Canadian Core CPI rises to 2.9% y/y, The Australian economy adds 50.2k new jobs in June

Let’s hop straight into five of the biggest developments this week.

1. Chinese GDP contracts to 4.7% y/y

China’s National Bureau of Statistics on Monday said the country’s second-quarter GDP rose by 4.7% year on year, missing expectations of a 5.1% growth. June retail sales also missed estimates, rising 2% compared with the 3.3% growth forecast. The miss in retail sales really demonstrates exactly what is happening in China, with weak demand being the primary driver of a slowing economy.

2. Canadian Core CPI rises to 2.9% y/y

The Bank of Canada’s (BoC) core inflation gauges were hot again in m/m terms last month. There have been two back-to-back months of hot core readings. The BoC is still likely to cut next week, however, they are within their target range of 1-3% which means there is a slim probability that they do not.

3. New Zealand CPI q/q rises by 0.4% missing expectations

New Zealand inflation slowed more than forecast to its weakest in three years, in the second quarter even as domestic price pressures persisted. The annual inflation rate fell to 3.3% from 4% in the first quarter. The RBNZ forecasted 3.6%. Consumer prices advanced 0.4% from three months earlier, less than the 0.5% estimate of economists. The RBNZ held the Official Cash Rate at 5.5% last week but surprised markets by acknowledging signs of a deepening economic downturn.

4. British CPI rises to 2.0% y/y, up from 1.9% expected

The Consumer Prices Index (CPI) rose by 2.0% in the 12 months to June 2024, the same rate as the 12 months to May 2024. On a monthly basis, CPI rose by 0.1% in June 2024, the same rate as in June 2023. The largest upward contribution to the monthly change in both CPI annual rates came from restaurants and hotels, where prices of hotels rose more than a year ago.

5. The Australian economy adds 50.2k new jobs in June

In June the Australian added 50,200 new jobs, while the unemployment rate remained at 4.1%. The participation rate remained steady at 66.8%. The number of new jobs continued to show the strength of the labour market, which may encourage the RBA to increase rates one last time in August, however, interest rate markets are only giving this a mild possibility.

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

For the first time and a long while, equity markets have experienced a pullback from record highs. In response to this, we saw the VIX index rise ~10%, with the Nasdaq, Euro Stoxx 50, and the Nikkei 225, all dropping over -2.7%. The Russell 2000 and Dow Jones both had periods of solid performance, rising +2.22% and +1.66% respectively. In currency markets it was relatively quiet, however, there was action in the JPY which had an impact on the USD, which subsequently impacted risk currencies and commodities. Fixed-income markets were all quiet, as they continued to trade within a tight range.

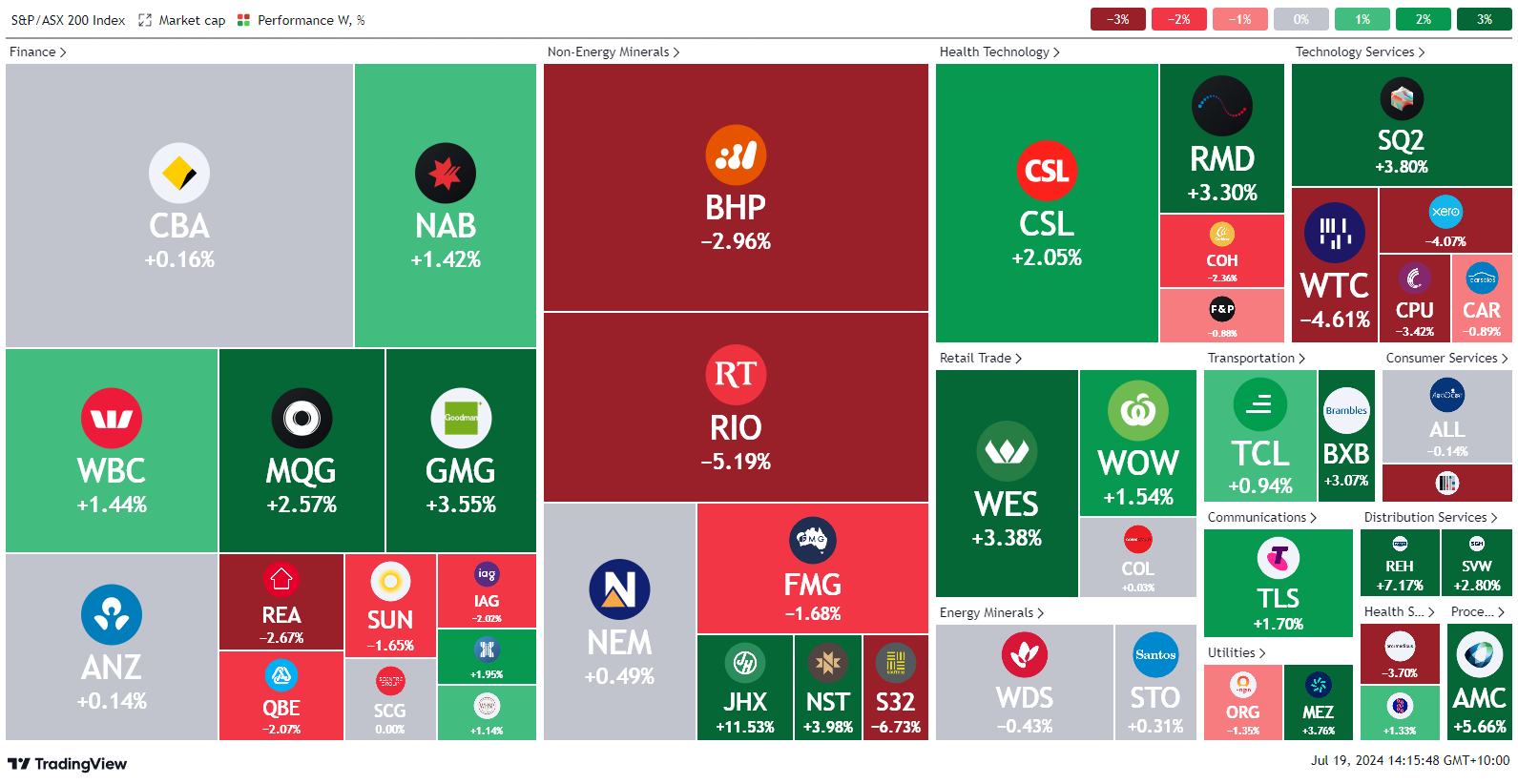

Here is the week's heatmap for the largest companies in the ASX.

For the most part, the trend from last week has continued, with banks, staples, and health care continuing their move higher. WBC and NAB continued their climb as they rose +1.44% & 1.42% respectively. WES and WOW continued to climb as investors looked for homes in companies that may benefit from an increase in consumer prices. AMC & BXB jumped +5.66% and +3.07% respectively as investors allocated, expecting that they would benefit from a rise in global economic growth.

5 topics

5 stocks mentioned