Can Aussie stocks give you the long term growth you need?

At

the start of the year, I wrote a wire that asserted, cut-a-long-story-short,

that Australian stocks as a growth vehicle have underperformed US stocks for a

long time and that going forward, it would probably continue to happen (see the box below).

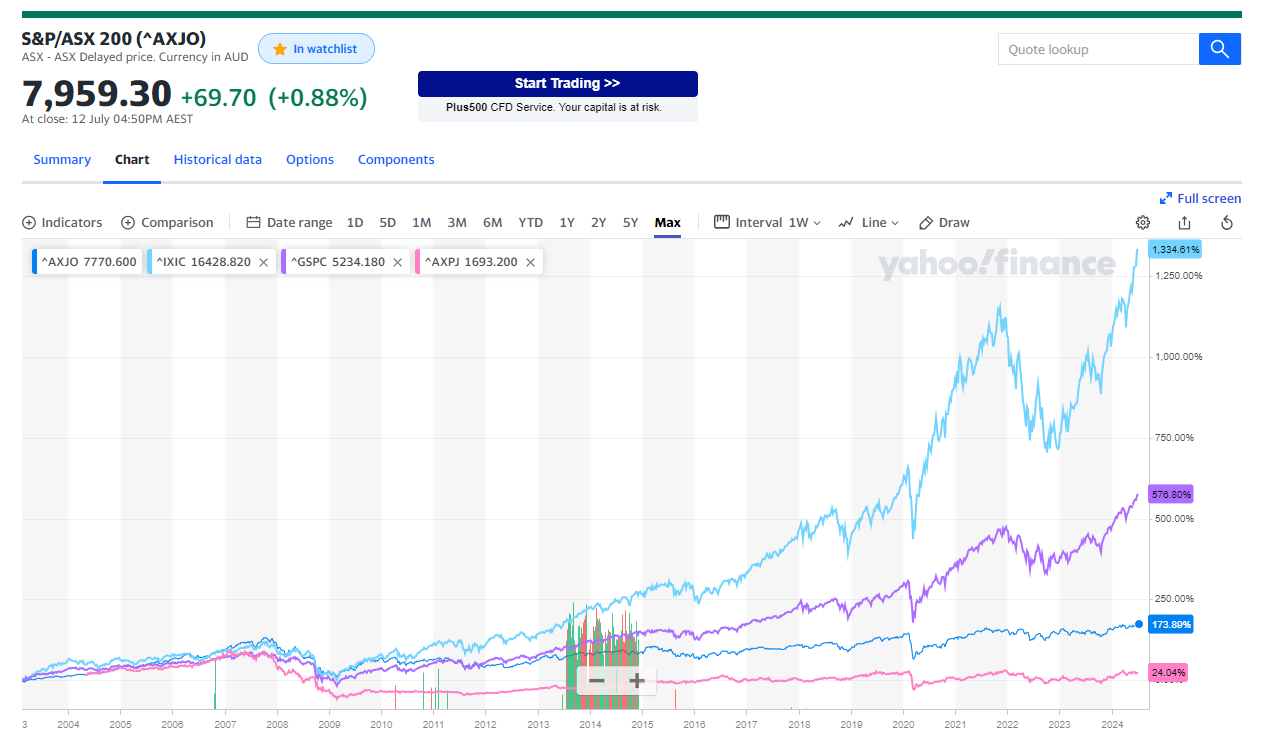

So 6 months later, with the financial year behind us, how did that assertion do? Well, it turns out it was spot-on…..take a look.

Now to be clear, almost everyone should build, or should hire a professional to build, a fully diversified global portfolio. Your risk appetite and financial profile will determine the percentage of the assets that should aim for growth and the percentage that should be defensive, but it is a rare situation indeed where a collection of asset classes that “go up over time but not always at the same time” isn’t your best option - the final portfolio solution for a typical private client is very unlikely to be concentrated. It is very likely diversified, global, and it includes multiple sources of return.

Furthermore, the portfolio should be built with asset classes and sub-asset classes that have a specific role to play in the portfolio. What a good segue…..

In the prior piece noted above, I was addressing that home country bias means we are very often told that Aussie stocks are great for everything – diversification, growth, income, whatever you need. As a result, most Australian super funds and most Australian investment portfolios are massively overweight Australian stocks. I have a different view and I walked through how for the 10 years to 31 December 2022, the ASX 200 delivered a total return of 8.6% per year – that was 4.2% in price and an additional 4.4% in yield. However, over the same period, the S&P 500 returned 12.5% (10.4% growth and 2.1% yield) and the Nasdaq 100 delivered 15.5% (14.5% and 1.0%). So even accounting for a generous franking credit, the S&P 500 was around 2.5% better per year and the Nasdaq around 5.5%.

Those are big annual numbers to repeat year-after-year for 10 years. Big. And more recently:

| 2023 | Gap | FY24 | Gap | |

| ASX 200 | 12.4% | 13.5% | ||

| S&P 500 | 26.0% | +13.6% | 24.5% | +11.0% |

| Nasdaq 100 | 54.8% | +42.4% | 30.7% | +17.2% |

That’s almost 12 years of sustained and significant outperformance. Portfolio changing outperformance. But by the way, there's more - the outperformance goes all the way back to 2008. And if you skip over a brief period in 2007, the outperformance goes all the way back to the early 2000s.

To be clear, there have been long periods of value stocks (stocks more closely aligned with the current-day ASX 200) outperforming growth stocks (stocks more closely aligned with the current-day S&P 500 and Nasdaq 100), but part of my argument here is that the global economy for as far as we can see forward, at least for now, looks much more like the last 15 years or so than it does a period in the 1970s, or the early-to-mid 1990s.

And to be clear again, when I say “growth”, I mean an investment that will deliver superior risk-adjusted returns. The "risk" in the ASX 200 and the S&P 500 or the Nasdaq 100 is roughly the same, but the returns have, over the last 20+ years at least, varied significantly.

It isn’t that the ASX 200 didn’t grow, because it did, but that it didn’t grow enough given the readily available options and the essentially equal risk of those options.

To be clear yet again, investors should NOT ignore Aussie stocks. They have a role in your globally diversified portfolio and if you want or need income, Australian stocks are almost unrivaled at delivering that income, and tax efficiently too if you're a resident Australian taxpayer. But the argument that I hear regularly, that Aussie stocks are a great place for growth, is flawed - I would posit you’re much better off being in international stocks for that, and in the US in particular.

A lot has been said about market concentration in the US, and it is true – a small number of companies dominate US stock markets. That said, have you noticed how much of the ASX is concentrated?

- The top 10 companies represent 43% of the ASX 200, the top 5 companies are 30%, and the top 2 alone are 18%.

- Of the top 10 companies in Australia, 5 of them are banks, and 3 of them are miners.

In the US, the Magnificent 7 account for 31% of the index, and the top 10 is 35%. Clearly the top 7 dominates the top 10 but still, the top 10 in the S&P 500 is 35% versus 43% in Australia. If the banks and miners don’t have a good day, neither does the ASX 200.

The reason I make this point is that I sometimes get pushback on investing in US markets solely on the concentration front. If you want to argue that US markets are overvalued because of the role of the US dollar, or because of the hype around AI, or because of the upcoming US election, or because of the profligate fiscal spending – got it. But if you want to argue that the problem is concentration, you can’t make that argument and then invest in the ASX 200.

Not to mention that the industries which dominate the S&P 500 are price makers. That is, technology and healthcare. Contrast that to Australia where banks and miners dominate and they are both price takers. Price makers are more likely, over time, to perform better than price takers.

Let’s go to Europe then – except that they have a concentration problem too, they call it “granolas”. Those 11 companies (GlaxoSmithKline, Roche, ASML, Nestle, Novartis, Novo Nordisk, LÓreal, LVMH, AstraZeneca, SAP, and Sanofi) made up half the 2023 gains of the Euro Stoxx 600, although granted, there is a greater dispersion of industry in the granolas than there is in the Mag 7, or in the ASX 200.

But still – the Euro Stoxx 600 is concentrated. Just like the ASX 200 is concentrated, and just like the S&P 500 is concentrated. It turns out, most markets are concentrated, and much of the time.

And this is why you need to craft globally diversified portfolios that are a collection of asset classes and sub-asset classes that go up over time but not always at the same time. It’s not about stocks, or ideas, or IPOs. It’s about diversified strategies, often in a fund structure, working together to achieve whatever wealth growth goal you and/or your family needs.

The thing this teaches us, I think, is that you have to consider two things. Firstly, the palette from which you choose investments has to be markedly broader than just Australian stocks. If the firm you’re with, or the firm you’re considering, is only speaking to you about Australian stocks, I would respectfully posit you should speak to other firms. Your portfolio needs a mix of assets that will most likely include Australian stocks but it should almost certainly also include some of (many of?) the following asset classes – international equities, private credit, private equity, growth diversifiers, alternatives, fixed income, and these days even some cash.

Secondly, and as I mentioned earlier, you need to think through what you’re hoping to achieve by holding the asset class. Remember that each asset class and sub-asset class has a role in your portfolio and to the extent you need tax effective income today, buy Australian stocks that pay fully franked dividends. They are maybe the best vehicle for that purpose for most Australian taxpayers. But if you want (or need) growth, as opposed to income, there is no question – you won’t get the growth you need in the ASX 200. For that, you need exposure into the industries of the future, where there is growth coming and the corporations who will deliver it are often using capital-light models. Their multiples are going to be higher, often much higher, but so are their earnings and so are their profit margins. This is why the tech sector in the US, for the foreseeable future at least, is the most likely sector to underpin the outperformance of international equities over a portfolio of purely Australian equities that pay fully franked dividends.

Good luck out there.

5 topics