Chalice Mining: From green metals darling to a scoping study disaster

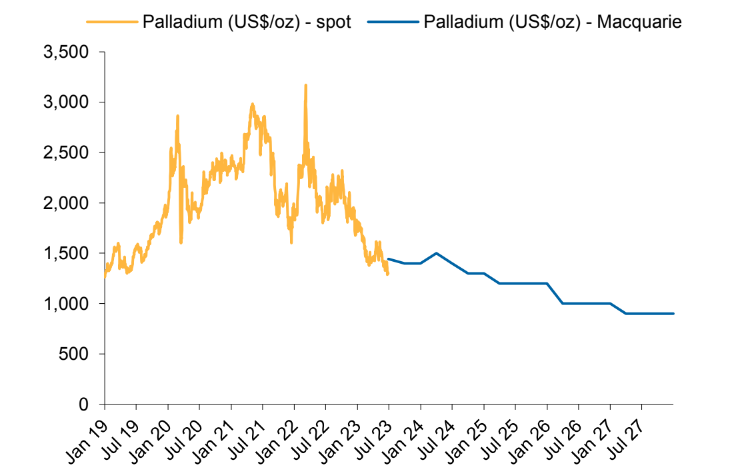

Shares in Chalice Mining (ASX: CHN) cratered 25% on Wednesday after its long-awaited scoping study opted for lofty commodity price assumptions such as US$2,000 an ounce for palladium compared to current levels of around US$1,250 an ounce.

The 25% tumble might be enticing for dip buyers and green metal enthusiasts – Notwithstanding the results of the scoping study, Chalice’s Gonneville deposit is a globally significant resource capable of supplying enough metals for approximately 330,000 electric vehicles annually.

But trying to catch the falling knife would have cut your hands, at least for now, with the stock down another 5.3% on Thursday and 11% so far on Friday.

The study outlines Gonneville as a “new long-life, low-cost, low-carbon green metals project in Western Australia,” but to find actual numbers – You’d have to scroll all the way down to page 8 for project economics and then page 12 for key assumptions.

In this piece, we’ll break down all the interesting tidbits of the scoping study.

Gonneville at a glance

The scoping study models for a 15 and 30 million tonnes per annum (Mtpa) case and the below outlines key metrics at the midpoint of the two cases.

Production

- Annual palladium, platinum and gold production between 280,000 to 470,000 ounces

- Annual nickel production between 9,000 to 16,000 tonnes

- Annual copper production between 10,000 to 16,000 tonnes

- Annual cobalt production between 800 to 1,400 tonnes

Economics

- Post tax net present value (NPV) of between $2.8 billion to $4.2 billion

- Capex of between $1.6 billion to $2.3 billion

- A payback period of approximately 2 years for both cases

- Post tax-free cash flow of between $440 million and $690 million per annum over the life of the mine.

In a nutshell – Chalice is set to produce a significant amount of metals, at a decent NPV (relative to ~$1.5bn market cap on Wednesday) with a relatively short payback period.

But that’s just the figures at face value. Upon closer inspection, things get a little tricky.

Bullish commodity price assumptions

The scoping study is based on some rather outlandish commodity price assumptions, which we'll highlight and compare with current spot prices.

Commodity |

Assumption |

Current price |

% Difference |

Nickel |

US$24,000/t |

US$20,500/t |

17.1% |

Copper |

US$11,000/t |

US$8,374/t |

31.4% |

Cobalt |

US$46,000/t |

US$33,400/t |

37.7% |

Palladium |

US$2,000/oz |

US$1,250/oz |

60% |

Gold |

US$1,900/oz |

US$1,940/oz |

-2.1% |

Source: Chalice Mining Scoping Study | ‘Current price’ as at 30 August 2023

Palladium is expected to account for approximately 55% of revenue from the mine, followed by nickel (24%), copper (12%) and cobalt (4%).

Chalice has an assumed life of mine average annual revenue between $1.3 billion and $2.1 billion (or $1.7 billion at the midpoint).

If you were to replace the US$2,000 palladium price assumption with current spot prices – This would theoretically lower the midpoint figure from $1.7 billion to $1.33 billion.

And that's just looking at prices and leaving other assumptions such as grade, recovery and payability unchanged.

In response to the commodity price assumptions, Chalice managing director Alex Dorsch said "There is about seven plus years until we are actually producing any metal, so we are not talking about producing in the current commodity price environment, nor have we designed our operation in the current spot price, commodity price environment," the Australian Financial Review reported.

“We are designing a 20-year operation ... we are trying to understand those long-term dynamics as best as possible."

Capex and cost of capital

The scoping study outlines a pre-production capex between $1.6 billion to $2.3 billion. But if reporting season has taught us anything – Is that there’s a lot of upside risk to capex and nobody is safe.

Several household names like Pilbara Minerals (ASX: PLS), Mineral Resources (ASX: MIN) and Lynas (ASX: LYC) reported capex figures or provided guidance that was well above company and/or analyst expectations.

The scoping study also assumes a weighted average cost of capital (WACC) of 6.5%, which might sound a little optimistic given the current interest rate environment.

The WACC measures the cost of a company's debt and equity.

Ratings gone wrong

At the beginning of August, Macquarie was Outperform rated on Chalice with a $9.20 target price.

"The Gonneville deposit is world-class and remains open at depth and along strike. The release of the scoping study, which should confirm capex and opex and key metallurgical recovery rates, particularly for palladium and nickel, is the key focus area in the near term," the analysts said in the note.

Interestingly, Macquarie's long-term palladium assumption (which only goes as far as mid-2027) is around US$1,000 an ounce.

A version of this article was originally published for Market Index on Wednesday, 30 August 2023.

2 topics

4 stocks mentioned