Buy Hold Sell: 5 of the best performing growth stocks

Amid a pandemic ripping through equity markets, there are a set of stocks which quickly developed herd immunity and eliminated the virus from their growth trajectory to become the top-performing ASX 200 companies.

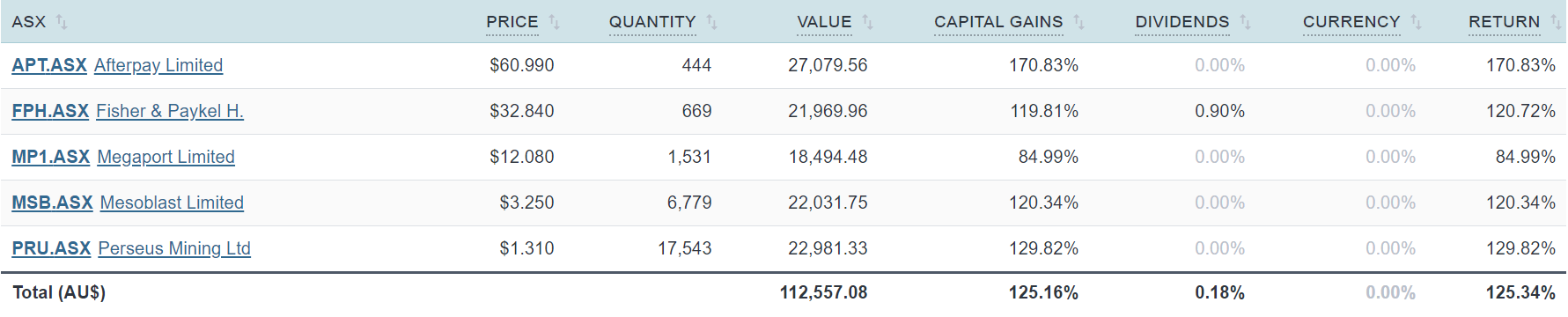

These five superstars, with an average market cap of $9 billion, emerged from March with a scorching vengeance to round-off financial year 2020 with a total return of 125% on an equally-weighted basis. Meanwhile, the S&P/ASX 200 lost 7.68% over that same period.

But has this WAAAX-filled, biotech-laden and gold-plated monster of a group gone too far, considering their PE ratios range from -454x to +72x this year's earnings?

In this episode, James Marlay is joined by Eleanor Swanson of Firetrail Investments and Jun Bei Liu of Tribeca Investment Partners for a high-energy, no-fence-sitting debate on whether Australia's growth miracles can keep on keeping on.

Notes: Watch, read or listen to the discussion below. This episode was filmed on 1 5 July 2020. Scroll down below for the performance table.

Access the podcast

Edited Transcript

James Marlay: Welcome to Buy, Hold, Sell, brought to you by Livewire Markets. My name's James Marlay, and today we're going to have a chat about the five best performing stocks from FY20. A couple of stats for you on these ones. Average market cap, $9 billion, 125% return in FY20 and a lazy P/E of -450 to +72, so a big range in what we're looking at. Joining me to discuss these five top performers I've got Eleanor Swanson from Firetrail and Jun Bei Liu from Tribeca. Jun Bei, your first one, first cab off the rank, the hottest stock on the market at the moment, Afterpay defying gravity, buy, hold, or sell?

Afterpay (ASX:APT)

Jun Bei Liu (Hold): It's a hold for me. Look, it was a buy, but certainly its share price has gone through the roof. We think the opportunity set is enormous for this company and they're only just touching the surface of what they could achieve. 1% penetration in the U.S. and other markets. Now they're moving into raise huge amounts of money and they got the war chest to go and go after those market share, so it is a hold for me.

James Marlay: Okay. Well, big market cap. They've executed flawlessly, huge capital raising, buy, hold, or sell?

Eleanor Swanson (Hold): It's also a hold for me. Afterpay has absolutely dominated the retail market in Australia and it looks like they're going to do the same thing in the U.S. However, we feel that's largely priced into the current share price. To get upside from here, I need to see Afterpay starting to roll out into new markets. I tend to try and value it market by market, and each new market adds about $6 to the current share price. In addition, we think there's an opportunity for Afterpay to really go after marketing for these retailers and build out a marketing platform. To put that opportunity into context, they generated 10 million leads for U.S. retailers in the month of April alone. They're not monetising that at the moment and we think that's a huge opportunity for the company. It's a comfortable hold.

Mesoblast (ASX:MSB)

James Marlay: Okay. Mesoblast generated a lot of interest with some of its opportunities around COVID. Buy, hold, or sell?

Eleanor Swanson (Buy): Yeah, Mesoblast is a buy. The company is a global leader in developing stem-cell therapies. They've got multiple trials underway at present including one for chronic heart failure and another one for chronic lower back pain. Over the next six months it's probably going to be some of the most exciting for the company just given they've got two phase three trial results coming out. If either of these prove to be successful we're expecting a material rewriting in the share price because they are blockbuster drugs and it will just clarify the path to commercialisation for the drugs. Just given the upside potential we think Mesoblast should be in everyone's portfolio, albeit a small position given that clinical trials are very binary in nature.

James Marlay: Okay. Can you get pumped up about Mesoblast? It should be in everyone's portfolio. Jun Bei, is it in yours?

Jun Bei Liu (Sell): Okay, this seems like it's a first for me. Look, no Mesoblast is a sell for me. When we talked to the rerate I felt it's already been rerated, share price has gone up 70% since they took to the COVID-related trial that potentially could generate a lot of interest in the earnings. And to me, it's already been priced in. And secondly, since the announcement, since the share price has gone up 70%, the standard care for COVID-related patients has already gone up significantly. Which means that it will be tougher for them to meet the end point, which means the chance of a failure is higher.

And secondly, they took to charging a huge premium should that trial be proven successful. To me that will be quite challenging just given we've seen some of the early indication, some of the steroids treatment out of the UK and the like are charging very low prices. There's a lot of unknowns to do with why the share price rerate is 70%, and to me, firmly the risk is on the downside.

Fisher & Paykel Healthcare (ASX:FPH)

James Marlay: Fisher & Paykel Health. A manufacturer of a number of different products. One of them is ventilators, which has obviously put them in the spotlight. It's had a cracking year. Buy, hold, or sell? Can it do it again?

Jun Bei Liu (Sell): Fisher & Paykel is a hold to sell. Look, I think it's an incredible company, it's probably a sell for me at this point. It's an incredible company, done really, really well and delivered significant amount of earnings growth because of COVID-related products pull-through. And we think structurally will mean, and the hype for their product and the demand, will be significantly higher. However, the current lump earning is pull forwards of many years of growth in their future. And with the earnings of trading more than 50 times it certainly seems they're bit too rich at this point. We prefer the cheaper alternative such as ResMed at this point.

James Marlay: Too rich for Jun Bei. Are you a buy, hold, or sell on Fisher & Paykel?

Eleanor Swanson (Sell): Yeah, we agree. Fisher & Paykel is a sell. As you've alluded to, two thirds of the business is focused on ventilators, selling them to hospitals. And just given COVID, Jun Bei has alluded to the pull forward of demand there. We do think some of that is sustainable, so they will retain some of the market share they've gained for this nasal high flow product. However, over 50 times earnings well and truly price priced in, and in addition a third of the business is focused on sleep apnea and they're actually losing market share in this segment, so it's a sell for us.

Perseus Mining Limited (ASX:PRU)

James Marlay: The complete other end of the spectrum in terms of drivers, but gold has been a big, bright spot on the market. Perseus Mining, mid-tier Australian miner. Buy, hold, or sell?

Eleanor Swanson (Hold): Perseus is a hold. Firetrail is overweight gold. We like gold because it's a hedge against the extraordinary amounts of money being printed by central banks around the world. Perseus gold currently has two operating mines. One is in Ghana and the other is on the Ivory Coast. We think there's better ways to play the gold thematic just given the higher risk of investing in miners in West Africa. Yeah, we like gold but it's a hold for us.

James Marlay: Okay. Jun Bei, have you got a view on Perseus? Buy, hold, or sell?

Jun Bei Liu (Hold): I will probably move to more hold. Look, Perseus is a whole lot cheaper than the rest of the gold miners, simply because of where their mine is situated. You always need to be very mindful that for a company that is mining out of Africa, there's a lot of risk that we can't predict. And many years ago, Perseus had issues at its mines and share price has lost a significant amount of value. But since then they've done incredibly well, they've delivered to expectations. They've done a great job, but it just that risk premium, you need to take that into account. I would much rather play through the likes of Saracen, or Northern Star or even Macraes.

Megaport (ASX:MP1)

James Marlay: Okay, let's round out our top five. Megaport, one of the new kids on the block in the Australian technology scene. Buy, hold, or sell?

Jun Bei Liu (Buy): It's a buy. I like Megaport because Megaport is probably the only cloud infrastructure company that you can find in this market. Yes, there's NEXTDC but NEXTDC is the future, essentially the future property trust. They build assets for companies to use and so that's more cloud-related and demand for that type of product is going through the roof and COVID certainly has speeded up that kind of adoption. Now, Megaport is the future Telstra and it has innovated that space and it's global. It's the largest in its sector because it's the innovator and it's got enough runway for it to continue to expand global dominance. For me, it's one of the rare exposure to that space in the Australian market.

James Marlay: Okay. Eleanor, moving to the cloud, it's been one of the major trends in the structural shifts that we've seen accelerate through the past few months. Buy, hold, or sell on Megaport?

Eleanor Swanson (Buy): Jun Bei, I promise I'm not copying you but I'm a buyer on Megaport as well. What the company does is they facilitate the transfer of data by virtual cloud connections and they've got an amazing first mover advantage in building out their network footprint. The company has currently got 600 data centres, that is double their nearest competitor, and they've also managed to double the number of data centres installed on their network over the last 12 months. We expect the company to continue these phenomenal growth rates. And in addition they've got a new product pipeline which we expect to support valuation going forward, so it's a buy.

James Marlay: Okay. Well, the five stocks had a cracking year in FY20 and I guess there will be more momentum left so don't chuck them out just yet.

Performance table (1 July 2019 to 30 June 2020)

Click to enlarge.

source: sharesight

Enjoying Buy Hold Sell?

- Hit ‘follow’ below to get notifications of when we publish Buy Hold Sell

- Stay tuned for next Tuesday (21/07), when Eleanor will swap with Blake Henricks to join Jun Bei Liu and discuss how you can prepare for August reporting season

- View the full Buy Hold Sell archive here

1 topic

7 stocks mentioned

5 contributors mentioned