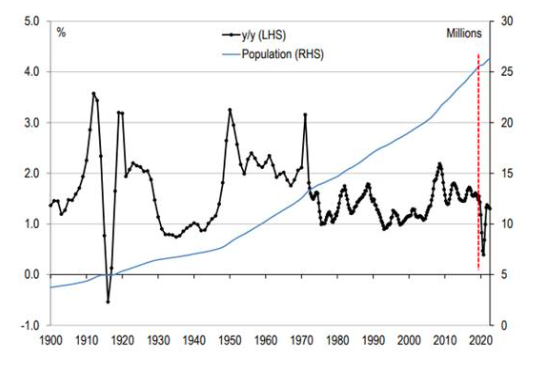

Chart of the day: Australia’s population growth slowest since 1916?

Australia’s faster trend pace of population growth over the past half century has been a key driver of its relatively fast trend economic growth, its recent record run without a recession and its sustained strength over time in housing demand and house price growth. However, recent government estimates suggest population growth is going to fall sharply over the next year or so due to the impact of the COVID-19 pandemic. In particular, not only have large swathes of temporary residents and tourists already left through April, but those on student and temporary working visas are likely to fall sharply over the coming year, in addition to a likely sharp drop in short-term tourist arrivals.

The Government estimates long-term migration arrivals could fall by around 300,000 over the next 18 months, with a drop of 72,000 in the first half of this calendar year and another 204,000 in the 2020/21 financial year. According to UBS and shown in our chart today, population growth is forecast to slow to just 0.5% in 2020, its slowest pace since 1916 (and below our recent average of between 1.5%-2.0% per year). There are likely to be both positive and negative short-term impacts from this. At the positive end of the spectrum, with faster population growth over recent years arguably stressing some of the infrastructure in our major cities, a temporary pullback in migration flows could provide some time for infrastructure works to ‘catch up’ over the next 18 months.

In terms of shorter-term negatives, the weakness in short-term tourist arrivals will drag on the domestic tourism industry (though this is likely to be offset in part by more Australians travelling at home when domestic travel restrictions are lifted). For residential housing, the weakness in migration is a significant headwind. UBS estimates “underlying housing demand [will] fall sharply from around 200,000 before to only around 130,000 in the near term—albeit before recovering towards 190,000 by the end of 2022. This will cause downward pressure on house prices…trigger a slump of dwelling commencements”. Lower population growth, as well as fewer short-term arrivals, is also likely to add to the downward pressure on rental price growth.

While there is an increasing likelihood of a sharp initial rebound in activity in H2 2020 as lockdown restrictions are eased, once this is passed a more moderate pace of activity is likely to unfold in some key sectors reflecting a range of post-COVID-19 headwinds, such as (necessary) social distancing restrictions on social gatherings (like cafes, restaurants and sporting events), as well as the impact of weaker short and long-term visitor flows on tourism, education and housing sectors. Longer term, these headwinds will ease, particularly given Australia’s sustained comparative advantage as an education destination, as well as a tourism destination, likely enhanced by our recent relatively successful containment of the COVID-19 pandemic.

Falling migration will likely see population growth slow to slowest pace since 1916

Source: ABS, Source Papers in Economic History, UBS.

Be the first to know

I’ll be sharing Crestone Wealth Management's views as new developments unfold. Click the ‘FOLLOW’ button below to be the first to hear from us.

2 topics

1 contributor mentioned