Can the 10 biggest losers of the ASX 100 turn their fortunes around?

Just because a company's share price is down doesn’t necessarily make it a dog. It could be a value opportunity – if said company has the fundamentals to turn things around in the future.

Take ResMed (ASX: RMD) for example.

In late 2023 and early 2024, share prices in the healthcare company took a nosedive as investors were concerned that the success of GP-1 drugs like Ozempic would hit the sleep apnoea market. It's a different story today with share prices up 30.54% for the year-to-date, helped by a 9% revenue increase and record-high dividends in its latest earnings release. Brokers remained relatively confident about ResMed's prospects throughout.

On the flip side though, sometimes a poorly performing company is a reflection of its internal workings. Booktopia, for example, suspended trading in June and went into administration. Its 1-year share performance was down 65.38% - the falling price reflected its poor balance sheet and $60 million in debt.

What will the story be though for the 10 worst-performing ASX100 companies of the last 12 months? A future champion or cheap for a reason?

In this wire, I'll take a look.

The 10 worst-performing companies in the ASX 100

|

Company |

Code |

Price |

1 year performance (%) |

|

Pilbara Minerals |

PLS |

$2.85 |

-40.87 |

|

Woodside Energy |

WDS |

$25.50 |

-34.01 |

|

Mineral Resources |

MIN |

$48.58 |

-26.02 |

|

Lendlease Group |

LLC |

$6.20 |

-25.48 |

|

South32 |

S32 |

$2.96 |

-22.11 |

|

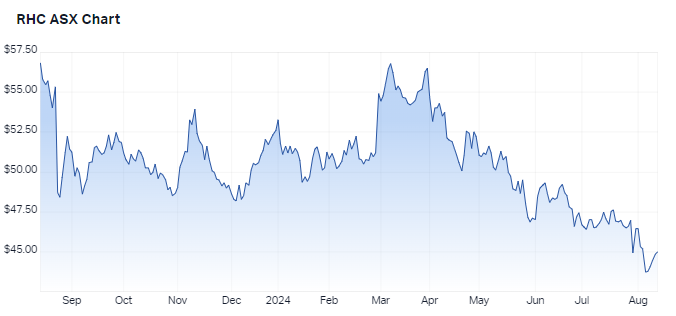

Ramsay Healthcare |

RHC |

$44.97 |

-20.88 |

|

Sonic Healthcare |

SHL |

$27.20 |

-20.19 |

|

Worley |

WOR |

$14.24 |

-19.37 |

|

Atlas Arteria |

ALX |

$5.07 |

-18.36 |

|

TPG Telecom |

TPG |

$4.54 |

-17.00 |

Source: Market Index, data as of 13 August 2024 COB

Key themes to note

- Falling commodity prices were a challenge for four of the 10 names. Lithium falls were a standout factor affecting both Pilbara Minerals and Mineral Resources.

- Challenges from inflation and higher interest rates continue to be a theme for healthcare businesses, along with companies like Atlas Arteria.

Value play or steer clear: a closer look at the worst 10

1. Pilbara Minerals (ASX: PLS): down 40.87%

There are no surprises as to Pilbara Minerals' fall. Lithium prices fell by 70% in FY24 courtesy of an oversupply of materials sourced from China and Africa. Pilbara has also consistently featured in the most-shorted ASX positions, currently standing at 22.09%.

Brokers have been mixed in their views on Pilbara Minerals, with Goldman Sachs viewing it as overvalued, while Market Index’s broker consensus tool positions it as a Hold.

In a recent episode of Buy Hold Sell, Seneca Financial’s Luke Laretive believed it was still a HOLD, noting that “it’s a pretty solid business with a decent balance sheet”. He has faith in the medium-term outlook though expects weaker lithium and EV sentiment to continue to hit performance in the short term.

2. Woodside Energy Group (ASX: WDS): down 34.01%

Another business to be hit by commodity prices, Woodside Energy has been affected by declines in crude oil prices. Broker consensus remains positive on its future, with it standing as a BUY in Market Index’s Broker Consensus tool.

It has also been referenced by fund managers on Livewire, with the likes of Merlon Capital’s Andrew Fraser recently adding to his investment in the company.

“At a macro level, there's been continued underinvestment in future oil production, which should be supportive over the medium term of the oil price,” said Fraser in an episode of Buy Hold Sell, also highlighting that its costs of production are cheaper than competitors so are less affected by price falls.

It was also cited by Lazard’s Dr Philipp Hofflin as an ideal income play, pointing to its 6% fully franked dividend.

3. Mineral Resources (ASX: MIN) down 26.02%

Another resources player to be hit by lithium oversupply (before we factor in price challenges in segments like iron ore), it has typically been viewed more favourably by brokers. Morgan Stanley tips it as its preferred lithium exposure, while the Market Index Broker Consensus notes it as a Buy.

Wilson Advisory’s Greg Burke recently said MIN is one of his preferred exposures to iron ore due to its strong production growth and lower cost, higher quality operations.

4. Lendlease (ASX: LLC) down 25.48%

The real estate developer’s woes are well known after a failed attempt at an international expansion. It has since announced plans to divest most of its international projects. It has also been hit by supply constraints driving up construction prices and disappointing expectations in the first half of 2024. Can it turn things around?

Market Index’s Broker Consensus Tool positions it as a HOLD, with brokers like UBS, Citi and Morgan Stanley viewing risks as the business restructures itself in coming years.

5. South32 (ASX: S32) down 22.11%

South32 is another story of soft commodity prices, and share prices were also hit by downgrades to FY25 guidance. However, it’s not all bad news for the miner.

Morgan Stanley points to it as offering quality earnings, while Schroders' Head of Australian Equities, Martin Conlon, uses it to play the aluminium and copper themes, arguing that people are going to need to increasingly rely on these conductive metals given there isn’t enough copper in the world.

6. Ramsay Healthcare (ASX: RHC) down 20.19%

Inflation and rising interest rates have been a significant challenge for Ramsay Healthcare and other healthcare providers. It has meant increasing the cost of medical supplies, while the cost of living crisis has seen large portions of elective surgery patients switch to public options instead of private.

There is likely to be further pain ahead of Ramsay Healthcare, according to Rudi Filapek-Vandyck, with Macquarie analysts also tipping the business to disappoint in the reporting season despite above-average second-half FY24 earnings.

On the other hand, the aforementioned Conlon sees it as a prospective value opportunity.

7. Sonic Healthcare (ASX: SHL) down 20.19%

The pathology and radiology provider had more than 20% net EPS downgrades in the lead-up to the August reporting season. Unsurprisingly, that hurt share prices. The business has been challenged by inflation, along with headwinds in currency hitting profits in the international portions of its business. It has made some acquisitions which may help it going forward including Synlab Suisse, Dr Risch and PathologyWatch.

Despite challenges, brokers are positive about the prospects for the business, with it ranking as a Buy in Market Index’s Broker Consensus tool. Conlon also referenced it as a value opportunity given price falls.

8. Worley (ASX: WOR) down 19.37%

The global provider of professional project and asset services in the energy, chemicals and resources sectors has had its prices hit by an institutional selldown – Sidara sold out its 19% stake, which caused a further slide in its share price. The selldown was not related to the fundamentals of Worley – the market views it as Sidara choosing to step out as it is unable to gain governance control.

Broker views on the business are positive, with Worley ranking as a Strong Buy in Market Index’s Broker Consensus Tool.

Martin Currie’s Reece Birtles recently tipped the stock as undervalued and viewed it as a good defensive position. He holds it in his portfolio. Similarly, Ausbil’s Michael Price was positive on Worley in an episode of Signal or Noise and viewed it as a part-income, part-growth play.

9. Atlas Arteria (ASX: ALX) down 18.36%

The toll road developer and operator is sensitive to rising interest rates and the ongoing work-from-home trend has affected its revenue. It spent the last year coming off significant capital raising to purchase a majority stake in US toll road Chicago Skyway.

Views are somewhat mixed on the business, though brokers position it as a Hold in the Market Index Broker Consensus tool.

Plato’s Dr Don Hamson believes it is a SELL on every criterion he has for value and outlook, while Lazard’s Wayne Robinson has previously nominated it as his preferred infrastructure stock, noting it earns 50% of its income from North American and French toll roads.

10. TPG Telecoms (ASX: TPG) down 17%

The telecommunications provider saw significant falls back in February off the back of disappointing FY23 results. It was also hit more recently by a bearish re-rate from Goldman Sachs to SELL, with the broker arguing that Telstra was a better option for investors.

This view is not the consensus though, with Market Index’s Broker Consensus Tool ranking it as a Buy. The business has not been profiled by Livewire’s fund managers in recent months.

3 topics

11 stocks mentioned

9 contributors mentioned