house. So you may want to take this view with a grain of salt, given the bond market has consistently priced in a worst-case scenario for some time.

And finally... the Australian view: UBS' Richard Schellenbach

Of course, Australia is not the United States, and while the big themes may be the same, there are key granular differences. But as we continue to wind through the August earnings season, a few headwinds are beginning to rear their ugly heads:

- Deceleration not recession is the more likely story if you believe the banks' commentary

- Input cost pressures are everywhere

- Earnings revisions have begun and may carry on for a while

Of course, the story will continue to develop and change over the next few weeks. But as Richard Schellenbach points out:

Equities still face a decelerating economy and earnings downgrade cycle, and therefore the scope for any further gains driven by dovish rate assumptions would seem limited.

Buckle up, folks. The ride's about to get even bumpier - or more exciting depending on the way you look at things.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

3 topics