Buybacks and dividends are at record highs - but are companies also out of ideas?

If there was a sure-fire way to make an investor jump for joy, it's buybacks and dividends. Buybacks reduce the number of shares on issue, making your holding more valuable. In contrast, dividends provide an intermittent source of income for shareholders.

And as long as the payouts are going up and buybacks are being instituted safely, investors will handsomely reward such moves.

Corporates appear to have been receiving this message from investors loud and clear. Globally, share buybacks and dividend payouts are both at all-time highs.

But while this is undoubtedly good news for equities, we couldn't help but wonder if it's also a signal of many other things on the horizon.

In this wire, we'll take a look at some of the reasons why buybacks and dividends may be at record highs around the world. Plus, we'll discuss the issues (and the unintended consequences) of all this with two of Australia's leading fund managers.

Dividends are climbing but buybacks are soaring

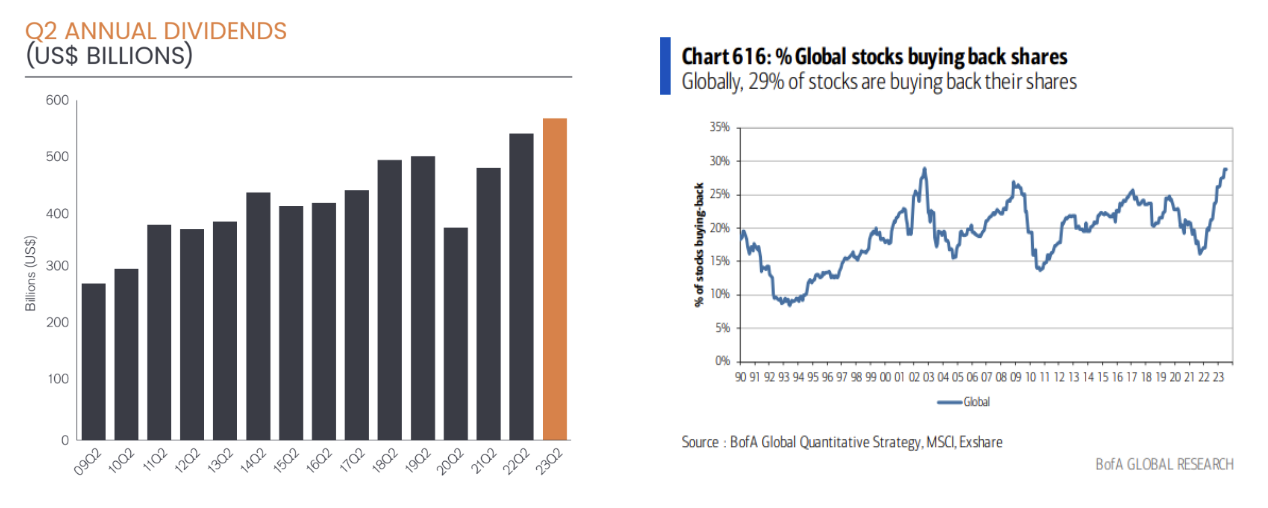

The two charts below are the genesis for this story.

The first chart comes from Janus Henderson's most recent update around global company dividend payouts. And while this obviously cannot feature every company in the world, the index features the world's 1200 largest companies.

Janus says that between these names, they also pay out 90% of all dividends so it's as close to a truly global read as one can get. The index is updated quarterly and is run by Ben Lofthouse and the Janus Henderson Global Equity Income team.

The second chart is from the Bank of America buy-side team. The chart shows that globally, 29% of stocks are now announcing or are under way with buybacks. The Asia-Pacific figure actually just hit a 20-year high. Data generally shows that companies who commence frequent buybacks tend to have high-performing share prices as well. Fundamentals-dependent, of course.

We posed both of these charts to Plato Investment Management's Dan Pennell. Here's what he said.

What do these two charts suggest about capital management priorities for companies in today’s market?

Being income-focussed investors, Pennell is naturally delighted that these charts are trending in the right direction. He also says it's indicative of companies maintaining balance sheet strength despite the headwinds of rising rates and soaring cost of debt.

"The strong post-pandemic bounce in dividends has been driven by stronger company balance sheets," Pennell said. "With increasing uncertainty in the market, and an ageing income-focused population, investors are likely to reward dividend paying companies," he added.

Does a record payout environment plausibly suggest that companies are out of reinvestment ideas and/or are just looking to answer shareholder concerns in the very short term?

Pennell disagrees with this premise, arguing it's actually a sign of better capital management and income normalisation rather than an explicit lack of opportunities to reinvest or spend on.

"Dividends are increasing roughly in line with markets, and after a substantial drop in income

due to the global pandemic, it is more a matter of companies returning to previous levels," he said.

"An increase in corporate confidence has enabled a return to payouts, rather than a lack of investment opportunity," he added.

Will these records continue to be shattered?

While global dividends are at a record high, it was Australian companies who cut or eliminated payouts that dominated the August reporting season. A slimmed down dividend was an immediate cut for savage selling. Pennell said there was good reason to be cautious - even if investors won't be kind about it.

"A note of caution is that a weaker Aussie dollar was responsible for turbo boosting payouts for a domestic investor," he said.

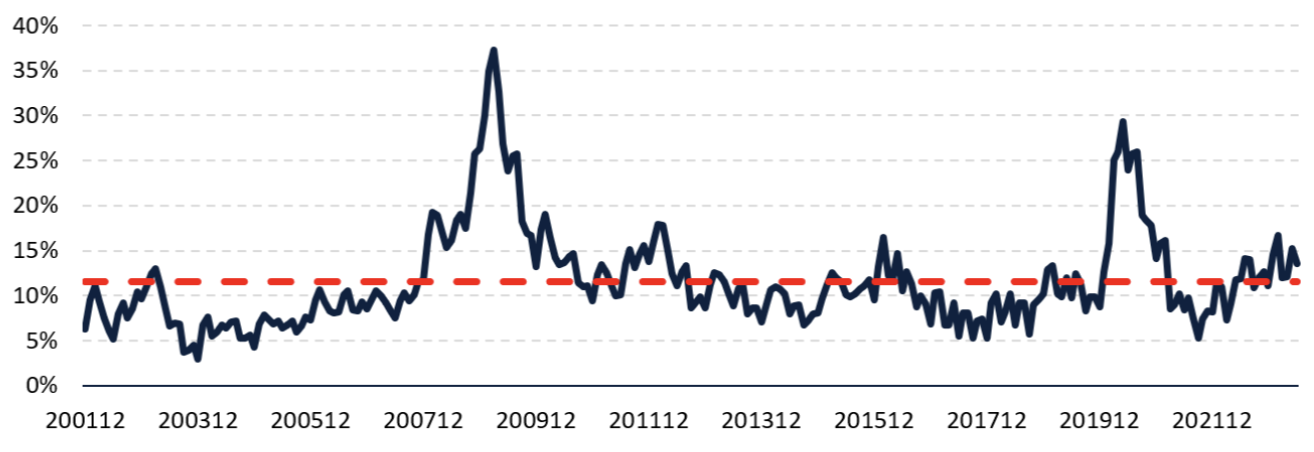

"Our proprietary forward-looking dividend cut model (chart below) suggests a little more caution than the chart from Janus Henderson. Although only slightly above the long-term average, the rise in risk reflects the tightening of monetary policy and concern that it may lead to a hard economic landing," Pennell noted.

Plato forecasts the risk to dividend cuts to be marginally above the long term average

On the subject of buybacks, Pennell is less sure about whether the strength can go on.

"Although not yet a substantial driver, the US buyback tax did come into effect earlier this year. It is not yet large enough to push companies towards increasing dividends, but Biden has hinted at increasing it and this is an important policy change as we look to future dividend levels," he said.

How much influence does an increasing dividend or buyback announcement have on your investing strategy?

Pennell's approach is to find quality companies with strong earnings prospects and are trading at below intrinsic value.

But he also says that finding companies with strong dividend payouts is as important as finding companies who are cutting their payouts. That's because companies which are cutting their dividends often offer a double whammy, in that these businesses may also be capital growth traps.

"If a company cuts its dividend, it is often a sign of deeper issues and an investor can be hit by falling income, and a falling stock price," he said.

3 topics

1 contributor mentioned