Chart of the day: Aussie ‘soft data’ edging up?

‘Risk-off’ has been the flavour so far this week. Overnight, US Federal Reserve Chair Powell dismissed all talk of turning to negative rates to address a downturn "significantly worse than any recession since World War II", while UK growth in Q1 fell 2.0%—slightly better than expected, but its worst pace since the depths of the GFC. Rising tensions between the US and China (and Australia and China) are adding to this risk-off sentiment. Following last Friday’s historic loss of US jobs and jump in unemployment to 15% for April, today in Australia, it’s our turn to see just how sharply unemployment rose as our economy went into lockdown. Consensus centres on a 600,000 job loss and a jump in unemployment from 5.2% to 8.3% for April. Already this week, Australia’s NAB business conditions survey slumped to its lowest since the 1991 recession, Q1 wages growth slowed and April tourist arrivals slumped 99%!

The past month has seen many of our key signals for a sustained trough in risk appetite secured, from massive monetary and fiscal support, a new oil production deal, to signs of a peak in new COVID-19 cases globally. However, while this has led us to suspect equity markets won’t retest their 23 March lows. The headwind of relatively horrific data this month and for several to come (as well as the rally in markets away from prior levels of valuation support) leaves us judging the risk of a near-term correction (a 5-10% drawdown) is elevated. Still, as the risks of an L-shaped recovery wane, and U-shaped recovery rise, the risks that equity markets and bond yields will be higher by end-2020 or early 2021 are rising.

Yet, nestled among the flow of recessionary ‘hard’ data, we may just be starting to see some of the ‘softer’ data turning more positive. This is not to say all is well…the recession comes! However, some improvement in domestic and global leading indicators may build confidence that the worst of the economic data will be confined to Q1 and Q2 this year (depending on when particular countries entered lockdown). In the US, jobless claims are weak but trending less weak, with another key update due tonight.

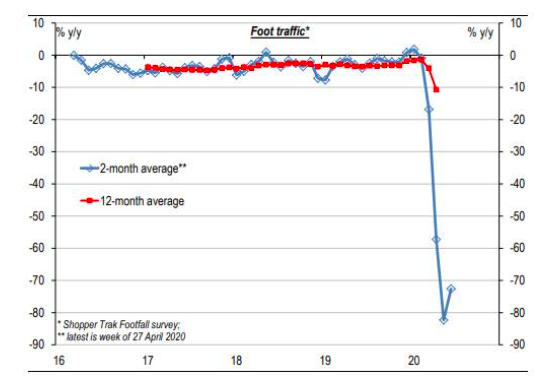

Which brings us to today’s chart, which shows a small recovery in foot traffic at Australia’s retail establishments. And this rise from -90% to -80% is for the two weeks ending 27 April, before recent announcements flagging an easing of lockdowns seemed to lead Aussies to break forth from their ‘virtual’ hibernation. This week business and consumer confidence made small rebounds, while data on housing clearance rates and new listings lifted. Much will depend globally and domestically on avoiding second wave pandemic crises (and containing first round outbreaks in emerging countries like Brazil, Russia and India). But the easing of lockdown restrictions, if managed well, should continue to increase the risks of a gradual U-shaped recovery for many economies through H2 2020.

Is retail foot traffic returning in Australia?

Source: Shopper Trak Footfall survey.

Be the first to know

I’ll be sharing Crestone Wealth Management's views as new developments unfold. Click the ‘FOLLOW’ button below to be the first to hear from us.

2 topics

1 contributor mentioned